Property Tax Payment Franklin County

Please provide a good daytime telephone number. 2020 Tax Sale Property Map.

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

The Franklin County Tax Commissioners Office makes every effort to produce and publish the most accurate information possible.

Property tax payment franklin county. Pay online by credit card or eCheck. Pay Your Taxes You can search and pay Franklin County taxes online or you can pay your taxes over the phone by calling 1-888-272-9829. Search for a Property Search by.

You may begin by choosing a search method below. Delinquent tax refers to a tax that is unpaid after the payment due date. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Please have your tax bill and credit card information available as you will need information from both to complete this transaction. Click NEXT to Pay Your Personal Property and Real Estate Taxes in Franklin County Arkansas. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments.

The Franklin County Treasurers Office wants to make paying your taxes as easy as possible. Franklin County Treasurer Website Safe Secure. Franklin County Real Estate Tax Payment.

Use this inquiry search to access Franklin Countys real estate tax records. Envelopes to put your payment in are available inside the security building. Franklin County Treasurer 1016 N 4th Avenue Pasco WA 99301 Note.

Franklin County Tax Payments. Pay your bills anytime anywhereon-the-go or via computer. Online payments are available for most counties.

When paying in person please bring your tax bill s with you. 1010 Franklin Ave Room 106. Quickly search submit and confirm payment through the Pay Now button.

Map Group Parcel Special Interest. 123 Main Parcel ID Ex. To Pay Online Visit.

John Smith Street Address Ex. This website gives you the ability to view search and pay taxes online and is beneficial for all taxpayers locally and worldwide. If you want a paid receipt please also include a Self-addressed Stamped Envelope.

The statewide property tax deadline is October 15. Pay your real estate taxes online by clicking on the link below. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

Pay taxes online Your payment will be considered accepted and paid on the submitted date. Payments for property taxes may be made in person or via mail to. Your payment will be posted within minutes of transaction approval.

Welcome to Franklin County MO Bill Pay Website for Real Estate and Personal Property Taxes. Search and Pay Taxes. Payments of property taxes can be made via mail but must be postmarked April 30 2020.

New application provides a simple search by your parcel owner name or property address. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Click here to View your bills Online.

If you mail in your payment please include the top portion of your tax bill s. PaySearch Property Taxes Welcome to the Tennessee Trustee Tax Payment Solution Service. To Pay by Phone CALL.

Please note you cannot use home equity line of credit checks or money market account to make an online payment. Pay-by-Phone IVR 1-866-257-2055. In addition a payment drop box is available at the parking lot of the Courthouse 1016 N.

Payments may also be made via credit card or by using an e-check with following options. This service gives you the freedom to pay and search 24 hours a day 7 days a. If you are mailing your taxes on the due date check the collection time on the mail box.

You will need to know your parcel zip code bill number tax year and tax account number in order to make a payment by phone. Ozark AR 72949 Email. Be sure to pay before then to avoid late penalties.

However it may take 2-4 business days for processing. To ensure proper credit tax bills are necessary when making payment. The County assumes no responsibility for errors.

However this material may be slightly dated which would have an impact on its accuracy. Want to avoid paying a 10 late penalty. View an Example Taxcard View all search methods.

There will be a nominal convenience fee charged for these services. 4th Ave Pasco WA outside the security building. Sign up for Gov2Go to get personalized reminders when its time to.

Property tax information last updated. Any errors or omissions should be reported for investigation. The following provides you with information on property tax payments.

Franklin County Tax Assessor S Office

Franklin County Tax Assessor S Office

Franklin County Virginia Moonshine Capital Of The World Franklin County Is Located In The Blue Ridge Franklin County Virginia Is For Lovers Virginia Map

Franklin County Virginia Moonshine Capital Of The World Franklin County Is Located In The Blue Ridge Franklin County Virginia Is For Lovers Virginia Map

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Brought To You In Part By The Franklin County Area Agency On Aging This Month S Issue Features Agency O Health Programs Senior Activities Community Activities

Brought To You In Part By The Franklin County Area Agency On Aging This Month S Issue Features Agency O Health Programs Senior Activities Community Activities

Tax Sale For Franklin County Florida Fl Tax Lien Certificates And Tax Deeds Franklin County Tax Lawyer Tax Attorney

Tax Sale For Franklin County Florida Fl Tax Lien Certificates And Tax Deeds Franklin County Tax Lawyer Tax Attorney

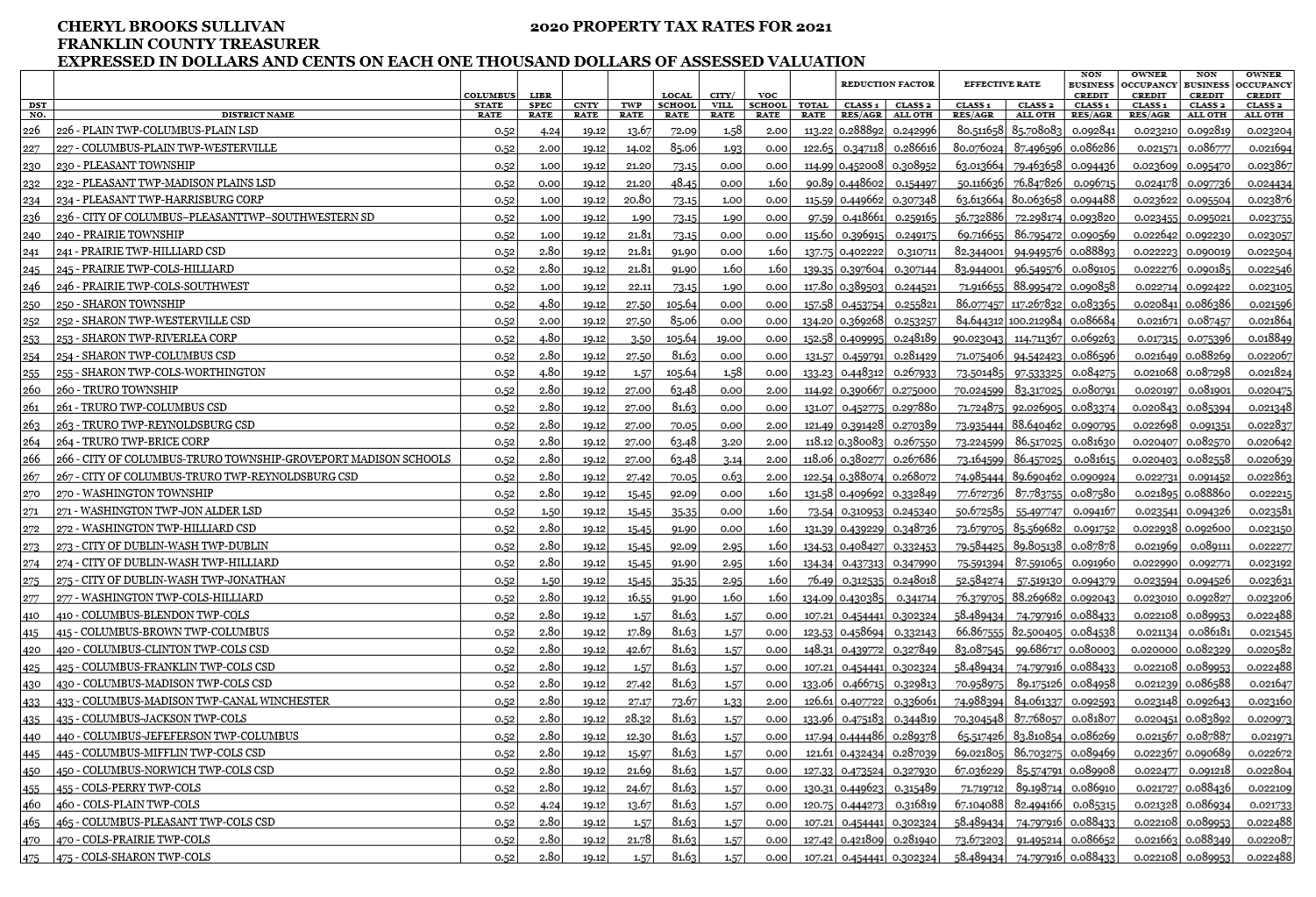

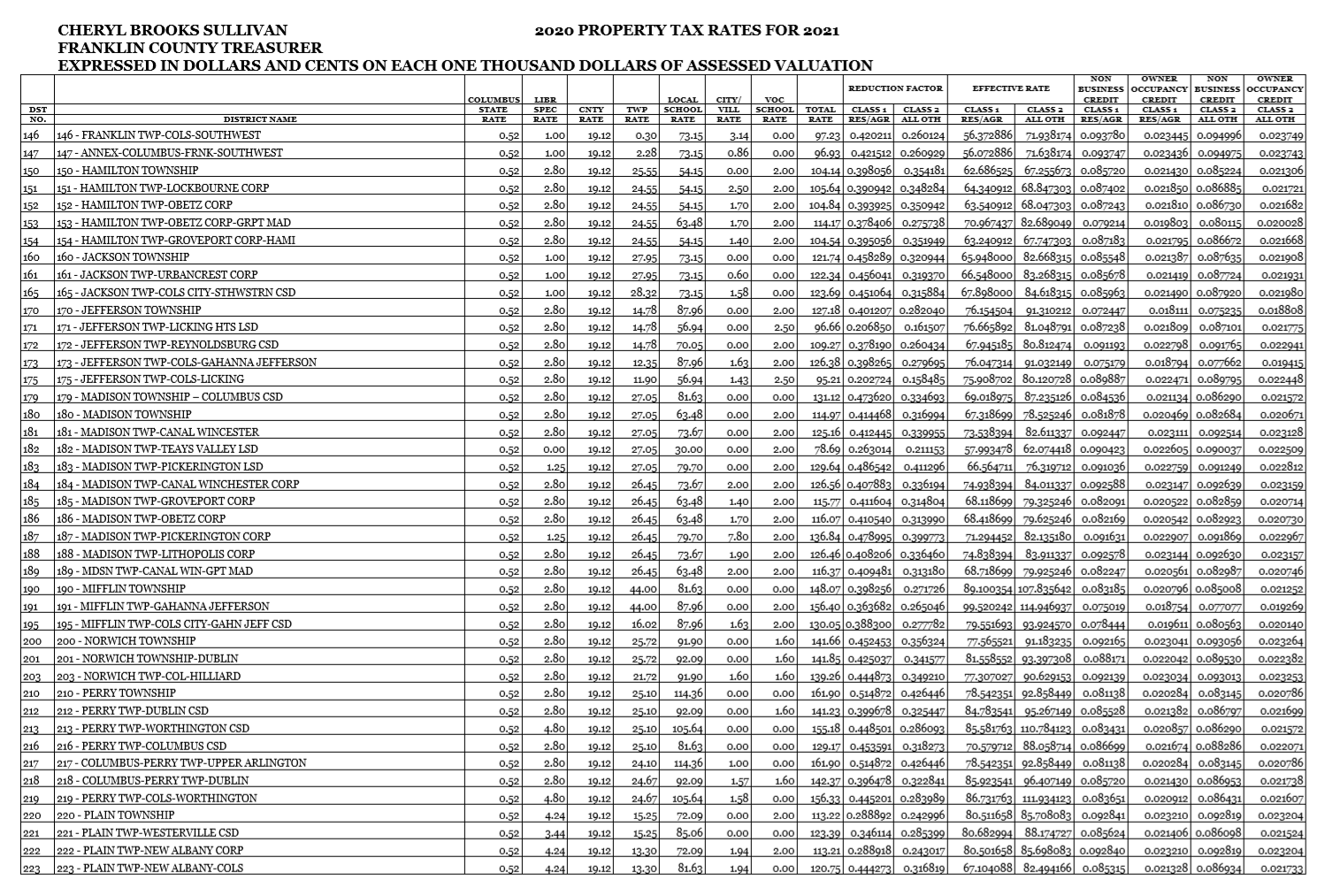

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Property Tax Inquiry

Franklin County Property Tax Inquiry

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Tax Assessor S Office

Franklin County Tax Assessor S Office

Minnesota Property Taxes By County 2015 Property Tax Tax Reduction Income Tax Return

Minnesota Property Taxes By County 2015 Property Tax Tax Reduction Income Tax Return

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Submitted By The Pennsylvania Housing Finance Agency Raystown Crossing Low Income Housing Tax Credits Low Income

Submitted By The Pennsylvania Housing Finance Agency Raystown Crossing Low Income Housing Tax Credits Low Income

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Qpublic Net Franklin County Fl Franklin County County Franklin

Qpublic Net Franklin County Fl Franklin County County Franklin

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home