Kentucky Property Tax Exemption For Disabled Veterans

California for instance allows. DISABLED VETERANS EXEMPTION NRS 361091 The Disabled Veterans Exemption is provided for veterans who have a permanent service-connected disability of at least 60.

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Article X of the Constitution of Virginia and.

Kentucky property tax exemption for disabled veterans. The United States Department of Veterans Affairs or the Department of Defense. Kentucky offers a homestead tax exemption for veterans with 100 service-connected disabilities as rated by the Department of Veterans Affairs Kentucky State Tax Credit for National Guard Members Kentucky residents are eligible for a 20 tax credit if the taxpayer is a National Guard member at the end of the calendar year. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined to be totally disabled and are receiving payments pursuant to their disability.

This amount is deducted from the assessed value of the applicants home and property taxes are computed based upon the remaining assessment. The value of the homestead exemption for the 2019-2020 assessment years is 39300. A tax exemption on a home and land on the same parcel up to five acres that is classified as owner occupied and either titled solely to the veteran or jointly with a spouse.

The amount of exemption is dependent upon the degree of disability incurred. Multiple residencesOwners of may only. The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service-connected injury or disease have been rated 100 disabled or are being compensated at the 100 rate due to unemployability.

3 The exemption shall be made available to qualified Kentucky residents as. ALBEMARLE COUNTY Va. Kentucky has a homestead property tax exemption for disabled veterans.

According to a release the exemption is for veterans with 100 percent service-connected permanent and total disability. Kentucky Property Tax Exemptions Disabled veterans are eligible for the same homestead tax break that Kentucky residents aged 65 and older or who are declared as totally disabled as determined by a government agency in-state get. 34 rows Many states offer exemptions solely for disabled veterans.

CBS19 NEWS -- Disabled veterans may qualify for a personal property tax exemption in Albemarle County. Kentucky Tuition Exemption for Spouse or Child of Permanently Disabled Members of the Kentucky National Guard Reserves War Veterans Former Prisoners of War. Find out more about the homestead exemption.

The state willreimburse the county treasurer for the lost revenue. A disabled veteran in Kentucky may receive a property tax exemption of up to 36000 on hisher primary residence if the veteran is 100 percent disabled as a result of service. Provides information about military tax issues including military pay income tax exemption military spouses residency relief act military retirement and military filing extensions in Kentucky.

This tax break is a property tax exemption of up to 37600 at the time of this writing for primary residences. Members of the Kentucky National Guard or Reserve Component must be rated one hundred percent 100 permanently and totally disabled as provided in KRS Chapter 342. Legislation expanded the senior property tax exemption to include qualifying disabled veterans For disabled veterans who qualify 50 percent of the first 200000 of actual value of the veterans primary ce is residen exempted.

Property Tax for Disabled Veterans Totally disabled veterans are eligible for up to a 37600 deduction on the assessed value of their home for property tax purposes. Veterans deemed totally and permanently service-connected disabled qualify for. To qualify the veteran must be totally and permanently disabled and the disability must be related to their military.

Disabled Veterans Exemption In accordance with MCL 2117b real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or the disabled veterans un-remarried surviving spouse. Kentucky does not tax active duty military pay. They have been determined to be totally and permanently disabled under the rules of the Kentucky Retirement Systems.

To apply for the Disabled Veterans Exemption you must.

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Residence Homestead Exemption Information Williamson Cad

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

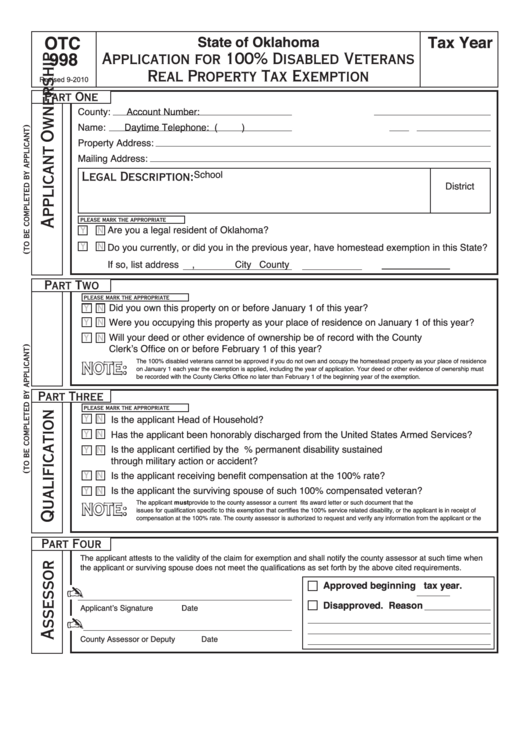

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Tax Exemption Printable Pdf Download

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Tax Exemption Printable Pdf Download

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Do You Qualify For A Property Tax Exemption Find Out Here

Do You Qualify For A Property Tax Exemption Find Out Here

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home