Real Estate Tax Franklin County Ohio

The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. The real estate divisions employees oversee the appraisal of 432388 parcels.

Franklin County Treasurer Property Search

Franklin County Treasurer Property Search

The real estate tax collection begins with the assessment of the real estate parcels in Franklin County.

Real estate tax franklin county ohio. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Second-Half Real Estate Tax Payments Due. Throughout Ohio there is a Transfer Tax and Conveyance fee on real property and manufactured homes.

The median property tax on a 15530000 house is 211208. 1 days ago. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County Auditor.

The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. 123 Main Parcel ID Ex. Office Closed in Observance of Memorial Day.

The Treasurers Office collects real estate taxes for the previous year during the current year. Ohio law mandates a general reappraisal every six years with an. The real estate divisions employees oversee the appraisal of 432388 parcels.

Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. The following provides you with information on property tax payments. The County assumes no responsibility for errors in the information and does not guarantee that the.

This is also known as payment arrears For example. John Smith Street Address Ex. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

Probate Only with Real Estate. 6900 plus 100 per page if over 4 pages Will for Record Only. Users of this data are notified that the primary information source should be.

Overview The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Probate Only with Real Estate Tax.

Taxes collected in 2021 represent the real estate tax obligations from 2020. Residential property owners will also need the Residential Data Sheet to accompany the above complaint form. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

The Franklin County Auditors Office maintains the most comprehensive set of real estate records available in Franklin County. Real Estate Transfer Tax. The only changes to a propertys value outside of the three year cycle would be due to.

New application provides a simple search by your parcel owner name or property address. This estimator is provided to assist taxpayers in making informed decisions about real estate taxes and to anticipate the impact of property value fluctuations. Office Closed in Observance of Juneteenth.

Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. Real Estate property taxes are due semi-annually each January 20th and June 20th. The Franklin County Auditors Office is a leader in public service and provides quality cost-effective information and services to all Franklin County residents.

Get information on a Franklin County property and view your tax bill. In Franklin County that fee is 3 per every 1000 of the sale price with a 3 minimum and a 050 per parcel transfer tax. The due date for the second-half real estate collection is Monday June 21 2021.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Franklin County Tax Appraisers office. Tax rates are established for the next year by the State of Ohio Department of Taxation. Search for a Property Search by.

7600 plus 100 per page if over 4 pages Foreign Record. Please note you cannot use home equity line of credit checks or money market account to make an online payment. All parcels within Tax District 010 that begin with 287.

7400 plus 100 per page if over 4 pages Real Estate Transfer Only. Pay taxes online Your payment will be considered accepted and paid on the submitted date. The Franklin County Treasurers Office wants to make paying your taxes as easy as possible.

This includes the 1 per 1000 fee set by the state and the 2 per 1000 set by the Franklin County Board of Commissioners who last updated the fee in August 2019. The median property tax on a 15530000 house is 259351 in Franklin County. Please note that the Franklin County Treasurers Office collects real estate taxes for the previous year during the current year.

Franklin County collects on average 167. All parcels within Tax District 010 that end with 266. The Auditors office handles a wide variety of important responsibilities that affect all of Franklin Countys residents and businesses.

Ohio law mandates a general reappraisal every six years with an update at. Will for Record Only with Taxes. However it may take 2-4 business days for processing.

If either January 20th or June 20th occurs on a weekend the due date will be changed to the next business day following the 20th.

Buying A Home In Warren County Ohio Mason Ohio Ohio Real Estate Mason Homes

Buying A Home In Warren County Ohio Mason Ohio Ohio Real Estate Mason Homes

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Treasurer Real Estate Taxes

Franklin County Treasurer Real Estate Taxes

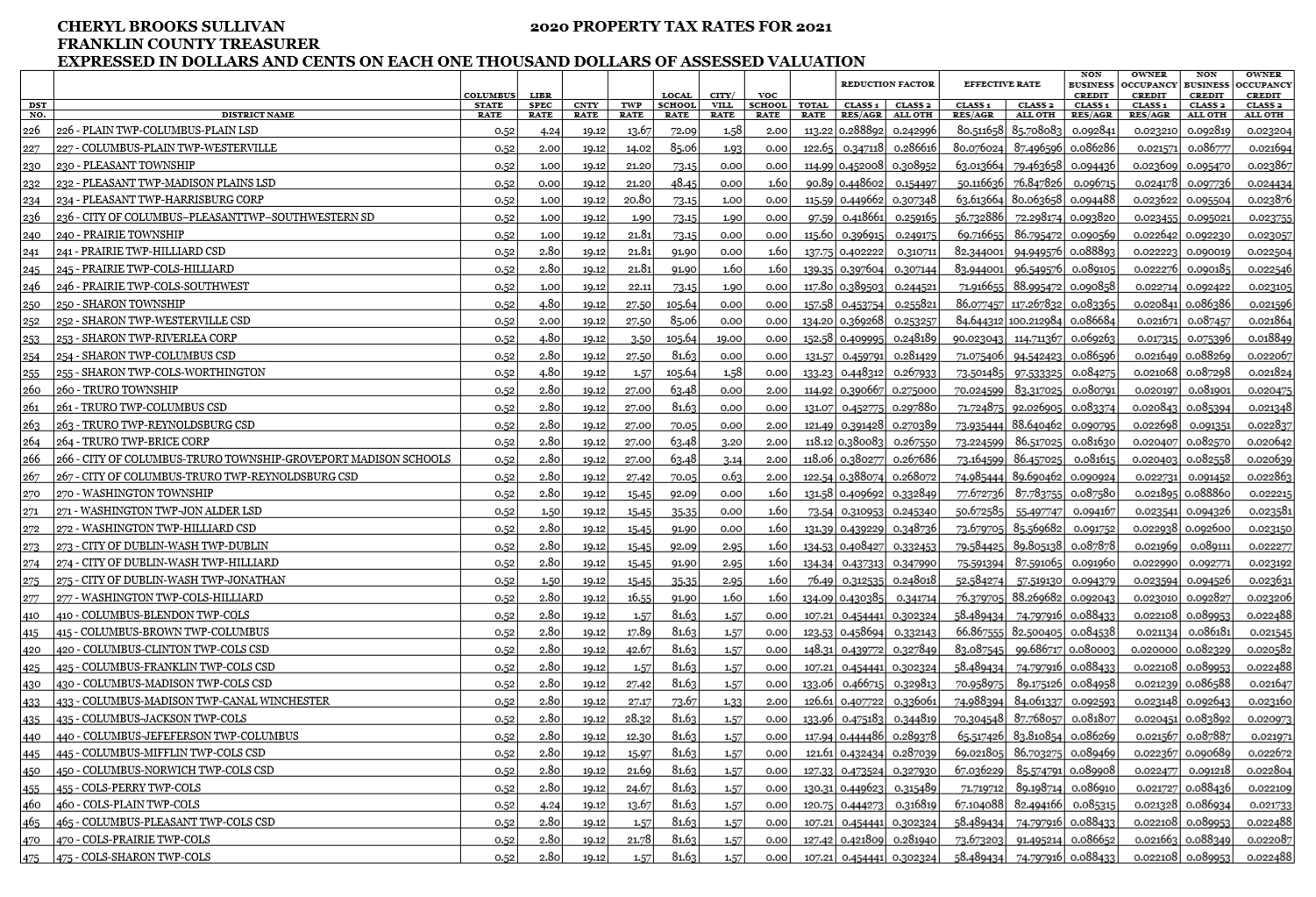

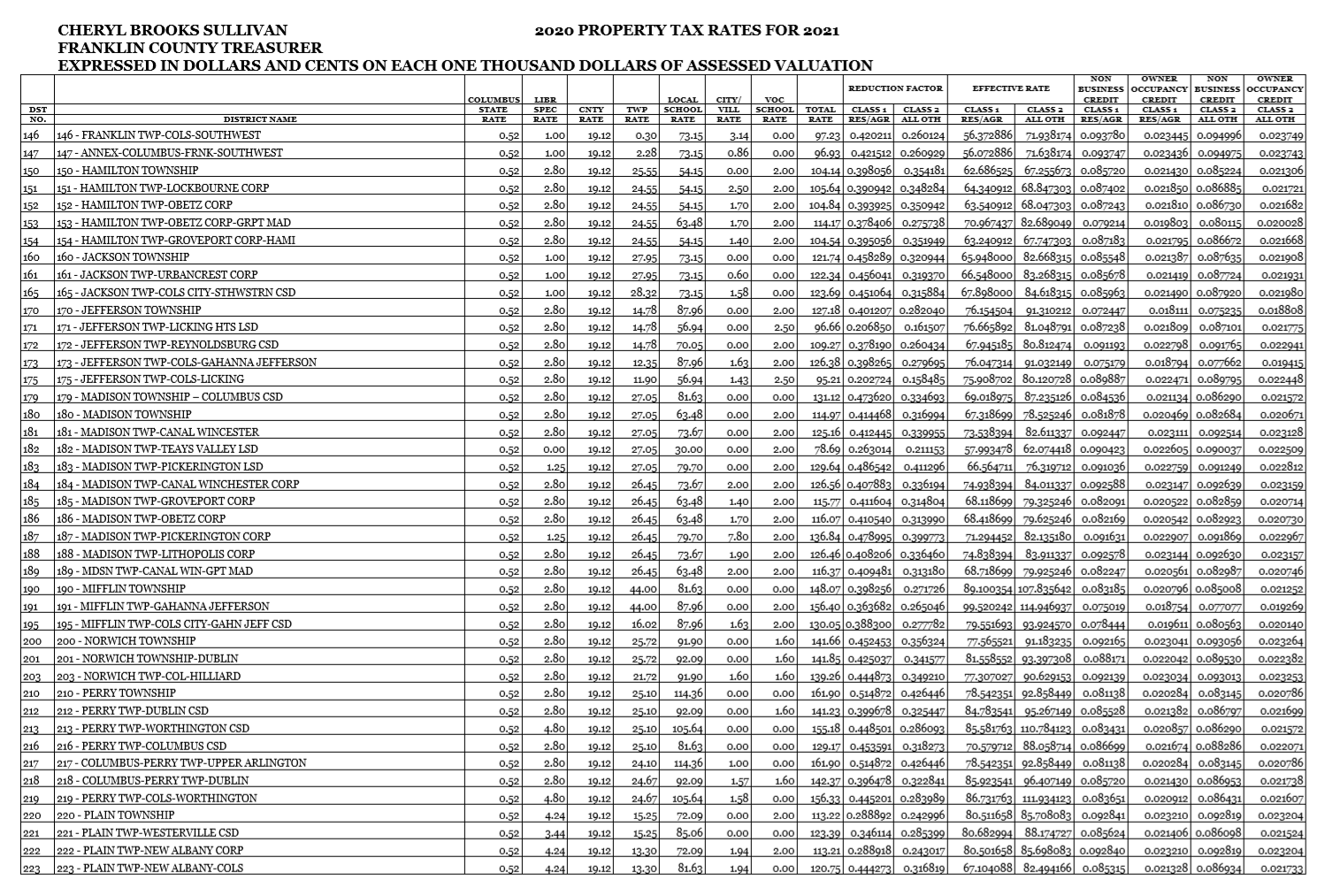

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Map Of Warren County Ohio School Districts Google Search Warren County Warren Ohio Ohio

Map Of Warren County Ohio School Districts Google Search Warren County Warren Ohio Ohio

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Warehouses Will Total 1 5 Million Square Feet Canal Winchester Sidewalk Repair Parks Department

Warehouses Will Total 1 5 Million Square Feet Canal Winchester Sidewalk Repair Parks Department

Buying A Home In Warren County Ohio Ohio Real Estate Mason Ohio Mason Homes

Buying A Home In Warren County Ohio Ohio Real Estate Mason Ohio Mason Homes

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home