Property Tax Payment History Of Upic

The fee number will display all tax bills associated with this property including supplemental tax bills and defaulted tax years. Property tax payments must be received or United States Postal Service USPS postmarked by the delinquency date to avoid penalties.

Property Owners Get Upic Cards

Property Owners Get Upic Cards

Fees will be added to late property tax payments.

Property tax payment history of upic. Bills are generally mailed and posted on our website about a month before your taxes are due. Credit and Debit Card service fees are non-refundable and cover administrative costs associated with accepting payments online. We recommend using the fee number for online payments.

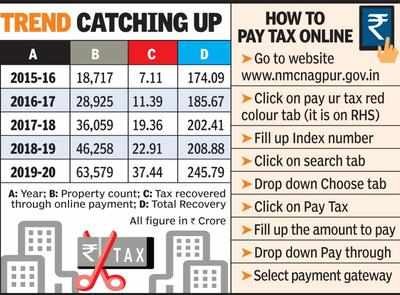

Some information relating to property taxes is provided below. The property tax account is being reviewed prior to billing. The 2020 property taxes are.

The process mirrors paper checks but is done electronically. However it may take 2-4 business days for processing. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

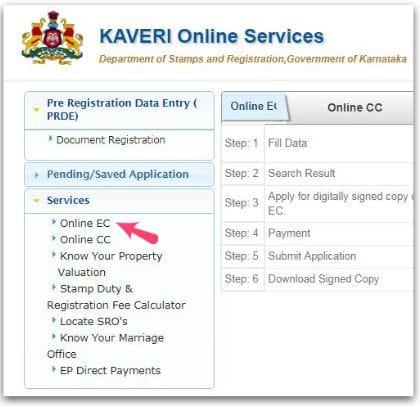

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Help prevent the financial collapse of the. SBR_3145_15_06_2020httpsyoutubeqh7Pt2JbxT8 10 Minutes Payment of Property Tax FY 2020-21 by 30-06-2020Filing Details for Filing Property Tax Retur.

Pay your tax bill online by electronic check eCheck with no service fee by entering in your checking account information. Convenience Fees are charged and collected by JPMorgan and are non-refundable. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Data and Lot Information. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. Otherwise the payment is delinquent and penalties will be imposed in accordance with State law.

Use of the ASMT number displays that specific tax bill only. Property taxes are levied on land improvements and business personal property. Enter Property Parcel Number APN.

The funds are withdrawn from the taxpayers bank account usually a checking account transferred over the ACH network then deposited into the Tax Collectors office bank account. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment.

Pay taxes online Your payment will be considered accepted and paid on the submitted date. Exemptions. The fastest way to process your Property Tax payment is online using the Taxes on the Web system.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. If the message doesnt reach you for any reason you are still required to pay your property taxes on time.

This service is only a reminder of King County property tax payment deadlines. FREE eCheck electronic check is a digital version of the paper check. It is 110 years older than the retail sales tax although sales taxes on cigarettes and gasoline were in existence prior to 1935 and nearly 150 years older than our notorious income tax which was born in 1971.

Property Tax Bills. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. King County is not at fault for late payments even if this notice fails to send or is never received.

This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. A Little History. Assessed Value History by Email.

Find Property Borough Block and Lot BBL Payment History Search. Payments by Electronic Check or CreditDebit Card. Payments made by eCheck routing and account number from your checking or savings account required are made without an additional processing fee.

Payments made by credit card or debit card require a 239 processing fee paid to the payment processor with a minimum processing charge. Search to see a 5-year history of the original tax amounts billed for a PIN. Watch our instructional video on making an online property tax payment.

Several options are available for paying your Ohio andor school district income tax. This program is designed to help you access property tax information and pay your property taxes online. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Your tax bill shows both an assessment ASMT number and a fee number. The real property tax is Ohios oldest tax originating in 1825. Pay your property taxes conveniently and securely using our website.

New application provides a simple search by your parcel owner name or property address. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County.

Read more »