Property Tax Payment History Ventura County

Credit and debit card payments are charged a 234 processing fee by our processing vendor. There are several safe and convenient ways to pay your property taxes during this event.

Https Assessor Countyofventura Org Forms Public 20information 20fees 20schedule Pdf

Treasurer-Tax Collector - Ventura County.

Property tax payment history ventura county. The bill for the coming tax year is then issued to the owner of record at that time and that individual is liable for the taxes even if the boat was sold soon after that date. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Payments made by credit card or debit card require a 239 processing fee paid to the payment processor with a minimum processing charge.

By contacting us at 805 654-2181 or visiting the Assessors Office located at 800 South Victoria Avenue Ventura CA. When making phone or electronic payments please note that. On your title report which you received when you acquired title insurance.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. If you do not receive a tax bill you may request a substitute bill by calling the Treasurer-Tax Collector at 805 654-3744 or visiting their website at Ventura County Property Tax. The Tax Collector does not grant tax exemptions.

If you believe you have a case for a penalty waiver DO NOT PAY ONLINE. Fees will be added to late property tax payments. The fastest way to process your Property Tax payment is online using the Taxes on the Web system.

Liability for vessel property taxes attaches to its owner as of 1201 am. Payments made by eCheck routing and account number from your checking or savings account required are made without an additional processing fee. Tax Payments for Calendar Year 2020.

E-Check payments are free. Once paid the Tax Collector will not remove the payment. To pay by telephone call toll-free 18884730835Your Secured Property Tax Bill contains your Assessors Identification Number AIN Year and Sequence which you will need to complete the transaction.

See Ventura County CA tax rates tax exemptions for any property the tax assessment history for the past years and more. The first installment is delinquent if payment is not received on or postmarked by December 10 the second installment is delinquent if payment is not received on or postmarked by April 10. All online payments will have penalties if past the delinquency date.

On your Annual Property Tax Bill or Supplemental Property Tax Bill By entering your property address on the Property Characteristics and Values page. Pay Property Tax Online Ventura County. Pay Your Taxes - Ventura County.

Electronic Payments can be made online from our property tax payment website. Property tax payments must be received or United States Postal Service USPS postmarked by the delinquency date to avoid penalties. Property taxes are levied on land improvements and business personal property.

Annual tax bills are mailed once a year in mid October. Quickly identify tax rates in your area and see how much your neighbors are paying in property taxes. Secured Taxes - Ventura County.

We accept major credit card and debit card payments over the telephone. Ventura County CA Tax per Square Foot. Annual Property Tax Bills.

Property Tax- Description - Ventura County. Permit Imprint Pre-sorted mail used by bill pay services such as online home banking. The Tax Collector does not have the ability to change or alter the amount to be paid online.

If the message doesnt reach you for any reason you are still required to pay your property taxes on time. King County is not at fault for late payments even if this notice fails to send or is never received. Phone Payments can be made at 1 888 636-8418.

Otherwise the payment is delinquent and penalties will be imposed in accordance with State law. This program is designed to help you access property tax information and pay your property taxes online. On January 1 each year lien date.

Please visit the Fresno County Property Tax Web Application for tax bill information and payment processing. Convenience Fees are charged and collected by JPMorgan and are non-refundable. County of Ventura - WebTax - Tax Payment History.

The redesigned FY 2020-21 Secured Property Tax Bill sample. This service is only a reminder of King County property tax payment deadlines.

Slo How It Was For About 10 000 Years Beautiful Still Native American Peoples Native American Culture First Peoples

Slo How It Was For About 10 000 Years Beautiful Still Native American Peoples Native American Culture First Peoples

Snow In Ventura In January Of 1949 Ventura California Ventura County Ventura

Snow In Ventura In January Of 1949 Ventura California Ventura County Ventura

This Map Shows How Much You Need To Make To Afford The Average Home In Every State Map 30 Year Mortgage Northern California

This Map Shows How Much You Need To Make To Afford The Average Home In Every State Map 30 Year Mortgage Northern California

California Wildfire Crisis Is Getting Worse Because Of Climate Change Business Insider California Wildfires California History Fire Prevention

California Wildfire Crisis Is Getting Worse Because Of Climate Change Business Insider California Wildfires California History Fire Prevention

Https Vcportal Ventura Org Ceo Docs Publications Fy2020 21 Countywide Service Rates Fees Pdf

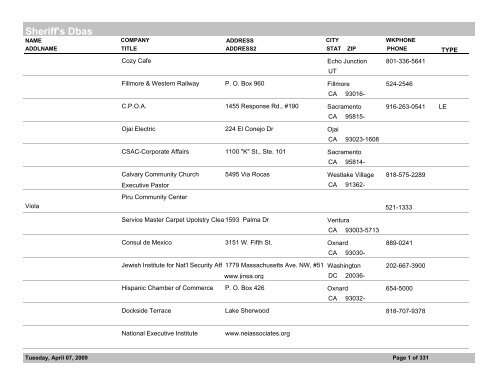

Sheriff S Dbas Ventura County Star

Sheriff S Dbas Ventura County Star

Traditional Chumash Home Under Construction At Ventura County Fair In California 1923 Native American History California History Aboriginal American

Traditional Chumash Home Under Construction At Ventura County Fair In California 1923 Native American History California History Aboriginal American

Pin By Teresa Davis Homes By Exp Real On Buying A House Home Home Equity Home Buying Capital Gain

Pin By Teresa Davis Homes By Exp Real On Buying A House Home Home Equity Home Buying Capital Gain

Credit Reports And Scores Usagov Credit Report Credit Score Good Credit

Credit Reports And Scores Usagov Credit Report Credit Score Good Credit

Measure O Passes In Ventura Now What Estate Tax Ventura County Real Estate

Measure O Passes In Ventura Now What Estate Tax Ventura County Real Estate

Community Resources Ventura County

Community Resources Ventura County

Ventura County Property Tax Records Ventura County Property Taxes Ca

Ventura County Property Tax Records Ventura County Property Taxes Ca

Gis And Mapping Ventura County

Gis And Mapping Ventura County

We Care About Our Customers Let Us Know How We Can Help You Today Http Www Lawyersvc Com Lawyerstitle Titlein Title Insurance This Is Us Ventura County

We Care About Our Customers Let Us Know How We Can Help You Today Http Www Lawyersvc Com Lawyerstitle Titlein Title Insurance This Is Us Ventura County

Pin On My Ventura County Real Estate Blog

Pin On My Ventura County Real Estate Blog

Interactive Maps Ventura County Public Works Agency

Ventura County Assessor Supplemental Assessments

Ventura County Assessor Supplemental Assessments

Ventura County Property Tax Records Ventura County Property Taxes Ca

Ventura County Property Tax Records Ventura County Property Taxes Ca

California Public Records Public Records California Public

California Public Records Public Records California Public

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home