Dublin Ohio Property Tax Payment

The City of Dublins online bill payment system has added a NEW payment option. CheckingSavings electronic payment no fee is available to pay your tax due with your return filing make estimated payments or other forms of tax.

Dublin Ohio Usa How To Guard Against Tax Fraud

Dublin Ohio Usa How To Guard Against Tax Fraud

The Finance Committee will reevaluate these requests quarterly in 2021 and may approve add.

Dublin ohio property tax payment. Counties in Ohio collect an average of 136 of a propertys assesed fair. Ohio Department of Taxation Estate Tax unit 4485 Northland Ridge Blvd Columbus OH 43229. Dublin Ohio 43017.

The countys average effective property tax rate is 218 which ranks as the second-highest out of Ohios 88 counties. The tax type should appear in the upper left corner of your bill. The Tax Division is located at 5200 Emerald Parkway Dublin Ohio 43017 and is open Monday through Friday 8 am.

Situated along the Michigan border and Lake Erie in northern Ohio Lucas County has property tax rates that are higher than both state and national averages. New application provides a simple search by your parcel owner name or property address. Cheryl brooks sullivan.

Ohio Department of Taxation PO Box 182197 Columbus Ohio. The median annual property tax payment is 2511. Refunds Individual or Withholding 6144104460.

Your tax rate is an accumulation of all these levies and bond issues. Toll Free Tax Number. Dublin Ohio 43017.

Ohio Department of Taxation PO Box 182389 Columbus Ohio 43218-2389. Refunds Individual or Withholding 6144104460. Look Up Secured Property Tax Look Up Supplemental Property Tax.

You can file jointly with the City of Dublin even if you filed separately for the IRS. The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. Property Tax Property taxes are based on the tax rate where the property is located and the taxable value based on 35 of market value of the property as determined by the county auditor.

Register Pay via. Dublin OH Dublin City Council approved 185442 in hotelmotel tax grants for 2021 at its meeting on December 7 2020. If your tax liability after credits is anticipated to be greater than 200 you are required to make quarterly estimated payments April 15 June 15 September 15 January 15.

Corporate Estates Partnerships Trusts Corporate Refunds 6144104460. SD 40PSD 40XP payment coupon with payment. If you are remitting for both Ohio and school district income taxes you must remit each payment as a separate transaction.

For payments made online a convenience fee of 25 will be charged for a credit card transaction. Some of the grant amounts approved were lower than the amount requested. Ohio law limits the amount of taxation without a vote of the people to what is know as the 10 mill limit 10 per thousand of assessed valuation.

Our mailing address is City of Dublin Income Tax Division. However it may take 2-4 business days for processing. Dublin Ohio 43017.

Estate Tax Notices and Responses. Toll Free Tax Number. No fee for an electronic check from your checking or savings account.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Pay taxes online Your payment will be considered accepted and paid on the submitted date. Corporate Estates Partnerships Trusts Corporate Refunds 6144104460.

New Payment Option Available to Pay Your Dublin Taxes. Refunds Individual or Withholding 6144104460. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Toll Free Tax Number. Corporate Estates Partnerships Trusts Corporate Refunds 6144104460.

SD 100 without payment. The City of Dublin receives approximately 2 percent of your property taxes. Any additional real estate taxes for any purpose must be voted by County residents.

Forms and instructions are available on our web site httpsdublinohiousagovtaxationindividual-forms or you may call the Income Tax Division 6144104434.

Dublin Ohio Usa Dublin Boundary Map

Incentives Thrive In Dublin Ohio Usa

Incentives Thrive In Dublin Ohio Usa

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Dublin Ohio Usa Visiting Dublin

Dublin Ohio Usa Visiting Dublin

Dublin Ohio Usa Resident S Guide To Understanding Taxes

Dublin Ohio Usa Resident S Guide To Understanding Taxes

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Dublin Ohio Usa Historic Dublin

Dublin Ohio Usa Historic Dublin

43017 Zip Code Dublin Ohio Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

43017 Zip Code Dublin Ohio Profile Homes Apartments Schools Population Income Averages Housing Demographics Location Statistics Sex Offenders Residents And Real Estate Info

Http Dublinohiousa Gov Dev Dev Wp Content Uploads 2013 10 Resident Guide To Taxes Pdf

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Job Opportunities Sorted By Job Title Ascending More Than A Job Dublin Oh Usa

Job Opportunities Sorted By Job Title Ascending More Than A Job Dublin Oh Usa

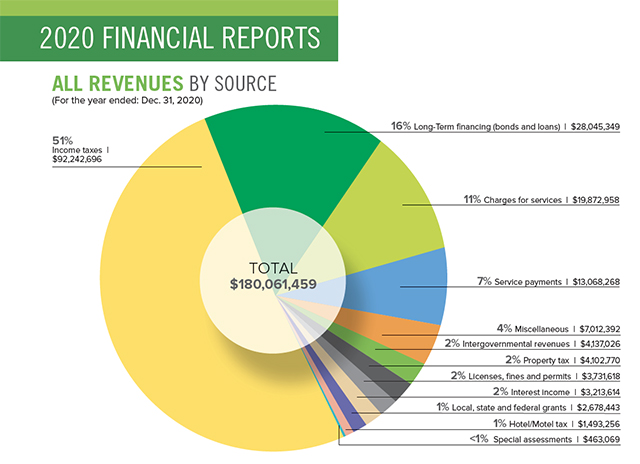

Dublin Ohio Usa 2020 Annual Report

Dublin Ohio Usa 2020 Annual Report

Dublin Ohio Oh 43064 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home