Property Tax In Houston Texas 2019

Harris County Hospital District. The Harris County Tax Assessor-Collectors Office Property Tax Division maintains approximately 15 million tax accounts and collects property.

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Loans Mortgage Payment

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Loans Mortgage Payment

Mike Sullivan Launches Property Tax Workshops Apr.

Property tax in houston texas 2019. Fortunately Texas 2019 recently concluded legislative session saw the passage of Senate Bill 2 by state Sen. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Texas Property Tax Code.

Public administration and educational services are the top employment industries in the area. The typical Texas homeowner pays 3390 annually in property taxes. Box 4277 Houston TX 77210-4277.

Texass median income is 62353 per year so the. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The property tax account is being reviewed prior to billing.

Estimated Property Tax Revenues. The Harris County Tax Assessor-Collectors Office is working Election Day from 7 am - 7 pm. This is a complex question and many Texans think they have the answer.

The average property tax payment in Terrell County is 531 and the effective property tax rate falls around 080. On Wednesday he signed Senate Bill 2 into law which is meant to do just that. The effective tax rate is the total tax rate needed to raise the same amount of property tax revenue for City of Houston from the same properties in both the 2018 tax year and the 2019 tax year.

The 2020 property taxes are. SB 2 limits local government to 35 per year annual. 95 rows Property tax tates for all 1018 Texas independent school districts are available by clicking on.

Submit Tax Payments PO. Y280817 and film code no. Houston Community College System.

1311 farhills ct houston tx. In our continued efort to make the information from our ofce more accessible we. Texas Property Tax Exemptions Property tax exemptions reduce the appraised value of your real estate and this can in turn reduce your tax bill.

The measure caps the rate of annual property tax growth in Texas at 35 percent. In this blog the Home Tax Solutions team is going to take a look at some of the reasons Texans find themselves with hefty property tax bills each year what homeowners can do and how the Home Tax Solutions team helps. General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623.

You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. 576270 as modified by any supplements thereto or replats thereof. Te 2019 edition of the.

Port of Houston Authority. Mailing Contact Information. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

A tax rate of 0567920 per 100 valuation has been proposed by the governing body of City of Houston. Harris County Flood Control Dist. Final Week of Property Tax Workshops.

Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property. Compare that to the national average which currently stands at 107. Lot 26 block 02 of eagle landing section 2 an addition in harris county texas according to the map or plat thereof recorded in the map records of harris county texas under clerks file no.

Tis publication is a valuable tool for property tax professionals and the public to be informed about property tax administration. Property taxes can be baffling and frustrating if you dont deal with them regularly but our. Today the county is home to 721 people and the median property value is around 66600.

For example a tax rate of 18 applied to an appraised value of 200000 works out to more than 18 of an appraised 175000 valueits a difference of 450. 2015 Property Tax Workshops Successful. 254 rows Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169.

NOTICE OF 2019 TAX YEAR PROPOSED PROPERTY TAX RATE FOR CITY OF HOUSTON.

Royal Oaks Country Club In Harris County Texas Harris County Texas Houston Real Estate Oaks

Royal Oaks Country Club In Harris County Texas Harris County Texas Houston Real Estate Oaks

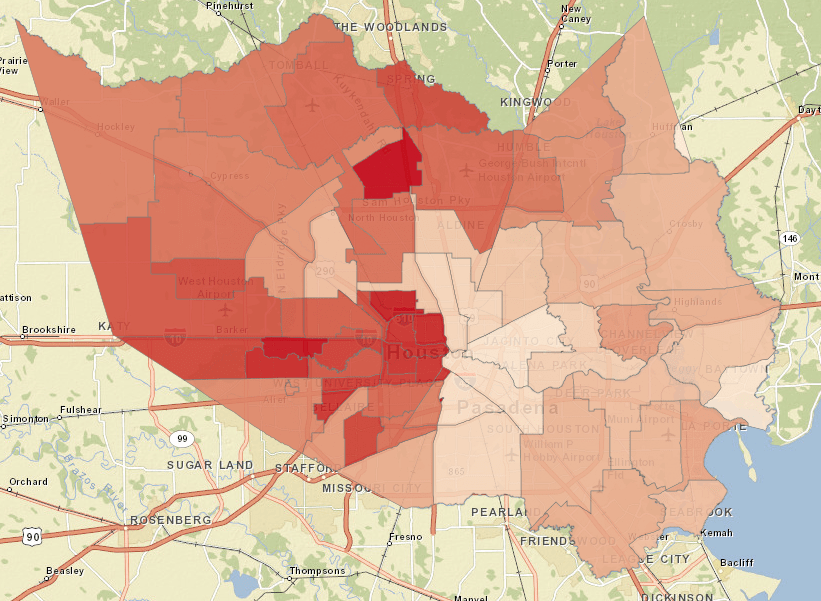

Houston Property Tax Rates H David Ballinger

Houston Property Tax Rates H David Ballinger

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Ten Mayors Of North Texas Austin S Property Tax Cap Plan Could Hurt Cities

Ten Mayors Of North Texas Austin S Property Tax Cap Plan Could Hurt Cities

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Irs 2017 Schedule E Tax Refund Irs Home Loans

Irs 2017 Schedule E Tax Refund Irs Home Loans

Tac School Property Taxes By County

Tac School Property Taxes By County

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Tac School Property Taxes By County

Tac School Property Taxes By County

12510 Boheme Drive Houston Tx 77024 Magnificent 6 Bedroom 5 5 Bath Custom Home Built By Northstone Builders S Houston Real Estate Resort Style Custom Homes

12510 Boheme Drive Houston Tx 77024 Magnificent 6 Bedroom 5 5 Bath Custom Home Built By Northstone Builders S Houston Real Estate Resort Style Custom Homes

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

Fnma Future Stock Price Real Time Quotes Stock Quotes Stock Prices

Fnma Future Stock Price Real Time Quotes Stock Quotes Stock Prices

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Tac School Property Taxes By County

Tac School Property Taxes By County

Irs Back Tax Help For Houston Tx Affordable Flat Fee Tax Debt Help Should You Live In Houston Texas And Fi Houston Texas Skyline Skyline Best Places To Eat

Irs Back Tax Help For Houston Tx Affordable Flat Fee Tax Debt Help Should You Live In Houston Texas And Fi Houston Texas Skyline Skyline Best Places To Eat

Houston Property Tax Altus Group

Houston Property Tax Altus Group

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home