South Carolina Property Tax Depreciation Schedule

30 of total system cost with no cap. Form PT-300 - Property Return.

A Map Shows The Kent Estates Property East Of S C 170 Landpreservation Beaufortcounty Bluffton Land Realestate Charter Beaufort County Bluffton Kent

A Map Shows The Kent Estates Property East Of S C 170 Landpreservation Beaufortcounty Bluffton Land Realestate Charter Beaufort County Bluffton Kent

Essentially the amount of tax you owe depends upon three variables.

South carolina property tax depreciation schedule. Please note that the Department of Revenue makes the final determination of the allowable depreciation. 2016 Economic Incentives Report. For manufacturing property the depreciation schedule is based upon a fixed depreciation percentage.

South Carolina Department of Revenue Manufacturing Section PO Box 125 Columbia SC 29214-0740Phone. 25 of total system cost up to 35000. For all other years of the depreciable life of the property an additional depreciation deduction is available for South Carolina purposes.

Federal MACRS depreciation 5 year property schedule. County and Municipal Effective Tax Rates. Amount of South Carolina net operating loss that is more then the federal amount.

Other incentives and resources. Income tax depreciation is not used to determine the value of personal property and the statutory depreciation allowance generally results in slower depreciation. South Carolina forms and schedules.

Form PT-100 - Business Personal Property Return. Therefore the South Carolina adjusted basis is greater than the federal adjusted basis. Taxes And North Carolina Gross State Product.

Form PT-100 - Business Personal Property Return. 2016 Cost Index and Depreciation Schedules. Code 12-37-930 and varies from 6 percent to 20 percent based on the classification of a manufacturer.

The company will be allowed to depreciate its personal property to a level of 10 of the original property value. Form PT-300 - Property Return. For other business personal property income.

4a The assessment ratio may not be lower than four percent. It prepares the personal property tax returns from depreciation data entered in the Asset Detail dialog. South Carolina forms and schedules.

Statistical Abstract of North Carolina Taxes 2004. Code Section 1254100 authorizes the Department to examine the books and records of a taxpayer to ascertain the correctness of any return or tax liability. The local millage rate is applied to the assessed depreciated value to determine taxes.

Payment of the taxes on the real property. Real and personal property are subject to the tax. Approximately two-thirds of county-levied property taxes are used to support public education.

The UltraTaxSouth Carolina Personal Property Tax application supports 1040 1041 1065 1120 and 1120S entities. Addition many of South Carolinas property tax laws are new so precedents have yet to be set for many situations. Property tax is administered and collected by local governments with assistance from the SCDOR.

A South Carolina modification is required on the South Carolina income tax return. Corporation Income and Business Franchise Taxes. Code Section 1254210 requires all taxpayers to keep books and records as the South Carolina Department of Revenue may prescribe.

Beaufort County collects the highest property tax in South Carolina levying an average of 131900 045 of median home value yearly in property taxes while Chesterfield County has the lowest property tax in the state collecting an average tax of 29300 038 of median home value per year. SC Code 12 -37-610 and 12-49-20. Current Commercial Tax Credits 1117 State Tax Credit.

2016 Economic Incentives Report. South Carolina net operating loss. Commercial property is depreciated over 39 years.

For other business personal property income tax depreciation is used as the metric for lowering taxable. A leasehold interest will be subject to ad valorem tax if real property that is subject to a property tax exemption is leased for a definite term and the lessee does not qualify for an exemption. B with respect to personal property based on the then depreciated value applicable to such property under the fee and thereafter continuing with the South Carolina property tax depreciation schedule.

Residential income property is depreciated over 275 years on a straight-line basis. Fiscal Year 2018-2019. Bonus Depreciation Section 168k Federal Overview.

South Carolina Department of Revenue Business Personal Property Columbia SC 29214-0301 BPP Taxes Phone. Internal Revenue Code Section 168k provides for a 30 additional first year depreciation allowance for qualifying property as provided in the Job Creation and. The depreciation allowance is set forth in SC.

See Clarendon County ex rel. 2016 Cost Index and Depreciation Schedules. This is set to expire 12312021.

Can only take 3500 or 50 of your tax liability per year for up to 10 years. County Taxable Real Property Valuations. For manufacturing property the depreciation schedule is based upon a fixed depreciation percentage.

Personal property used in operating the property such as apartment appliances is depreciated over shorter periods typically five to 10 years. The UltraTaxSouth Carolina Personal Property Tax application supports 1040 1041 1065 1120 and 1120S entities. Statistical Abstract 2004 - Part II.

The exact property tax levied depends on the county in South Carolina the property is located in. It prepares the personal property tax returns from depreciation data entered in the Asset Detail dialog. Understanding South Carolinas real and personal property tax structure involves a trip back to your high school algebra class.

County Property Tax Rates and Reappraisal Schedules.

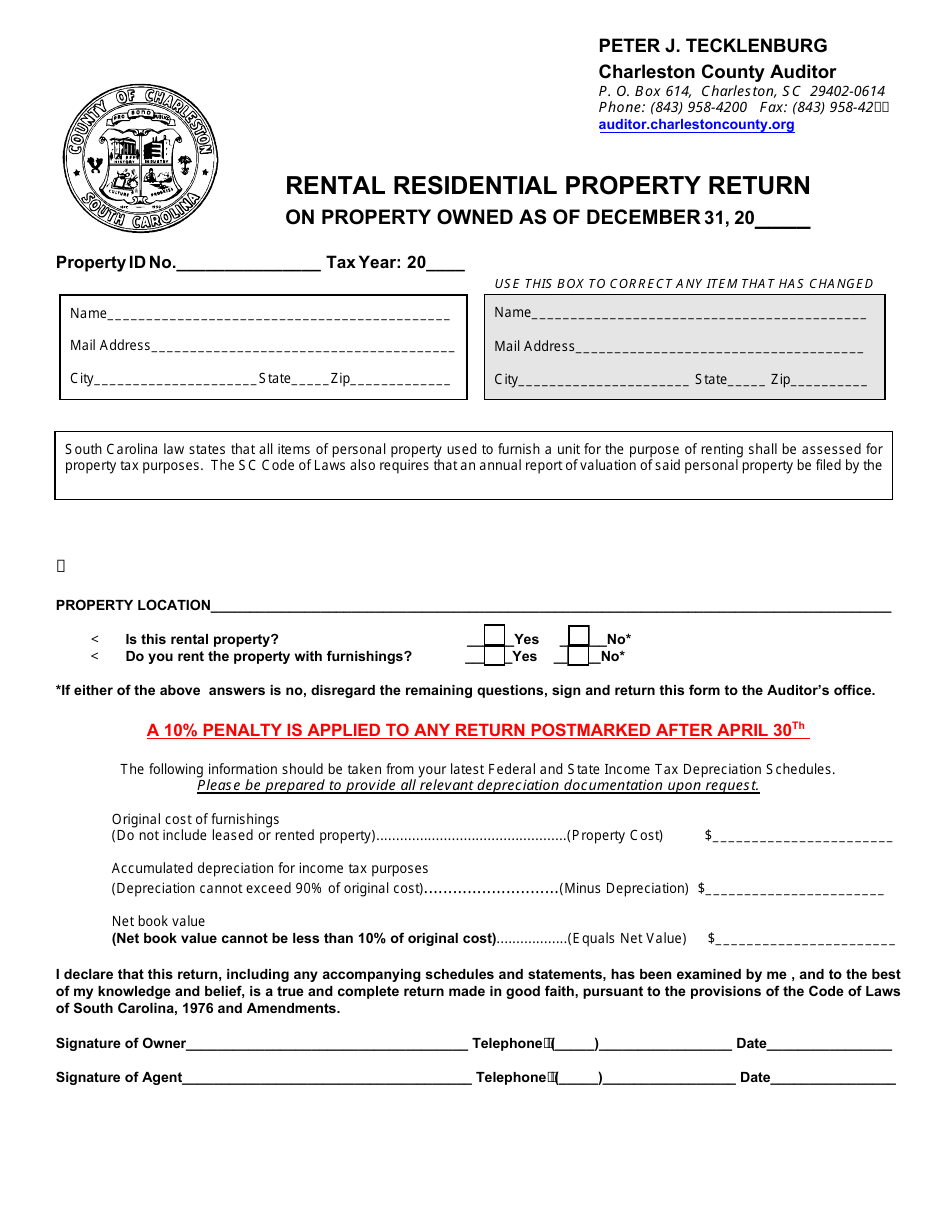

County Of Charleston South Carolina Rental Residential Property Return Form Download Fillable Pdf Templateroller

County Of Charleston South Carolina Rental Residential Property Return Form Download Fillable Pdf Templateroller

Csra Discount Homes 866 480 Repo 7376 Home Ownership Discounted Home

Csra Discount Homes 866 480 Repo 7376 Home Ownership Discounted Home

Home On Charleston High Battery Charleston Sc South Carolina Real Estate Edisto Island Charleston Homes

Home On Charleston High Battery Charleston Sc South Carolina Real Estate Edisto Island Charleston Homes

Https Www Charlestoncounty Org Files Forms Tax Rentresidproprtnfrm Pdf 10

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr18 13 Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Documents Sctied Chapter 204 Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr05 20 Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr93 11 Pdf

Business Personal Property Tax In Sc What To Know

Business Personal Property Tax In Sc What To Know

Funfact Bizarretax Taxes Tax Bizarre Online Marketing Strategies Infographic Marketing Online Marketing

Funfact Bizarretax Taxes Tax Bizarre Online Marketing Strategies Infographic Marketing Online Marketing

5 Reasons Homeowners Can Throw Better Super Bowl Parties Infographic Your Centralmaryland Realestate Conn Superbowl Party Real Estate Trends Sell My House

5 Reasons Homeowners Can Throw Better Super Bowl Parties Infographic Your Centralmaryland Realestate Conn Superbowl Party Real Estate Trends Sell My House

Https Www Orangeburgcounty Org Documentcenter View 111 Department Of Revenue Application For Exemption Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Pro02 4 Pdf

Https Dor Sc Gov Forms Site Forms Pt300inst 2020 Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr05 2 Pdf

Https Www Scbar Org Media Filer Public D5 80 D580e36d D256 443b Ab07 A5d77704639b Real Estate Materials Pdf

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rp09 1 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home