When Are Property Taxes Due In Delaware County Ohio

Delaware Countys higher property taxes are partially due to property values as the median home value in Delaware County is 25270000. Use 18 Digit Parcel Number Example.

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

However due to the constantly changing nature of tax information the Delaware County Auditors Office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this tax information.

When are property taxes due in delaware county ohio. The collection closing date changes per billing cycle and is indicated on the property tax bill. The deadline for manufactured-home tax collections has been. 183335552227774003 Numbers Only Please use only 1 Search Option at a time.

Legal DisclaimerPublic information data is furnished by this office and must be accepted and used by the recipient with the understanding that this office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this data. Unpaid tax bills at year-end are turned over to the countys Tax Claim Bureau for collection starting March 1stTax Claim is also the authorized agent for collecting delinquent Municipal and School District taxes. 2 12 Reduction Contract ACH Automatic Deduction Form Escrow Agreement Homestead Application.

Delaware County officials today announced they have received approval from Ohio Tax Commissioner Jeffrey McClain and the Ohio Department of Taxation for an extension of property-tax payment deadlines in the county. Your tax rate is an accumulation of all these levies and bond issues. If you know the parcel number of your property located in the top right hand corner of your tax bill you may enter the parcel number with or without hyphens.

Use First Name Last Name Example. For comparison the state-wide median property value is 13460000. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Delaware County has one of the highest median property taxes in the United States and is ranked 85th of the 3143 counties in order of median property taxes. You may search for your property or properties using any one of the following three search criteria. Of the eighty-eight counties in Ohio Delaware County is ranked 1st by median property taxes and 9th by median tax as percentage of home value.

66 rows Any additional real estate taxes for any purpose must be voted by County residents. 100 W Main St OR. In this example the first half billing is due in January of 2016 and the second half billing is due in July 2016.

Government Center Ground Floor. Owners of manufactured or mobile homes may. When finished click the Continue button and you will be asked to review the information for accuracy before your payment is processed.

Please complete the form below. 7122021 Second Half Taxes Due Looking for forms applications reports and more. In-depth Delaware County OH Property Tax Information.

The deadline for real-property tax collections has been moved from July 10 2020 to Aug. However due to the constantly changing nature of tax information the Delaware County Auditors Office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this tax information. If you believe your application was improperly denied you may appeal the auditors decision to the county Board of Revision by filing form DTE 106B Homestead Exemption and 25 Reduction Complaint on or before the deadline for paying the first-half taxes for the year for real property in most counties the due date is in January or February of the following year.

Although you are normally billed for property taxes twice a year you may also pay the optional full year tax during the first half collection. The Delaware County Auditors office makes every effort to provide accurate and timely information. The Delaware County Auditors office makes every effort to provide accurate and timely information.

The median property tax in Delaware County Ohio is 3732 per year for a home worth the median value of 252700. Delaware County collects on average 148 of a propertys assessed fair market value as property tax. The official website of Delaware County Indiana.

FirstNameJohn and LastName Doe OR. However due to the constantly changing nature of tax information the Delaware County Auditors Office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this tax information. The Delaware County Auditors office makes every effort to provide accurate and timely information.

Use Address Example. Listed below is a table which shows the amount of tax on a 100000 home in selected Delaware County Tax Districts for tax year 2020. At a 10 penalty until year-end.

However due to the constantly changing nature of tax information the Delaware County Auditors Office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this tax information. The Delaware County Auditors office makes every effort to provide accurate and timely information.

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

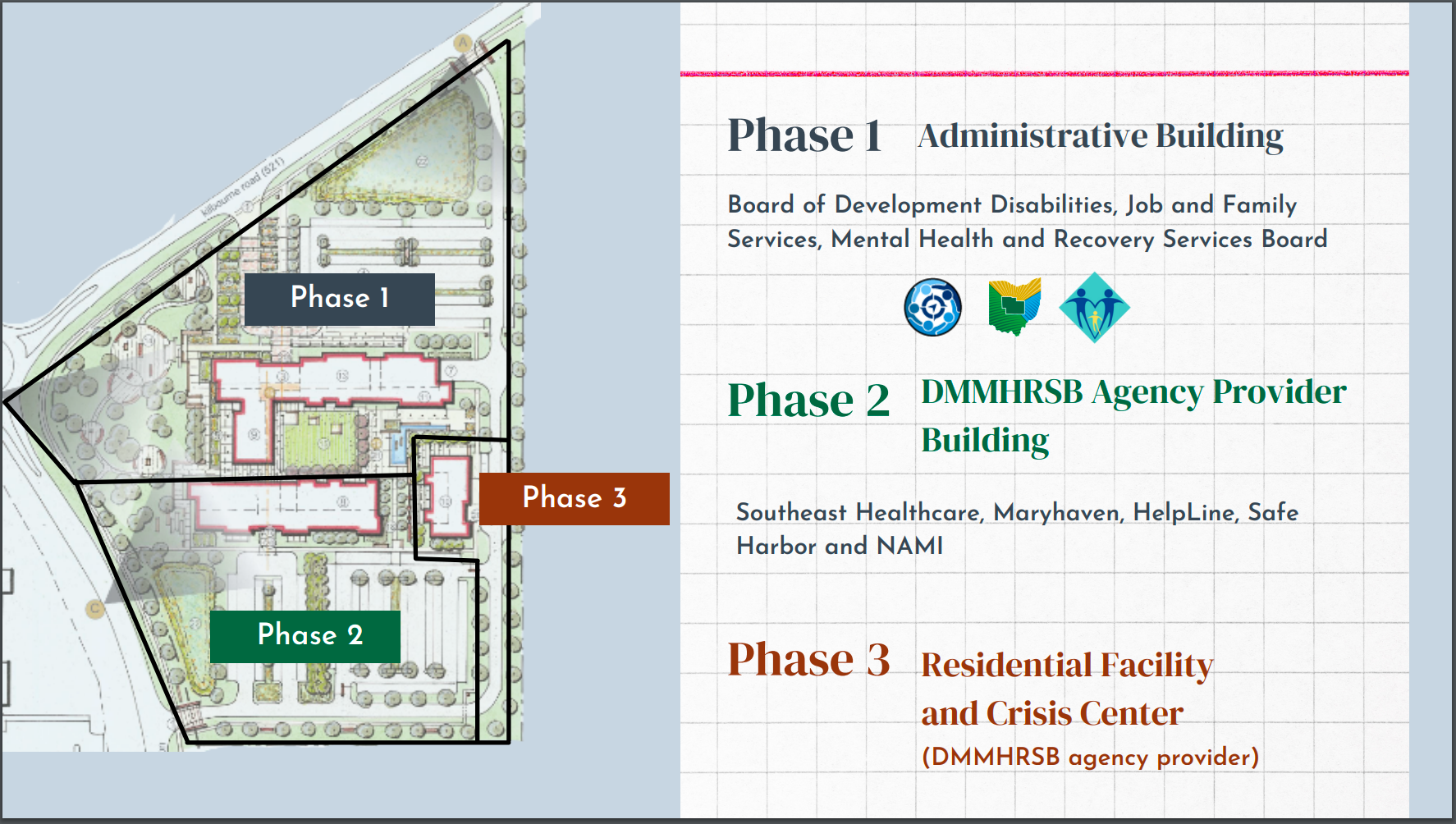

40 Million Social Services Campus Proposed In Delaware County

40 Million Social Services Campus Proposed In Delaware County

Map Of Delaware County Also A Part Of Marion And Morrow Counties Library Of Congress

Delaware County Treasurer Ohio Online Payments

Delaware Based American Freight Purchased American Freight Furniture Furniture Today Retail Furniture

Delaware Based American Freight Purchased American Freight Furniture Furniture Today Retail Furniture

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Delaware County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delco Map Of Delaware Delaware County Lansdowne

Delco Map Of Delaware Delaware County Lansdowne

Penneast Won T Pay Property Taxes In Pa Paying Taxes Property Tax Tax

Penneast Won T Pay Property Taxes In Pa Paying Taxes Property Tax Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home