Jackson County Property Tax Payment History

Find and link your properties through a simple search. MasterCard DebitCredit American Express Discover and Visa Credit.

Tax Assessor Collectors Brazoria County Appraisal District

Tax Assessor Collectors Brazoria County Appraisal District

How much is a duplicate receipt.

Jackson county property tax payment history. Its that time of year again when property tax statements start showing up in mailboxes across Jackson County. Our office hours are Monday through Friday 800 am. You may also obtain a duplicate of.

Interest penalties and fees will accrue if payment is late. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. Find out how taxes are calculated how to pay them and what other fees are involved.

Amador County Tax Collector. Please write your account number which is your borough block and lot number on any payment that you mail to us along with the tax period the payment is for. In addition the Collectors Office is responsible for the collection of taxes levied by the Town of Dillsboro Village of Forest HillsTown of Highlands and the Town of Webster.

Jackson County does not collect or retain any portion of this fee. The Billing History is displayed. Anyone who has paid Jackson County personal or real estate property taxes may get a duplicate tax receipt.

On December 31 2020. Property Tax Payment FAQ Pay Online Pay by Phone Pay Using Online Bill Pay Pay by Mail Pay in Person. Lafayette St Suite 107 PO Box 697Marianna FL 32447 850-482-9653 FAX850-526-3821 Monday - Friday 800am-400pm CST Map It.

Personal Property Business Real Estate Taxes. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. To save time and avoid crowds online payment is encouraged.

To be timely payment of 2020 property taxes must be received or postmarked no later than December 31 2020. Property tax statements will be mailed by October 25th for the 2020-2021 tax year. If an e-check transaction is processed against an.

Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes. Karen Coffman Jackson County Treasurer has published a Real Property Tax and Forfeiture and Foreclosure Timeline Presentation PDF. The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021.

From the Dashboard select the account you want a receipt for. Visa Debit Card 395 Visa Credit MasterCard DebitCredit American Express and Discover 25 of transaction 200 minimum and Electronic Check 250. If you have not received your statement by November 1st.

Enter the required information for your selection. Pay Your Taxes With Your Credit Card or Debit Card Online or by Telephone Pay by credit card or debit card online or by phone. The Jackson County Tax Collectors Office is responsible for the timely collection and disposition of real and personal property taxes within Jackson County.

Pay Your Taxes In Person. 25 of transaction 200 minimum Electronic Check250. Taxes paid online after the website reopens in 2021 will.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Pay your property taxes or schedule future payments. Continue to PayIt Login.

In Public Access you can. View your property tax bills annual notices of property value NOPV and other important. Pay Your Taxes Online From Your Checking Account Pay by electronic check e-check.

The Tax Commissioners Office in Jefferson is the only location in Jackson County for handling motor vehicle transactions and the billing and collecting of mobile home timber and property taxes for the County. From questions about your statement to where and how you can pay your taxes here are some resources on our website to help guide you. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Jackson County does not collect or retain any portion of the fee. Please do not mail cash. Property Tax payments can also be made in person at any of our Business Centers.

An official app of Jackson County Missouri. Find historical receipts and current receipts. State of Michigan Department of Treasury Pay View Delinquent Taxes Online.

Look up information about a property including its tax class and market value. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments.

Tax bills are mailed once a year with. Payments on our website are administered by a third-party who charges a fee. Tax Payments Online.

If you prefer to pay by mail you can mail your payment with the coupon on your Property Tax Bill. COVID-19 INFO Jackson County Services related to COVID-19 Updated. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year.

You may obtain a duplicate of your original property tax receipt for free online. Click Link Account and Pay Property Tax. We are closed New Years Day Memorial Day Independence Day.

When the linked parcel is displayed click Im Done. Checks or money orders should be made payable to. Bills are generally mailed and posted on our website about a month before your taxes are due.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

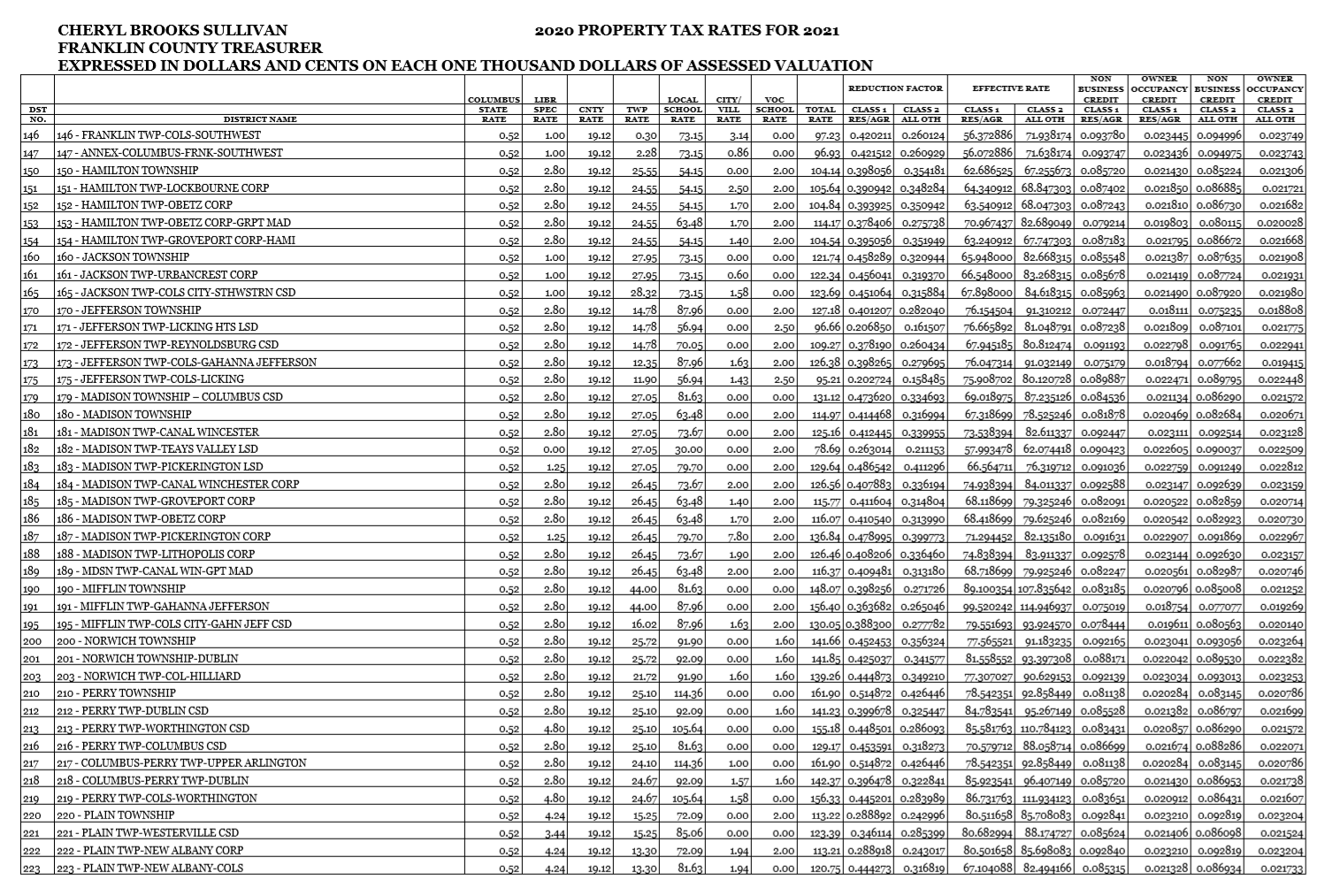

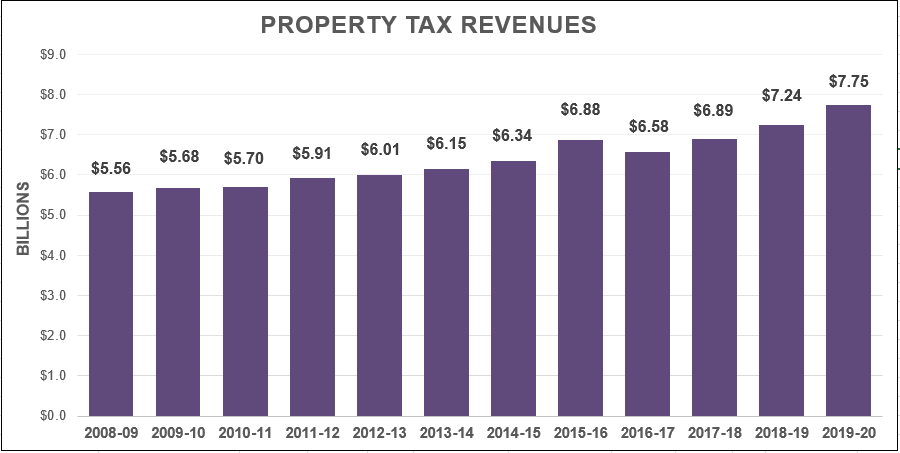

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Jackson County Florida Jackson County Florida Florida Georgia

Jackson County Florida Jackson County Florida Florida Georgia

Tax Assessor Collectors Brazoria County Appraisal District

Tax Assessor Collectors Brazoria County Appraisal District

Tax Maps Real Property Tax Services Tax Services Erie County Property Tax

Tax Maps Real Property Tax Services Tax Services Erie County Property Tax

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Real Estate And Tax Data Search Fond Du Lac County

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Property Data Online Jackson County Oregon

Property Data Online Jackson County Oregon

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home