Property Tax Payment History San Diego

When making phone or electronic payments please note that. Taxpayers who are unable to pay their property taxes by April 12 2021 because of the COVID-19 crisis are encouraged to submit a request for a penalty waiver online.

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

This information can also be obtained by going to View Fixed Charge Special Assessment by Parcel or contacting Property Tax Services at 858 694-2901.

Property tax payment history san diego. Please use the online payment system to searchpay current-year delinquent or defaulted taxes. The property taxes you pay are primarily based on your propertys assessed value as determined by the County Assessor. Property Tax Postponement The program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including 40 percent equity in the home and an annual household income of 45000 or less.

In-depth San Diego County CA Property Tax Information. E-Check payments are free. Payments made by credit card or debit card require a 239 processing fee paid to the payment processor with a minimum processing charge.

Phone Payments can be made at 1 888 636-8418. Please choose to search by either Assessor Parcel Number Supplemental Bill Number Escape Bill Number Mailing Address or Unsecured Bill Number to display a list of matching or related records. Payments made by eCheck routing and account number from your checking or savings account required are made without an additional processing fee.

A Tax Clearance Certificate is a document that certifies there are no outstanding property tax obligations and that an additional security payment has been made for any estimated taxes on the existing parcel. A requirement for subdivision and condo conversion is to obtain a Tax Clearance Certificate before the final map is recorded. We do not display prior-year information online for already paid property tax bills.

Paying online is free if you use e-check electronic check. You can view and print your current property tax statements or view past payment history by visiting the Property Tax Payment Portal. These records will show the owner as of the January 1 lien date.

This program is designed to help you access property tax information and pay your property taxes online. Search Property Tax Information This page allows you to search for San Diego County secured unsecured and defaulted properties. These records can include San Diego County property tax assessments and assessment challenges appraisals and income taxes.

Property Tax Payment Portal. This includes Secured and Unsecured supplemental escaped additional and corrected tax bills issued for property. Convenience Fees are charged and collected by JPMorgan and are non-refundable.

Once an account becomes delinquent payments can only be made through the Office of the City Treasurers Delinquent Accounts Program. San Diego CA. Credit and debit card payments are charged a 234 processing fee by our processing vendor.

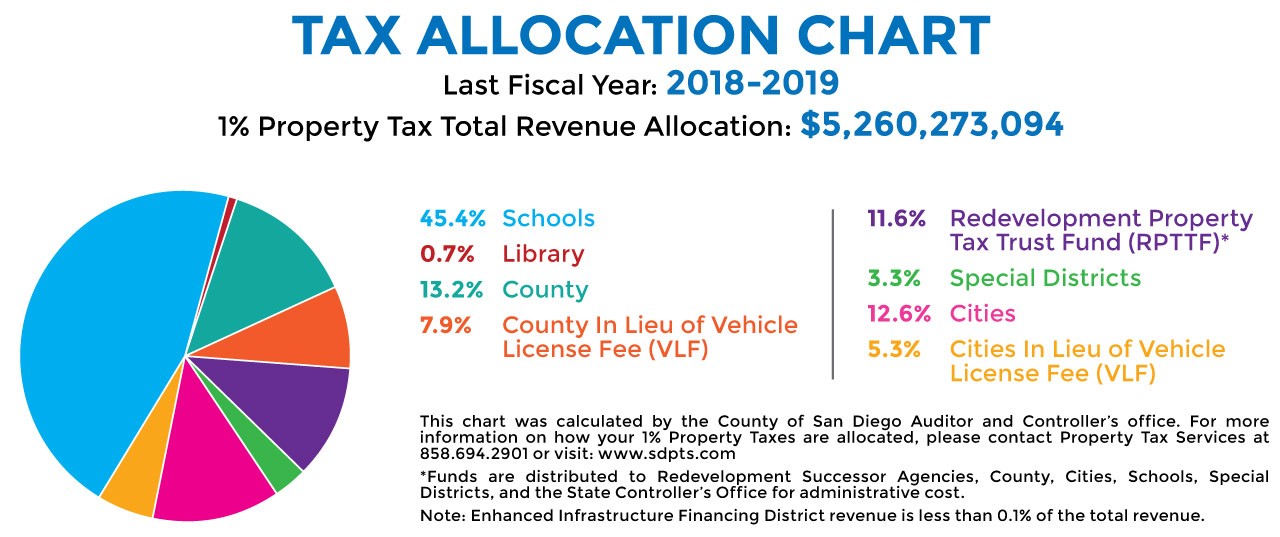

Property tax payments must be received or United States Postal Service USPS postmarked by the delinquency date to avoid penalties. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Property taxes are levied on land improvements and business personal property.

As a Property Tax Agent your responsibility is to process Assessment Appeal. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. Enter Property Parcel Number APN.

Proposition 13 the property tax limitation initiative was approved by California voters in 1978. All citywide payments except delinquent accounts are accepted by the cashiers at the Office of the City Treasurer 1200 Third Ave Suite 100 San Diego CA 92101. Therefore a search for prior-year paid tax bills will show no record found If you would like to request a copy of a prior-year tax bill please contact us.

Your property tax bill will identify Mello-Roos fees as a Community Facilities District CFD followed by a telephone number and a tax amount. If you disagree with value established by the Assessor you can appeal that value to the Assessment Appeals Board. Otherwise the payment is delinquent and penalties will be imposed in accordance with State law.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Electronic Payments can be made online from our property tax payment website. The fastest way to process your Property Tax payment is online using the Taxes on the Web system.

The Tax Collectors office is responsible for the collection of property taxes. If you purchased the property after January 1 please reference your purchase date to determine which payments. San Diego CA 92101-2471.

Find San Diego County Tax Records San Diego County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in San Diego County California. There are several safe and convenient ways to pay your property taxes during this event.

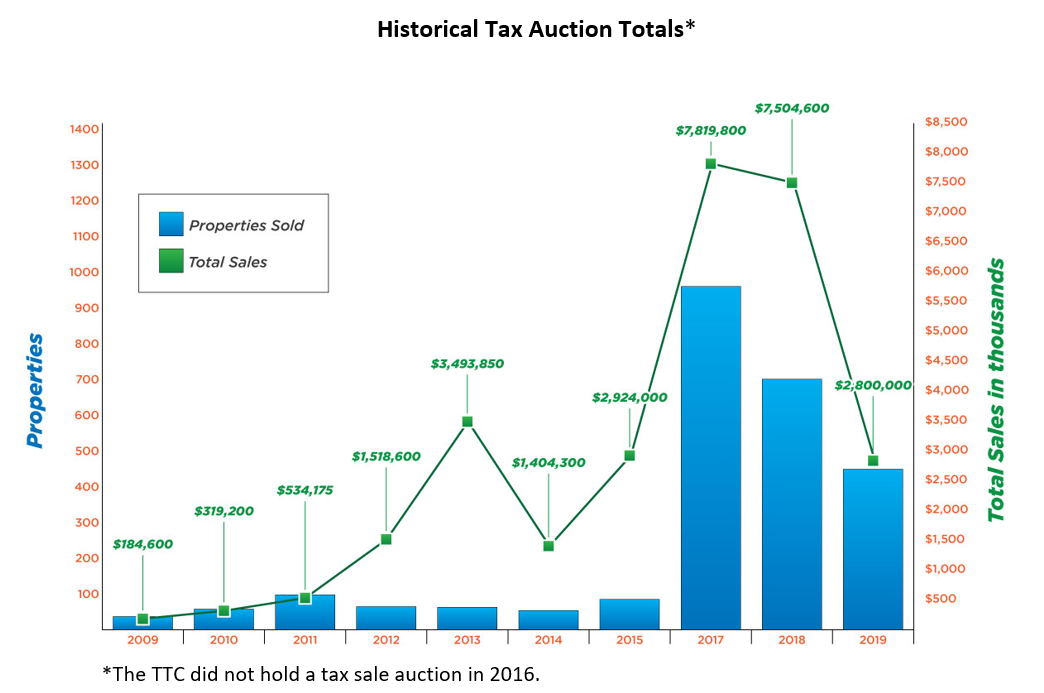

2020 Property Tax Auction Begins

2020 Property Tax Auction Begins

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

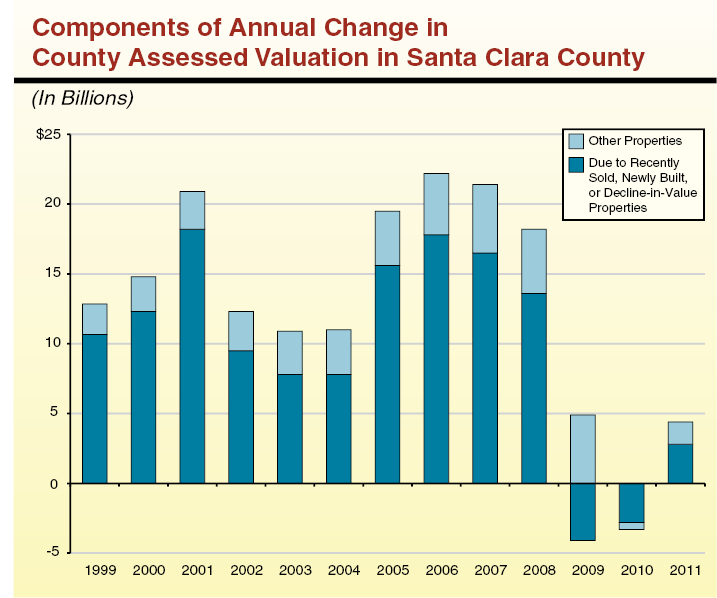

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Understanding California S Property Taxes

Understanding California S Property Taxes

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

2019 Property Tax Bills Mailed

2019 Property Tax Bills Mailed

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home