Kentucky Property Tax On Vehicles

21 Motor Vehicle Renewal of 10000 lb Plates or Greater. To register a boat you must have your registration certificate.

Https Revenue Ky Gov News Publications Motor 20vehicle 20tax 20rate 20books 20162015motorvehicletaxratebook Pdf

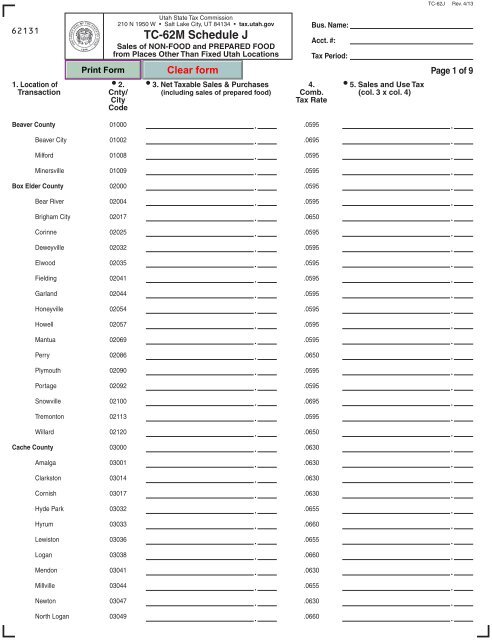

Explanation of the Property Tax Process.

Kentucky property tax on vehicles. Kentucky Revised Statute Section 64012 as amended by House Bill 537 mandates the following fee changes. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online KENTUCKY Vehicle Registration Renewal Portal. KRS 1322201a The person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year.

In fact the typical homeowner in. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Home 2020 Vehicle Tax Information The look-up for vehicle tax paid in 2020 is available at the bottom of the drivekygov homepage.

Please allow 5-7 working days for online renewals to be processed. 2 if the vehicle was not registered in Kentucky. Kentucky law requires all boats having motors to be registered if operated on public waters.

Online KENTUCKY Vehicle Registration Renewal Portal. You can find the VIN. The state tax rate for non-historic vehicles is 45 cents per 100 of value.

The vehicles renewed must have unexpired registrations. Search tax data by vehicle identification number for the year 2020. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. Kentucky VIN Lookup Vehicle Tax paid in 2020. Property Tax for Disabled Veterans.

You can find these fees further down on the page. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

Andrea Ash John Charlton Mary Lyons Published. Where can I find my Vehicle Identification Number VIN. Not all states collect an annual property tax on motor vehicles but Kentucky is one of them.

Leased vehicles cannot be renewed online. 551 PM EST February 22 2019. Non-historic motor vehicles are subject to full state and local taxation in Kentucky.

121 rows Good news. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker. Original factory and classic vehicles are currently assessed as high-value collectibles.

Property taxes in Kentucky are relatively low. Processing Fees Payment Methods. Totally disabled veterans are eligible for up to a 37600 deduction on the assessed value of their home for property tax purposes.

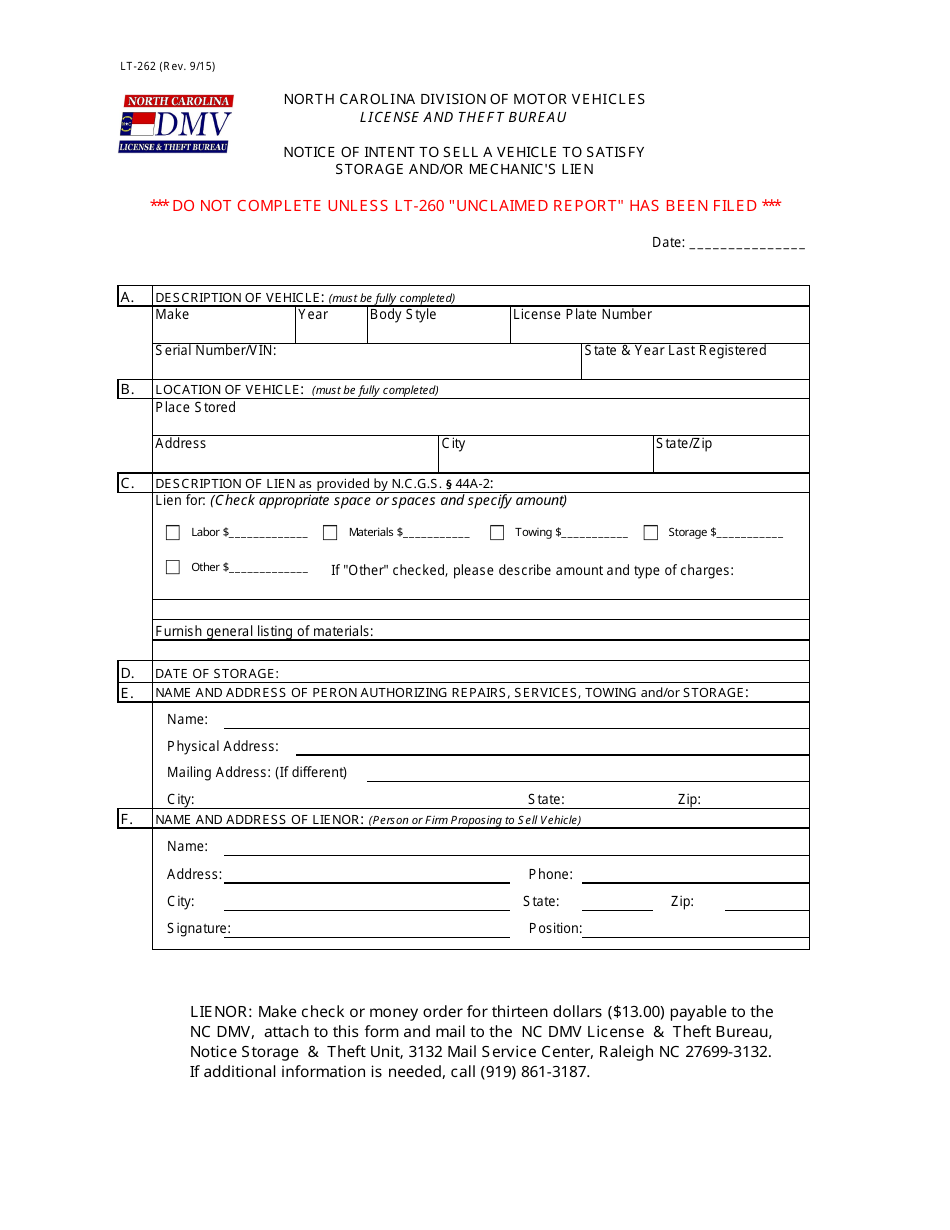

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Users are instructed to input their VIN and instructions are provided as to where their VIN can be found. Varies by Weight Motor Vehicle Transfer.

The owner of the vehicles cannot have overdue property taxes on any other vehicles they own. The Median Kentucky property tax is 84300 with exact property tax rates varying by location and county. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky.

Payment shall be made to the motor vehicle owners County Clerk. The state tax rate for historic motor vehicles is 25 cents per 100 of value. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees.

TurboTax will allow you to input multiple lines so list your car twice- once for each of these figures. Please enter the VIN. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

This measure instead provides three options for assessing the value of these vehicles. Boat renewals and property tax payments may be processed in the same ways that you renew a motor vehicle see above except by the internet. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

1 if the vehicle was registered in Kentucky in its 19th year it will be assessed at the value it was assessed at in its 19th year and that value will be reduced by 10 for each year after its 19th year. Historic motor vehicles are subject to state taxation only. The car registration and personal property taxes deduction is allowed when you are taxed based on the value of the car.

Since both of the tax charges you described are based on the cars value you may deduct both figures in Kentucky. Vehicles must be currently insured with a company that is registered with the Kentucky Department of Insurance to be eligible to renew online.

Read more »