How Is Property Tax Calculated In Utah

George UT 84770 435 634-5703. If you add up the total assessed value of each property in the county then subtract any tax exemptions like the residential exemption or tax exempt properties you have the total taxable value for the county.

Basics Of Taxes Free Consultation 801 676 5506 Tax Lawyer Tax Attorney Wage Garnishment

Basics Of Taxes Free Consultation 801 676 5506 Tax Lawyer Tax Attorney Wage Garnishment

Please click on each item for more information.

How is property tax calculated in utah. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The first step in Utahs property tax system is the valuation of property. Overview of Utah Taxes.

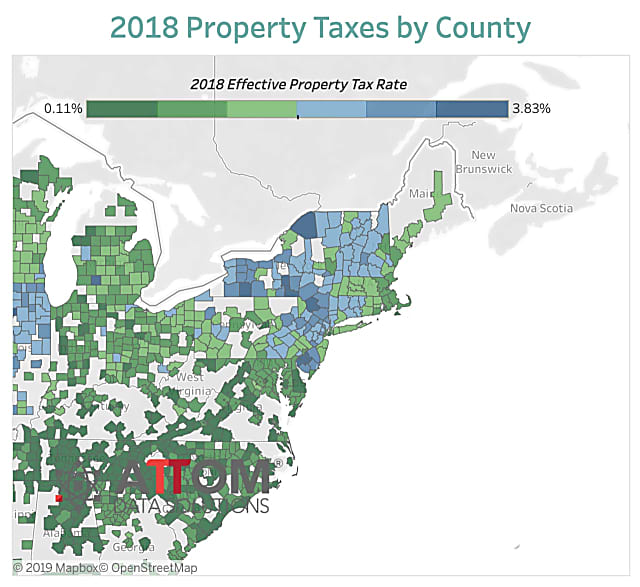

The state sets certain guidelines and assists counties with administering the property tax but counties are responsible for the appraisal of property and the calculation of tax rates. 058 average effective rate. Please note that we can only estimate your property tax based on median property taxes in your area.

For real property your property tax is calculated by multiplying the taxable value of your property by that years tax rate for each taxing entity in your tax area. The area rate becomes the final tax rate charged by counties against the assessed value of a specific property. State income tax.

In Utah additional property tax revenue is not a simple matter of raising property values to increase revenue. The state of Utah has a single personal income tax with a flat rate of 495. There are two types of tax rates.

The taxable value interacts with the budget to calculate the third element in the equation. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Sevier County. Utah has a very simple income tax system with just a single flat rate.

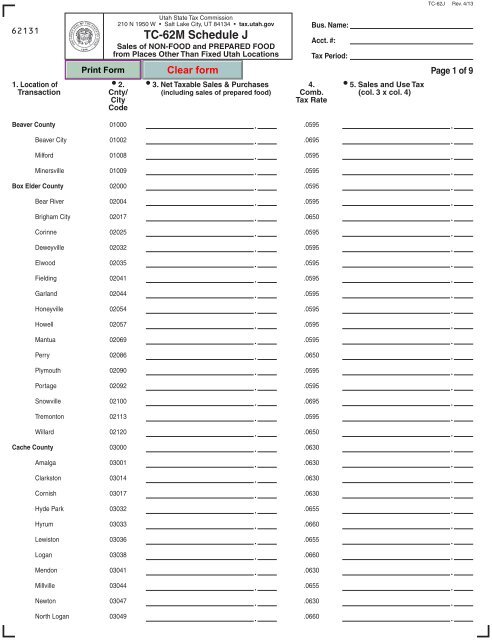

So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market.

Our Utah Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Utah and across the entire United States. How the Utah Property Tax Works. The various taxes and fees assessed by the DMV include but are not limited to the following.

Rather the base property tax revenue is the same from the prior year. What is a Tax Sale auction. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

1 entity and 2 area. The median property tax on a 14830000 house is 155715 in the United States. If you would like to get a more accurate property tax estimation choose the county your property is located in from the list on.

The median property tax on a 14830000 house is 80082 in Sevier County. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Just as households spend money on various budget items taxing entities frequently have more than one budget.

3110 cents per gallon of regular gasoline and diesel. Assuming everything else remains equal an increase in property value would mean a decrease in the tax rate and therefore the total dollar amount in taxes would stay the same. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. A group of entity rates make up the area rate. Sales taxes in Utah range from 610 to 905 depending on local rates.

Of course Utah taxpayers also have to. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Utah Code 41-1a-1206 and others.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Utah Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Utah. File electronically using Taxpayer Access Point at taputahgov. Tom Durrant 87 North 200 East STE 201 St.

Property taxes in Utah are largely handled at the county level. Parcels of real property which have unpaid property taxes that have been delinquent for over four years are offered for sale according to Utah Code. The median property tax on a 14830000 house is 88980 in Utah.

No cities in the Beehive State have local income taxes.

Read more »