Property Tax Exemption Lake County Il

To qualify for this exemption you must. Lake County 18 N County Street Waukegan IL 60085.

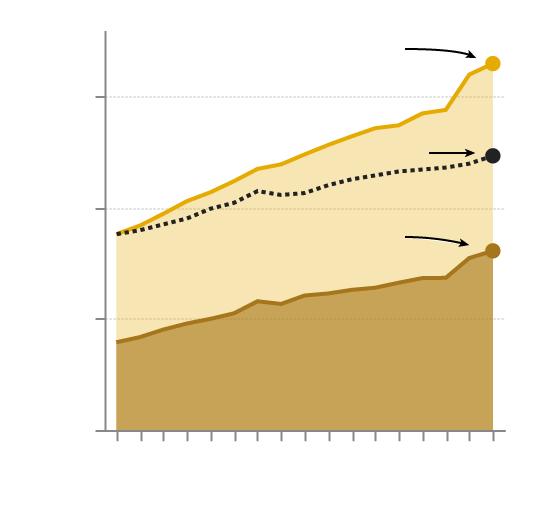

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

This site provides access to the Assessment and Tax office property records database in Lake County Illinois.

Property tax exemption lake county il. You may be eligible for this in addition to other exemptions. All Lake County residents who have a Senior Homestead Exemption will receive a letter in the mail in mid-March with information about the. This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is an owner of record of the property or has a legal or equitable interest therein as evidenced by a written instrument except for a leasehold interest other than a leasehold interest of land on which a single family residence is located which is occupied as a residence by a person 65 years or older who has an.

Under this program up to 100000 of the equalized assessed value of a home owned by a qualifying veteran or the veterans spouse or unmarried surviving spouse is exempt from property taxes. Lake County Clerk Property Tax Rates Sold Taxes. Chicago title land trust company ttee.

2019 taxes payable in 2020. This exemption lowers the equalized assessed value of the veterans principal residence by 5000 for two consecutive assessment tax years. Contact Us Monday-Friday 830am-500pm.

This would include the. Make sure that you are receiving all of the exemptions that are rightfully yours. You are 65 years of age or older as of January 1 in the year you file for the exemption.

MARCH 1 ST WAS THE FILING DEADLINE FOR 2021 HOMESTEAD EXEMPTION. There are a number of homestead exemptions for individuals with disabilities in Lake County Illinois. 18 N County Street - Room 101 Waukegan IL 60085 847 377-2404.

Even if a property owner has applied for and been granted the freeze exemption in prior years the application must be renewed annually. Complete applications may still be eligible for the 2021 tax-year. Have a disability of such nature that the Federal Government has authorized payment for the.

IF YOU PURCHASED A HOME IN 2021 CONGRATULATIONS AND WELCOME TO LAKE COUNTY. Search any Lake County property free of charge by entering an address property PIN number or property owner name to view tax bill. This would include the tax year and the following year that the veteran returns from active duty in an armed conflict involving the armed forces of the United States.

1601 n lewis ave. 2019 Taxes Payable in 2020. Under this program up to 100000 of the equalized assessed value of a home owned by a qualifying veteran or the veterans spouse or unmarried surviving spouse is exempt from property taxes.

Veterans With Disabilities Exemption For Specially-Adapted Housing. Lake County Treasurer Tax Bills and Payments. Select Tax Year on the right.

Lake County has authorized this exemption up to the full 50000. In Lake County Township Assessors identify which properties qualify for this exemption and turn that information in to the Chief County Assessment Office. These exemptions lower the equalized assessed value of your property.

Basic Search Advanced Search Map Search. If you purchased your home in 2020 and failed to file timely file online now. Returning veterans are entitled to a number of homestead exemptions in Lake County Illinois.

To Property records Search. To make property tax information easily accessible Lake County has launched taxlakecountyilgov which combines data from the Treasurer County Clerk and Chief County Assessment Office into one searchable database. Your adjusted gross household income does not exceed 31100 this amount to be adjusted annually by the Florida Department of Revenue.

In the year you return this exemption lowers the equalized assessed value of your property 5000. Some counties may require an application to aid in the identification of eligible properties. Enter the tax year 2021 for renewals only and your property PIN and follow the instructions.

It does NOT freeze taxes but it protects a property owner from tax increases due to rising property values. Some of these may be claimed in addition to other exemptions. This exemption lowers the equalized assessed value of the veterans principal residence by 5000 for two consecutive assessment tax years.

18 N County Street - Room 102 Waukegan IL. 18 N County Street - 7th Floor Waukegan IL 60085 847 377-2050. Lake County Assessor Property Valuations Exemptions.

Have served in the Armed Forces of the United States. Search for Property Tax Information. Click Available Filings and choose EX - Homestead Exemption Form if you are a first-time applicant or EX - Homestead Renewal if you are applying to renew your exemption.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois. If you know of a property in Lake County that you believe should NOT be receiving a tax reduction from a homestead exemption or an agricultural classification has non-permitted construction or has under-reported doc stamps we urge you to report the property. You can access public records by search by street address Parcel ID or various other methods.

Read more »