Property Tax Bill Lake County Indiana

There are 10 Treasurer Tax Collector Offices in Lake County Indiana serving a population of 488694 people in an area of 499 square milesThere is 1 Treasurer Tax Collector Office per 48869 people and 1 Treasurer Tax Collector Office per 49 square miles. Please note there is a nomimal convenience fee charged for these services.

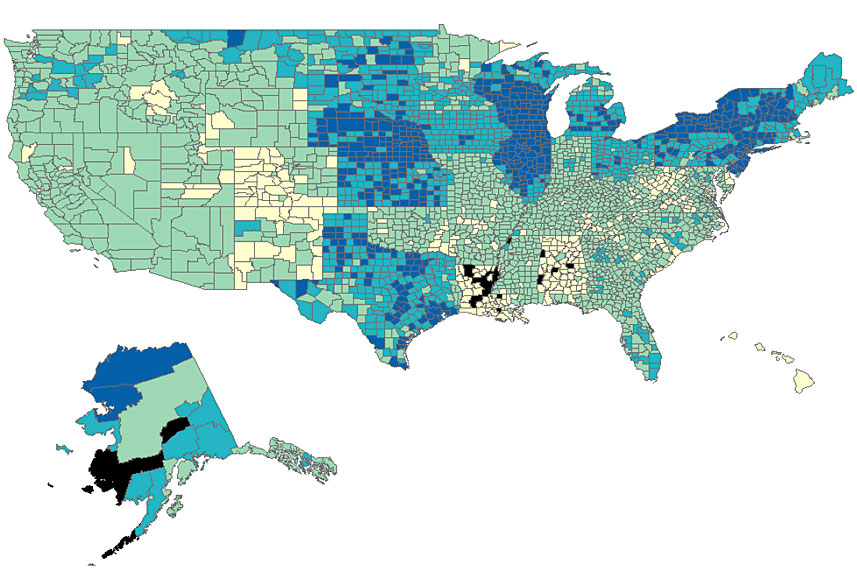

Property Tax Rates Across The State

Property Tax Bills Tax Statements Property Sales.

Property tax bill lake county indiana. Change Tax Bill Mailing Address. Property Tax Records View property tax records andor pay your property taxes securely online using a major credit card or electronic check. Yearly median tax in Lake County.

While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. 4 by November 30th. LA PORTE COUNTY REFUND POLICY Any payment made by a taxpayer via the Countys web payment portal is NON-REFUNDABLE in whole or in part once the payment has been submitted confirmed and accepted by the County.

Property Record Cards Assessed Values. Find information about changing the mailing address for your tax bill. Tax Bill Search The information provided in these databases is public record and available through public information requests.

Indiana offers property owners a number of deductions that can help lower property tax bills. Assessor County Townships Directory of Lake County Townships. All the Lake County Indiana Property Tax Assessment Information You Need.

Indiana residents can pay their May property tax installment until July 10 without penalty this year in response to the COVID-19 pandemic and Lake and Porter county. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax. Your tax payment once you have paid it with your credit card will be posted to the La Porte County tax system within 3 business days.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. It may not.

Learn how and where to pay property taxes. Lake County collects on average 137 of a propertys assessed fair market value as property tax. Treasurer The County Treasurer can help answer local and state tax.

Make sure the tax year is set to the right year. These fees are not retained by Lake County and therefore are not refundable for any reason. Disable your popup blocker and click Go A copy of your tax bill will appear in a new tab.

In Indiana Lake County is ranked 77th of 92 counties in Treasurer Tax Collector Offices per capita and 1st of 92 counties in. ENotices Paperless Tax Bills. Property Tax Deductions and Credits.

Property owners in Lake County pay the highest taxes in Indiana with an average effective property tax rate of 113. In-depth Lake County IN Property Tax Information. The Marion County Treasurers Office will be practicing social distancing methods to prevent the potential spread of COVID-19 Coronavirus until further notice.

It collects various taxes including local and state property taxes inheritance taxes and delinquent taxes. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. For example 2019 taxes are payable and billed in 2020.

And issues property tax statements. If an installment of real property taxes is completely paid on or before the date 30 days after the due date and the taxpayer is not liable for delinquent property taxes first due and payable in a previous installment for the same parcel the amount of the penalty is equal to 5 of the amount of delinquent taxes. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy.

These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes. Pay Your Property Taxes or View Current Tax Bill Make a one-time full or partial payment. Please utilize digital resources and online payment options available by.

If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax. Taxpayers who do not pay property taxes by the due date receive a penalty. Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Indiana.

Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. The Treasurers Office collects retains custody of and disburses county funds.

Residents of one Hoosier State county are not so lucky. Find information about the most common deductions. Property Documents Recorders Office.

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. Having the average effective property tax rate of 081 marks Indiana as one of the states with low property taxes. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL.

Find information about filing Personal Property Forms. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners and other taxing authorities set the respective millage rates. School districts get the biggest portion about 69 percent.

Property Tax Information Lake County Il

Texas Real Estate Property Power Of Attorney Power Of Attorney Form Texas Real Estate Power Of Attorney

Texas Real Estate Property Power Of Attorney Power Of Attorney Form Texas Real Estate Power Of Attorney

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Property Tax Information Lake County Il

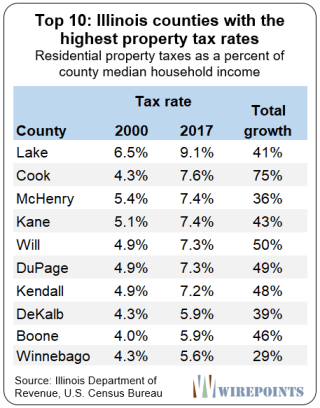

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Property Tax Bills Have Been Sent Here S Where You Can Go To Make A Payment

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Comparing Illinois Property Taxes With Household Income Mchenry County Blog

Comparing Illinois Property Taxes With Household Income Mchenry County Blog

Current Payment Status Lake County Il

Lake County Property Tax Records Lake County Property Taxes In

Lake County Property Tax Records Lake County Property Taxes In

Lake County Property Tax Records Lake County Property Taxes In

Lake County Property Tax Records Lake County Property Taxes In

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Perry County Property Tax Inquiry

Additional Information On Property Taxes

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

How We Got Here From There A Chronology Of Indiana Property Tax Laws

How We Got Here From There A Chronology Of Indiana Property Tax Laws

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home