How To Find Personal Property Tax Records

Message from the Chief Appraiser. All Payment Options The Tax Office accepts both full.

Real Estate Tax Frequently Asked Questions Tax Administration

Real Estate Tax Frequently Asked Questions Tax Administration

Rent restricted properties vary widely.

How to find personal property tax records. Land Improvements to Land and Personal. The property records and tax bill data provided herein represent information as it currently exists in the Wake County collection system. Want to avoid paying a 10 late penalty.

There are three types of property. Search results can include tax records as well as appraisal records. Be sure to pay before then to avoid late penalties.

Use our free Texas property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. This data is subject to change daily. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

A few County Assessor and County Collector offices provide an online searchable database where searches can be performed by owner name parcel number address or by using an interactive map. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. Welcome to our website I hope that you will find general information helpful about the District and the ad valorem property tax system.

The Treasurer is responsible for preparing mailing and collecting the taxes based on what the COR discovers to be unbilled tangible personal property. Assessing Personal Property Tax Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. May 10 th Forms of Payment.

To obtain a statement of the property taxes paid for your vehicles visit NC DMV online. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. 111825r of the Texas Property Tax Code the Gregg County Appraisal District gives public notice of the capitalization rate to be used for tax year 2021 to value properties receiving exemptions under this section.

The statewide property tax deadline is October 15. The United States postal service postmark determines the timeliness of payment. Pay-by-Phone IVR 1-866-257-2055.

Free Property Records Search Find residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. This data is subject to change daily. Depending on the county registration may be required to access property tax records.

Property tax is administered and collected by local governments with assistance from the SCDOR. Monday Through Friday 8 AM - 5 PM. Approximately two-thirds of county-levied property taxes are used to support public education.

Collector - Personal Property Tax and Real Estate Tax Department. The first billing for Personal Property taxes is due June 5th for the current calendar year. Contact the Collector - Personal Property Tax and Real Estate Tax Department.

ACH Electronic Check or Credit cards. Tax Receipts can be found on the current statement page or by clicking on the Property Tax Receipts button. We prepare mail and collect various supplemental billings at the CORs request to collect for previous years undiscovered as well as newly acquired tangible personal property.

The tax bill data and payment history provided herein represents information as it currently exists in the Pitt County collection system. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. The Tax Commissioner must issue a ruling by the end of February of the calendar tax year.

Save time pay online. We would like to show you a description here but the site wont allow us. Your feedback was not sent.

Information and online services regarding your taxes. Local Property Appraisal and Tax Information The Comptrollers office does not have access to your local property appraisal or tax information. Real and personal property are subject to the tax.

Municipalities levy a tax on property situated within the limits of the municipality for services. Pitt County makes no warranties express or implied concerning the accuracy completeness. Leave this field blank.

Perform a free public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. Online payments are available for most counties. These variations can have an effect on the valuation of the property.

Real Estate and Personal Property Tax Owners pays property tax on the value of the property being taxed. Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector. Our property records tool can return a variety of information about your property that affect your property tax.

December 20 th Second half.

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

5 Free Rental Property Expenses Spreadsheets Excel Tmp Rental Property Management Rental Property Being A Landlord

5 Free Rental Property Expenses Spreadsheets Excel Tmp Rental Property Management Rental Property Being A Landlord

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

How To File Taxes The Easy And Organized Way Filing Taxes Tax Checklist Tax Prep Checklist

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Small Business Tax Tax Prep

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Small Business Tax Tax Prep

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Abandoned Personal Property Letter Sample Beautiful 60 Best Images About Property Management On Being A Landlord Property Management Marketing Landlord Tenant

Abandoned Personal Property Letter Sample Beautiful 60 Best Images About Property Management On Being A Landlord Property Management Marketing Landlord Tenant

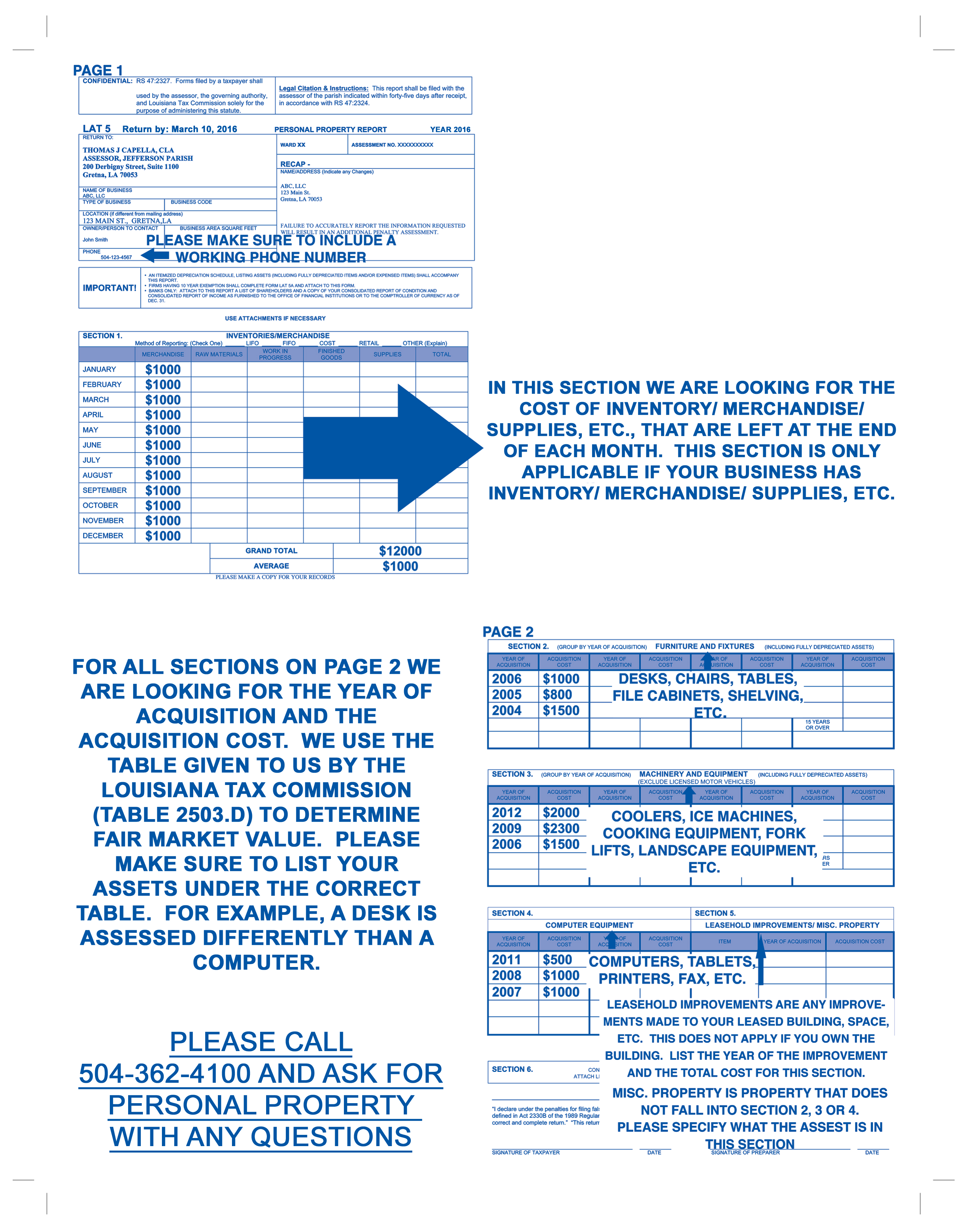

Jefferson Parish Assessor S Office Personal Property

Jefferson Parish Assessor S Office Personal Property

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

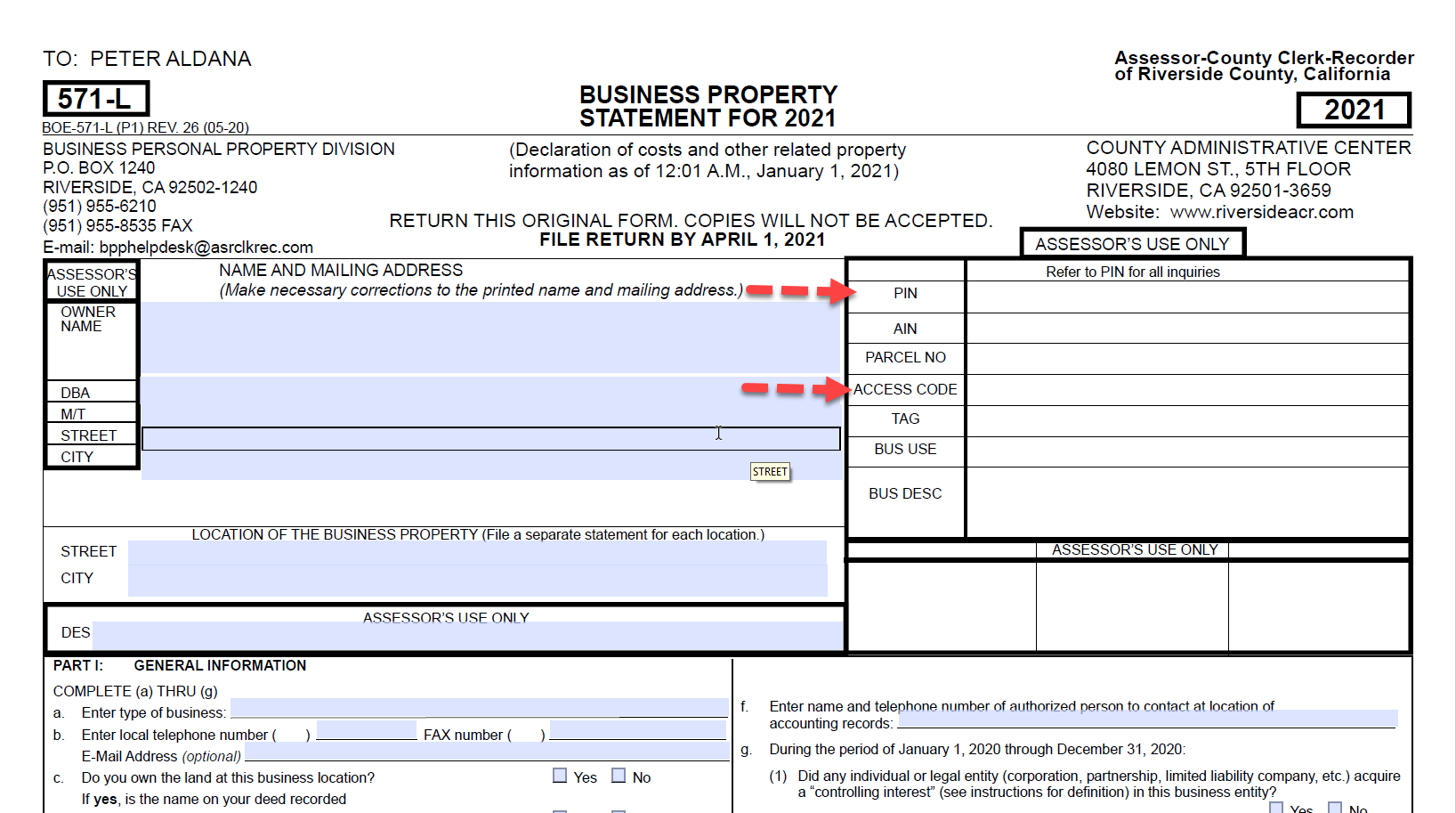

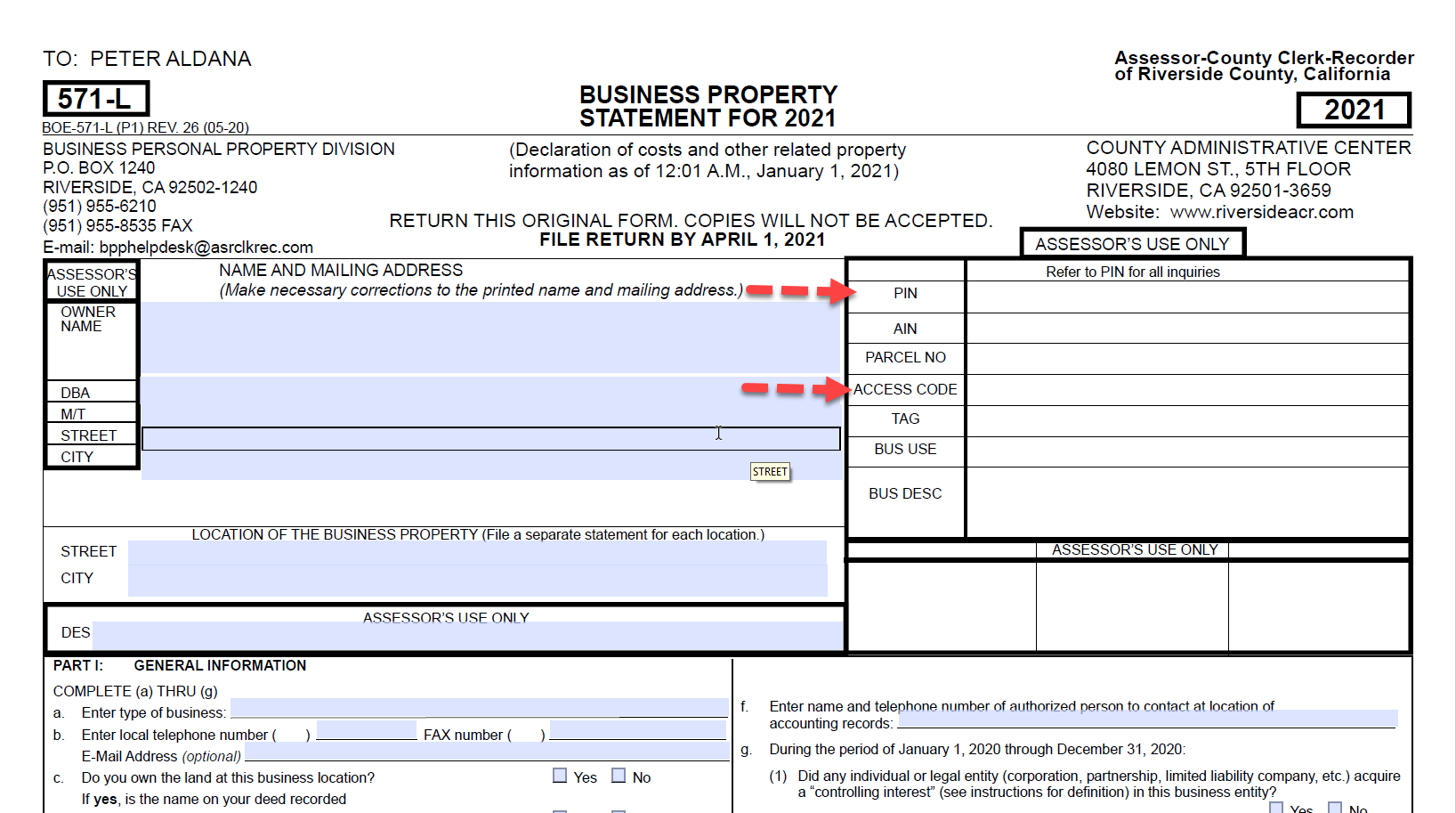

Riverside County Assessor County Clerk Recorder Business Personal Property

Riverside County Assessor County Clerk Recorder Business Personal Property

Taxes Not Fun To Pay But Great Genealogy Records Genealogy Records Genealogy History Genealogy

Taxes Not Fun To Pay But Great Genealogy Records Genealogy Records Genealogy History Genealogy

A Property Inventory Template Is The Record Of A Rental Property And All Its Contents The Schedule Of Condition Is Personal Property Excel Templates Templates

A Property Inventory Template Is The Record Of A Rental Property And All Its Contents The Schedule Of Condition Is Personal Property Excel Templates Templates

Labels: find

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home