Ca Llc Tax Due Date 2021

The extended deadline is Oct. Estimated LLC taxes did they move the due date for 2021.

12 Best Tax Deductions For 2021 Cnet

12 Best Tax Deductions For 2021 Cnet

If your California LLC goes into existence on or after January 1st 2021 but before December 31st 2023 there is no 800 payment due the 1st year.

Ca llc tax due date 2021. When the due date falls on a weekend or holiday the deadline to file and pay. Then your return is due on the 15th day of the 3rd month at the close of your taxable year. For those affected by Hurricane Delta with valid extensions to file by October 15 may file their returns by February 16 2021.

The deadline is December 15 2021. On April 15 2021 file and pay your taxes by June 15 2021. The extended deadline is Sept.

C-corporation income tax returns IRS Form 1120. You form a new LLC and register with SOS on June 18 2020. Do not include Social Security numbers or any personal or confidential information.

This extension is generally granted. Their tax year was 15 days or fewer. The annual LLC tax is due and payable by the 15th day of the 4th month after the beginning of the LLCs taxable year fiscal year or April 15 2021 calendar year.

If you are living or traveling outside of the US. If a trust files by calendar year it must file Form 541-T by March 8 2021. 2021 fourth quarter estimated tax payments due for corporations.

An SMLLC is not subject to the annual tax and fee if both of the following are true. If you need more time to file we give you an automatic extension. 565 Partnership Booklet Instructions included 568 Limited Liability Company Tax Booklet Instructions included December 15 2021.

California LLC franchise tax due dates after Assembly Bill 85. They did not conduct any business in California during the tax year. 15th day of the 9th month after the close of your tax year.

Extended due date for 2020 Partnership and LLC Income Tax returns for calendar year filers. Relief doesnt apply to estimated self-employment tax payments which will be due on April 15 2021 as per usual. Businesses may use Form 1120 or request a six-month extension by filing Form 7004 and submitting a deposit for the amount of estimated tax owed.

Companies have until April 15 2021 to submit corporate tax returns for income received in 2020. Since states issue separate. The annual tax payment is due with LLC Tax Voucher FTB 3522.

The first 800 payment is due in the LLCs 2nd year. We give you an automatic 6-month extension to file your return. Outside of the USA.

100-ES Form PDF 100-ES Instructions. No application is required. The deadline is October 15 2021.

An extension to file your tax. When the due. You must file by the deadline to avoid a late filing penalty.

The due date to file and pay taxes and fees owed to the California Department of Tax and Fee Administration CDTFA originally due between December 15 2020 and April 30 2021 has been extended by three months. Exceptions to the first year annual tax. 2021 first quarter estimated tax payments due for individuals and corporations.

19 rows 1st Quarter Due Date as extended 2nd Quarter Due Date 3rd Quarter Due Date 4th. If your LLC is taxed as Sole Proprietorship the due date for most filers will be April 15th. 15th day of the 3rd month after the close of your tax year.

Lets look at a few examples below. These are due April 15 2021 for C-corporations that operate on a calendar year. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month Your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year.

Due Dates for Income Tax Return Filing and Audit Report for FY 2020-21 AY 2021-22 Time limits reduced for Belated Revised returns as amended by Finance. Your total tax owed is due on the 15th day of the 3rd month after the close of your tax year. If your LLC is taxed as Partnership the due date for most filers will be March 15th.

Extended due date for 2020 Partnership and LLC Income Tax returns for calendar year filers. The taxes of any non-resident member of your LLC Form 568 is due each year usually by March 15th or April 15th. Texas - Answered by a verified Tax Professional.

Detailed California state income tax rates and brackets are available on this page. People and corporations affected by the California wildfires who had a valid extension to file their 2019 tax returns by October 15 2020 now have until January 15 2021 to file their returns. Minimum franchise tax.

The first quarterly estimated tax payment of the year is also due on this date.

What Is The Best Tax Software 2021 Winners

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

The Best Online Tax Prep Software For 2021 Money Com

The Best Online Tax Prep Software For 2021 Money Com

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

How To Get More Money Back From Your Tax Return 2019 Tax Help Tax Refund Income Tax

How To Get More Money Back From Your Tax Return 2019 Tax Help Tax Refund Income Tax

Tax Day 2021 Tax Filing Deadline H R Block

Tax Day 2021 Tax Filing Deadline H R Block

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

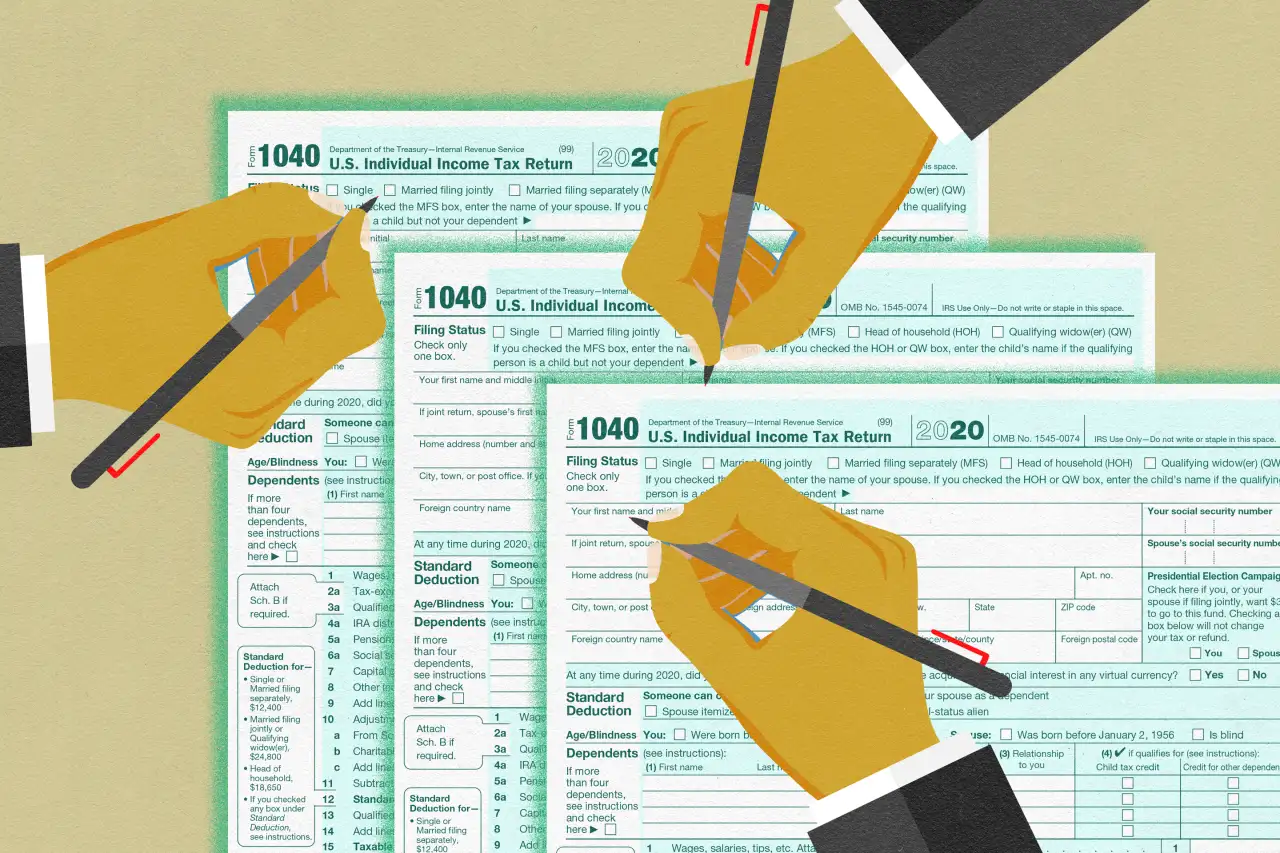

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

How To Fill Schedule 112a Bulk Upload Import Excel To Java Utility Detai Equity Excel Schedule

How To Fill Schedule 112a Bulk Upload Import Excel To Java Utility Detai Equity Excel Schedule

When Are Corporate Taxes Due Tax Return Deadlines 2021 Jetpack Workflow

When Are Corporate Taxes Due Tax Return Deadlines 2021 Jetpack Workflow

Us Tax Deadlines Updated For Expats Businesses Online Taxman

Us Tax Deadlines Updated For Expats Businesses Online Taxman

Income Tax Planning Income Tax Tax Consulting Corporate Accounting

Income Tax Planning Income Tax Tax Consulting Corporate Accounting

Tax Day 2021 Tax Filing Deadline H R Block

Tax Day 2021 Tax Filing Deadline H R Block

California State Sales Tax 2021 What You Need To Knowtaxjar Blog

California State Sales Tax 2021 What You Need To Knowtaxjar Blog

Calculating Your Solar Tax Credit 2021 Rec Solar

Calculating Your Solar Tax Credit 2021 Rec Solar

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Is Your T4 Accurate In 2021 Income Tax Return Tax Season Tax Return

Is Your T4 Accurate In 2021 Income Tax Return Tax Season Tax Return

Will 2021 Tax Deadline Be Extended Again Cpa Practice Advisor

Will 2021 Tax Deadline Be Extended Again Cpa Practice Advisor

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home