How Do I File Homestead Exemption In Indiana

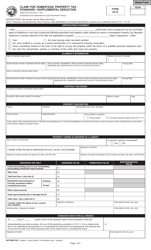

When you file your standard homestead you are required to provide your social security number and drivers license number as well as the same information for your spouse regardless of how you took title. An exemption request must be filed timely with the County Assessor by filing a Form 136 Application for Property Tax Exemption.

The Bankruptcy Homestead Exemption Explained Sawin Shea

The Bankruptcy Homestead Exemption Explained Sawin Shea

The Mortgage Deduction Application must be completed and dated no later than December 31st.

How do i file homestead exemption in indiana. Applications must be filed with the county in which the property exists on or before Jan. Taxpayers do not need to reapply for deductions annually. If the person does not have a valid social security number then provide the last 5 numbers of there drivers license number and state.

Indiana Code 6-11-10-16 insert link to IC describes the useor purpose necessary to become tax exempt. Homeowners who owned and occupied their residence after January 1 are encouraged to. Mortgages and homestead exemptions are filed with the County Auditor and will be applied to the following years taxes.

Submit an application no later than March 1 of the year you wish the exemption to begin. Last 5 numbers of social security number. The title may be submitted in person by mail at 1 E.

Reduce the property tax on your home. This intuitive site will lead you through a series of steps necessary to successfully file your deduction application. Here you will be able to enterselect your property address which will then prefill the necessary information to the deduction form you have selected.

To apply for the Indiana Homestead Property Tax Deduction an application must be filled out in a timely manner. STATE OF INDIANA Page 1 of 10 INDIANA GOVERNMENT CENTER NORTH 100 NORTH SENATE AVENUE N1058B INDIANAPOLIS IN 46204 PHONE 317 232-3777 FAX 317 974-1629 DEPARTMENT OF LOCAL GOVERNMENT FINANCE Frequently Asked Questions. The homeowner must also complete and date a Homestead Application by December 31st and file the application on or before January 5th.

The Form 136. If you meet these requirements you can access the application as follows. We cannot process the Homestead deduction application until we receive the title.

The form with the qualifications can be found here in the Auditors. Your filing deadline is. Reapplication should only occur if the property is sold the title is changed or the home is refinanced mortgage deduction only.

Have qualified for the homestead standard deduction on the property this year and last year. Own and occupy their Lake County home as their permanent residence as of January 1. You may also visit the Department of Local Government Finance website for application forms and information about eligibility and application requirements.

Download The Homestead Deduction Application Form You can download complete information about all deductions including maximum amounts eligibility and restrictions HERE. Have a gross assessed property value of 160000 or less on the homestead portion of the property. For any individual living at property.

3000 deducted from assessed value of property. November 1 2018. The two homestead deductions available to Marion County and City of Indianapolis residents are the standard homestead deduction and the supplemental homestead deduction.

Filing Requirements In order to receive these money saving exemptions on your property tax bill you will have to file a written application with the County Auditors office in the county in Indiana where your residence is located. The title company sends this form to the county recorders office along with your deed. To locate your local officials please see httpwwwingovdlgf2440htm.

102 Fort Wayne Indiana 46802 by email at acauditorallencountyus or by fax at 260-449-7679. Have an adjusted gross income of 30000 or less or a combined adjusted gross income with your spouse of 40000 or less. For properties closed after July 1 2008 new procedures require the title company to file for the Homestead Exemption using the Indiana State Sales Disclosure Form State Form 46201.

Deductions applied for prior to the annual deadlines will be applied to the next years tax bill. If you own a home and use it as your primary place of residence your home and up to one acre of land could qualify for homestead deductions on your property tax bill. Porter County Auditor 155 Indiana Ave Suite 204 Valparaiso IN 46383.

For additional information regarding. To file for the Homestead Deduction or another deduction contact your county auditor who can also advise if you have already filed. Homestead Standard Deduction and Other Deductions.

12938 A homeowner or an individual must meet certain qualifications found in the Indiana Code. Filing for the Deduction Homeowners do not need to reapply for this deduction unless there has been a change in deed marital status or change in the use of the property. Indiana Code 6-11-12-178d as amended by HEA 1450 requires that if an unmarried individual receiving a homestead deduction marries and would like to continue to receive the homestead deduction as long as they are still eligible for the deduction they must reapply.

When filing for a HOMESTEAD EXEMPTION provide the following. You can file the application in person or by mail at. Need to become a Lake County certified contractorPlan Commision Department website has information about zoning and subdivision ordinances permits special exceptions and variances.

Organizations such as charitable educational religious may be eligible for tax exemption. 5 of the year before the year the property owner wishes to apply the deduction. Do you need a building permit or Certificate of Occupancy.

Read more »