Homestead Property Tax Credit Indiana

Deductions work by reducing the amount of assessed value subject to property taxation. For additional information regarding.

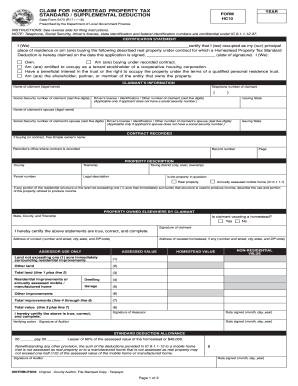

State Form 5473 Hc10 Download Fillable Pdf Or Fill Online Claim For Homestead Property Tax Standard Supplemental Deduction Indiana Templateroller

State Form 5473 Hc10 Download Fillable Pdf Or Fill Online Claim For Homestead Property Tax Standard Supplemental Deduction Indiana Templateroller

To learn more about property tax exemptions click HERE.

Homestead property tax credit indiana. Turned 65 or older by December 31 of the prior year. Shared Housing - If two or more individuals share ownership and occupy the homestead or are contracted to pay rent and occupy the rental property each may file a homestead property tax credit. Taxpayers may claim these benefits by filing an application with the Auditor in the County where the property is situated.

If you meet these requirements you can access the application as follows. Homestead Credit 35000 Deducted from the assessed value of property and 20 percent deducted from the net tax amount. Indiana Property Tax Benefits.

Buyers in contract can qualify if the purchase contract provides for them to pay taxes as of March 1. Homestead Standard Deduction and Other Deductions - November 1 2018. Have qualified for the homestead standard deduction on the property this year and last year.

The homestead standard deduction has been enacted to allow a property tax deduction for each qualified homestead. Homestead means an individuals principal place of residence. 35 of the assessed value of a property that is less than 600000.

Taxpayers are eligible for homestead credit on their principal residence only. You must meet these requirements to receive the deduction. Homestead consists of dwelling and real estate not to exceed 1 acre.

To be eligible for the homestead property tax credit the property must be the principal place of residence. County auditors are the best point of contact for questions regarding deductions and eligibility. 102 Fort Wayne Indiana 46802 by email at acauditorallencountyus or by fax at 260-449-7679.

November 1 2018. You must file an application to receive the homestead deductions. 25 of the assessed value of a property that is more than 600000.

Listed below are certain deductions and credits that are available to lower property taxes in Indiana. W-9 PDF - To report real estate transactions acquisition or abandonment of secured property. The homestead supplemental credit is calculated as a 35 deduction from the assessed value of the property after the standard deduction has been subtracted.

The maximum credit you can receive tax liability prior year tax x 102. Under certain circumstances an Indiana County Auditor may allow the deduction if the property owner proves that the summer home is used as a primary place of residence and the property owner is not taking the deduction on another piece of property. The supplemental homestead deduction is based on the assessed value of your property and equals.

The title may be submitted in person by mail at 1 E. The mortgage deduction application also may be filed with the Recorder in the County where the property is situated. Read carefully the qualifying guidelines below.

Homestead Standard Deduction and Other Deductions. To file for the Homestead Deduction or another deduction contact your county auditor who can also advise if you have already filed. Homestead Deduction Standard and Supplemental 50 of residential assessed value up to 45000 and additional percentage credit Standard and Supplemental Homestead Deductions - Must reside in the Mobile Home own by December 31 2021 and be listed on the Mobile Home title.

The claim must be based only on hisher prorated share of the taxable value and property taxes or rent paid and hisher own total household resources. To locate your local officials please see httpwwwingovdlgf2440htm. To qualify for the homestead credit in Indiana you must reside in your own home which includes mobile and manufactured homes on land not exceeding one acre and you must have owned the property by March 1 of the current property tax year.

STATE OF INDIANA Page 1 of 10 INDIANA GOVERNMENT CENTER NORTH 100 NORTH SENATE AVENUE N1058B INDIANAPOLIS IN 46204 PHONE 317 232-3777 FAX 317 974-1629 DEPARTMENT OF LOCAL GOVERNMENT FINANCE Frequently Asked Questions. How to receive the deductions. Tax Sale Bidder Registration Card PDF - To Register for the Hamilton County Property Tax Sale.

Property must be in owners name and be the principle place of residence as of December. The benefit of an additional homestead supplemental credit will be automatically applied when the 45000 maximum standard deduction is applied. We cannot process the Homestead deduction application until we receive the title.

That is located in Indiana. For assessed values greater than 600000 a 35 deduction will be applied for the 1st. Indiana Property Tax Benefits - A list of deductions and credits for property taxes on real property in Indiana.

Individuals and married couples are limited to one homestead standard deduction per homestead laws Indiana Code IC 6-11-12-31 and 6-11-209. Homestead Credit Additional Homestead Credit IC 6-11-209-1 through 6.

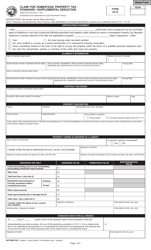

Mi 1040cr 5 Michigan Gov Documents Taxes

Mi 1040cr 5 Michigan Gov Documents Taxes

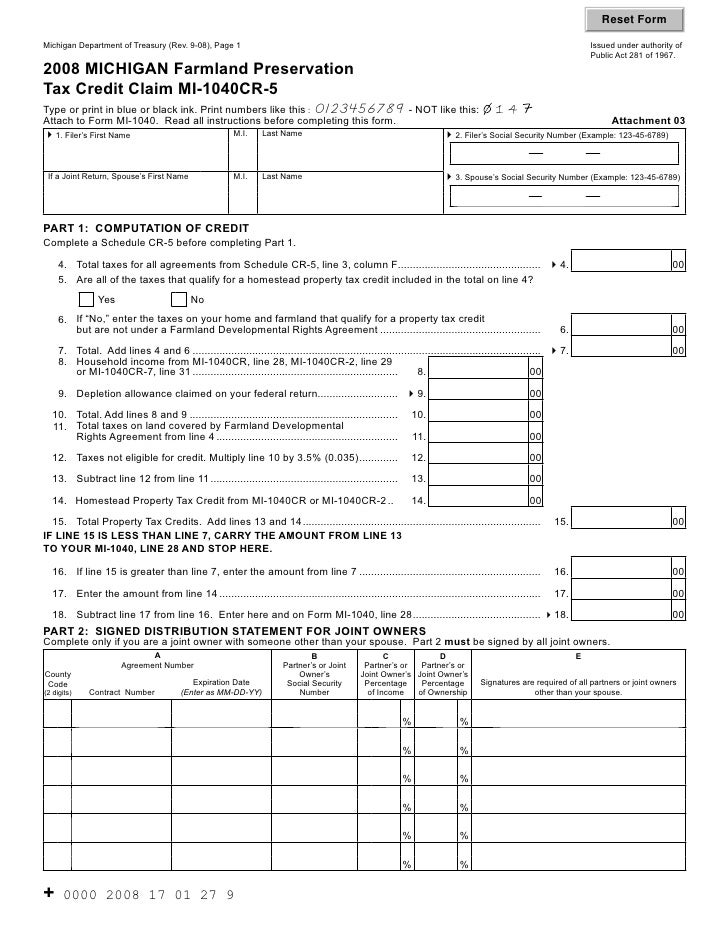

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

Http Www Indianacounties Org Egov Docs 479941162561599 Pdf

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Indiana Property Tax Deductions Are You Getting All Yours The Derrick Team 317 563 1110

Indiana Property Tax Deductions Are You Getting All Yours The Derrick Team 317 563 1110

Save Money By Filing For Your Homestead And Mortgage Exemptions

Save Money By Filing For Your Homestead And Mortgage Exemptions

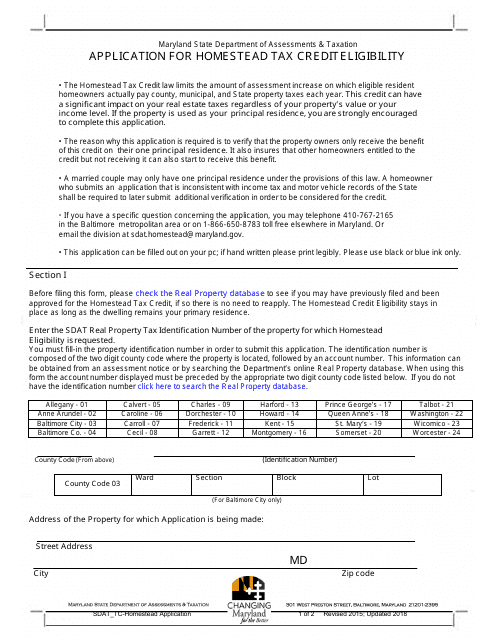

Form It 140 Schedule Heptc 1 Download Printable Pdf Or Fill Online Homestead Excess Property Tax Credit 2020 West Virginia Templateroller

Form It 140 Schedule Heptc 1 Download Printable Pdf Or Fill Online Homestead Excess Property Tax Credit 2020 West Virginia Templateroller

State Form 5473 Hc10 Download Fillable Pdf Or Fill Online Claim For Homestead Property Tax Standard Supplemental Deduction Indiana Templateroller

State Form 5473 Hc10 Download Fillable Pdf Or Fill Online Claim For Homestead Property Tax Standard Supplemental Deduction Indiana Templateroller

Property Tax Deductions Posey County Government

Property Tax Deductions Posey County Government

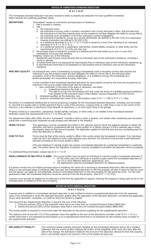

Beaver County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Beaver County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

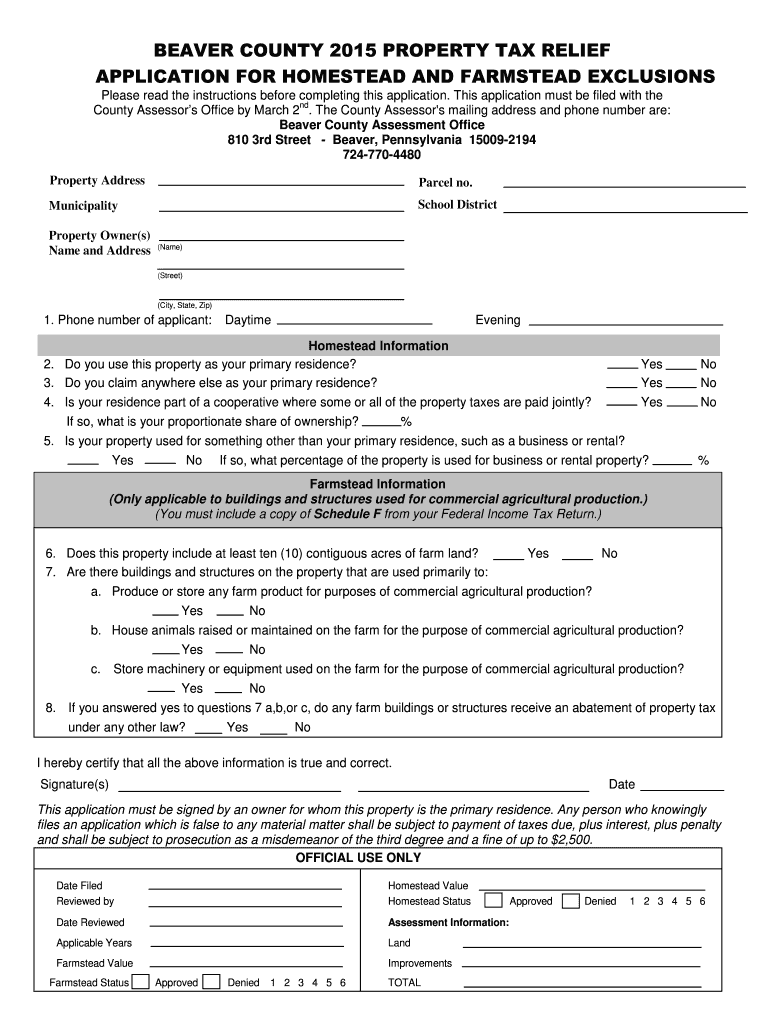

Indiana Property Tax Benefits State Form 51781 Town Of

Indiana Property Tax Benefits State Form 51781 Town Of

State Form 51781 Download Fillable Pdf Or Fill Online Indiana Property Tax Benefits Indiana Templateroller

State Form 51781 Download Fillable Pdf Or Fill Online Indiana Property Tax Benefits Indiana Templateroller

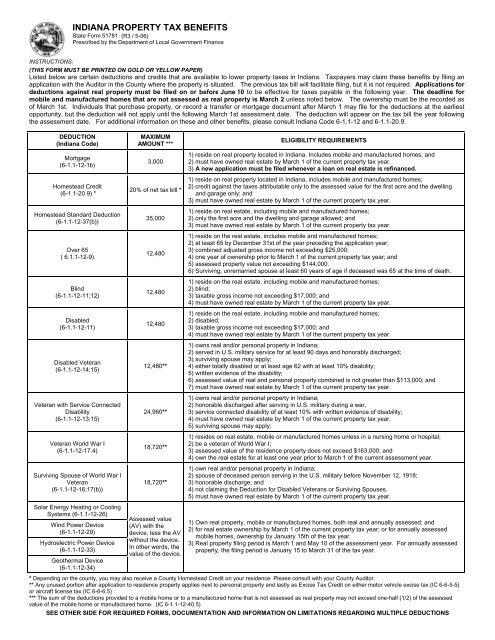

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

Fillable Online Indygov Indiana Property Tax Benefits State Form 51781 R2 106 R3 506 Prescribed By The Department Of Local Government Finance Instructions This Form Must Be Printed On Gold Or

Http Www Sbfcu Org Applications Indiana 20property 20benefits 20equity Pdf

Http Www Sbfcu Org Applications Indiana 20property 20benefits 20equity Pdf

Http Www Co Starke In Us Wp Content Uploads 2016 05 Property Deduction List Pdf

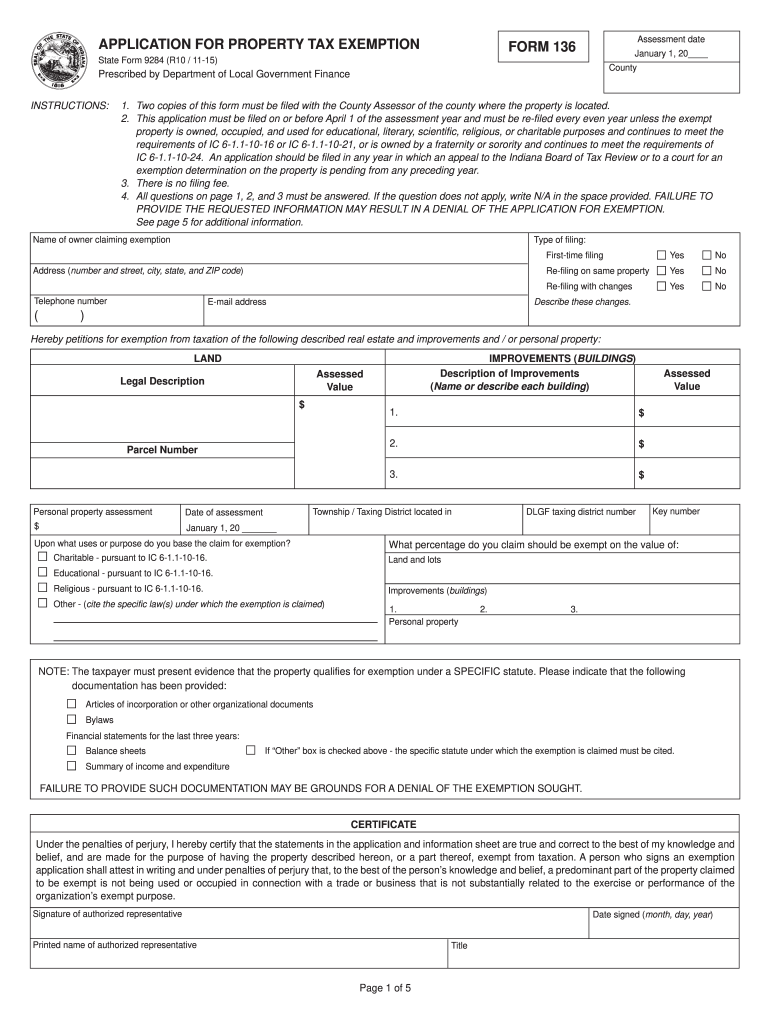

In State Form 9284 2015 2021 Fill Out Tax Template Online Us Legal Forms

In State Form 9284 2015 2021 Fill Out Tax Template Online Us Legal Forms

Indiana Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Indiana Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Https Wellscounty Org File 2017 04 Indiana Property Tax Benefits Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home