Property Tax Sale Marion County Indiana

Enter the 18-digit state parcel number eg. Marion County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Marion County does not.

Important Tax Links Grant County Indiana

Important Tax Links Grant County Indiana

Since Marion County homeowners began receiving their bills late last week the county treasurers office has been bombarded with calls.

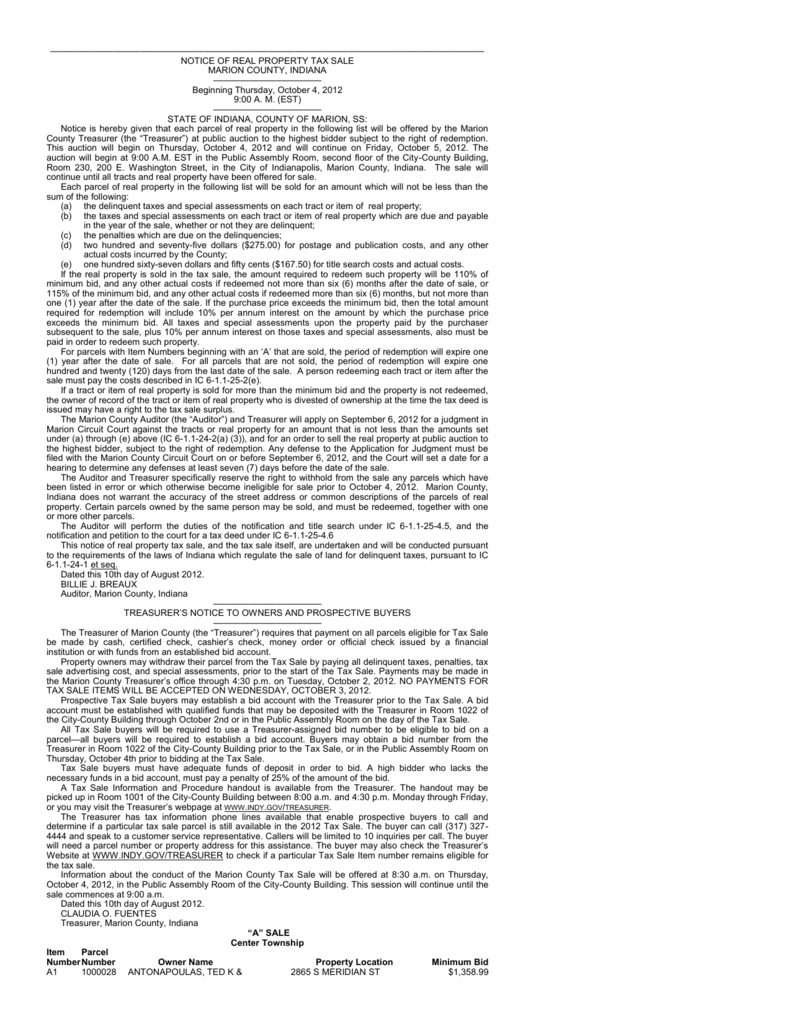

Property tax sale marion county indiana. Marion County Tax Sale Dates. The Indiana sales tax of 7 applies countywide. Tax deed sales will now be held online through RealAuction.

INDIANAPOLIS Property tax bills are going out across Indiana and you could face some sticker shock. Residents of Marion County pay a flat county income tax of 162 on earned income in addition to the Indiana income tax and the Federal income tax. Every tap on the map will result in another point of the polygon.

Change of Mailing or Property Address. Sale ID Minimum Sale Price Property Information and Address Reference Materials. Thursday and Friday March 25-26 2021.

Due to ongoing public health concerns related to the COVID-19 pandemic the 2020 Property Tax Sale originally scheduled for March 25 and 26 2021 has been cancelled. Learn about personal property tax guidelines and access important forms for filing taxes. Contact the Marion County Auditors Office 3173274646 if the parcel shows a County Lien status prior to the 2011 tax sale.

In Marion County the 2017 tax sale costs for each property were 45000. You have one year from the date of the sale to redeem taxes if your parcel was sold at a tax sale. The Marion County Treasurers Office and the Marion County Auditors Office are currently reviewing options to conduct both a postponed 2020 tax sale and a 2021 tax sale later this year likely in the 4th quarter.

Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes. Sign up to have your Tax Statement emailed to you instead of using traditional mail. If a property is delinquent for three or more installments it is eligible for a tax sale IC 6-11-24 and IC 6-11-25.

2902-01-31-02-04-017000 1192148 Osiris Opportunity Fund LLC Acreage 00 Section 31 Township 20 Range 3 BOXLEY ORGSHERIDAN Lot 3 Block 2. Treasurer Barbara Lawrence said. The Marion County Treasurers Office and the Marion County Auditors Office are currently reviewing options to conduct both a postponed 2020 tax sale and a 2021 tax sale later this year likely.

Grant County Government Indiana Treasurer Tiffany N Griffith 401 S. Some cities and local governments in Marion County collect additional local sales taxes which can be as high as 88817841970013E-16. A Tax Certificate when purchased becomes an enforceable first lien against the real estate.

Nonresidents who work in Marion County pay a local income tax of 041 which is 121 lower than the local income tax paid by residents. The Tax Certificate sale is open to all citizens and the certificates are sold in a reverse auction style with participants bidding downward on interest rates starting at 18. Double-click to finish drawing.

The Notice also sets forth the amount that it will cost a taxpayer andor a mortgage holder to redeem a property if it goes through a tax sale. RealAuction Online Tax Deed Sales Electronic Tax Deed Sale. When theyre available you can access reports on tax lien sales of different types of parcels.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Sign up now by. Search by Owner Name.

Tax sales take place in October Due to ongoing public health concerns related to the COVID-19 pandemic the 2020 Property Tax Sale originally scheduled for March 25 and 26 2021 has been cancelled. Rm 229 Marion IN 46953 765 668-6556 Office hours. The certificate is issued to the lowest bidder.

Please click the following links for any upcoming tax sale information and list of properties available. You have 120 days from the date of sale to redeem taxes if the tax parcel is a C-item or any unsold item. In-depth Marion County IN Property Tax Information.

Marion county tax sale. Have your Tax Statements andor your Notice of Assessments Sent to your email ever year. Public Assembly Room Rm 230 City-County Building Information about Marion Countys 2020 Tax Sale will be available on the Treasurers website Click here for the Marion County Treasurers website.

Parcels on the A list are the most common. Property Taxes in Marion County Property tax is a tax on real estate mobile homes and business personal property. Find reports on tax lien sales in Marion County including annual tax sale information and procedures tax sale sold lists with final bid tax sale status lists and tax sale combination lists.

Activate Polygon Draw Tool Deactivate Polygon Draw Tool Click on the map to start drawing.

Marion County Property Tax Records Indianapolis Property Walls

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

Covid 19 Government Continuity In Indianapolis And Marion County Indiana Citybase

Covid 19 Government Continuity In Indianapolis And Marion County Indiana Citybase

Property Tax Bills Still Due May 11 But There Is Some Relief For Those Struggling Wthr Com

Property Tax Bills Still Due May 11 But There Is Some Relief For Those Struggling Wthr Com

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

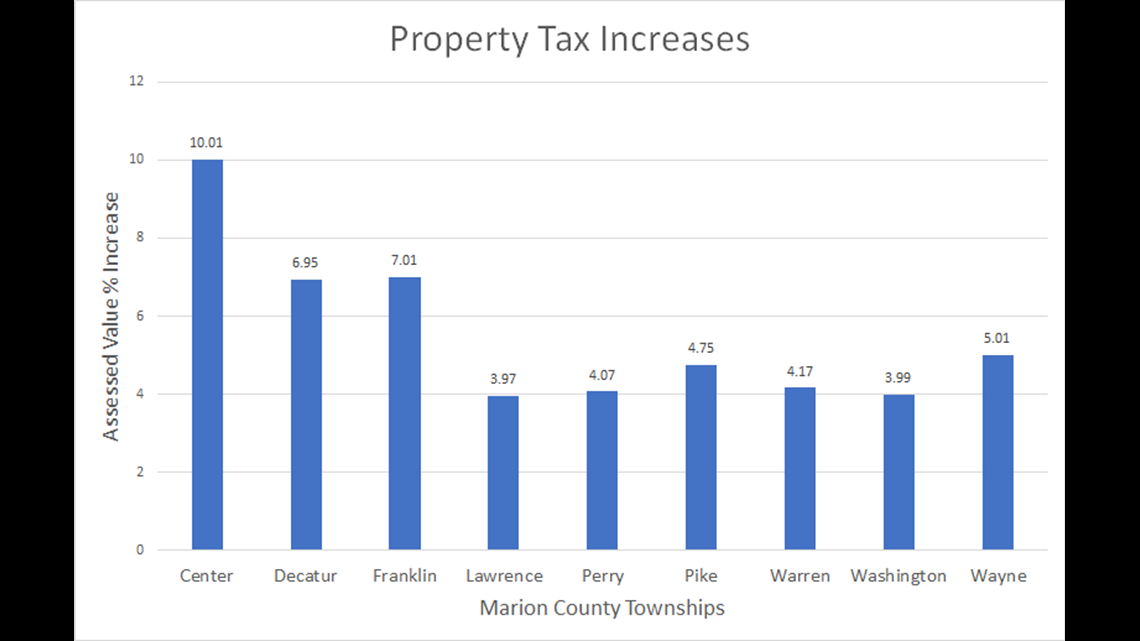

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

Indiana Officials Seek Tax Sale Abandoned Housing Reforms

Indiana Officials Seek Tax Sale Abandoned Housing Reforms

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

Marion County Tax Sale Viewer Overview

Marion County Tax Sale Viewer Overview

Marion County Property Taxes Are Being Sent But Many Have Extra Time To Pay Before The Due Date Fox 59

Marion County Property Taxes Are Being Sent But Many Have Extra Time To Pay Before The Due Date Fox 59

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

Are Tax Sale Properties In Indianapolis Worth The Investment Homevestors Franchise

Are Tax Sale Properties In Indianapolis Worth The Investment Homevestors Franchise

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

Why You Ll Likely Pay More In Property Taxes This Year Wthr Com

How Does The Marion County Sheriff Sale Work

How Does The Marion County Sheriff Sale Work

How Does The Marion County Tax Sale Work

How Does The Marion County Tax Sale Work

Marion County Property Tax Records Indianapolis Property Walls

Marion County Property Tax Records Indianapolis Property Walls

Marion County Property Tax Records Indianapolis Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home