Personal Property Tax In Montana

So while Gallatin Countys property tax rates are slightly lower than the state average homeowners in the county still pay among the highest property taxes in Montana in dollar terms. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year.

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

The typical Gallatin County resident has a property tax bill of 2604 placing the county as the second-most expensive behind only Missoula County.

Personal property tax in montana. Avoid sales tax and high licensing fees. Pay your County Taxes online. To pay real estate personal property or Mobile Home taxes by creditdebit card use the button below.

This amount must be obtained by contacting the Treasurers. Not all taxes are available. Non-residents may choose to register by the.

All property is taxable in Montana unless it is specifically exempted from taxation1. Click here to view the Personal Property Data Report Guide. Click here to download the personal property data dictionary.

The Municipal Fees portion of your vehicle registration fees. All Dates are Subject to Change. 10 rows 4221158 PERSONAL PROPERTY REPORTING REQUIREMENTS 1 A taxpayer having.

Access information about the Property Tax Department. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. Personal property that is expensed or depreciated out for income tax purposes remains taxable for property tax purposes.

Jefferson County provides an online property tax search tool. The Motor Vehicle Tax portion of your registration fees. For information on tax liens from 2016 going forward please refer to House Bill 18.

Taxes or fees in lieu of taxes are due along with appropriate registration fees US. Personal property includes everything that is the subject of ownership that is not included within the. The average effective property tax rate paid by homeowners is 083 across the state.

There is a 25 convenience fee charged to your credit card. Propertymtgov is down for maintenance. For information on tax liens from 2015 or prior please refer to Montana Code Annotated Title 15 Chapters 16 17 and 18.

A simple legal procedure is involved which in most cases helps clients save a great deal of money on taxes and licensing fees through creating a Montana LLC and then proceeding with Montana vehicle registration or Montana. Thats equal to 830 in property taxes for every 100000 in home value. Look up Cascade County tax parcel information andor securely pay.

The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. Under MCA 61-3-701 through 704 non-residents who are gainfully employed in Montana must present their current out-of-state vehicle registration to the county treasurers office. You will be transferred to a secure site for processing.

Property taxes in Montana are fairly low. The Personal Property Tax portion of your vehicle registration fees paid to your county. As a non-resident of Montana you may be able to avoid paying sales tax personal property tax and high licensing fees upon the purchase of your new high-performance car boat airplane or RV.

Property information can also be found at cadastralmtgov. No partial payments will be accepted. Enter an assessment code and select the county that issued the assessment to retrieve personal property records statewide.

We apologize for any inconvenience. The County Option Tax you paid on your vehicles. The state provides an exemption on all residential property that greatly reduces the property tax burden of residential homeowners.

Need payoff information or. Montana Department of Revenue. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected.

The Motor Vehicle Tax you paid on your vehicles. Personal Property Taxes July 31st Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates. If not please contact the Montana Department of Revenue - Bozeman Office at 406-582-3400 or email dorgallatinofficemtgov.

Due dates for property taxes. Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information. Parcel Tax Information Payments.

A convenience fee will be charged by Lake County for each tax receipt paid with a credit card in accordance with Montana Codes Annotated 7-6-617This fee will be charged anytime a credit card is used when paying in person by phone or online.

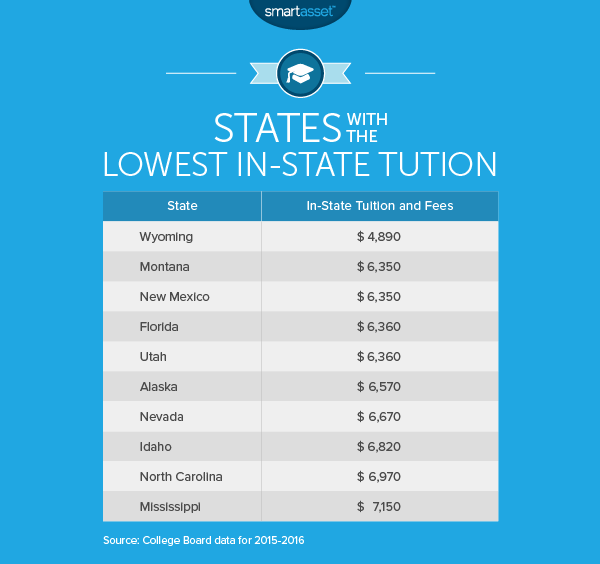

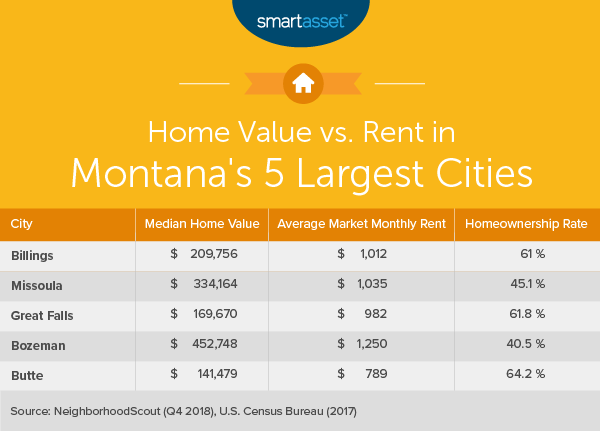

The Cost Of Living In Montana Smartasset

The Cost Of Living In Montana Smartasset

Probate In Montana Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Probate In Montana Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

Montana Income Tax Information What You Need To Know About Mt Taxes

Montana Income Tax Information What You Need To Know About Mt Taxes

Idaho Income Tax Calculator Smartasset

Idaho Income Tax Calculator Smartasset

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

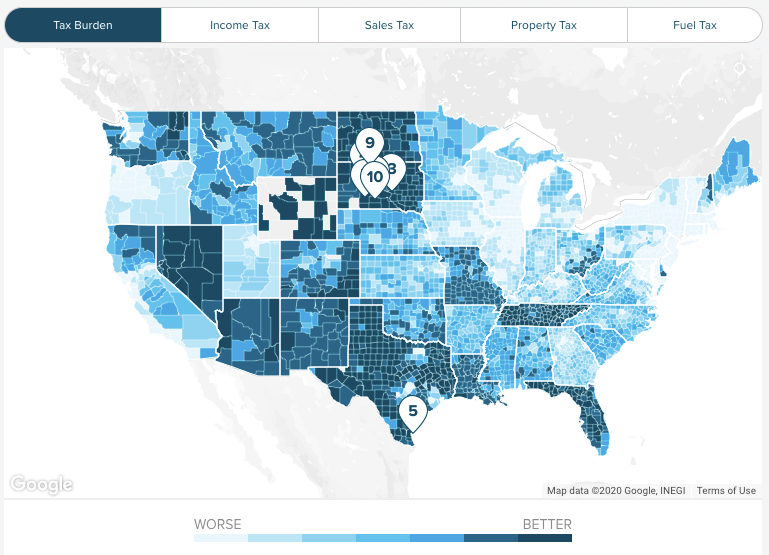

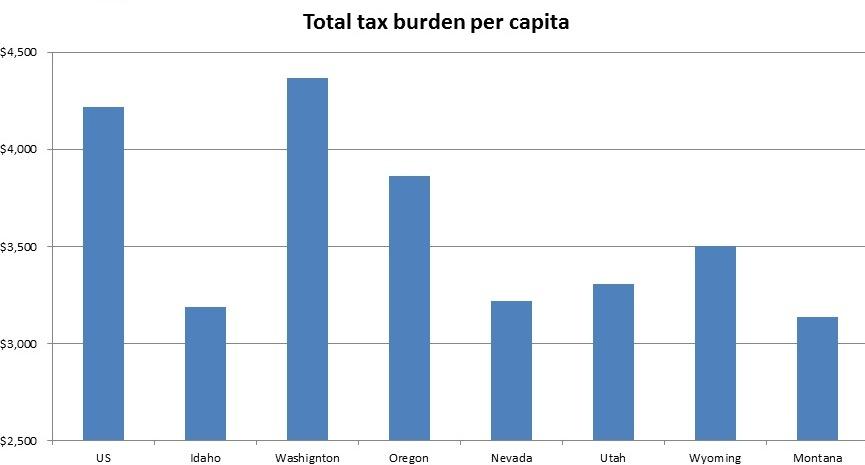

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Montana Property Tax Calculator Smartasset

Montana Property Tax Calculator Smartasset

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Tax And Labor Law Summary Care Com Homepay

Montana Tax And Labor Law Summary Care Com Homepay

The Cost Of Living In Montana Smartasset

The Cost Of Living In Montana Smartasset

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Income Tax Calculator Smartasset

Montana Income Tax Calculator Smartasset

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Https App Mt Gov Myrevenue Endpoint Downloadpdf Yearid 73

Montana Property Tax Calculator Smartasset

Montana Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home