Ulster County Public Property Records

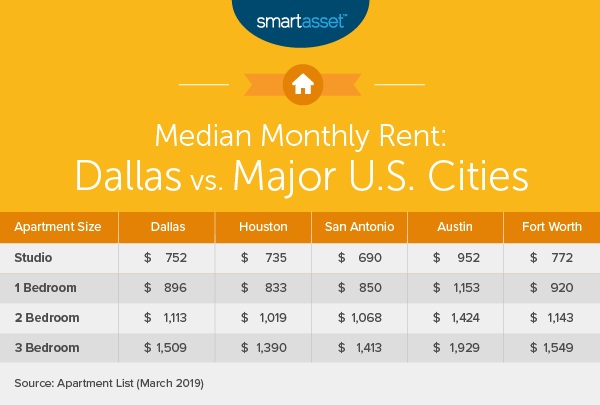

Property Taxes Mortgage 174679200. Go to Data Online.

Ulster County Vaccination Center Opens In Former Best Buy Store At Hudson Valley Mall Dailyfreeman Com

Ulster County Vaccination Center Opens In Former Best Buy Store At Hudson Valley Mall Dailyfreeman Com

OPEN MONDAY THROUGH FRIDAY 900 AM - 445 PM.

Ulster county public property records. Ulster County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Ulster County New York. Historic Aerials 480 967 - 6752. Kingston NY 12401 Number.

Go to Data Online. See Fee Schedule There are public terminals available for searching in the County Clerks 2nd floor Record Room. Nina Postupack County Clerk 244 Fair Street Kingston New York 12401 JOB VACANCY.

THE ULSTER COUNTY RECORDS CENTER. Land records recorded in the Ulster County Clerks Office include deeds mortgages assignments powers of attorney satisfaction of mortgages as well as many other document types. Archivesatcoulsternydotus 845 340-3415 845 340-3418.

These records can include Ulster County property tax assessments and assessment challenges appraisals and income taxes. Ulster County now has a dedicated full-time social worker as a part of Ulster County 911 Announced in the 2021 Budget Ulster County allocated 900000 to Mobile Mental Health Team. For more details about our reopening plans visit our COVID-19 Website Meet the County Clerk.

300 Foxhall Avenue Kingston NY 12401. It was established by Article 15A of the Real Property Tax Law to provide specified services to local governments including. Search Ulster County property tax and assessment records through GIS mapping.

The County Clerks Recording Desk and the Hall of Records are also not open to the public. There are many different types of records including Ulster County birth records criminal records and business records. If you do not.

Ulster Municipality Taxing Districts. Many Public Records are available at local Ulster County Clerks Recorders and Assessors Offices. Ulster County Property Tax Collections Total Ulster County New York.

Ulster County Clerks Office 244 Fair Street Kingston New York 12401. 2020 Annual Report2019 Annual Report2018 Annual Report2017 Annual Report2016 Annual Report2015 Annual Report2014 Annual Report2013 Annual Report2012 Annual ReportExemptionsRate and RatiosProperty Tax RatesSchool Tax RatesEqualization RatesResidential Assessment Ratios RARsThese rate charts are presented in Adobe Acrobat format. Ulster County Clerk 845 340 - 3288.

For any questions or concerns please contact Ulster County Clerk Nina Postupack at countyclerkatcoulsternydotus or visit our Facebook page. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Requests for copies can be made in person at 244 Fair Street in the 2nd floor Records Room.

300 Foxhall Avenue Kingston New York 12401. Assessor Real Property Tax Services Ulster County Real Property Tax Service Agency 244 Fair Street Kingston NY 12401 Phone. Producing and maintaining tax maps and ownership records for use by local assessors in preparing assessment rolls.

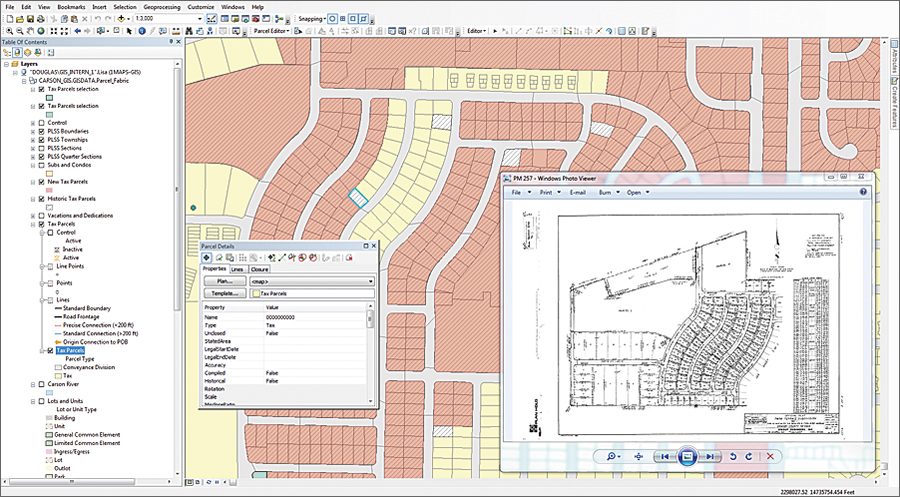

845-340-3288 opt 6 Homepage. Go to Data Online. The Ulster County Parcel Viewer is an Internet-based Geographic Information System GIS providing parcel data and other environmental information for Ulster County NY.

Ulster Mapping GIS. MON-FRI 900 AM - 445 PM 845 340-3415. These records are available from 1685 to present.

Records Clerk Permanent Full-Time Benefited. Associated fees must be paid when copies are made. Ulster County Property Records are real estate documents that contain information related to real property in Ulster County New York.

New York Ulster County 244 Fair St. Ulster County Public Records are any documents that are available for public inspection and retrieval in Ulster County NY. Ulster Real Property Tax Service 845 340 - 3490.

All recorded documents have a book and page number prior 2003 or instrument number assigned to them. 1707Hour Grade 6 FILL DATE. Ulster County Parcel Viewer combines geographic data about the community such as tax parcels water features and aerial photographs with tools to visualize query and map these features.

When requesting copies of instruments please make. The Ulster County Real Property Tax Service Agency is a division of the Ulster County Department of Finance. Go to Data Online.

Property Taxes No Mortgage 97155500.

Read more »