Douglas County Nevada Property Tax Records

FAQ - Property Assessment Questions. The percentage is called an assessment rate and the resulting value is called the assessed value Mill.

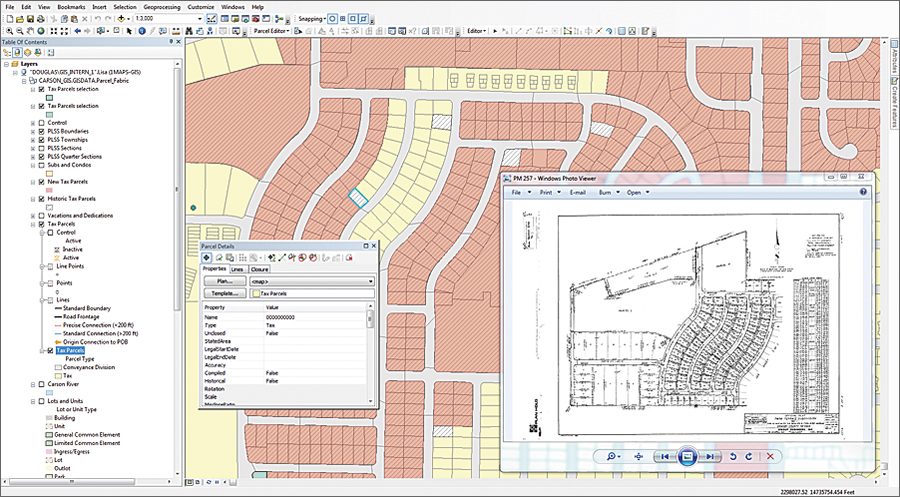

Douglas County Meets Growing Demand For Parcel Maps

Douglas County Meets Growing Demand For Parcel Maps

The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possibleNo warranties expressed or implied are provided for the data herein its use or its interpretation.

Douglas county nevada property tax records. 1819 Farnam St H-02. Colorado law is very specific in establishing how the Assessor values property. Nevada Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in NV.

Due to data update schedules the information on this web site may not reflect the most recent changes to property information. State and National Officials. County Commissioner Annual Appointments.

Board of County Commissioners. Street Name Street Type. Go to Data Online.

How to Calculate Taxes Statute provides that the actual value of property is not the taxable value. Tax Records include property tax assessments property appraisals and income tax records. Boards Committees and.

Rather the taxable value is a percentage of the actual value. Consider other options including drop box e-services or kiosks. Douglas County Assessor Property Records Report Link httpassessor-searchdouglasnvus1401cgi-binasw300 Search Douglas County Assessor property sales.

Douglas Recorder 775 782 - 9027. Get Taxes Due A link to the Douglas County Treasurer. BoPTA forms are available at County Clerks.

NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The fourth installment of the 2020-2021 property tax is due and payable on March 1 2021. Due to the ongoing impact of COVID-19 service wait times could take longer than usual. Your search for Douglas County NV property taxes is now as easy as typing an address into a search bar.

Douglas County honors service members heading off to World War I - 951917. The Assessor is responsible for listing classifying and valuing all property in the county in accordance with state laws. 11 rows Douglas County shall not be liable for errors contained herein or for any damages in.

Go to Data Online. Go to Data Online. Assessors Online Services Access online services related to the duties of the Assessors Office.

2017 Truth Taxation Property Tax Information. Douglas County Court House 305 8th Ave W Alexandria MN 56308. Douglas County Assessment Rolls Report Link httpassessor-searchdouglasnvus1401cgi-binasw100 Search Douglas County property assessments by tax roll parcel number property owner address and taxable value.

Business Declaration Form Obtain a declaration form for your business. NOTICE TO TAXPAYERS OF DOUGLAS COUNTY NEVADA The fourth installment of the 2020-2021 property tax is due and payable on March 1 2021. If you are a new visitor to our site please scroll down this page for important information regarding the Assessor transactions.

Douglas County Nevada GOVERNMENT Departments Assessor. Exemptions Learn about who qualifies and how to apply for tax exemptions. Douglas County shall not be liable for errors contained herein or for any damages in connection with the use of the information contained herein.

June 30 - Final determination date for property tax exemption status. September 25 - Assessor certifies value or value estimate of joint Taxing Districts. Historic Aerials 480 967 - 6752.

Douglas Assessor 775 782 - 9830. House Number Direction. -OR- Parcel Number.

Simply fill in the exact address of the property in the search form below. Personal Property Information Search for information about personal property located in Douglas County. July 15 - Taxing Districts certify tax levies and special assessments.

Douglas County NV Property Tax Search by Address Want to see what the taxes are for a certain property. Optional - Denotes required entry for Address Search. To ensure you have the latest information as we navigate our new operating environment we have created a COVID-19 information Here you can find the latest information about how we are responding to COVID-19 review our new processes and.

Real Property Tax Search Please enter either Address info or a Parcel Number. Douglas Treasurer 775 782 - 9018. Address Change Find out how to officially change an address in Douglas County.

Total Valuation Sales Information. July 1 - Start of the fiscal year and lien date for all taxes. Property Tax Law Changes.

Property Find out more about the various duties of the Assessors Office.

Read more »