Douglas County Property Value Search

FAQ - Property Assessment Questions. Call 402-444-6510 to have your BOE-related questions answered.

How Healthy Is Douglas County Minnesota Us News Healthiest Communities

How Healthy Is Douglas County Minnesota Us News Healthiest Communities

Real Estate Tax Property Search Look up real estate tax and property information.

Douglas county property value search. Contact the Assessors Office to discuss your valuation. BoPTA forms are available at County Clerks. John Smith Street Address Ex.

The Douglas County Assessors Office makes no warranties either expressed or implied concerning the accuracy or completeness of the data presented on this website for any other use and assumes no liability associated with the use of this data. Douglas County Assessment Rolls httpwwwcodouglasoruspuboaapuboaa_searchasp Search Douglas County property assessments by tax roll parcel number property owner address and taxable value. Properties in Douglas County are revalued annually.

Property Tax Law Changes. September 25 - Assessor certifies value or value estimate of joint Taxing Districts. Real Property Tax Search Please enter either Address info or a Parcel Number.

The County Assessors Office maintains an estimated value and a classification based on actual use on each of them. 2017 Truth Taxation Property Tax Information. Address PinParcel and Plate.

Douglas County Court House 305 8th Ave W Alexandria MN 56308. Douglas County Assessor County Maps httpwwwcodouglasoruspuboaamapsonlineasp View Douglas County Assessor maps list including aerial overlay and images acreages GIS GPS. House Number Direction.

July 15 - Taxing Districts certify tax levies and special assessments. The Pin and Plate search types are exact matches while the Address search type returns matches that are like the data string submitted. Sales Information Search information about sales in Douglas County.

Search Select a report. Register of Deeds Office Harney Street level. Douglas County Courthouse 1313 Belknap Street Superior Wisconsin 54880 Phone.

Douglas County Assessment Rolls Report Link httpswwwdouglascousdocuments2018-abstractpdf Search Douglas County property assessments by tax roll parcel number property owner address and taxable value. There are essentially 5 classifications - residential seasonal apartment agricultural and commercialindustrial. Billing Address CORELOGIC PO BOX 9202 COPPELL TX 75019-9208.

Online Business Declaration Currently unavailable File a business declaration using our online portal. Assessed Value Full Rate Reduction Taxes. Optional - Denotes required entry for Address Search.

Old Parcel Maps Old Parcel Maps. Street Name Street Type. Dodge County Property Search.

Douglas County Property Valuation Lookup. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of. Second select a Search Type with the following options.

Fillmore County Property Search. First begin by selecting a Property Type of Real Property or Personal Property. Search for a Property Search by.

Property Ownership Location Report Parcel Value Report Property Improvement Occupancy Report Property Improvement Segments Report Building Summary Report Sales Information Report Valuation History Report. Total Valuation Sales Information. Garden County Property Search.

1819 Farnam St H-02. Real Estate Tax Property Search. June 30 - Final determination date for property tax exemption status.

Gage County Property Search and Mapping. Franklin County Property Search. By clicking on a result in the search you acknowledge that you accept this disclaimer.

Dixon County Property Search. Search for information about the assessed values of any property in Douglas County. 715 395-1341 Quick Links.

Parcel Maps View our selection of different parcel maps. July 1 - Start of the fiscal year and lien date for all taxes. Also June 30 was the deadline to schedule a property-value protest with the Douglas County Board of Equalization BOE.

Douglas County has approximately 30000 parcels. PURCELL DOUGLAS E SR PURCELL JUDITH E. Furnas County Property Search.

Location Address 6204 BEAVER LAKE DR OH. The market value is supposed to be what the property would probably sell for if placed on the open market. Complete Assessor Address ListingPDF Excel Nebraska Assessors Online or Nebraska Taxes Online operated by Nebraska Association of County Officials.

Douglas County Assessor County Maps Report Link httpwwwdouglascousassessormapsothermaps View Douglas County Assessor maps. Dundy County Property Search. -OR- Parcel Number.

The exact property tax levied depends on the county in Ohio the property is located in. Washington State law requires property to be assessed at 100 of market value. The Assessors primary duty is to determine the value of all taxable real and personal property in the county for ad valorem purposes.

Frontier County Property Search and Mapping.

Welcome To Douglas County Illinois Online

How Healthy Is Douglas County Oregon Us News Healthiest Communities

How Healthy Is Douglas County Oregon Us News Healthiest Communities

Douglas County Nebraska Growing Food Connections

School Districts In Douglas County Ne Niche

School Districts In Douglas County Ne Niche

Douglas County Nebraska Growing Food Connections

2019 2020 Property Valuation Douglas County Government

2019 2020 Property Valuation Douglas County Government

Landmark Web Official Records Search

Landmark Web Official Records Search

State Of Oregon Blue Book Douglas County

State Of Oregon Blue Book Douglas County

How Healthy Is Douglas County Missouri Us News Healthiest Communities

How Healthy Is Douglas County Missouri Us News Healthiest Communities

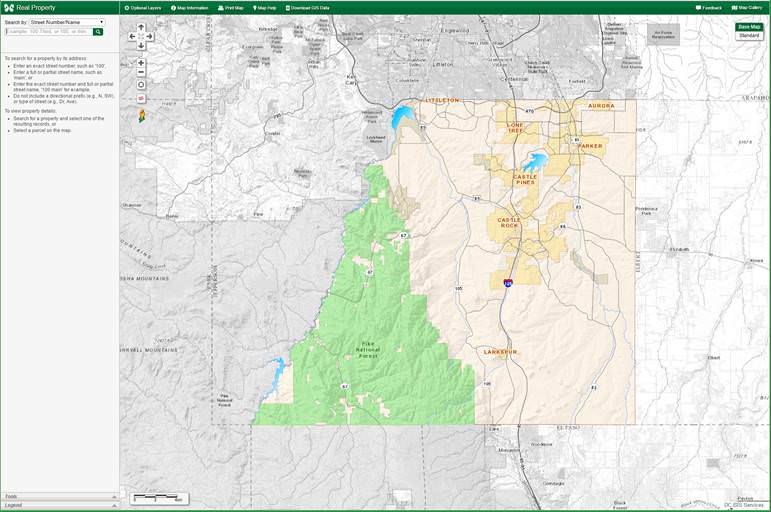

Assessor Douglas County Government

Assessor Douglas County Government

How Healthy Is Douglas County Nebraska Us News Healthiest Communities

How Healthy Is Douglas County Nebraska Us News Healthiest Communities

How Healthy Is Douglas County Colorado Us News Healthiest Communities

How Healthy Is Douglas County Colorado Us News Healthiest Communities

Geographic Information Systems Gis Douglas County Government

Geographic Information Systems Gis Douglas County Government

Taxes In Douglas County Douglas County Government

Taxes In Douglas County Douglas County Government

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home