Property Tax In Quebec City

Montreal will freeze property taxes for homeowners and businesses in 2021 Mayor Valerie Plante said Thursday in a press conference where she laid out the citys difficult financial position. One analysis reported the following figures for an annual income of 75000.

Notre Dame Des Victoires Church Quebec City Haunted Places Place Of Worship

Notre Dame Des Victoires Church Quebec City Haunted Places Place Of Worship

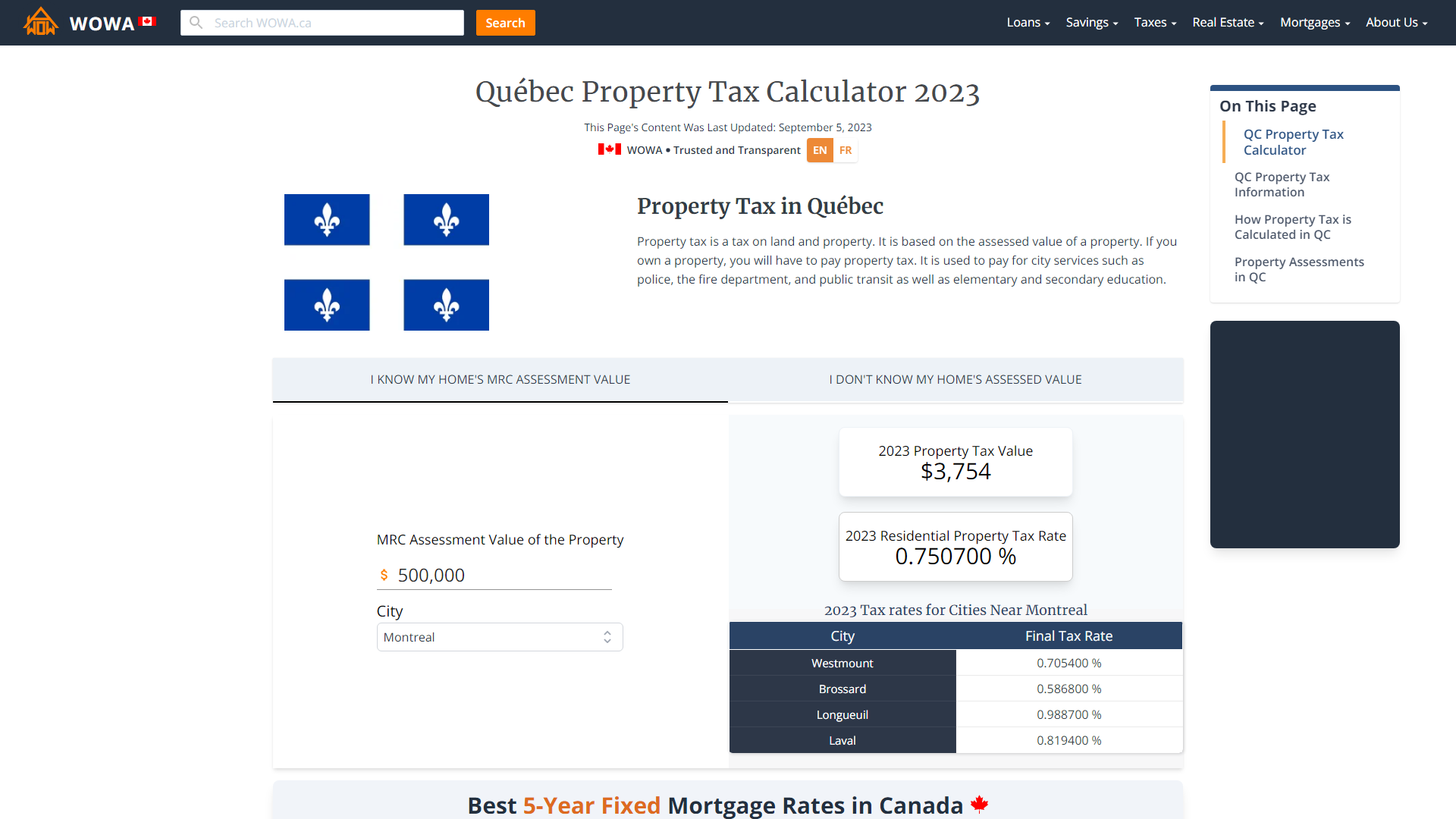

Property tax is a tax based on the assessed value of a property.

Property tax in quebec city. According to the land registration system all real property transactions become public upon registration in. It is based on the assessed value of a property. Many organizations view property taxes as a fixed expense and only act defensively when there is a drastic increase in the assessment value.

It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education. Find out about your tax account tax. If you own a property you will have to pay property tax.

Property Tax in Québec. In a new study from home listings site Zoocasa the city has the lowest property tax rate among Canadian municipalities at just above 024 per cent of a propertys value. The average estimated commercial property taxes per 1000 of assessment among the cities surveyed was 2421 representing a slight decrease of 023 between 2017 and 2018.

11 rows Property tax 205689 73336 1003 280028 Margin of error for property tax A. There were no sales tax rates modification for 2021. Do you want to know more about property taxes special taxes or borough taxes.

17715 Values 20M. Check Quebec rates rebates. Montreal Quebec City and Halifax posted the highest estimated commercial taxes.

In all provinces where the provincial sales tax is collected the tax is imposed on the sale price without GST in the past in Quebec and in Prince Edward Island PST was applied to the combined sum of sale price and GST. Cash cheque credit card cheques provided by your card company money order or debit card accepted. The mailing and payment dates for the annual municipal tax accounts have been postponed.

Regarding the sale of the book only the GST must be taken into account in this type of calculation. Take a proactive approach to managing your commercial property tax in Quebec City. If you own a property or parcel of land you will have to pay property tax.

There is a considerable difference in the amount of income tax that youll pay if you choose Quebec over Ontario. 15410 Values 20M. It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education.

But from acquisition to disposition property tax is a controllable expense that should be proactively reviewed at each decision point as well as on an annual and mid. 15410 Values 25M. Change of the GST or QST rates.

Amount without sales tax GST amount QST amount Total amount with sales taxes. At the Service Regina desk on the main floor. Of the provincial sales taxes only the QST and the HST are value-added.

Tax payment deadline for purchasers who must report and remit the GST and QST If the purchaser is a registrant and intends to use the real property primarily more than 50 in commercial activities the GST and QST must be remitted to us on or before the day on which the purchaser is required to file the return for the reporting period during which the GST and QST become payable. In Ontario you will pay 16561 in income taxes while in Quebec you would pay 20893 for the same income. Immovables of 6 or more dwellings.

Learn more about your property assessments the different methods you can use to pay your property taxes access your property tax information and more. At your financial institution online or in person At City Hall on weekdays between 8 am. The City provides reliable and transparent property assessment and tax administration to generate revenue which funds services residents interact with every day.

Pay your taxes in full by June 30 at your financial institution at City Hall or by mail. In fact according to. There are two main parts to property taxes in Québec.

Since the mid-19 th century the State has submitted all the real property transactions conducted in Québec in the various registers that make up the Land register of Québec. General property tax basic rate per 100 evaluation. Calculating taxes for Quebec residents to other provinces of Canada in 2021.

Property tax is a tax based on the assessed value of a. Property tax is a tax on land and property. 17758 Values 25M.

Calculate the GST 5 QST 9975 amount in Quebec by putting either the after tax or before tax amount. The rest are cascading taxes.

6 Projects To Watch For In Peterborough S 2020 Budget What S In And What S Been Excluded From The 2020 D Peterborough City Council Ferry Building San Francisco

6 Projects To Watch For In Peterborough S 2020 Budget What S In And What S Been Excluded From The 2020 D Peterborough City Council Ferry Building San Francisco

How Better Weather Forecasts Are Changing The Way Cities Are Run Better Weather Orleans Chicago Mercantile Exchange

How Better Weather Forecasts Are Changing The Way Cities Are Run Better Weather Orleans Chicago Mercantile Exchange

De Senneville Senneville Quebec Canada Guest Cottage Luxury Homes International Real Estate

De Senneville Senneville Quebec Canada Guest Cottage Luxury Homes International Real Estate

Quebec Property Tax Rates Calculator Wowa Ca

Quebec Property Tax Rates Calculator Wowa Ca

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Border Location Ignorance Equals Being Detained Expat Tax Tax Services Online Classes

Border Location Ignorance Equals Being Detained Expat Tax Tax Services Online Classes

Quebec City Property Tax 2021 Calculator Rates Wowa Ca

Quebec City Property Tax 2021 Calculator Rates Wowa Ca

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

America S 10 Best Big Cities A Mind Blowing Game Changing Reality Check Seattle City Seattle City

America S 10 Best Big Cities A Mind Blowing Game Changing Reality Check Seattle City Seattle City

5800 Ch Du Cure Barrette La Plaine Terrebonne Quebec Sotheby S International Realty Canada Luxury Real Estate Real Estate Estate Homes

5800 Ch Du Cure Barrette La Plaine Terrebonne Quebec Sotheby S International Realty Canada Luxury Real Estate Real Estate Estate Homes

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

The Best And Worst Cities In Canada For Property Taxes Huffpost Canada Business

Statistics Canada Property Taxes

Statistics Canada Property Taxes

5 Things Every First Time Investor Must Know Before Buying Real Estate Real Estate Buying Investors Rental Property Investment

5 Things Every First Time Investor Must Know Before Buying Real Estate Real Estate Buying Investors Rental Property Investment

Wall Map Of Brossard Quebec Wall Maps Trip Planning Map

Wall Map Of Brossard Quebec Wall Maps Trip Planning Map

Best 5 Neighbourhoods To Rent In Montreal The Neighbourhood Montreal Best

Best 5 Neighbourhoods To Rent In Montreal The Neighbourhood Montreal Best

Statistics Canada Property Taxes

Statistics Canada Property Taxes

32 Rue Des Saules Vaudreuil Dorion Quebec Canada Luxury Home For Sale Luxury Homes Spa Pool Luxury

32 Rue Des Saules Vaudreuil Dorion Quebec Canada Luxury Home For Sale Luxury Homes Spa Pool Luxury

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Check Out The Top 5 Best Places To Live In Canada Best Places To Live Median Household Income Canada

Who Pays The Least Property Tax In Canada Smart Reno

Who Pays The Least Property Tax In Canada Smart Reno

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home