How To Find Personal Property Tax Records In Missouri

Collector - Personal Property Tax and Real Estate Tax Department. Pay your taxes online.

Find Missouri residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records.

How to find personal property tax records in missouri. Use our tax search for property account number owner name and property address. Therefore you will need to contact your local county collector andor assessor regarding changes of address payment and billing tax receipts and all other questions regarding your account. A complete listing of collectors.

Tax Search Payments. The Uniform Commercial Code for the State of Missouri was substantially revised with the passage of Revised Article 9. 2020 Tax Sale Property Map.

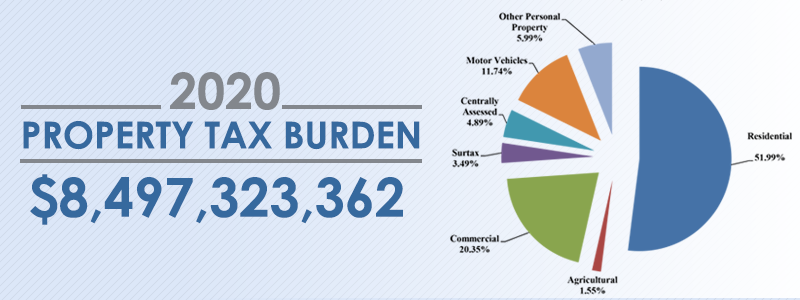

Missouri real and personal property tax records are managed by the County Assessor or County Collector in each county. Property values are assessed and paid locally. Your feedback was not sent.

Assessing Personal Property Tax Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. Personal property tax is collected by the Collector of Revenue each year on tangible property eg. Charles County Department of Public Health page or call the Information Hotline at 636-949-1899.

Leave this field blank. Free Missouri Property Tax Records Search. Motorized vehicles boats recreational vehicles owned on January 1st of that year.

The United States postal service postmark determines the timeliness of payment. Free Missouri Property Records Search. Search Personal Property Tax Info.

Visit the Municipal Court of Jackson County Missouri online ticket inquiry and payment website. You do not need to use every search option. License your vehicle in Cass County.

ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor. A few County Assessor and County Collector offices provide an online searchable database where searches can be performed by owner name parcel number. Available information includes property classification number and type of.

Our property records tool can return a variety of information about your property that affect your property tax. Contact the Collector - Personal Property Tax and Real Estate Tax Department. Enter your search criteria into at least one of the following fields.

The Assessors Personal Property service windows on the first floor are open to the public. How do I find out about my personal property taxes. View a comprehensive list of online services.

Personal property is assessed valued each year by the Assessors Office. The Personal Property Department collects taxes on all motorized vehicles. You can only search for one type of account personal or real estate by one type of criteria name tax id address.

Get information about personal property taxes. Land and land improvements are considered real property while mobile property is classified as personal property. The best way to search is to enter your Parcel Number for Real Estate Account Number for Personal Property or Last Name as it appears on your Tax Bill.

Monday Through Friday 8 AM - 5 PM. Contact your County Assessors Office. Please fill out ONLY ONE of the fields under Personal Property OR Real Estate.

Find Missouri residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. For contact information see the Missouri State Tax Commission website. For more information about COVID-19 visit the St.

Vehicle Licensing in Cass County. There will be a nominal convenience fee charged for these services. After entering in search information press ENTER or click the appropriate criteria button has a magnifying glass symbol.

Your assessment list is due by March 1st of that year. Find your personal property tax information. Use our free Missouri property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Online No Tax Due System Information

Online No Tax Due System Information

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

It Services Support For St Charles County Mo Managed Computer Services Small Business Tax Business Tax Audit

It Services Support For St Charles County Mo Managed Computer Services Small Business Tax Business Tax Audit

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Online No Tax Due System Information

Online No Tax Due System Information

Small Business Financial Statement Template Lovely 8 Sample Profit And Loss Statement Small Personal Financial Statement Statement Template Financial Statement

Small Business Financial Statement Template Lovely 8 Sample Profit And Loss Statement Small Personal Financial Statement Statement Template Financial Statement

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home