Lake County Property Tax Montana

Once we have processed your purchase information and your name appears in our records as the owner you may file online for your 2022 tax-year homestead exemption. Median Property Taxes Mortgage 1786.

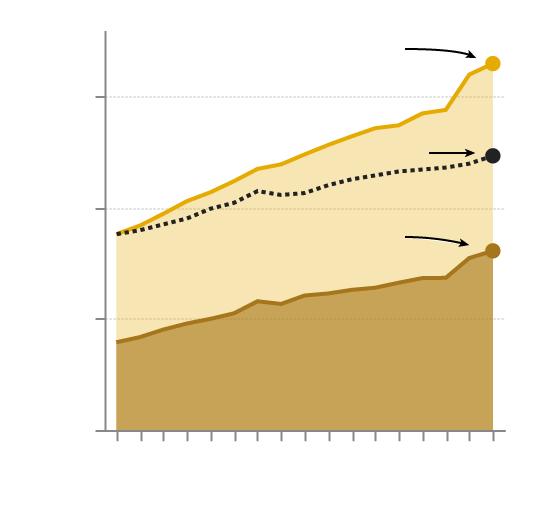

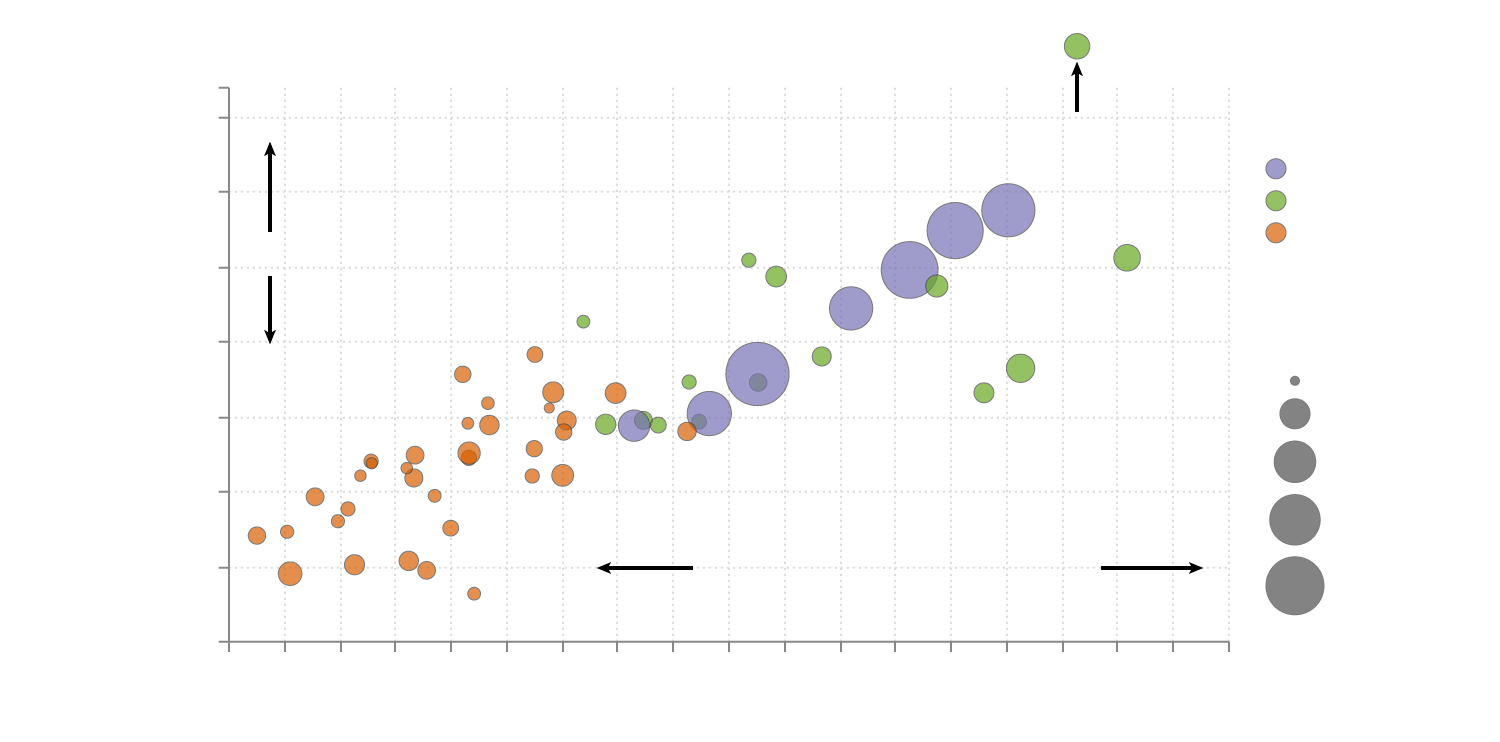

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Lake County collects on average 075 of a propertys assessed fair market value as property tax.

Lake county property tax montana. Property information can also be found at cadastralmtgov. School districts get the biggest portion about 69 percent. To access your property information enter a property number assessment code name or address in the search box above.

Payments made online must be. PO Box 490Painesville OH 44077. You may view print and pay your tax bill online.

Polson tax assessor office in Polson Montana maintains the assessment of real properties in its area of jurisdiction. Real Estate Tax Calendar. Maps Records Transparency.

We apologize for any inconvenience. Montana Department of Revenue. Lake County Property Tax Payments Annual Lake County Montana.

Lake County Jobs. IF YOU PURCHASED A HOME IN 2021 CONGRATULATIONS AND WELCOME TO LAKE COUNTY. Documents are recorded as quickly as possible.

The median property tax in Lake County Montana is 151500 All of the Lake County information on this page has been verified and checked for accuracy. Lake County Property Records are real estate documents that contain information related to real property in Lake County Montana. Median Property Taxes No Mortgage 1748.

Section maps in the plat books are updated each time a property boundary changes and are maintained in. A geocode in the Montana Department of Revenues Orion appraisal system is a 17 digit property identifier that is the primary database key between the map and Orion database. The median property tax also known as real estate tax in Lake County is 151500 per year based on a median home value of 20190000 and a median effective property tax rate of 075 of property value.

There is a 3 convenience fee to pay by creditdebit cards. The Plat Department maintains surveys recorded in Lake County as well as the history of property transfers in plat books filed by section township and range or by subdivision name. Complete applications may still be eligible for the 2021 tax-year.

Polson the county seat is the states 18th largest city with a population of 4488 according to the 2010 Census. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. It is also important in case you put your.

The Lake County GIS department provides map products to other county departments and the public to provide information and aid in decision making. Treasurers Office Calendar of Events. Located in northwestern Montana Lake County is Montanas ninth most populated with 29099 residents according to the 2014 estimates produced by the US.

Tax Assessor Office Address. Lake County Treasurer is now accepting credit cards for the payment of property taxes and vehicle licensing. Polson the county seat is the states 18th largest city with a population of 4488 according to the 2010 Census.

After entering a search term select a county to improve search speed. If any of the links or phone numbers provided no longer work please let us know and we will update this page. Lake County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. Propertymtgov is down for maintenance. Yearly median tax in Lake County The median property tax in Lake County Montana is 1515 per year for a home worth the median value of 201900.

Located in northwestern Montana Lake County is Montanas ninth most populated with 29099 residents according to the 2014 estimates produced by the US. Tax assessment helps determine how much you need to pay for your property taxes. Census Bureau median income for Lake County households in 2012 were 38268.

The Clerk and Recorders department records or files all public documents pertaining to property in Lake County as well as various miscellaneous documents. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. In most cases it is unique to a tax parcel polygon although exceptions can be found.

While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. Census Bureau median income for Lake County households in 2012 were 38268. This office is responsible for addressing in areas outside of city boundaries maintaining parcel boundaries for use by.

Seeley Lake Montana Mt 59868 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Https Leg Mt Gov Content Committees Interim 2019 2020 Revenue Meetings September 2019 Hj 35 Mon Tax Montana 20taxes 20comparisons Pdf

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Seeley Lake Montana Mt 59868 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Montana Property Tax Calculator Smartasset

Montana Property Tax Calculator Smartasset

Http Www Lakemt Gov Main Pdf Operations 20manual 20revised 20110117 Pdf

Medicine Lake Montana Mt 59247 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Https Leg Mt Gov Content Publications Fiscal 2021 Interim Jan 2020 Prop Tax Report Pdf

Seeley Lake Montana Mt 59868 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home