How Are Kentucky Property Taxes Calculated

It is based ONLY upon the taxes regarding inventory. The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020.

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

For comparison the median home value in Kenton County is 14520000.

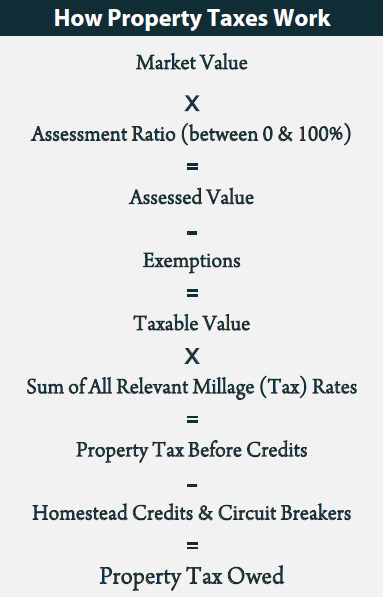

How are kentucky property taxes calculated. 121 rows Kentucky Property Tax Rules. Explanation of the Property Tax Process. You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Our Jefferson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Property taxes paid after December 31st will be subject to a 10 penalty.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate system during a tax reform in early 2018.

Please note that we can only estimate your property tax based on median property taxes in your area. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. Property tax bills are mailed in October of each year.

This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Property taxes in Kentucky follow a one-year cycle beginning on Jan. We multiplied the average sales tax rate for a city by the household income after subtracting income tax.

You also have to pay local income taxes which Kentucky calls occupational taxes. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year.

Various sections will be devoted to major topics such as. Tax bills are due by December 31st. Local Property Tax Rates.

Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Therefore the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit. 216 rows To calculate taxes owed taxpayers in Kentucky must make certain additions and.

Our property records tool can return a variety of information about your property that affect your property tax. A propertys assessed value is the basis for calculating property tax. The tax is collected by the county clerk or other officer.

Use our free Kentucky property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Real estate in Kentucky is typically assessed through a.

We calculated the effective property tax rate by dividing median property tax paid by median home value for each city. A 2 discount is available if the bill is paid by November 30th. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. A propertys assessed value is the basis for calculating property tax. For comparison the median home value in Kentucky is 11780000.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Section 172 of the Kentucky Constitution requires that assessed value to represent 100 of a propertys fair cash value as of January 1 of each year.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Available information includes property classification number and type of rooms year built recent sales lot size square footage and property tax. Regardless of their filing status Kentuckians are taxed at a flat rate of 5.

The assessment of property. Payment shall be made to the motor vehicle owners County Clerk. In order to determine sales tax burden we estimated that 35 of take-home after-tax pay is spent on taxable goods.

1 of each year. Each county determines the property tax districts that will be in effect. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

In addition the city will also add 12 interest compounded monthly to unpaid taxes. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. All counties have a general county rate set by the fiscal court and a school district.

For example the sale of a 200000 home would require a 200 transfer tax to be paid.

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Investing

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Investing

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

States With The Highest Taxes Google Search Property Tax Tax States

States With The Highest Taxes Google Search Property Tax Tax States

1311 Kentucky Avenue Real Estate Property Outdoor Structures

1311 Kentucky Avenue Real Estate Property Outdoor Structures

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housing L Usda Loan Mortgage Loans Usda

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housing L Usda Loan Mortgage Loans Usda

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Real Estate Investing

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Down Payment Assistance Kentucky 2021 Kentucky Housing Corporation Khc In 2021 Kentucky First Time Home Buyers Down Payment

Down Payment Assistance Kentucky 2021 Kentucky Housing Corporation Khc In 2021 Kentucky First Time Home Buyers Down Payment

Louisville Kentucky First Time Home Buyer Programs And Resources Real Estate Infographic Real Estate Tips Mortgage Loans

Louisville Kentucky First Time Home Buyer Programs And Resources Real Estate Infographic Real Estate Tips Mortgage Loans

100 Financing Home Loan Ky Credit Reports Credit Scores Debt Ratios Down Payment Assistance Fannie Mae Homep Debt Ratio First Time Home Buyers Home Loans

100 Financing Home Loan Ky Credit Reports Credit Scores Debt Ratios Down Payment Assistance Fannie Mae Homep Debt Ratio First Time Home Buyers Home Loans

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Property Tax Department Of Revenue

Property Tax Department Of Revenue

Pin On Team Smallwood Re Max Mena Real Estate Properties For Sale

Pin On Team Smallwood Re Max Mena Real Estate Properties For Sale

![]() Property Tax Department Of Revenue

Property Tax Department Of Revenue

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

The 7 Best Places To Travel In May Charleston Hotels Boutique Hotel Charleston Best Places To Travel

The 7 Best Places To Travel In May Charleston Hotels Boutique Hotel Charleston Best Places To Travel

Kentucky Property Taxes By County 2021

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home