Property Parcel Number Lookup Florida

Information should be independently confirmed and you use the information displayed here at your own risk. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill.

Parcel Search Orange County Property Appraiser

Parcel Search Orange County Property Appraiser

Important Message We will be performing scheduled maintenance on Saturday October 12 from 12 am.

Property parcel number lookup florida. The Volusia County Property Appraisers office will not be held liable as to the validity. The information that is supplied by the Volusia County Property Appraisers office is public information data and must be accepted and used with the understanding that the data was collected primarily for the use and purpose of creating a property tax roll per Florida Statutes. Help with STRAP Number Folio ID searches.

A Certificate of Title is a document stating title or ownership of a property is being confirmed by court order. See Florida Statute 119011. Some counties also offer separate searches for real or personal property tax records.

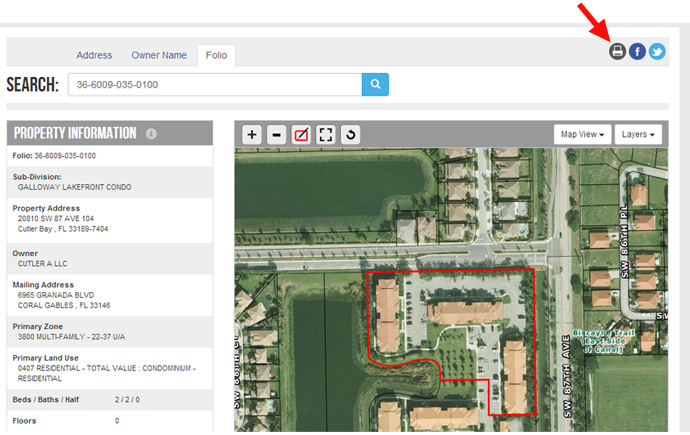

Parcel Search - Orange County Property Appraiser 942 Maypole Dr The Orange County Property Appraiser parcel with id 21-21-28-3631-01-000 is located at 942 Maypole Dr Apopka Fl 32703It is owned by. Parcel STRAP Number or Folio ID. You must enter at least the first six digits of the Parcel ID.

SMITH JOHN Address Source Site Info Owner Info. Start by selecting a County below. Editors frequently monitor and verify these resources on a routine basis.

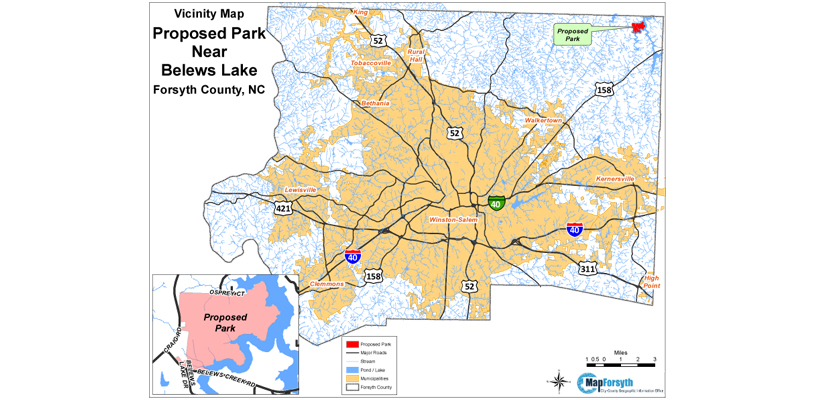

Most county Property Appraisers provide an online searchable database whereby searches can be performed by parcel number subdivision name neighborhood property type address owners name sale information or by using an interactive map. It is also referred to as the parcel identifier and represents a unique number that computer systems use to associate to a property. Search for a Parcel For more information call the.

FAPA members are committed to upholding the highest professional standards in the real estate. Values displayed reflect those from the last certified Tax Roll October 2020 and current In Progress values which are subject to. Section 01-36 Township 20-24 Range 27-34 Sub 0000-9999 or Blank Block 00-99 or Blank Lot 000-999 or Blank.

Tangible BusinessMobile Home Accounts. Search Using Property Information. Instead contact this office by phone or in writing.

11202020 West Palm Beach FL Palm Beach County Property Appraiser Dorothy Jacks CFA AAS was elected to serve as president of the Florida Association of Property Appraisers FAPA Tuesday night. Florida Property Records Search Links. Real estate information from public records including values and ownership are made easy to find and view.

Help others by sharing new links and reporting broken links. Home Page Property Search. This data is being generated as a convenience and a service to those individuals who have an interest in this information and is not a certification of a complete and current parcel status.

I am honored to be chosen to lead this professional organization said Jacks. The folio number is formatted as a 13 digit number 99-9999-999-9999. Torres-Molina Emilio Guadalupe Luciano Nancy.

3 Oversee property tax administration involving 109. Under Florida law e-mail addresses are public records. If you do NOT want your e-mail address released in response to a public records request do not send electronic mail to this entity.

Real Estate Property Records Find Parcel By ID Find Parcel By Owner Name Find Parcel By Site Address Simple Query Search. The database consists of all real estate parcels in Duval County including Jacksonville Jacksonville Beach Atlantic Beach Neptune Beach and the City of Baldwin. The Real Estate Parcel Information Parcel Description data displayed is updated daily.

Help with Address searches. Using the search options available when you select the button below for the Property Information Lookup you will be able to search by the Owner Address Account Number or PCNParcel Number to find valuable information on any property located in Martin County. This notice posted pursuant to s.

The Florida Property Records Search links below open in a new window and take you to third party websites that provide access to FL public records. Parcel Number Search The information that is supplied by the Alachua County Property Appraisers office is public information data and must be accepted and used with the understanding that the data was collected primarily for the use and purpose of creating a Property Tax Roll per Florida Statute. Home Page Property Search Map Search Downloads Links Employment FAQ Phone Numbers.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. The property information displayed here is obtained from public records. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. To 8 am on our Online Tools which may affect usability. Enter Parcel ID in Section-Township-Range or Range-Township-Section format.

The folio number is a means by which properties are identified in Miami-Dade County. Name Company Last name first. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Read more »