What Are Property Taxes In Hillsborough County

Payment Fees. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County.

Hillsborough Commission Keeps Property Tax Rate Flat But 2020 Budget Grows To 6 62 Billion

Hillsborough Commission Keeps Property Tax Rate Flat But 2020 Budget Grows To 6 62 Billion

According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax due and to pay the taxes before April 1.

What are property taxes in hillsborough county. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. Welcome to the Hillsborough County Property Appraisers TPP E-File System. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County.

Taxes are normally payable beginning November 1 of that year. The median property tax on a 19890000 house is 192933 in Florida. The township is situated 52 miles from Manhattan and 55 miles from downtown Philadelphia.

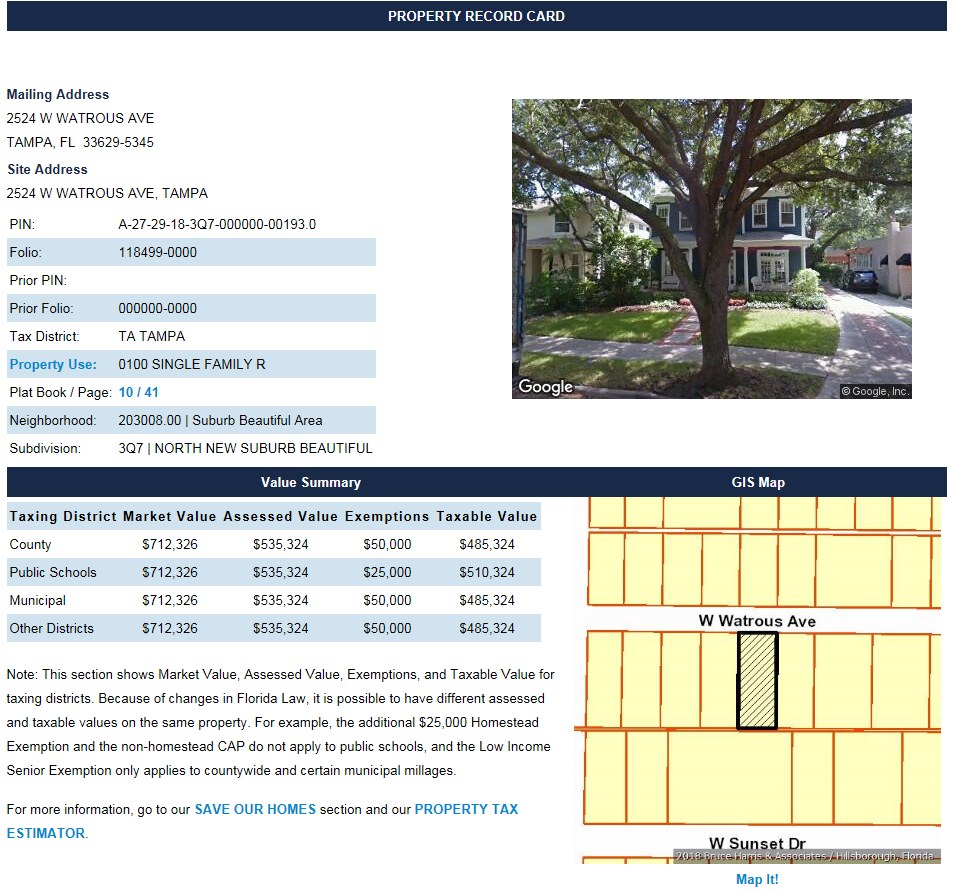

Welcome to the Hillsborough County Tax Collectors website. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Search for a Parcel.

Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. The only exceptions to this policy are for parcels that are in a bankruptcy or tax deed foreclosure status. Welcome to the Hillsborough County Tax Collectors online office where we strive to provide Hillsborough County citizens with the best customer service possible.

Title Tag Registration. This assessment fee is included as part of your annual property tax bill which is mailed to you on November 1 each year. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty.

If you are responsible for remitting property tax payments for 10 or more accounts to the Hillsborough County Tax Collectors office it is required that you do so using Escrow Express. Services Hours General Office Hours 800 am. The median property tax on a 19890000 house is 216801 in Hillsborough County.

Box 7 27 School Street Hillsborough NH 03244 Ph. Hillsborough Township is part of Somerset County located in the center of New Jersey. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website.

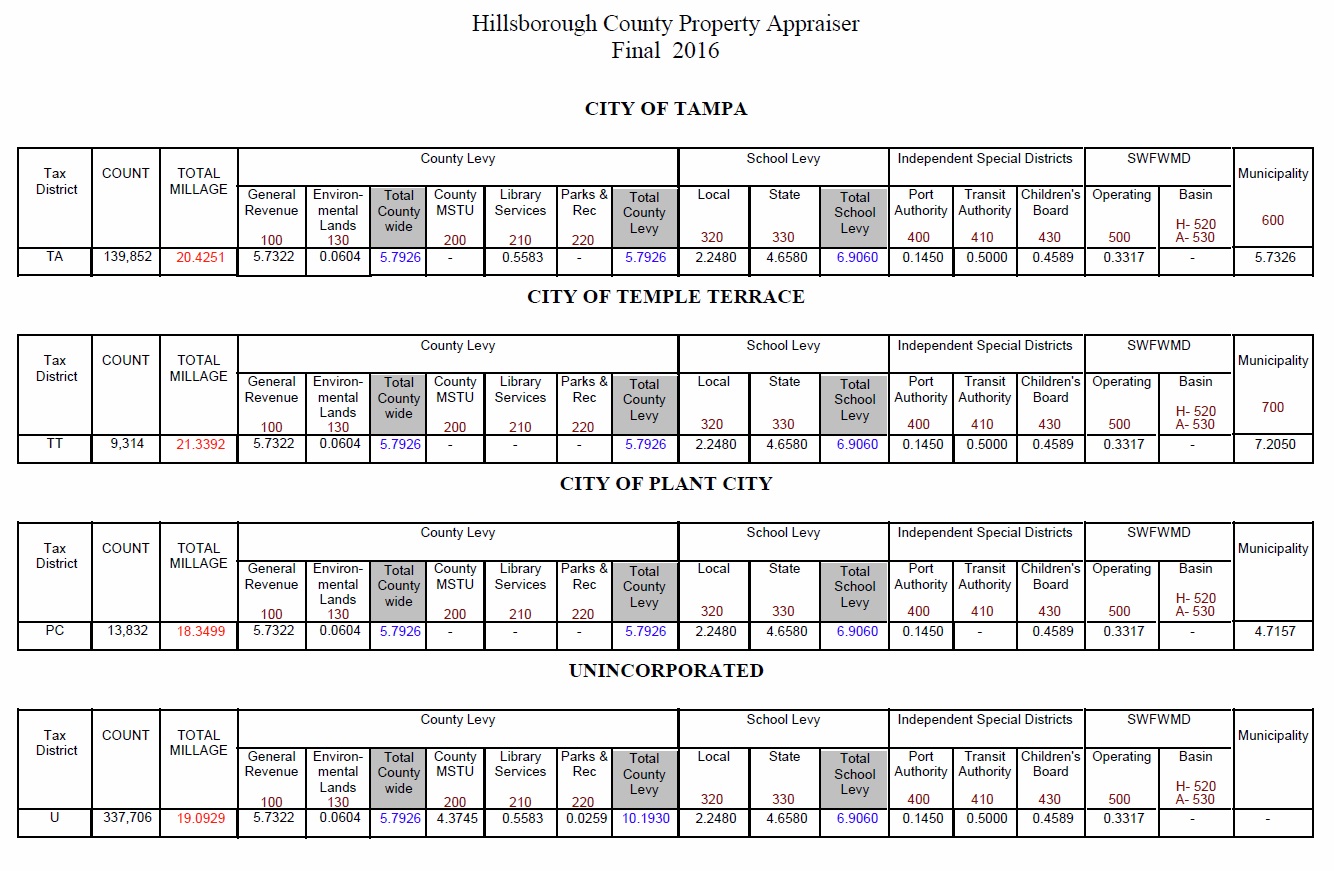

Search all services we offer. Hillsborough County Tax Collector Nancy C. 11 rows In-depth Hillsborough County FL Property Tax Information.

The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Hillsborough County Tax Collector Nancy C. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities.

The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. Hillsboroughs central location between the nations largest and fifth largest metropolises has allowed the town to grow steadily into the large diverse municipality it is today. If your property is billed for an accessory dwelling we also offer an exemption for additional collectiondisposal charges to qualified applicants.

Tangible Property Tax Payment. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. For more information call the Property Appraiser at. Town of Hillsborough NH PO.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Hillsborough County Tax Appraisers office. You can complete the Tangible Personal Property Tax Return if you own property used in a business or rental property other than real estate. In order to determine the tax.

Examples of tangible personal property are computers furniture fixtures tools equipment machinery signs leasehold.

Read more »Labels: county, hillsborough, what