Property Tax Estimator Hillsborough County

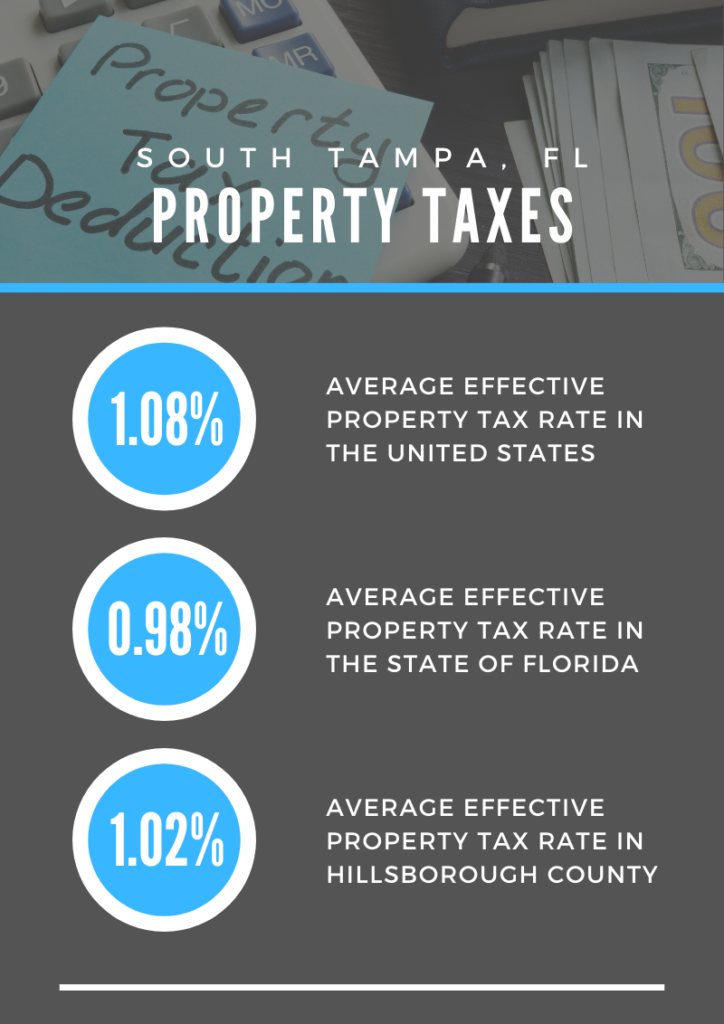

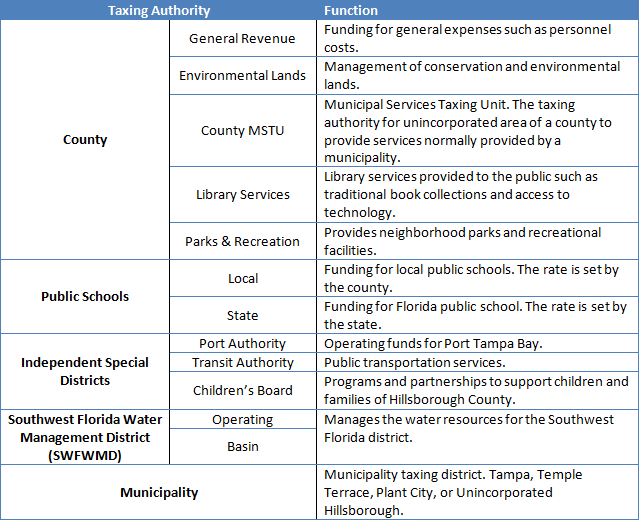

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. The median real estate tax payment is 2805 also one of the highest.

The median property tax on a 19890000 house is 216801 in Hillsborough County.

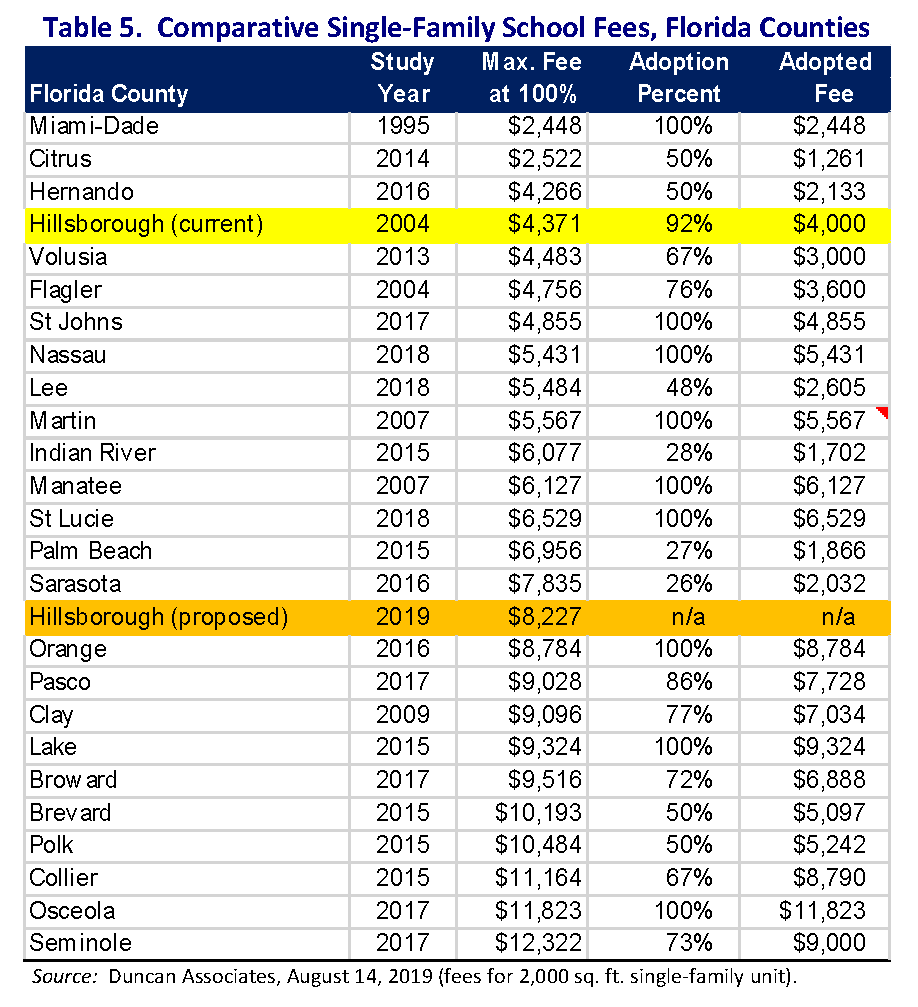

Property tax estimator hillsborough county. Tangible Personal Property Exemption To qualify and obtain the 25000 Tangible Personal Property TPP exemption business owners should complete the annual TPP Return and send it to the Property Appraisers Office by April 1st 2008. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax. Yearly median tax in Hillsborough County.

Commerce Avenue Sebring FL 33870 Phone. 109 of home value. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email.

Hillsborough County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. Hillsborough County has one of the highest median property taxes in the United States and is.

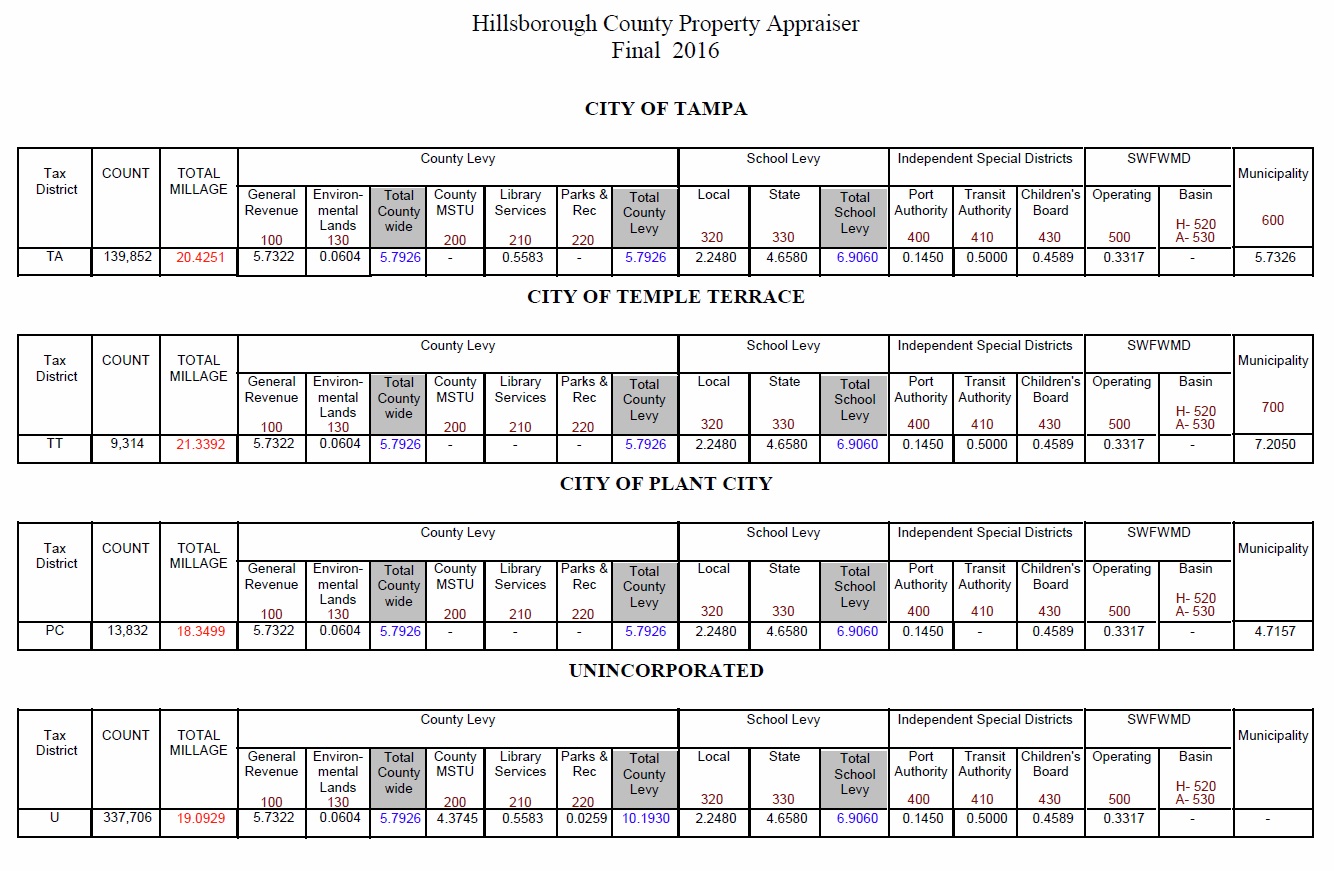

MarketJust Value 600000 Less Portability Benefit -150000 Assessed Value 450000 Less Homestead Exemption -50000. Property Tax Look-up Overview September 26 2017 County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. The final millage rates are used to calculate the estimated property tax on the proposed property purchase.

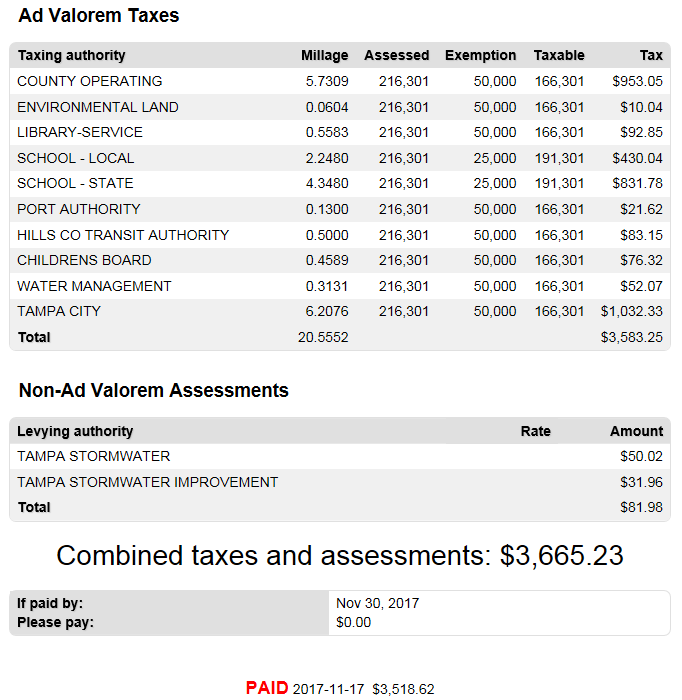

The estimated tax range reflects an estimate of taxes based on the information provided by the input values. Groceries are exempt from the Hillsborough County and Florida state sales taxes. The Tax Estimator only provides an estimate of taxes for the property.

This estimate does not include any non-ad valorem taxes that may be applicable to this property such as assessments for roads. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. Palm Beach Countys average effective property tax rate is 106 which is higher than most Florida counties.

The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. The Property Appraiser establishes the taxable value of real estate property.

Taxes on each parcel of real property have to be paid in full and at one time except for the installment method and homestead tax deferrals The Citrus County Tax Collector also accepts partial payments with a signed affidavit contact our office at 352 341-6500 option 2 or visit our nearest office for a copy of the affidavit per Florida. Exemption in order to. This tax estimator assumes the referenced property is homesteaded.

The median property tax on a 19890000 house is 192933 in Florida. The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Taxable Value 400000 Downsize All values as determined by the Property Appraiser.

The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County. The average savings for most homesteads in Hillsborough County is 250 300 depending on the millage rate which wont be set until September. Hillsborough County contains the city of Tampa and has a population of nearly 14 million people.

Sebring Main Office 540 S. Search all services we offer. Hillsborough County Tax Collector Nancy C.

This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. We use state and national averages when estimating your property insurance. Understand Hillsborough County Florida Closing Costs and Fees.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Hillsborough. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. Like taxes though homeowners insurance costs can greatly vary from place to place.

Please note that we can only estimate your property tax based on median property taxes in your area. Hillsborough County Tax Collector Nancy C. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March.

Please feel free to enter specific property tax for more accurate estimate. Taxes are normally payable beginning November 1 of that year. The median property tax on a 19890000 house is 208845 in the United States.

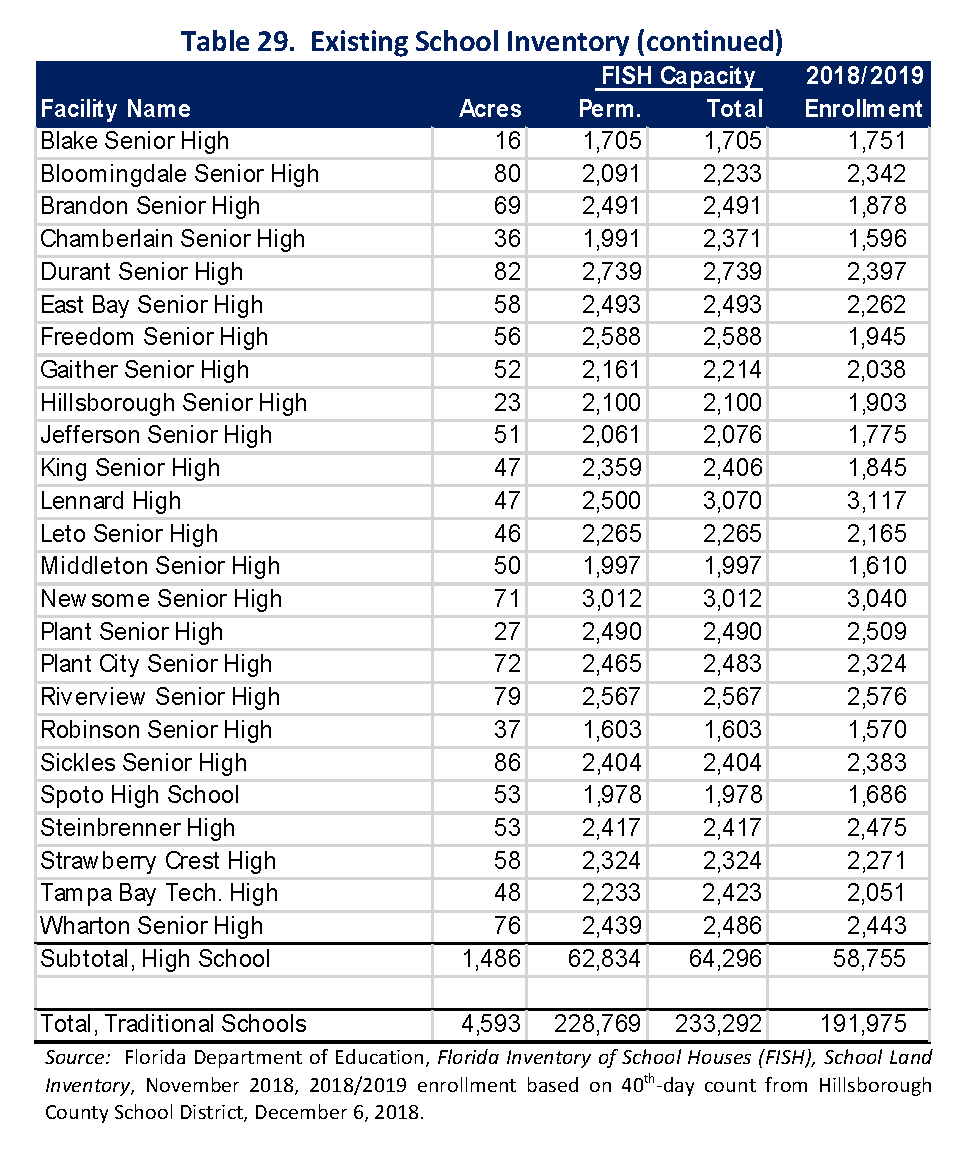

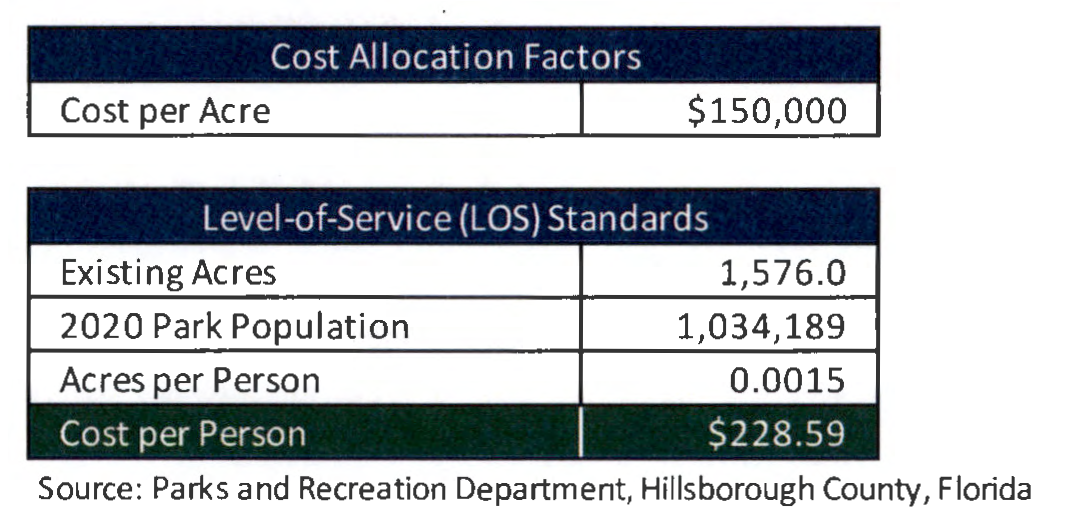

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

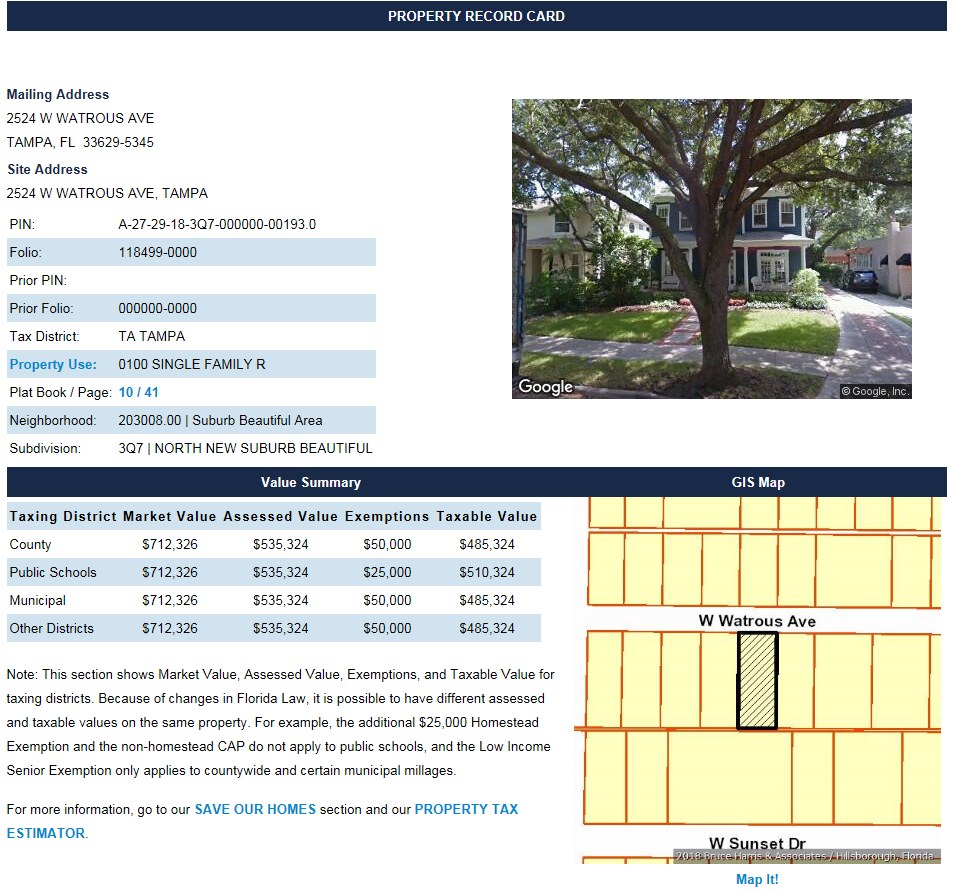

Property Taxes In South Tampa Fl Your South Tampa Home

Property Taxes In South Tampa Fl Your South Tampa Home

Hillsborough County Property Appraiser Property Info Greenbelt Agriculture

Hillsborough County Property Appraiser Property Info Greenbelt Agriculture

Hillsborough County Property Appraiser Property Info Truth In Millage

Hillsborough County Property Appraiser Property Info Truth In Millage

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Chapter 40 Planning And Development Code Of Ordinances Part A Hillsborough County Fl Municode Library

Hillsborough County Property Appraiser Our Office Budget Tax Roll Stats

Hillsborough County Property Appraiser Our Office Budget Tax Roll Stats

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Hillsborough County Property Appraiser Our Office Important Dates

Hillsborough County Property Appraiser Our Office Important Dates

Hillsborough County Property Appraiser Property Info Truth In Millage

Hillsborough County Property Appraiser Property Info Truth In Millage

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Hillsborough County Property Appraiser Downloads Maps Data

Hillsborough County Property Appraiser Downloads Maps Data

Labels: county, estimator, hillsborough

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home