What Is Third Party Property Insurance Definition

In this relationship youre the first party and the insurer is the second party. A liability claim is the most common form of a third-party insurance claim.

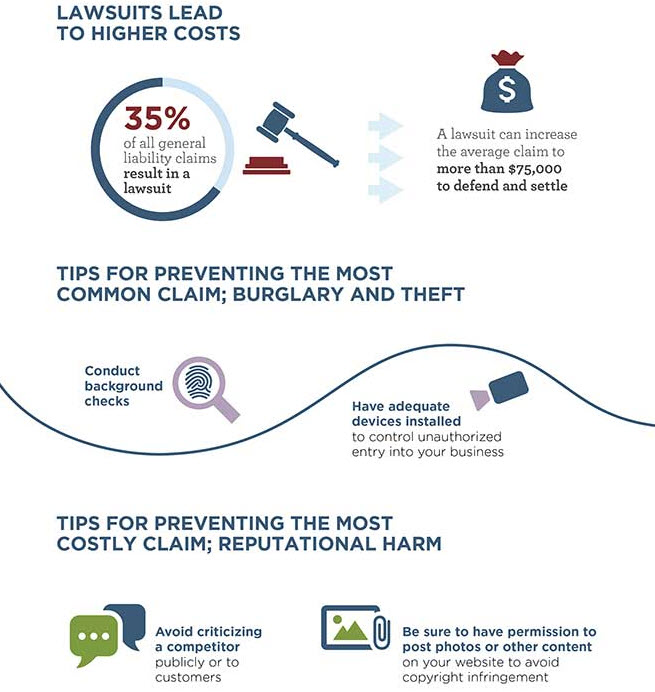

How Much Does General Liability Insurance Cost The Hartford

How Much Does General Liability Insurance Cost The Hartford

Motor third-party insurance or third-party liability cover which is sometimes also referred to as the act only cover is a statutory requirement under the Motor Vehicles Act.

What is third party property insurance definition. CTP insurance stands for compulsory third party insurance. In this case the insurer may be regarded as the second party. The first party is the insured individual.

The third party is another individual. This insurance provides compensation for people injured or killed when your vehicle is involved in an accident. Most insurance contracts only involved the insured the first party the insurance company and the second party.

Whereas Compulsory Third Party CTP also known as Green Slip insurance in New South Wales is compulsory in order to register any vehicle in NSW and the ACT. The main thing you get with Third Party Property Damage Insurance is liability cover. Third-party insurance is essentially a form of liability insurance purchased by an insured first-party from an insurer second party for protection against the claims of another third party.

You cannot register your vehicle without having a policy in place. A third-party administrator is a company that provides operational services such as claims processing and employee benefits management under contract to another company. A third party car insurance policy ensures that if you cause an accident any damage to the other persons vehicle or property will be paid for by your insurer.

Third party insurance meaning. Third-party insurance comes bundled into standard homeowners renters and many business policies and is. The second party is the insurance company.

A third party insurance claim is a claim made by someone other than the policyholder or the insurance provider. The third party is someone who doesnt have any involvement with creating this contract but could be affected by it. Third-party liability coverage is the portion of an insurance policy that protects you if youre sued or threatened to be sued for a physical injury or damage to someone elses property.

Third Party Property Damage Insurance is optional and provides cover if you need to pay for damage your vehicle causes to another persons vehicle or property. Its a basic level of cover all our car insurance policies come with liability cover up to 20 million. It covers only this and nothing else up to a certain limit commonly 20 million.

However damage to your vehicle will not be covered and you will need to pay the bill yourself to get things fixed. Third party property is a type of car insurance policy that covers you for damage to other peoples property for example someone elses car home or shop. THIRD PARTY PROPERTY DAMAGE EXTRA EXPENSE INSURANCE Extra Expense reimburses the production company for any extra expense necessary to complete principal photography of the insured production due to loss of damage to or destruction of property or facilities props sets wardrobe or equipment used in connection with the production.

It covers you for damage. What is third-party insurance. Repair or replacement costs for.

When you take out an insurance policy youre forming a legal relationship with your insurance provider. CTP insurance is compulsory in all states of Australia. Definition of Third Party Insurance.

Whats Third Party Property Damage Insurance for. Basically third-party insurance is liability coverage thats purchased by a consumer first party from an insurance company second party to protect against claims from other people third party for injuries or damage the first party causes. Third party insurance is an insurance policy that covers property damage caused by someone who isnt the insured.

Therefore a third-party insurance claim is made by someone who is not the policyholder or the insurance company. It is referred to as a third-party cover since the beneficiary of the policy is someone other than the two parties involved in the contract the car owner and the insurance company.

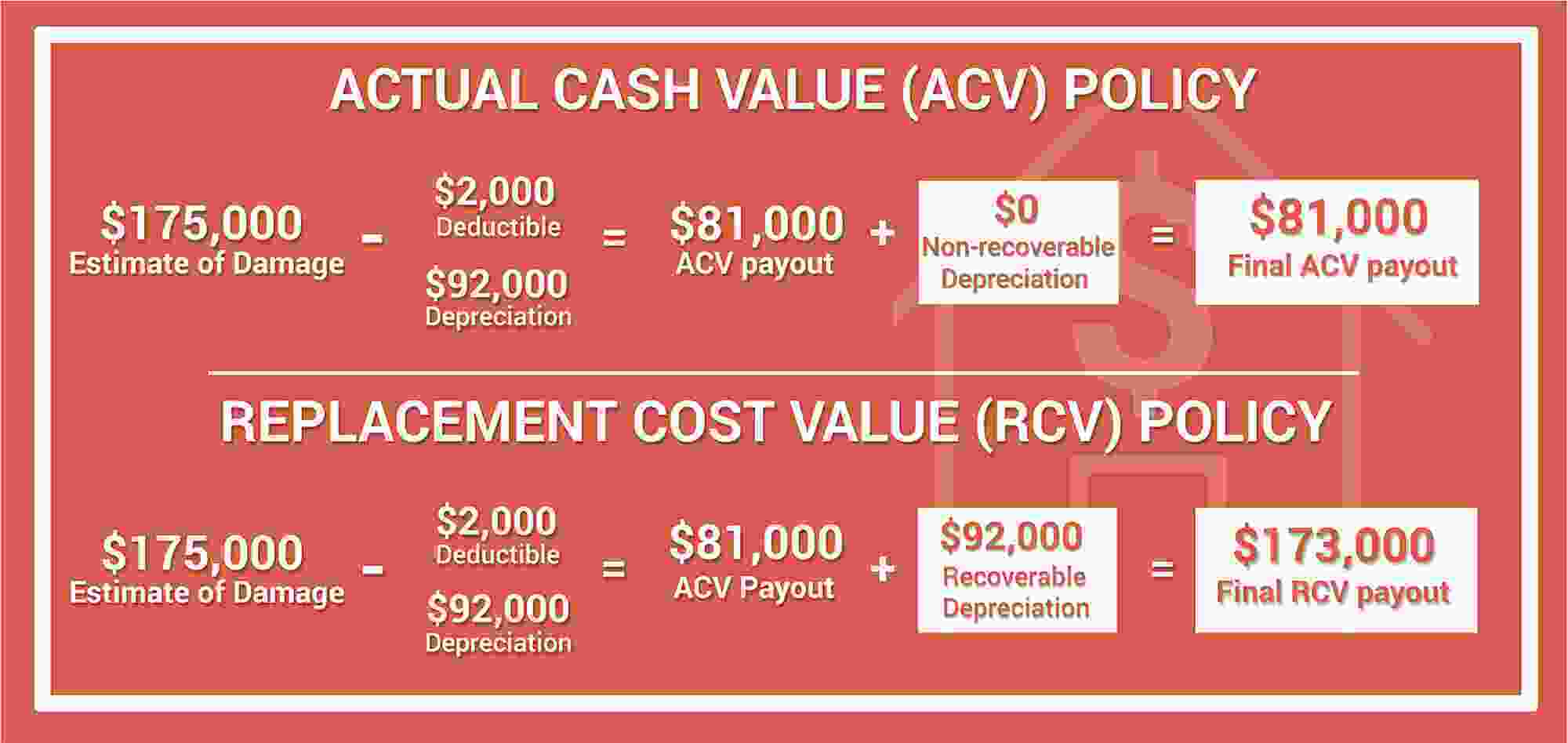

Acv Vs Rcv Office Of Public Insurance Counsel Opic

Acv Vs Rcv Office Of Public Insurance Counsel Opic

Nationwide Renters Insurance Review The Simple Dollar Homeowners Insurance Renters Insurance Renters Insurance Quotes

Nationwide Renters Insurance Review The Simple Dollar Homeowners Insurance Renters Insurance Renters Insurance Quotes

/homedisaster_AP110828045473-5425d4abb8604e1699a29b76123baf65.jpg) Homeowners Insurance Definition

Homeowners Insurance Definition

Buy Home Insurance House Insurance Policy Which Will Protect Not Only Your Home But Also The Belongings Content Home Insurance Homeowner Insurance Policy

Buy Home Insurance House Insurance Policy Which Will Protect Not Only Your Home But Also The Belongings Content Home Insurance Homeowner Insurance Policy

Great No Cost What Is The Importance Of General Insurance Cover Popular The Best Wellness Insuran Traveling By Yourself Health Insurance Companies Insurance

Great No Cost What Is The Importance Of General Insurance Cover Popular The Best Wellness Insuran Traveling By Yourself Health Insurance Companies Insurance

Trade Credit Risk Provides Insurance That Covers Every Aspect Of General And Professional Risk Our Relatio Liability Insurance Professional Liability Liability

Trade Credit Risk Provides Insurance That Covers Every Aspect Of General And Professional Risk Our Relatio Liability Insurance Professional Liability Liability

What Does Customer Experience Mean To Karlocompare What Does Customer Experience Means To Karlocom Customer Experience How To Memorize Things Helping People

What Does Customer Experience Mean To Karlocompare What Does Customer Experience Means To Karlocom Customer Experience How To Memorize Things Helping People

Anatomy Of A Title Commitment Proplogix Title Insurance Estate Law Title

Anatomy Of A Title Commitment Proplogix Title Insurance Estate Law Title

Mortgage Insurance Real Estate Terms Private Mortgage Insurance Title Insurance

Mortgage Insurance Real Estate Terms Private Mortgage Insurance Title Insurance

How Much Does General Liability Insurance Cost The Hartford

How Much Does General Liability Insurance Cost The Hartford

Title Insurance Policy Process Hillsboro Title Company Title Insurance Insurance Policy Title

Title Insurance Policy Process Hillsboro Title Company Title Insurance Insurance Policy Title

General Liability Insurance For Small Business Coverwallet

General Liability Insurance For Small Business Coverwallet

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Replacement Cost Value Rcv Vs Actual Cash Value Acv

Replacement Cost Value Rcv Vs Actual Cash Value Acv

What Is Owner S Title Insurance And Why Is It Important Erika Lewis Blog Title Insurance Commercial Insurance Insurance Marketing

What Is Owner S Title Insurance And Why Is It Important Erika Lewis Blog Title Insurance Commercial Insurance Insurance Marketing

7 Startup Lessons To Learn From Ridesharing Companies Start Up Lesson Best Seo Tools

7 Startup Lessons To Learn From Ridesharing Companies Start Up Lesson Best Seo Tools

117 Reference Of Auto Insurance Property Damage Definition Car Insurance Insurance Comprehensive Car Insurance

117 Reference Of Auto Insurance Property Damage Definition Car Insurance Insurance Comprehensive Car Insurance

General Liability Insurance For Small Business Coverwallet

General Liability Insurance For Small Business Coverwallet

Labels: definition, property, what

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home