Property Tax Estimator Williamson County

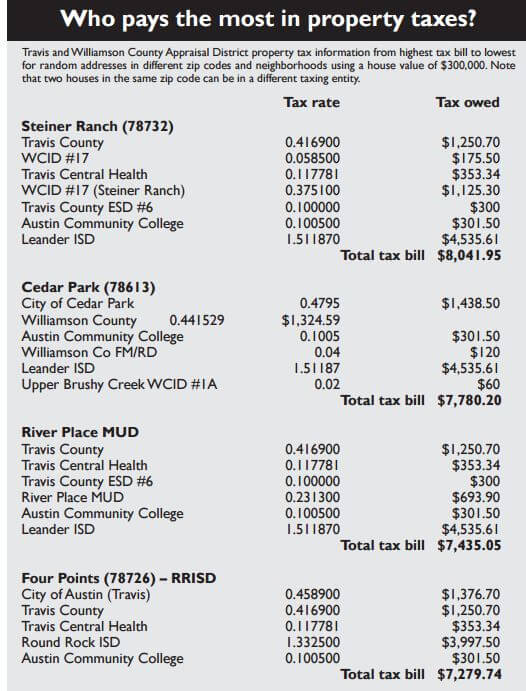

Property Tax Payment Dates Make checks payable to. The TAX RATE for each county and municipality is set by the mayor and the legislative body of the counties and municipalities based on the amount budgeted to fund services.

The maps have been prepared according to Section 93002 Tax Maps Texas Property Tax Laws.

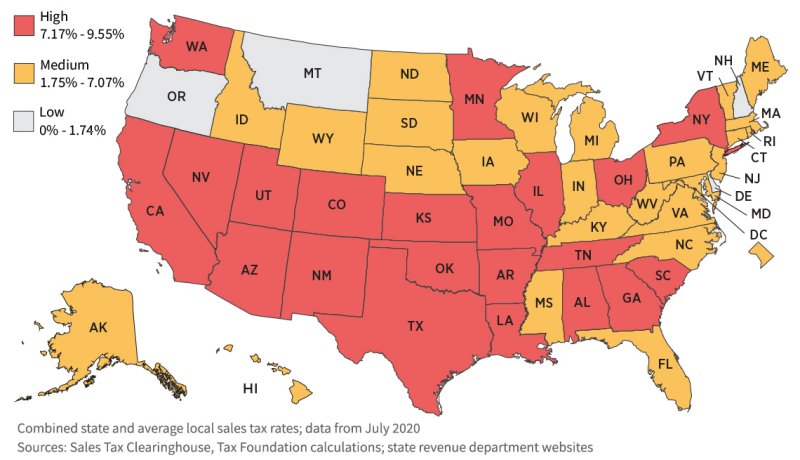

Property tax estimator williamson county. Williamson County TN - Official Site. Property Tax Estimator Notice The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Our Williamson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States.

You can use this equation to estimate property taxes. 11 rows Property Tax Rates Tax Rates Tax rates for Williamson County and each city or town. How do I figure my taxes.

The median property tax on a 33580000 house is 352590 in the United States. The Williamson County property tax rates for each tax jurisdiction for 2020 2019 2018 2017 and 2016 are presented here in a categorical list click here for an alphabetized list. However those high taxes are in large part due to high home values in the county.

Thats one of the highest values in the state. Williamson Act Estimator-2019 The Purpose Of This Estimator The purpose of this estimator is to illustrate the affect of the newly passed provisions of Assembly Bill 1265. The median property tax on a 33580000 house is 188048 in Williamson County.

More specifically the median home value in Williamson County is 417700. The information below shows typical animal types for Williamson county and is to be used for estimate purposes only. AB 1265 would reduce the property tax benefit to Williamson Act contracted owners by 10.

These tax rates vary depending on the level of services provided and the total value of the countys tax base. Williamson County collects on average 222 of a propertys assessed fair market value as property tax. You may now access historical property tax information for the cities of Brentwood Franklin Nolensville and Thompson Station HERE.

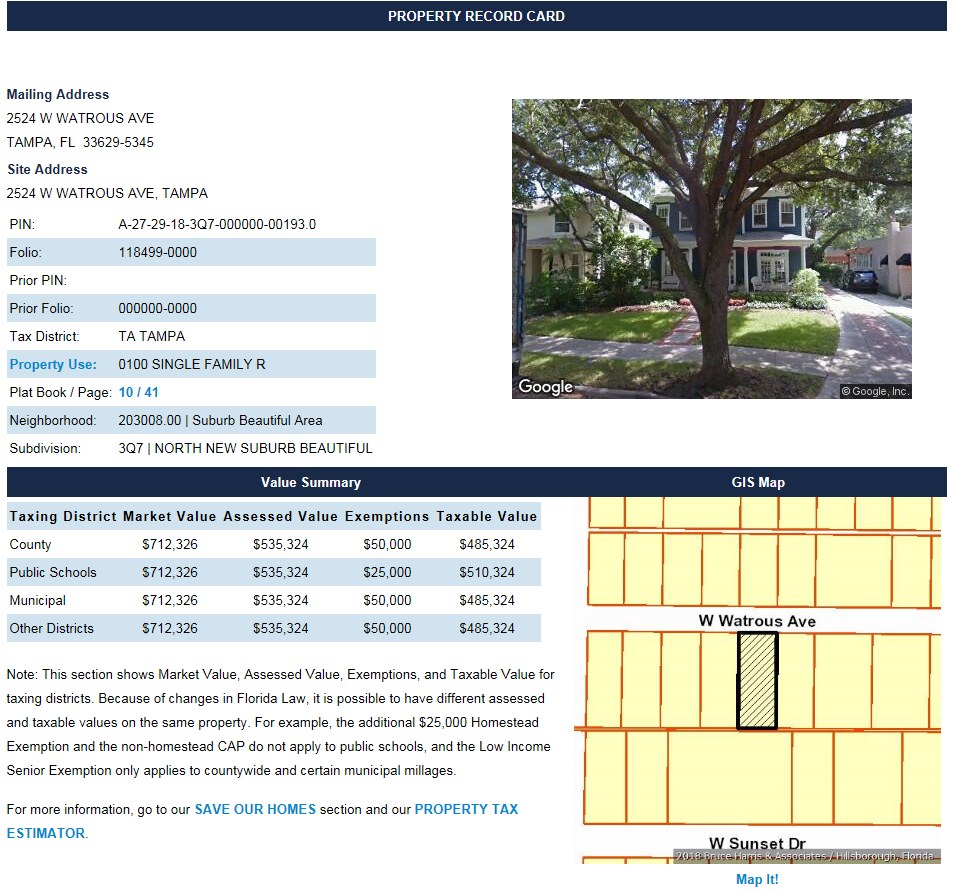

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office.

Accuracy is limited to the validity of available data. Multipy your tax rate per hundred of your ASSESSED VALUE for your tax amount. Please call 615 790-5709 if you need additional information.

The median property tax on a 33580000 house is 228344 in Tennessee. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property tax rates are generally set by each taxing entity around September of each year.

Property taxes are your share of the total cost of local government and they are used to help support a variety of valuable resources in the county cities and schools. For Williamson County the property tax rate is 0418719 per 100 valuation for the 2020-21 year. Property Tax in Williamson County.

Williamson County has one of the highest median property taxes in the United States and is ranked 78th of the 3143 counties in order of median property taxes. Minneapolis 2020 disaster reassessment for property tax relief. Monroe Street Suite 104 Marion IL 62959 Phone.

The median annual property tax paid by homeowners in Williamson County is 2301 highest in the state and almost double the state average. Please note that we can only estimate your property tax based on median property taxes in your area. The Williamson Central Appraisal District is located at 625 FM 1460 Georgetown TX 78626 and the contact number is 512-930-3787.

Tax amount tax rate x taxable value of your property 100. The median property tax in Williamson County Texas is 3817 per year for a home worth the median value of 172200. If a property is valued at 400000 property taxes will cost the owner 167488.

Williamson County Treasurer Resources Property Tax Payment Instructions Property Tax Exemptions Tax. If you attempt to use the link below and are unsuccessful please try again at a later time. Take your TOTAL APPRAISAL multiply by 25 for Residential 40 for Commercial Industrial or 30 for Personal Property to get your ASSESSED VALUE.

Contact ASHLEY GOTT Treasurer Williamson County Treasurer 407 N. Williamson County - TN disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. Hennepin County is committed to managing that share wisely and transparently.

The example below is for a typical residential property with an Appraised Value of.

Read more »