Property Tax Estimator North Carolina

Our property records tool can return a variety of information about your property that affect your property tax. 2100 of Assessed Home Value.

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

The results will be based on a few parameters the user enters.

Property tax estimator north carolina. My 2016 taxes would be. Furthermore the typical homeowner in North Carolina pays about 1493 annually in property taxes good for just a little more. Mail the completed paper form and your estimated payment to the North Carolina.

This calculator is designed to estimate the county vehicle property tax for your vehicle. The median property tax on a 12820000 house is 85894 in Davidson County. Orange County collects the highest property tax in North Carolina levying an average of 282900 109 of median home value yearly in property taxes while Montgomery County has the lowest property tax in the state collecting an average tax of 49400 059 of median home value per year.

Or call the Department at 1-877-252-3052 and request that the form be mailed to you. The tax rate for the district that I live in within Wake county is an additional 25 cents per 100 value. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

Estimate Property Tax Our Avery County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in North Carolina and across the entire United States. 200000100 x 865 1730. Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Davidson. 2019 Individual Income Tax Estimator 2020 Individual Income Tax Estimator. North Carolina Property Tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Its made up of 13 municipalities including Raleigh the states capital and the county seat. Enter Your Property Value.

North Carolinas property tax rates are nonetheless relatively low in comparison to what exists in other states. The median property tax on a 12820000 house is 99996 in North Carolina. Property that was to be listed as of January 1 2016 would be subject to this tax rate.

The average effective property tax rate in North Carolina is 077 which compares rather favorably to the 107 national average. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund and is. Many counties in North Carolina collect property taxes at an effective rate taxes paid as a percentage of home value of less than 1 making the state average effective property tax rate 077 which is below the national average.

Use our free North Carolina property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Use our property tax calculator to determine your estimated property taxes in Blowing Rock Boone Banner Elk Beech Mountain and West Jefferson North Carolina. Your county vehicle property tax due may be higher or lower depending on other factors.

Contact your county tax department for more information. 2160 of Assessed Home Value. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of real estate personal property or a motor vehicle.

Vehicles are also subject to property taxes which the NC. Wake County is located in northern North Carolina. Enter the Vehicles NC.

Pick up the paper form at one of our Service Centers. If you are unable to file and pay your North Carolina estimated tax electronically or want to use a paper form visit Download Forms and Instructions to access instructions and download the paper form. The calculator should not be used to determine your actual tax bill.

That makes the countys average effective property tax. My house market value as of the last reappraisal was 200000. The median home value in Wake County is 265800 with a median property tax payment of 2327.

The median property tax on a 12820000 house is 134610 in the United States. The exact property tax levied depends on the county in North Carolina the property is located in. Our North Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in North Carolina and across the entire United States.

How To Calculate Closing Costs On A Home Real Estate

How To Calculate Closing Costs On A Home Real Estate

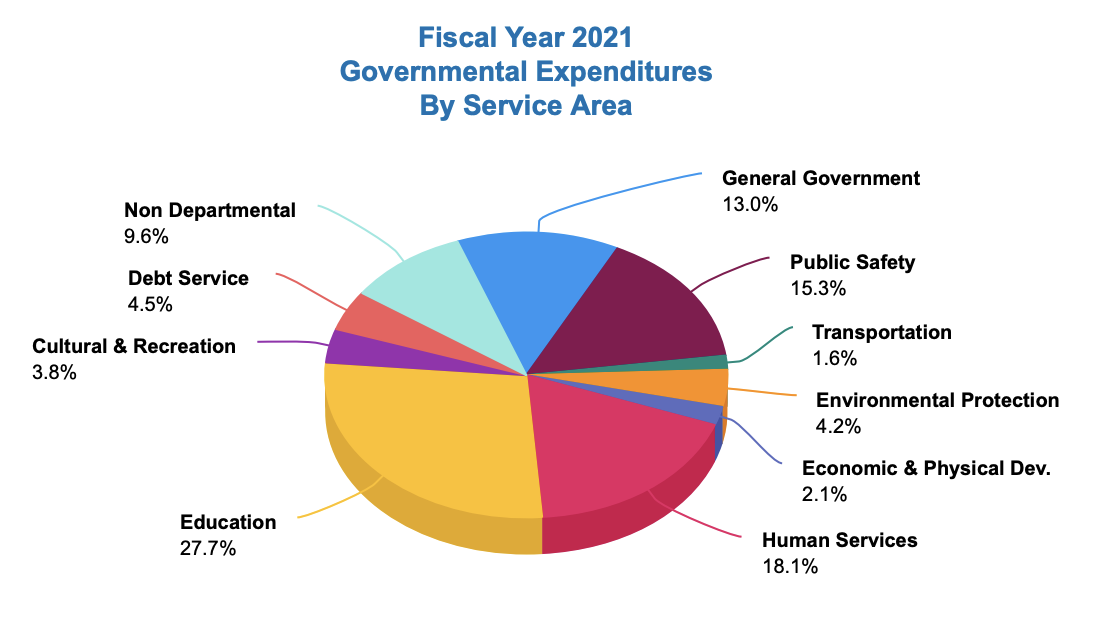

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

Carteret County Adopts Fy2020 21 Budget With 2 Cent Tax Increase News Carolinacoastonline Com

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

North Carolina Budget Compromise Delivers Further Tax Reform Tax Foundation

North Carolina Budget Compromise Delivers Further Tax Reform Tax Foundation

Motor Vehicles Information Tax Department Tax Department North Carolina

North Carolina Paycheck Calculator Smartasset

North Carolina Paycheck Calculator Smartasset

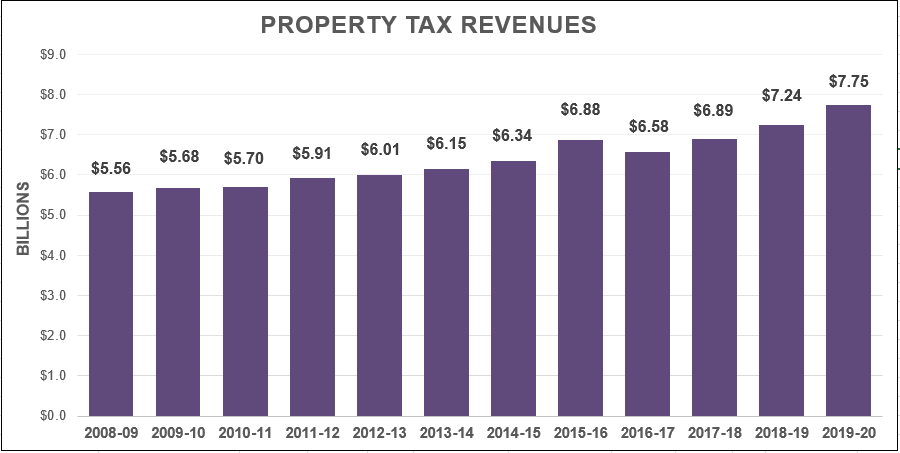

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Property Tax Records North Carolina Property Taxes Nc

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

Taxes Wake County Economic Development

Taxes Wake County Economic Development

Taxes Pitt County Development Commission

Taxes Pitt County Development Commission

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Property Tax Records North Carolina Property Taxes Nc

North Carolina Income Tax Calculator Smartasset

North Carolina Income Tax Calculator Smartasset

.png)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home