Property Tax Estimator Travis County

AUSTIN Texas Travis County property owners can now review proposed tax rates and the impact they could have on their property tax. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Tcp Real Estate Homepage Tcp Real Estate Home Ownership Real Estate Tips Real Estate Buying

Tcp Real Estate Homepage Tcp Real Estate Home Ownership Real Estate Tips Real Estate Buying

The Travis Central Appraisal District makes no claims promises or.

Property tax estimator travis county. Travis County collects on average 198 of a propertys assessed fair market value as property tax. The median property tax on a 20030000 house is 362543 in Texas. You can learn more about exemptions from the Travis Central Appraisal District the government entity that grants property exemptions.

Estimate your property taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Travis County. The median property tax on a 20030000 house is 210315 in the United States.

In-depth Travis County TX Property Tax Information. Property Tax Division Mission Statement. Easily look up your property tax account what you owe print a receipt and pay your property taxes online.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. You will be able to find. Exemptions lower the taxable value of your property and your tax liability.

Property tax estimator. Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. For example if your homes market value is 100000 and you qualify for a 10000 exemption you will pay taxes on 90000.

All information contained herein is considered in the public domain and is distributed without warranty of any kind implied expressed or statutory. The median property tax in Travis County Texas is 3972 per year for a home worth the median value of 200300. You can call the Travis County Tax Assessors Office for assistance at 512-854-9473.

Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. 198 of home value. Yearly median tax in Travis County.

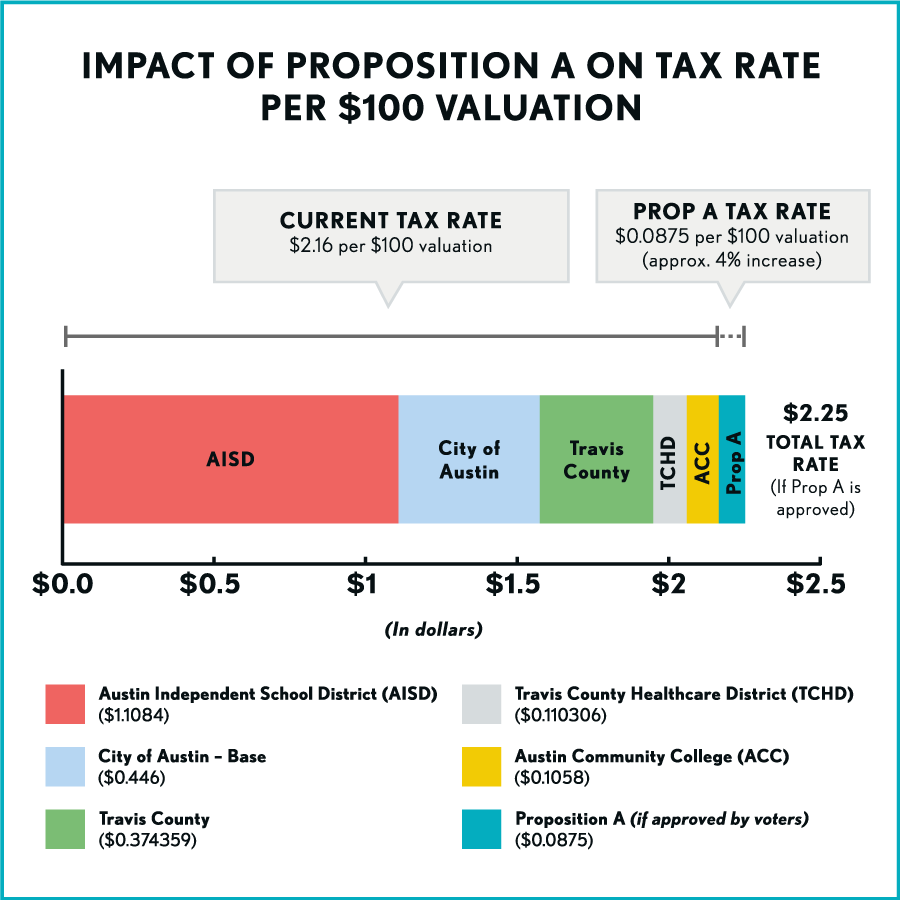

Property tax rates are generally set by each taxing entity around September of each year. PROPOSED TAX RATES NOW AVAILABLE ONLINE FOR TRAVIS COUNTY PROPERTY OWNERS. Learn how you can get a property tax break.

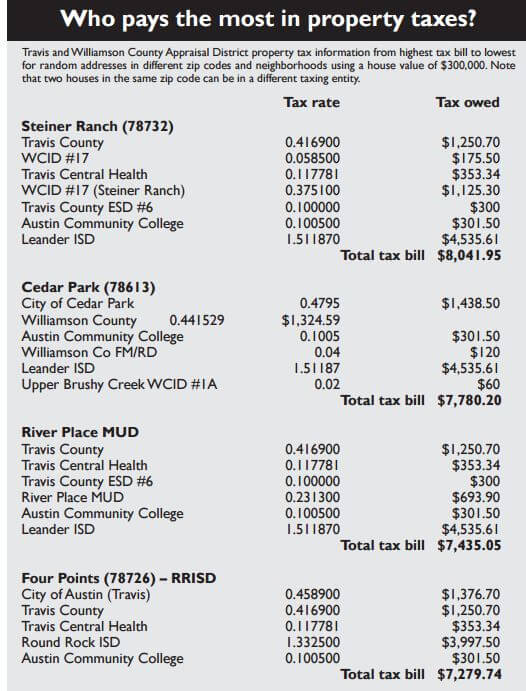

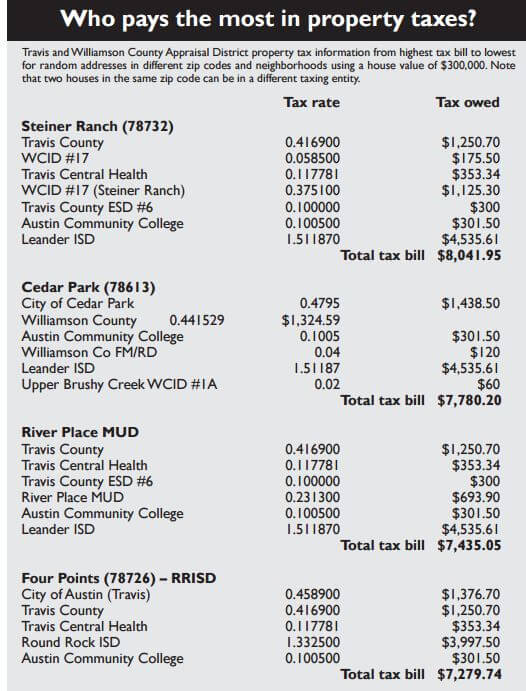

In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts. If you feel uncertain about whether you have the correct tax rate or appraised value contact your county appraisal district or consult with a tax professional to. The Travis County property tax rates for each tax jurisdiction for 2020 2019 2018 2017 and 2016 are presented here in an alphabetical list click here for a categorized list.

Property taxes current The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. The median property tax also known as real estate tax in Travis County is 397200 per year based on a median home value of 20030000 and a median effective property tax rate of 198 of property value. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

When contacting Travis County about your property taxes make sure that you are contacting the correct office. The median property tax on a 20030000 house is 396594 in Travis County. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100.

Whether your taxes are paid or the balance that is due. As an example a property appraised at 300000 in Austin Travis County will have an annual estimated tax rate of 22267 and will have an estimated annual property tax of 668010. 254 rows Travis County Travis County contains the state capital of Austin as well as some of the.

Travis Central Appraisal District. Your original current and previous years tax statements. Travis County has one of the highest median property taxes in the United States and is ranked 69th of the 3143 counties in.

1 day agoOverall the Travis County appraisal roll increased 12 to 3229 billion led by more than 39 billion in increases for residential properties said Marya Crigler chief appraiser of the Travis. The capitalization rate which the Travis Central Appraisal District will use in the valuation of properties with a Community Housing Development Organization designation is 775. To administer accurately and efficiently the billing collection and reporting of property tax revenues levied as directed by California State Law and County Ordinances and assist the public with understanding property tax information in a prompt efficient and courteous manner.

Https Theaustinbulldog Org Download 1348 Pablo Ornelas Jr And Ofilia Ornelas 2386 Travis County Tax Bills For The Ornelas Homes Pdf

Medical District Coming To Life Community Impact Newspaper Medical District Medical Life

Medical District Coming To Life Community Impact Newspaper Medical District Medical Life

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Pin By Travis On Current Events Teacher Salary Teacher Salary By State Elementary Teacher Salary

Pin By Travis On Current Events Teacher Salary Teacher Salary By State Elementary Teacher Salary

More Fun On The Lake Go On An Adventurous Zipline Ride While Staying At The Palms On Lake Travis Lake Travis Ziplining Zipline Tours

More Fun On The Lake Go On An Adventurous Zipline Ride While Staying At The Palms On Lake Travis Lake Travis Ziplining Zipline Tours

15108 Mettle Drive Don T Miss This Austin Texas Home For Sale Texas Homes For Sale Texas Homes Texas Real Estate

15108 Mettle Drive Don T Miss This Austin Texas Home For Sale Texas Homes For Sale Texas Homes Texas Real Estate

2021 Best Places To Buy A House In Travis County Tx Niche

2021 Best Places To Buy A House In Travis County Tx Niche

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Https Www Traviscad Org Wp Content Uploads 2020 06 Fy 2021 Proposed Budget Pdf

Sunway Hotel Booking Wordpress Theme Hotel Sunway Booking Theme Wordpress Themes And Plugins Vacation Rental Hotel Vacation

Sunway Hotel Booking Wordpress Theme Hotel Sunway Booking Theme Wordpress Themes And Plugins Vacation Rental Hotel Vacation

2020 Mobility Elections Proposition A Austintexas Gov

2020 Mobility Elections Proposition A Austintexas Gov

Travis County Appraisal District How To Protest Property Taxes

Travis County Appraisal District How To Protest Property Taxes

Where To Live In Austin Youtube Austin Neighborhoods Austin Home Buying

Where To Live In Austin Youtube Austin Neighborhoods Austin Home Buying

Everything You Need To Know About Travis County Property Tax

Everything You Need To Know About Travis County Property Tax

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

10 Things You Should Know About A Home Inspection Home Inspection Austin Real Estate 10 Things

10 Things You Should Know About A Home Inspection Home Inspection Austin Real Estate 10 Things

Payment Options Payment Options Government

Payment Options Payment Options Government

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home