Property Taxes Hillsborough County Florida

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Hillsborough County Tax Appraisers office. The median property tax on a 19890000 house is 216801 in Hillsborough County.

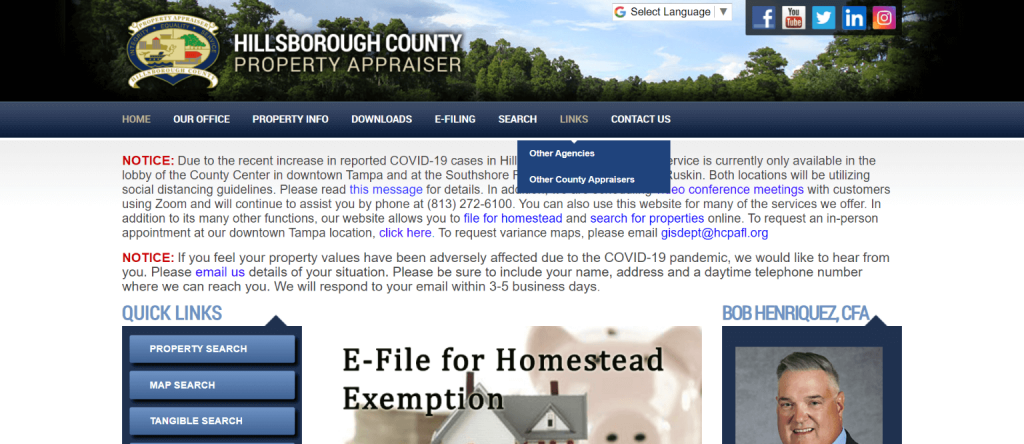

Information is available from the property appraisers office in the county where the applicant owns a homestead or other property.

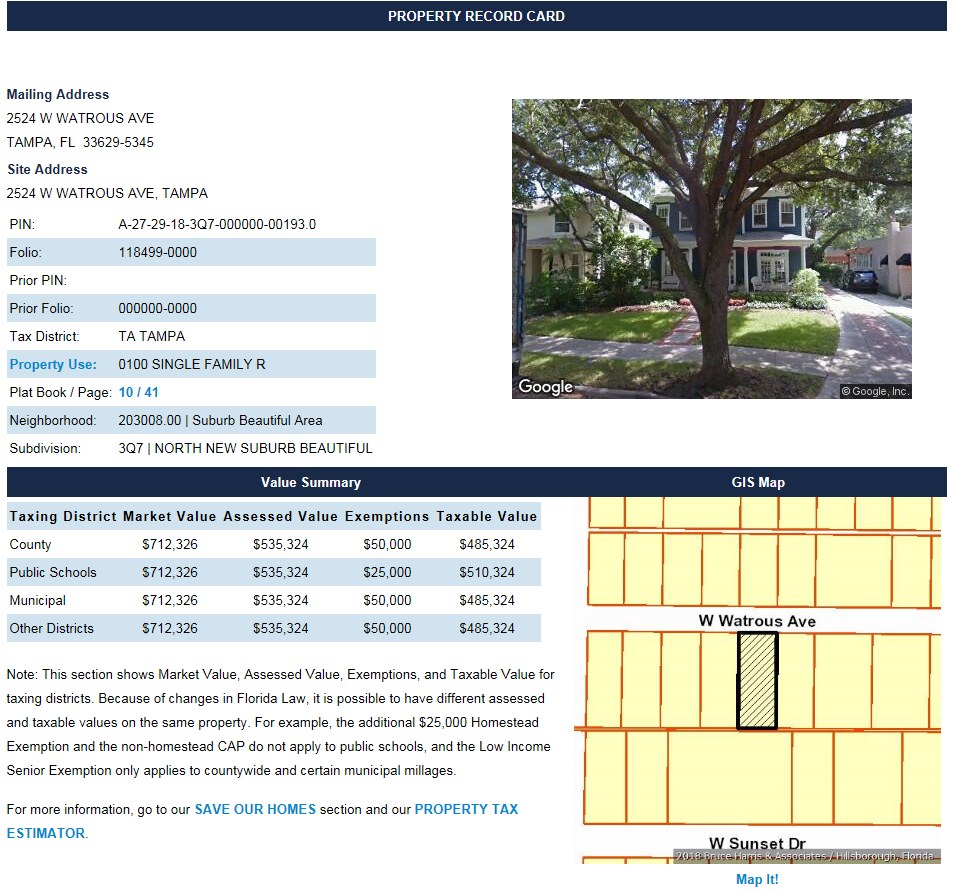

Property taxes hillsborough county florida. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website. Search all services we offer. Search and apply for the latest Group tax manager jobs in Hillsborough County FL.

In accordance with city and county ordinances customers are required to wear masks face coverings when doing business with our office. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. A board of county commissioners or the.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Search for a Parcel. DrivingRoad test appointments are available to Hillsborough County residents only.

Examples of tangible personal property are computers furniture fixtures tools equipment machinery signs leasehold. You can complete the Tangible Personal Property Tax Return if you own property used in a business or rental property other than real estate. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty.

Property valuation of Colson Road Plant City FL. Free fast and easy way find a job of 740000 postings in Hillsborough County FL and other big cities in USA. Proof of residency will be required for drivingroad test appointments.

This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Full-time temporary and part-time jobs. Hillsborough County Tax Collector Nancy C.

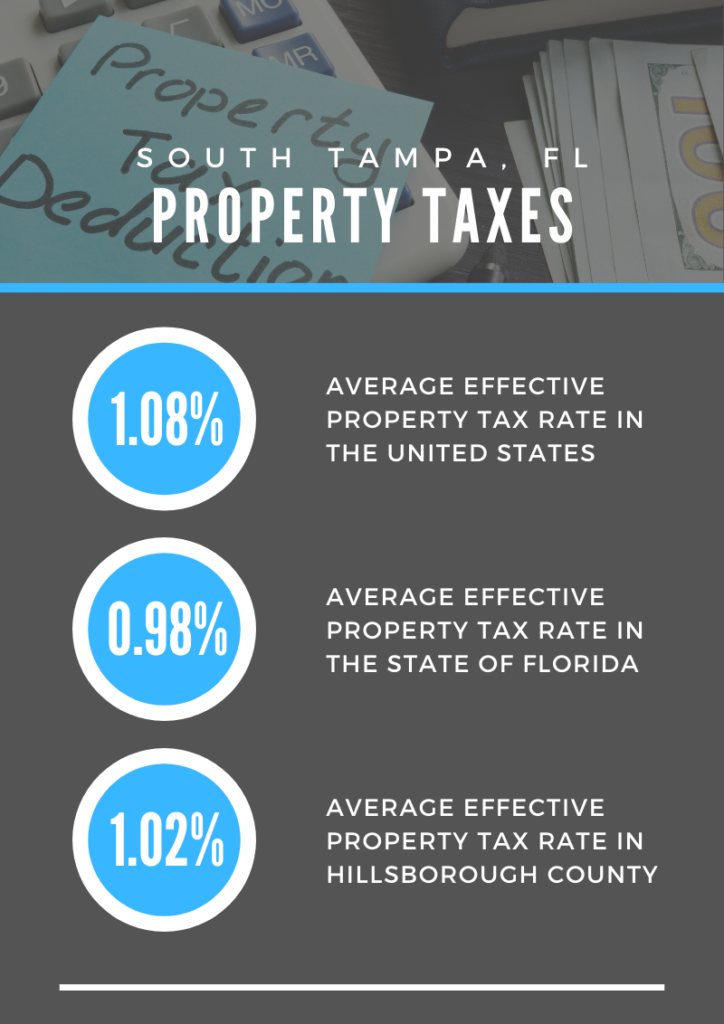

The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Box 89637 Tampa FL 33689-0410. In terms of both annual payments and effective property tax rates this county is pricier than Florida averages.

In fact theres a 1935 median annual property tax payment and a 098 average effective rate the latter of which is higher than the state average. Millan reminds Hillsborough County constituents that 2020 property and tangible taxes are due by end of March. Hillsborough CountyPUD Attn.

Falkenburg Road Tampa FL 33619 This PDF is fillable and may not work with many browsers Chrome Firefox Microsoft Edge etc - if you have issues with the PDF form do one of the following. City of Tampa up to 50000 Unincorporated Hillsborough County up to 50000 and Temple Terrace up to 25000. Hillsborough County Tax Collector Nancy C.

903 911 911 1001 1005 1006 1009 1013 1035 1103 tax assessments. The median property tax on a 19890000 house is 192933 in Florida. For more information call the Property Appraiser at.

In person 332 N. Welcome to the Hillsborough County Property Appraisers TPP E-File System. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County.

The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email.

Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax. Eligibility for property tax exemptions depends on certain requirements. Certain property tax benefits are available to persons 65 or older in Florida.

.jpg) Hillsborough County Fl Property Tax Bill Property Walls

Hillsborough County Fl Property Tax Bill Property Walls

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

Taxes Hillsborough County Tax Collector

Taxes Hillsborough County Tax Collector

Taxes Hillsborough County Tax Collector

Taxes Hillsborough County Tax Collector

Hillsborough County Fl Property Tax Bill Property Walls

Hillsborough County Fl Property Tax Bill Property Walls

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

Hillsborough County Property Appraiser Downloads Maps Data

Hillsborough County Property Appraiser Downloads Maps Data

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

How To Pay Property Taxes And Late Payments In Hillsborough County Florida Tampa Bay Homes For Sale Re Max Acr Elite Group Inc

How To Pay Property Taxes And Late Payments In Hillsborough County Florida Tampa Bay Homes For Sale Re Max Acr Elite Group Inc

Hillsborough County Property Appraiser How To Check Your Property S Value

Hillsborough County Property Appraiser How To Check Your Property S Value

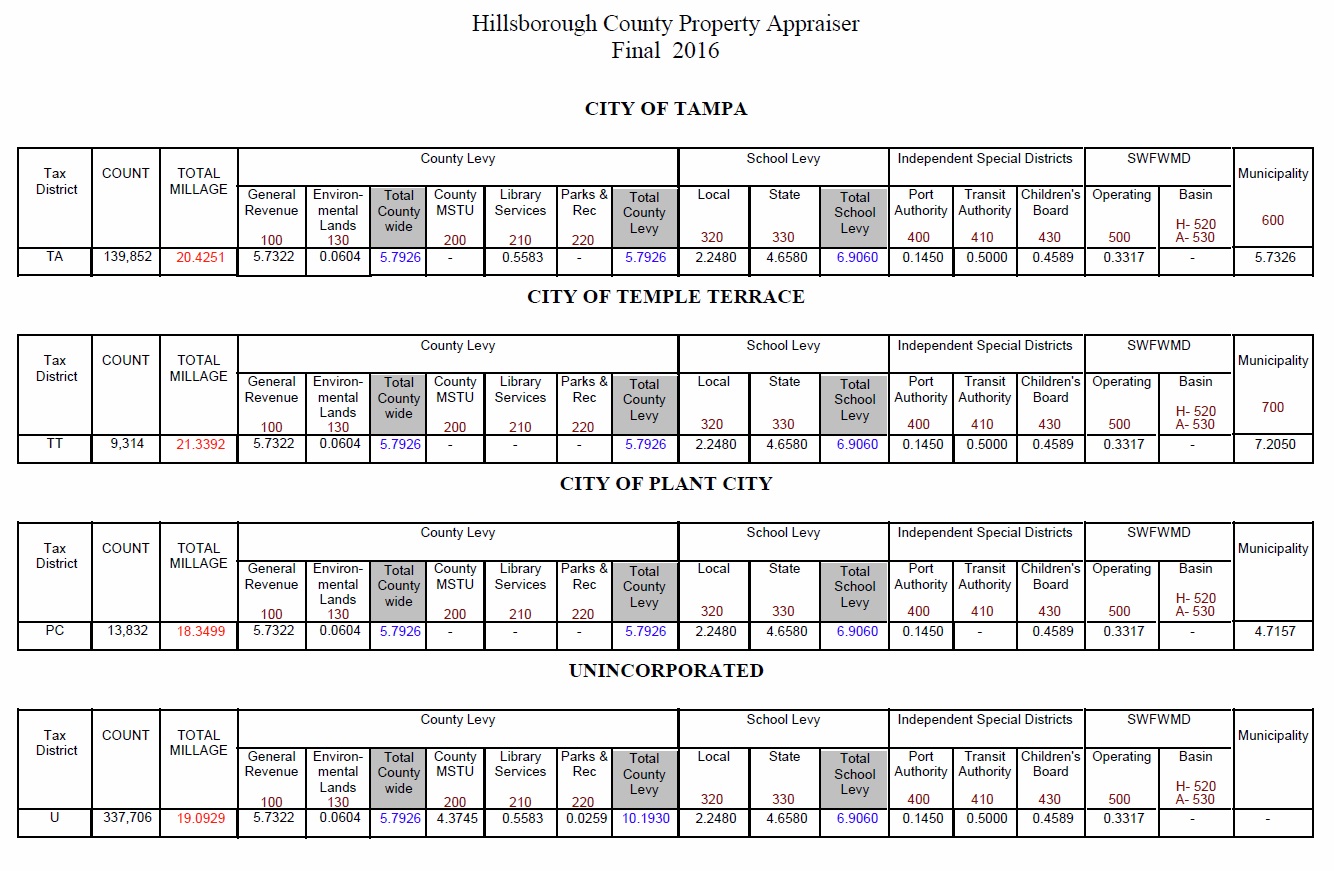

Hillsborough County Property Appraiser Property Info Truth In Millage

Hillsborough County Property Appraiser Property Info Truth In Millage

Property Taxes In South Tampa Fl Your South Tampa Home

Property Taxes In South Tampa Fl Your South Tampa Home

Hillsborough County Look Up A Zoning Case

Hillsborough County Look Up A Zoning Case

Hillsborough County Property Appraiser How To Check Your Property S Value

Hillsborough County Property Appraiser How To Check Your Property S Value

Labels: county, florida, hillsborough, taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home