Can You Look Up Property Taxes Online

Be sure to pay before then to avoid late penalties. Enter owners last name followed by a space and the first name or initial.

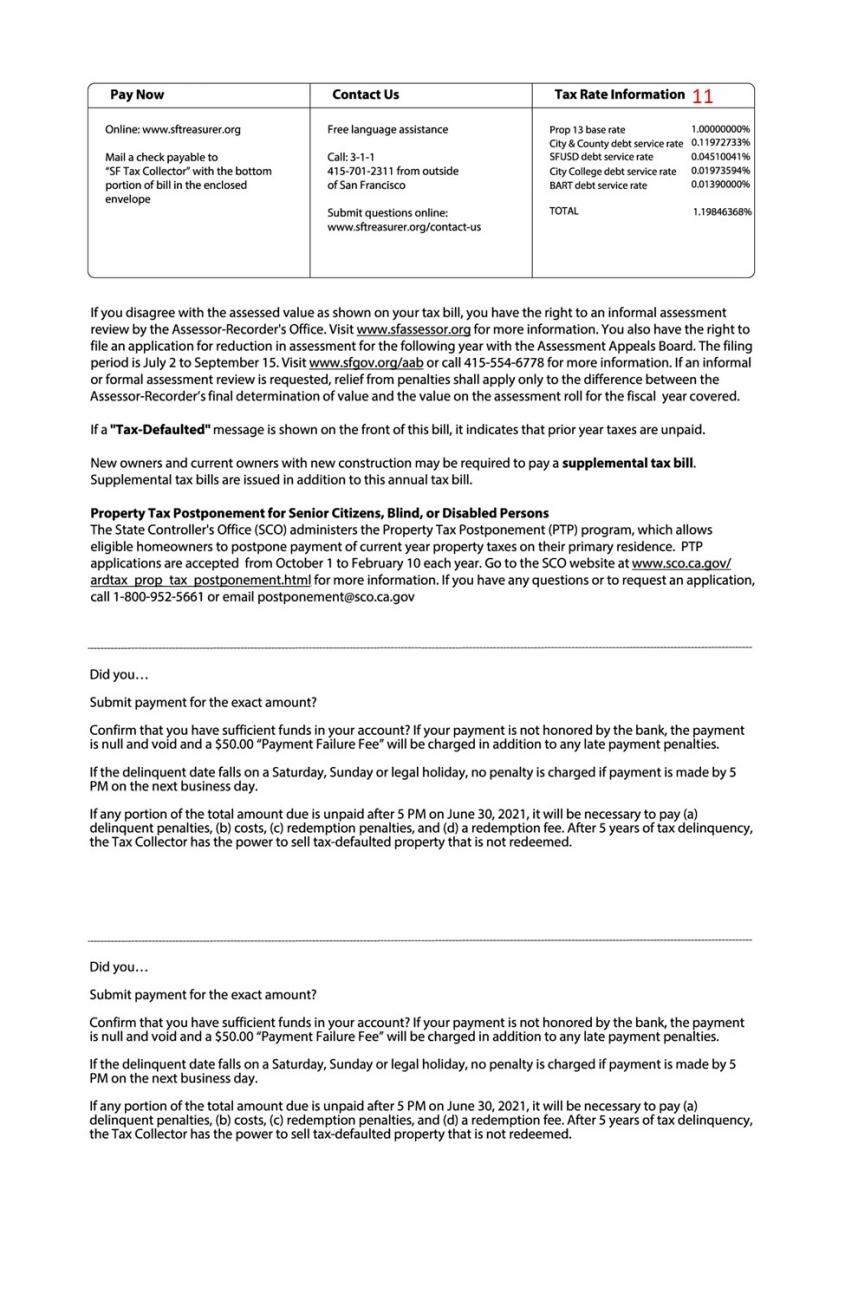

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Our property records tool can return a variety of information about your property.

Can you look up property taxes online. Select the propertys Parcel ID from a list. Available records include the taxpayers name and address. After accessing an account and clicking the Pay Now button the payment website switches to a secured HTTPS connection and all payment information is protected.

Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. For general property tax questions you can call the Department of Revenue at 605 773-3311 or email us at proptaxinstatesdus. Weve redesigned the page to provide easy access to content and tools for property owners local officials and real estate professionals.

Scroll down to select the content youre looking for regarding local property tax. If you do nothing it will be automatically applied to your next tax bill. The statewide property tax deadline is October 15.

The Clerks Office provides property-related services and forms including. Pay Property Tax Online. Any overpaid property tax will be credited to your account.

Search for your property Real Estate or Personal. Want to avoid paying a 10 late penalty. If you encounter a problem accessing a website on this list you will need to contact the office of the Board of Tax Assessors or the Tax Commissioner in the county.

Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. Select the Statement you want to pay or view.

In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. If you do not know the account number try searching by owner name address or property location. Pay-by-Phone IVR 1-866-257-2055.

Select to pay first half or second half or both. Some credits are treated differently. Nassau County Clerks Office.

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year. The assessment of property setting property tax rates and the billing and. The Property Tax Lookup is a convenient way to review your City of Toronto property tax account anytime anywhere from your computer or mobile device.

The Board of Tax Assessors is responsible for property. Make an Online Property Tax Payment Part 1. Enter Debit or Credit Card Details.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Details provided include account balance current and previous billing amounts payment details due dates and more. Create an Online Profile.

Select the county in which your property resides. Review the total due less the. Property Tax Online Forms PT 1292 Application Ag Status.

Make an Online Property Tax Payment Part 2. Property and Business Tax information is public record. Property Tax Credit Lookup You can view and print the following information regarding your 2017 2018 2019 and 2020 property tax credit checks that have been issued.

Various sections will be devoted to major topics such as. Online payments are available for most counties. The list below has links to county websites where property records can be searched online or property tax payments can be made online.

Access local real estate records. The assessors databases are available online free of charge to anyone wanting to research property tax records. Look Up Your Propertys Tax Assessment.

Look up property assessments online. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides. Account numbers can be found on your Tarrant County Tax Statement.

Make an Online Property Tax Payment Part 3. Description STAR or Property Tax Relief. Welcome to the online Property Tax Lookup.

Therefore this information does not need to be secured under HTTPS. Welcome to our new Real Property landing page. For more details of many of the basic State laws related to property tax administration see California Revenue and Taxation Code sections 11 through 4180 in law books at the Law Library or access through the Internet at wwwleginfocagov View or Pay Property Taxes Requires parcel number which can be found on your Tax bill.

For a faster search.

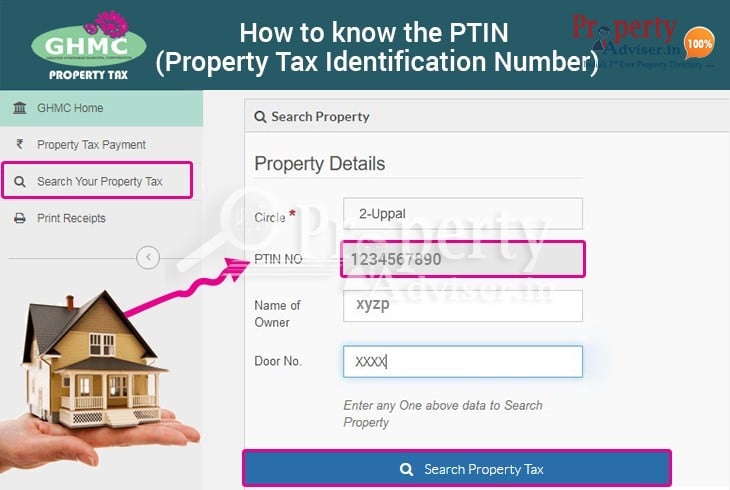

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

Florida Property Tax H R Block

Florida Property Tax H R Block

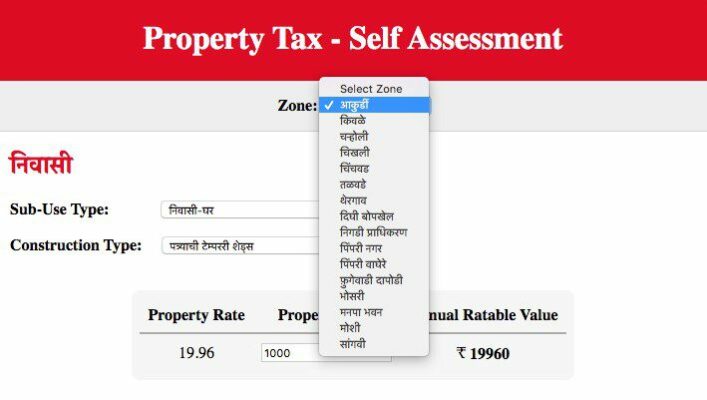

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

How To Determine Your State Tax Refund Status Tax Relief Center Tax Refund State Tax Tax Help

How To Determine Your State Tax Refund Status Tax Relief Center Tax Refund State Tax Tax Help

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Looking To Decrease Your Taxes Find Out How To Appeal A Property Tax Assessment Money Matters Trulia Blog Property Tax Money Matters Real Estate Career

Looking To Decrease Your Taxes Find Out How To Appeal A Property Tax Assessment Money Matters Trulia Blog Property Tax Money Matters Real Estate Career

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Current Payment Status Lake County Il

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad In 2021 Property Tax Tax Property

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad In 2021 Property Tax Tax Property

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Property Tax Information Lake County Il

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home