Property Tax Lookup Suffolk County Ny

State of New York. Route 17 Taxing District.

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

City Wide Tax Rate.

Property tax lookup suffolk county ny. Land Records Online Record Search. Find Property Borough Block and Lot BBL Payment History Search. 44 North Ferry Rd PO Box 970 Shelter Island NY 11964.

Also known as the District Section Block and Lot numbers. Home of AREIS Advanced Real Estate Information System on the Internet. Suffolk County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps.

If you need assistance in appealing your propertys value and getting a better rate on your property taxes give us a call in Nassau County. 200 Howell Avenue Riverhead NY 11901. Shelter Island Assessor 631 749-1080.

Suffolk County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Suffolk County New York. Must use the 19 digit number Tax Map ID No. These records can include Suffolk County property tax assessments and assessment challenges appraisals and income taxes.

40 Nassau Avenue Islip NY 11751. 40 Maple Avenue Smithtown NY 11787. Real Estate taxes are due in two installments.

Riverhead Assessor 631 727-3200. Suffolk County is a located in the US. Enter without punctuation ie 0501 010 00 0300 019000.

Contact Larry at 631 852-1550 or email Larrysuffolkcountynygov. Numerous resources for starting financing or relocating a business in Suffolk County including licensing taxes zoning compliance and more. For instance on your tax bill the DSBL numbers could be 0200 District is Brookhaven.

State of New York. Suffolk Treasurer 631 852 - 1500. For a trial subscription or subscriber assistance with AREIS on the Internet.

The tax map number is the keystone to the. Search Property Records in Suffolk County. And 001000 Lot 1.

116 Hampton Road Southampton NY 11968. Suffolk Real Property Tax Service 631 852 - 1550. The County occupies the easternmost portion of Long Island in the southeastern portion of New York State.

Islip Assessor 631 224-5585. In-depth Suffolk County NY Property Tax Information. Suffolk County is a located in the US.

Access to Business Development Centers Business Groups Financial Assistance Centers IDAs and more. You may contact the Town Assessors office in which the property is located to obtain the Tax Map Identification Number. We have all the data you need for easy property research including detailed property reports foreclosure.

It is the responsibility of the User of this database to read and understand all limitations and conditions associated with its use. Certain types of Tax Records are available to the general public while some Tax Records are only. Suffolk County Assessors Website Report Link httpswwwsuffolkcountynygovDepartmentsReal-Property-Tax-Service-Agency Visit the Suffolk County Assessors website for contact information office.

Begining March 13 2020 there will be only limited access to the services of the Suffolk County Real Property Tax Service Agency until further notice. We will not charge you a single penny until we secure you a lower tax rate. Riverhead New York 11901.

Suffolk County through the Suffolk County Clerks Office hereby agrees to provide access to you the user of its Land Records Database in accordance with the following terms and conditions. Property Tax Bills Payments. 516 342-4849 or in Suffolk County.

Go to Data Online. Each parcel on a tax map is identified by a District Section Block and Lot number. Assessed Value History by Email.

Real Property Tax Service Agency. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Exemptions Abatement Lookup.

Data and Lot Information. December 5 and June 5 of each year. Smithtown Assessor 631 360-7560.

Historic Aerials 480 967 - 6752. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Suffolk Mapping GIS.

Go to Data Online. Real Estate Tax Rates The Real Estate Tax rates are currently as follows. 1215 per 100 of assessed value.

44 North Ferry Rd PO Box 970 Shelter Island NY 11964. 111 per 100 of assessed value. Suffolk County Clerk 631 852 - 2000.

135 per 100 of assessed value.

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Compare Your Property Taxes Empire Center For Public Policy

Compare Your Property Taxes Empire Center For Public Policy

Property Tax Grievance Archives Property Tax Grievance Heller Consultants Tax Grievance

Property Tax Grievance Archives Property Tax Grievance Heller Consultants Tax Grievance

Tax Debt Negotiation Settlement Lawyer In Long Island Long Island Bankruptcy Foreclosure Law Firm

Tax Debt Negotiation Settlement Lawyer In Long Island Long Island Bankruptcy Foreclosure Law Firm

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

Ny Property Grievance Info Archives Property Tax Grievance Heller Consultants Tax Grievance

Ny Property Grievance Info Archives Property Tax Grievance Heller Consultants Tax Grievance

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

Suffolk County Property Tax Records Suffolk County Property Taxes Ny

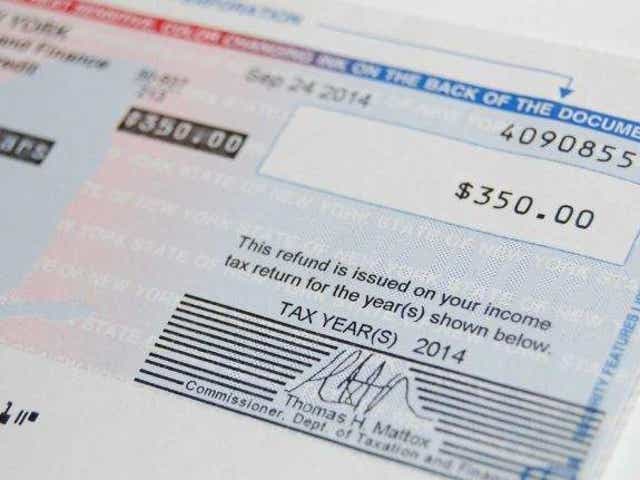

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home