Property Tax Notice Jefferson County Al

If you did not receive a tax notice for property you owned before 2019 you may find the tax notice using the Treasurers Property Records Search Application. Welcome to Jefferson County Property Tax Administration Website.

Tax Bills Increase For Many In Jefferson County Birminghamwatch

Tax Bills Increase For Many In Jefferson County Birminghamwatch

You may elect to complete the appeal form attached to your notice of valuation and mail it to.

Property tax notice jefferson county al. Register As A Vendor With The County To Sell Goods. Apply For A Job With Jefferson County. Once your price quote is processed it will be emailed to you.

You must specify the schedule number and check the verification box for this online appeal to be considered. Jefferson County Property Records are real estate documents that contain information related to real property in Jefferson County Alabama. The Alabama Department of Revenue has instructed the county chief appraisers to hold off any COVID-related relief.

To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division. Jefferson County Tax Collector JT. Vision Statement Our vision is to value fair and equitably all taxable real property in Jefferson County to notify taxpayers of valuation increases to hear and to decide protests and to.

Change of Address Form. If you have an escrow account with your mortgage company a copy of the tax information is sent to them if requested. 00 Jefferson County Parkway Golden CO 80419 Phone 303-271-8629 Fax 303-271-8674.

After the ALDOR approval The Appraisal Division of the Board sends Valuation Notices only to properties with value increases or boundary changes. Please search by address or PINSchedule if known. You may file online between May 1 and June 1.

Obtain Or Renew Business License. The values reverted to the original 2019 values despite the possible effects COVID-19 could have had on businesses and property owners in the area. Anyone who paid their property taxes last year should ignore the notices.

On Monday June 29 Jefferson County Alabama property tax notices were issued with an official appeal deadline of July 29 2020. Once the ownership records are updated the new owner will be notified of the taxes due. Your remittance must be postmarked no later than the twentieth calendar day.

A homestead is defined as a single-family owner-occupied dwelling and the land thereto not exceeding 160 acres. You are given twenty calendar days from the date on the price quote to remit your payment. Hours Monday - Thursday 730 am.

The Jefferson County Tax Collector sends out the tax notices each October 1 due and payable October 1 through December 31 without penalty. Smallwood Jefferson County Tax Collector. Each year after the Appraisal Division sets real property values the Alabama Department of Revenue reviews and directs changes to valuation and equalization in accordance with the ALDOR Tax Plan.

We create and update GIS maps with multi layers of data. The Jefferson County GIS tax map system is considered the leader in the state of Alabama. The Jefferson County Tax Assessor is charged with responsibility to discover list assess apply exemptions abatements current use and process real and personal property tax returns.

TY 2019 Birmingham Citation Ad JT. Find A County Facility. 2020 payments will be accepted beginning October 1 2020.

If you receive a tax notice for a property you sold in 2019 please disregard it. TY 2020 Birmingham Citation Ad. On Monday June 29 Jefferson County Alabama property tax notices were issued with an official appeal deadline of July 29 2020.

Renew My Drivers License. Property Tax Notices Jefferson County recently mailed valuation notices for properties that had an increase in value or boundary change. Find documents for real property.

Welcome to Jefferson County Tax Assessor web site. Below is a helpful QA to understand why notices are sent. You may request a price quote for State held tax delinquent property by submitting an electronic application.

Submit a Bid for. Jefferson County Courthouse North. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

303-271-8660 Real Estate Information. Please book an appointment for in-person services. More than 375000 property tax notifications every year go to all homeowners and business owners in Jefferson County.

The values reverted to the original 2019 values despite the possible effects COVID-19 could have had on businesses and property owners in the area. Jefferson County has published a list of property owners who are late paying their property taxes. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying.

Property taxes are due October 1 and are delinquent after December 31 of each year. If you would like to challenge the established value click here for instructions on how to do so with the Board of Equalization office. Scot Kersgaard Jefferson County Assessor 100 Jefferson County Parkway Golden CO 80419.

Jefferson County Tax Collector

Https Revenue Alabama Gov Wp Content Uploads 2017 07 Jefferson County 20170802 Pdf

Https Www Jccal Org Sites Jefferson County Documents Finance Aljefferson01a Fin Pdf

Https Www Jccal Org Sites Jefferson County Documents Human 20resources Modified 20consent 20decree 1982 20consent 20decree Pdf

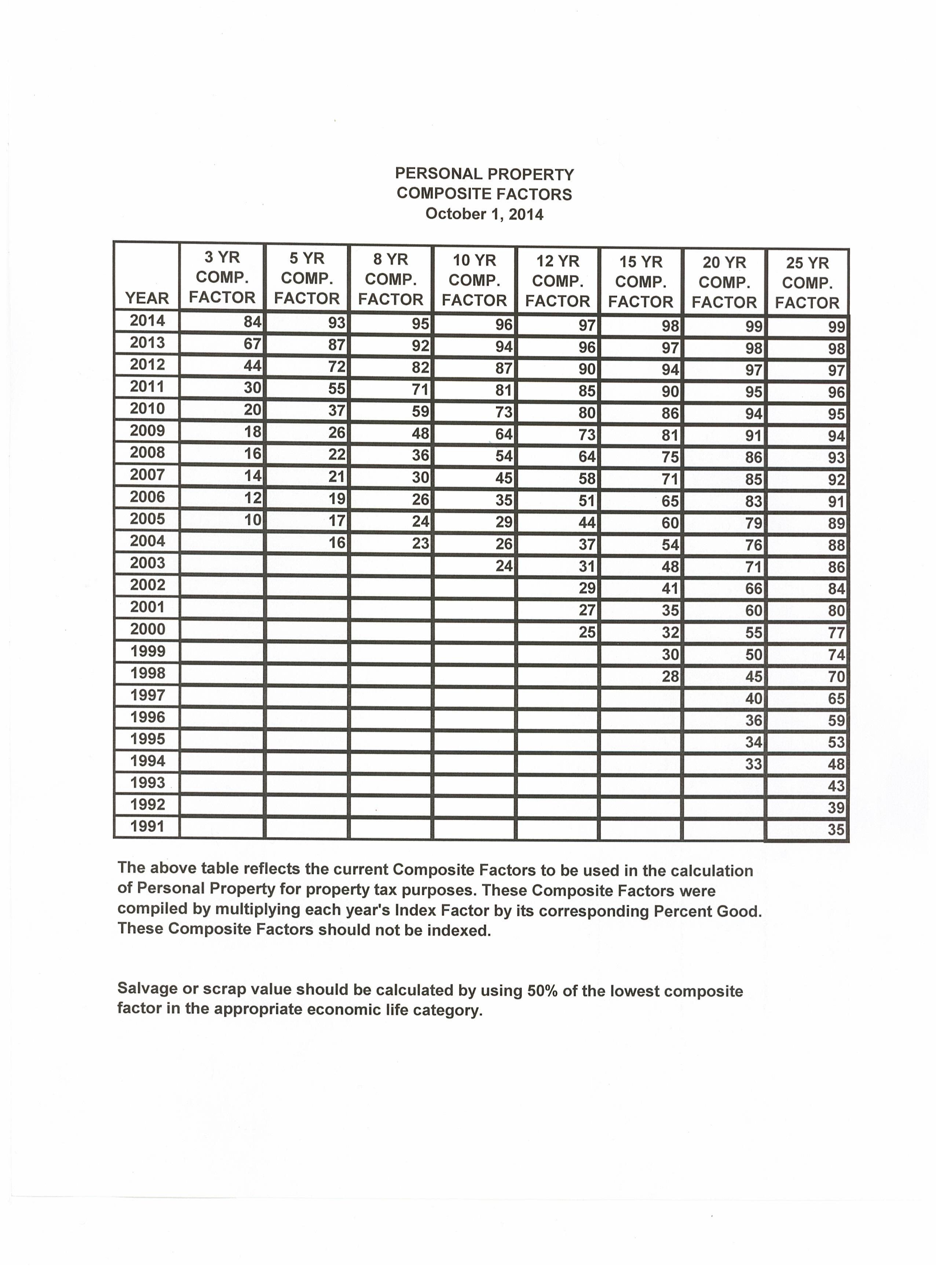

Jefferson County Personal Property

Jefferson County Personal Property

Jefferson County Jeffco Communications Center

Jefferson County Jeffco Communications Center

Jefferson County Tax Collector

Jefferson County Tax Collector

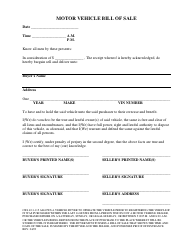

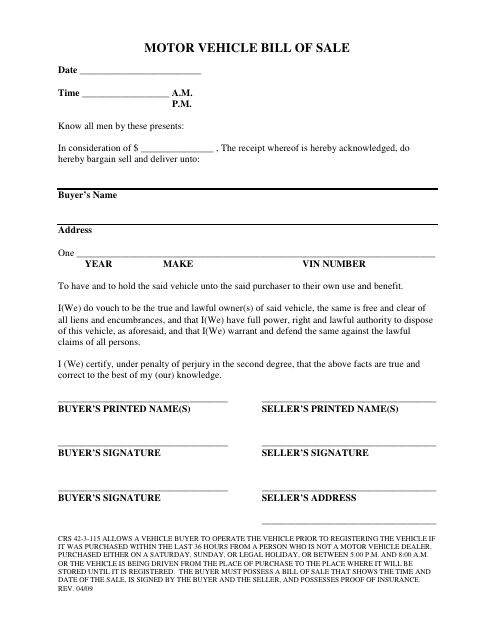

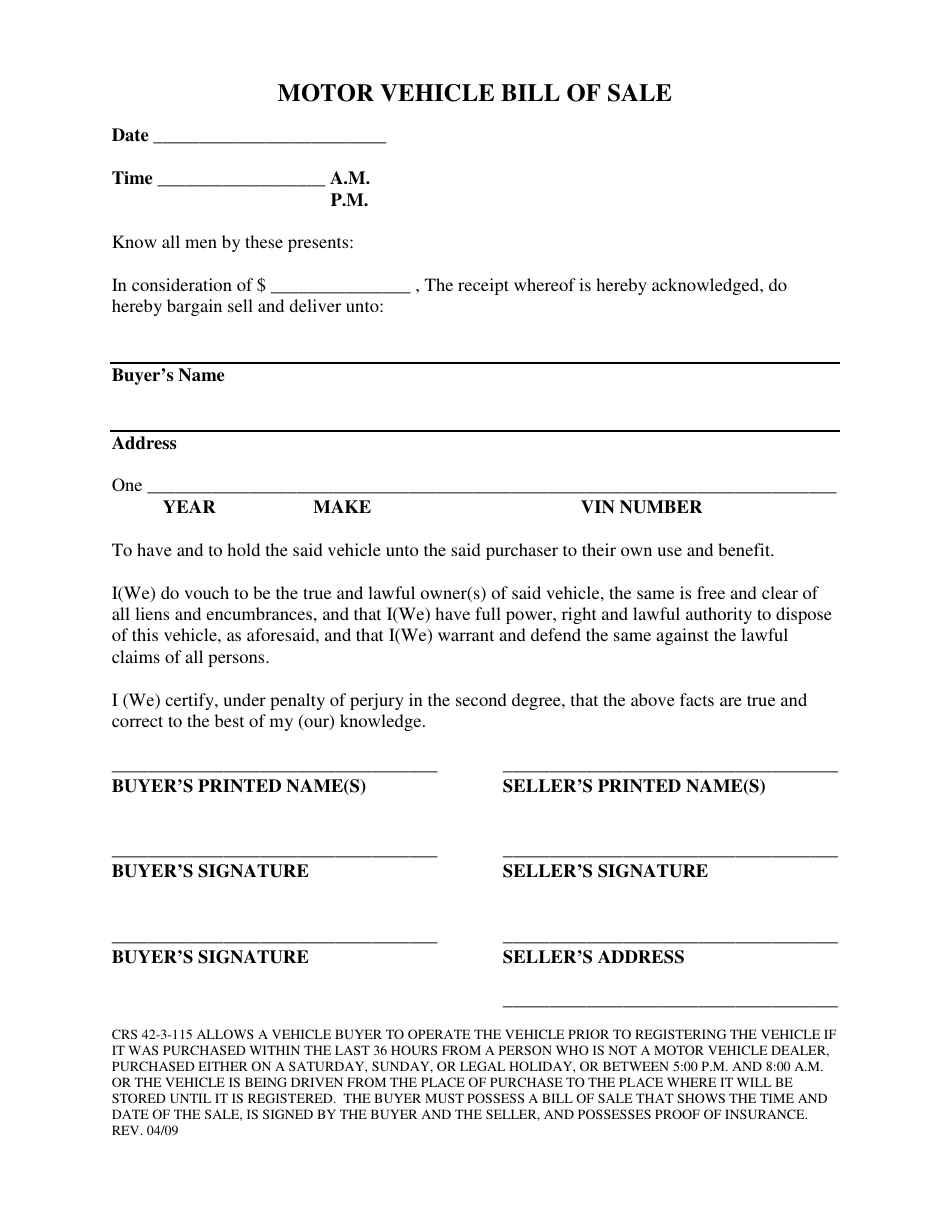

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Personal Property

Jefferson County Personal Property

Https Www Brzostek Com Downloadfile Aspx Type A Id 9731

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Jefferson County Property Tax Notices

Jefferson County Property Tax Notices

Jefferson County Tax Collector

Tax Bills Increase For Many In Jefferson County

Tax Bills Increase For Many In Jefferson County

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home