Property Tax Ks Vs Mo

Property taxes in KCK are high but housing there is cheap for good reason. If first half taxes are not paid by this date the full amount including interest becomes due for personal property.

Map Of Property Taxes On Business Inventory By State Map Property Tax Cartography

Map Of Property Taxes On Business Inventory By State Map Property Tax Cartography

For each state we assumed all residents own the same car.

Property tax ks vs mo. The 44 effective tax rate on commercial property in Kansas is more than double the rate in Missouri and Nebraska and more than four times the ETR in Oklahoma. Click on any state in the map below for a detailed summary of state taxes on retirement income real property every-day purchases and more. Duplicate Property Tax Receipts.

When analyzing the property tax rates by state its noticeable that blue states have higher effective taxes on properties. For income taxes in all fifty states see the income tax by state. Full year tax is owed on all Personal Property owned as of Jan.

Missouri law requires that property be assessed at the following. Except trucks over 16000 lbs. You will not be reimbursed further.

And types of watercraft First half taxes are due on or before Dec. Kansas law makes no provision for pro-ration. Vehicle Property Tax.

Property Tax Red States vs Blue States. This online service is provided by Kansasgov a third-party working under a contract awarded and administered by the Information Network of Kansas INK. Nothing in KC is really that different that sets is apart from other areas.

Find property tax in Kansas City MO on Yellowbook. Obtain a merchant license. The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000.

The top four states with the highest property taxes are blue. Counties in Kansas collect an average of 129 of a propertys assesed fair market value as property tax per year. Well also point you to special state tax breaks for.

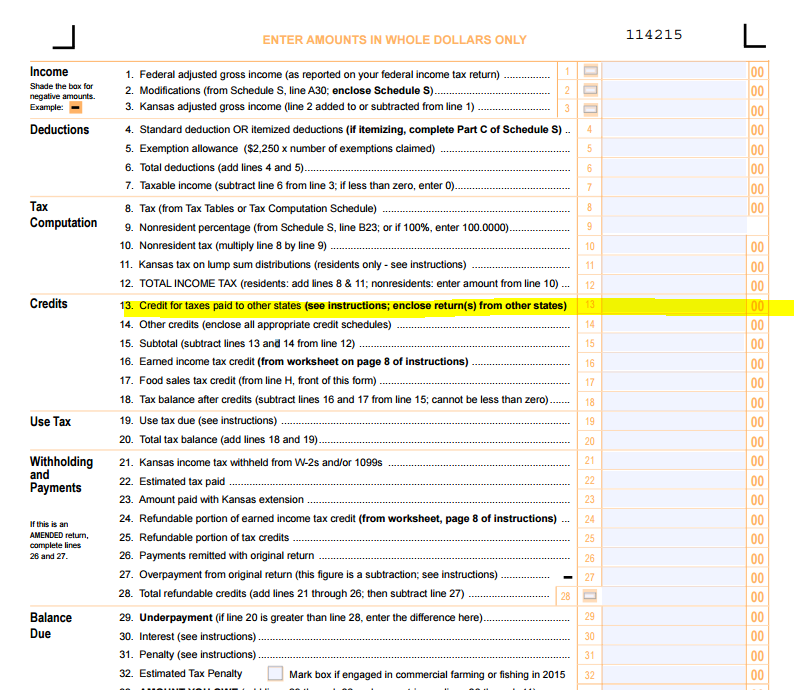

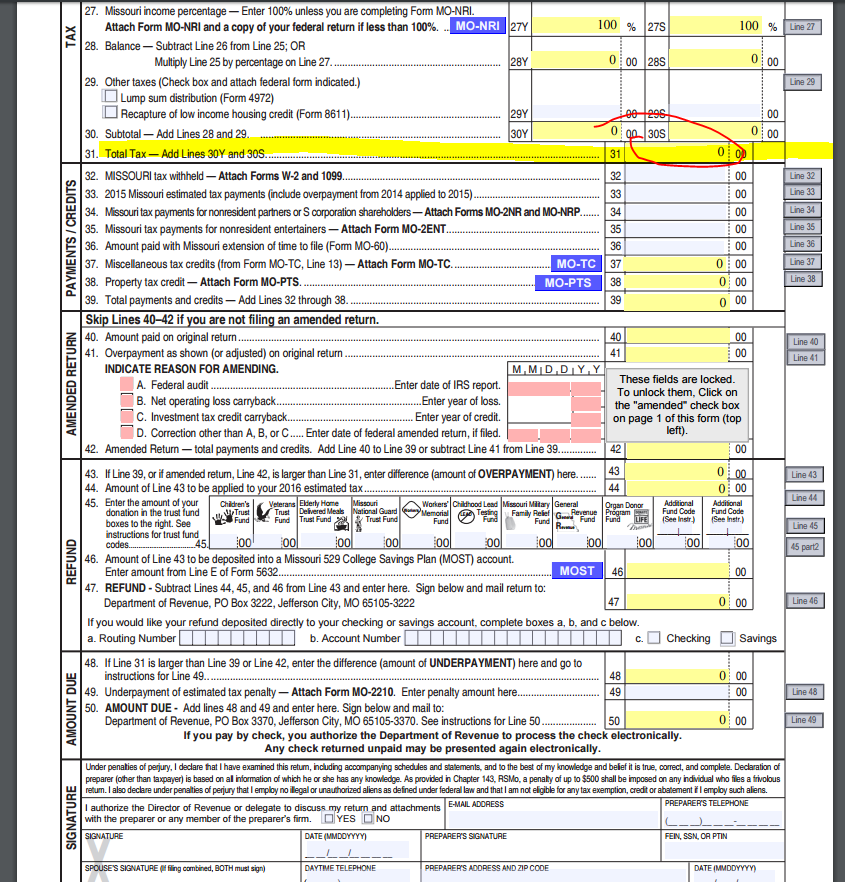

We examined data for cities and counties collectively accounting for at least 50 percent of the states population and extrapolated this to the state level using weighted averages based on population size. So if you earned 50000 and Missouri taxes you 2000 but Kansas only taxes you 1800 you will receive a credit of 1800 on your Kansas taxes to bring it down to zero. Learn about bankruptcy filings and property taxes.

Property taxes matter to businesses for several reasons. See reviews photos directions phone numbers and more for Pay Property Taxes locations in Kansas City MO. Kansas will give you a credit for the tax you pay in Missouri but only up to the amount of Kansas tax on the same income.

Property tax is an especially large barrier to economic growth in rural areas. Kansas is ranked number twenty six out of the fifty states in order of the average amount of property taxes collected. Get reviews and contact details for each business including videos opening hours and more.

Among the 10 states with the highest effective tax rate on median owner-occupied homes seven are Democrat. Kansas City Missouri is a dump. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone.

A Toyota Camry LE four-door sedan 2020s highest. For residents of Kansas City real and personal property taxes other than for railroads and utilities are included on the county property tax bill. Learn about tax rates.

No separate billing for these taxes comes from the City. I think over all the taxes are slightly lower on the MO side but it depends some parts of Lees Summit and Platte County get pretty high. Get a copy of your tax receipts.

This tool compares the tax brackets for single individuals in each state. Todays map shows states rankings on the property tax component of the 2019 State Business Tax Climate IndexThe Indexs property tax component evaluates state and local taxes on real and personal property net worth and asset transfersThe property tax component accounts for 154 percent of each states overall Index score. The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device.

The online price of items or services purchased. Use this tool to compare the state income taxes in Kansas and Missouri or any other pair of states. Property Taxes and Appraisals Disclaimer This application allows you to view property appraisal information real property specials taxes billed taxes due payment history and make online tax payments using your American Express Visa MasterCard Discover or check for property in Sedgwick County KS.

Tax Entities Rates. 116 rows Situated on the Missouri River north of Kansas City Clay County has one of the highest. The people seem like theyre too busy for time the streets and adjoining properties are in utter disrepair the crime rate is higher overall the property values are much lower taxes are lower snow removal is much slower the surrounding foliage of the highways are jungles of little concern downtown is steeped in young professionals with a feel for the loft hustle-and-bustle.

Sign up now to pay your Cass County Real Estate andor Personal Property taxes on a monthly installment basis. For more information about the income tax in these states visit the Kansas and Missouri income tax pages.

Kansas City Missouri Cost Of Living

Kansas City Missouri Cost Of Living

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

Kansas City Missouri Cost Of Living

Kansas City Missouri Cost Of Living

20 Best Kansas City Tax Services Expertise Com

20 Best Kansas City Tax Services Expertise Com

Statistical Areas Metro Dataline

5029 Sunset Dr Kansas City Mo 3 Beds 3 Baths Kansas City Kansas City

5029 Sunset Dr Kansas City Mo 3 Beds 3 Baths Kansas City Kansas City

Most Tax Friendly States For Retirees Kiplinger Tax Map Retirement Locations Map Retirement Income

Most Tax Friendly States For Retirees Kiplinger Tax Map Retirement Locations Map Retirement Income

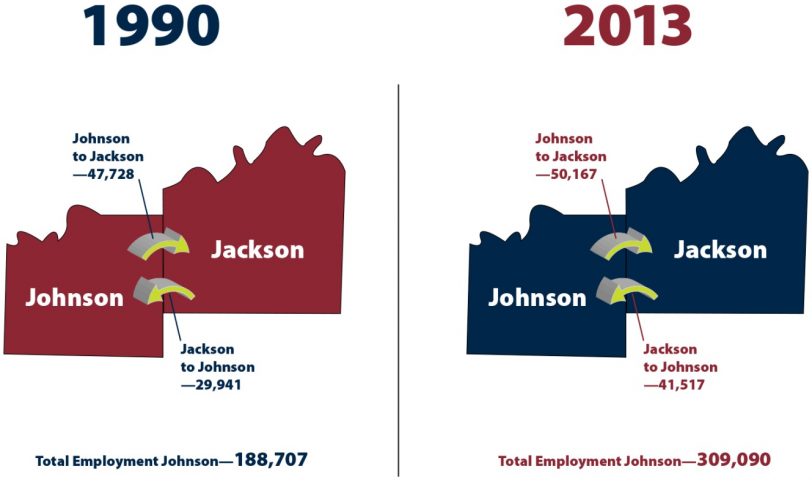

Working In Kansas City The Rise Of Johnson County Show Me Institute

Working In Kansas City The Rise Of Johnson County Show Me Institute

Moody S Kansas Missouri Ill Prepared For Covid Revenue Declines Kansas Policy Institute

Moody S Kansas Missouri Ill Prepared For Covid Revenue Declines Kansas Policy Institute

20 Best Kansas City Tax Services Expertise Com

20 Best Kansas City Tax Services Expertise Com

Mo Kansas City Earnings Tax Form Rd 109 Drake18

Mo Kansas City Earnings Tax Form Rd 109 Drake18

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Taxes By State A Map Of The U S Best Places To Retire Retirement Locations Map

Where Your State Gets Its Money Fivethirtyeight State Tax How To Get States

Where Your State Gets Its Money Fivethirtyeight State Tax How To Get States

How Far Is It From Kansas City Ks To Kansas City Mo Quora

How Far Is It From Kansas City Ks To Kansas City Mo Quora

Is It Better To Live In Kansas Or Missouri Moving Proz

Is It Better To Live In Kansas Or Missouri Moving Proz

The Complete List Of Best And Worst U S Markets For Rental Housing Returns Rental Income Income Property Rental

The Complete List Of Best And Worst U S Markets For Rental Housing Returns Rental Income Income Property Rental

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home