Nc Property Tax Bill Lookup

However this material may be slightly dated which would have an impact on its accuracy. The tax bill data and payment history provided herein is periodically copied from the Henderson County collection system.

Access Property Tax Assessment Records Tippecanoe County In

This search option allows you to view bill detail on real estate individual and personal property tax bills that are unpaid or paid.

Nc property tax bill lookup. Land Value Min Land Value Max Total Taxable Min Total Taxable Max Acreage Min Acreage Max Sales Criteria. The tax bill data and payment history provided herein represents information as it currently exists in the Pitt County collection system. Please note delinquent taxes cannot be paid by phone.

You will receive a receipt number. Please enter a valid year. Real Estate Tax Bill Search.

Union County taxpayers recently received their 2020 property tax bills. Add the desired bill to your cart and continue through the payment process. Than one empty box can be filled out for a more complex search.

Payments made today by credit card will be applied the following business day and updated to the web within 48 hours. Real Property Record Search Tax Bill Search GIS Search. North Carolina law does not have a provision to allow local governments to absorb the cost of paying a bill online.

Enter the information as prompted. Currently this data is updated hourly. Welcome to the NHC Tax Department.

Property Search - Text. While you may search by address for real estate bills it is recommended that you do those searches through the Detailed Property Information as this provides. For questions regarding the Streamside Subdivision assessment Matthews jurisdiction only please call.

Consequently there will be a short delay between the time a bill is satisfied either in our offices or using our online payment vendor and when payment is reflected on this site. Historically a footnote and chart included on the tax bill have provided a categorical breakdown of only general fund expenditures. Please read prior to submitting an online payment regarding mandatory convenience fees to pay online.

Look up your bill using any of the search options listed. Street Num Tax Year Please select criteria. Appeals County Home Forms Land Record Search Revaluation Search and Pay Taxes.

The Delinquent Collections section works to collect any and all property tax bills that are past-due. Using the tax bill search you can browse billing and payment information for real estate personal business and motor vehicle accounts and select accounts to pay online. Gaston County Property Tax Inquiry.

Searches may be done by bill number owners name business name or parcel number. NC and Data Providers assume no legal responsibility for the use of the information contained herein. If you have any questions close your browser by using the X in the upper right hand corner and contact the Tax Collections Department at 910 259-1222.

To obtain a statement of the property taxes paid for your vehicles visit NC. All Years 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. For best results look up by the property tax bill number.

Pitt County makes no warranties express or implied concerning the accuracy completeness reliability or suitability of this data. To pay by phone call 1-833-303-6673 please have the bill. The Tax Department is responsible for obtaining developing analyzing and maintaining records necessary for the appraisal assessment billing collection and listing of taxes associated with real and personal property within the jurisdiction of the county and municipalities according to the state of North Carolina General Statutes.

2020 Property Tax Bills Correction. For best results search in one or two fields only. This data is subject to change daily.

House Number Low House Number High Street Name. Tax Collections Open Property Tax Bill Search in new window If you have questions on your tax bill please call 311 or dial 704-336-7600 if outside Mecklenburg County limits. Search By Owner Name.

Oldest to Newest Newest to Oldest. Amounts due are updated nightly. You do NOT need to fill out all fields.

Please call 919-718-4662 if you have any problems. The chart on the 2020 tax bills addresses all categories of expenditures included in the FY21 adopted budget. Type in the full name or a part of the full name into the Name box.

Macon County - NC makes every effort to produce and publish the most accurate information possible. Any errors or omissions should be reported for investigation. Statements of vehicle property taxes paid to the NC DMV at the time of registration are not available on the Countys web site.

Taxpayers may pay bills by sending the payment coupon directly to the Tax Department visiting the Tax Department in the Historic Courthouse at 1 Courthouse Square Carthage NC or on-line at wwwmoorecountyncgovtaxpay.

Wic Food Packages Henderson County North Carolina

Wic Food Packages Henderson County North Carolina

Town Of Campton Assessing Information Town Of Campton

Town Of Campton Assessing Information Town Of Campton

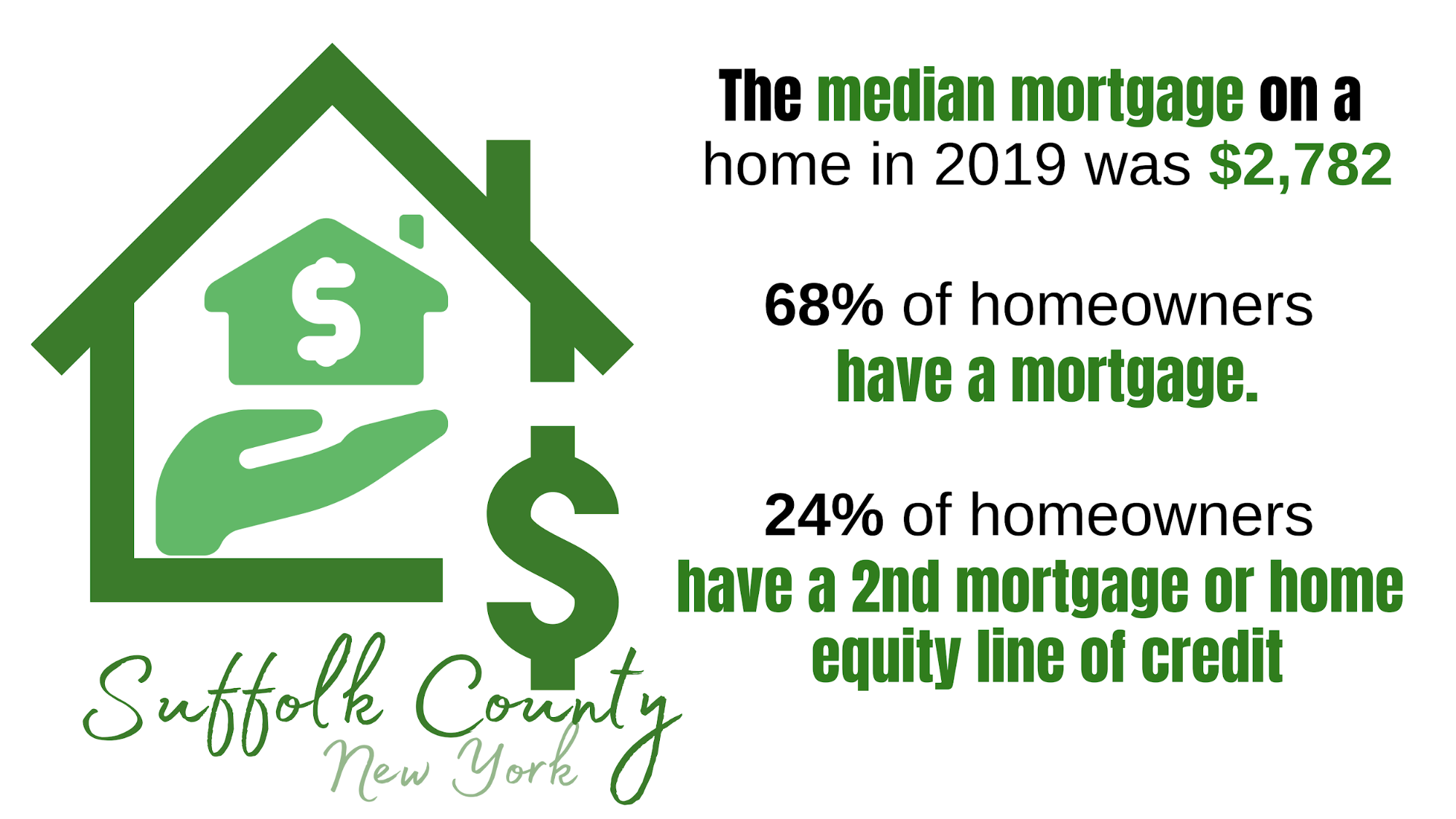

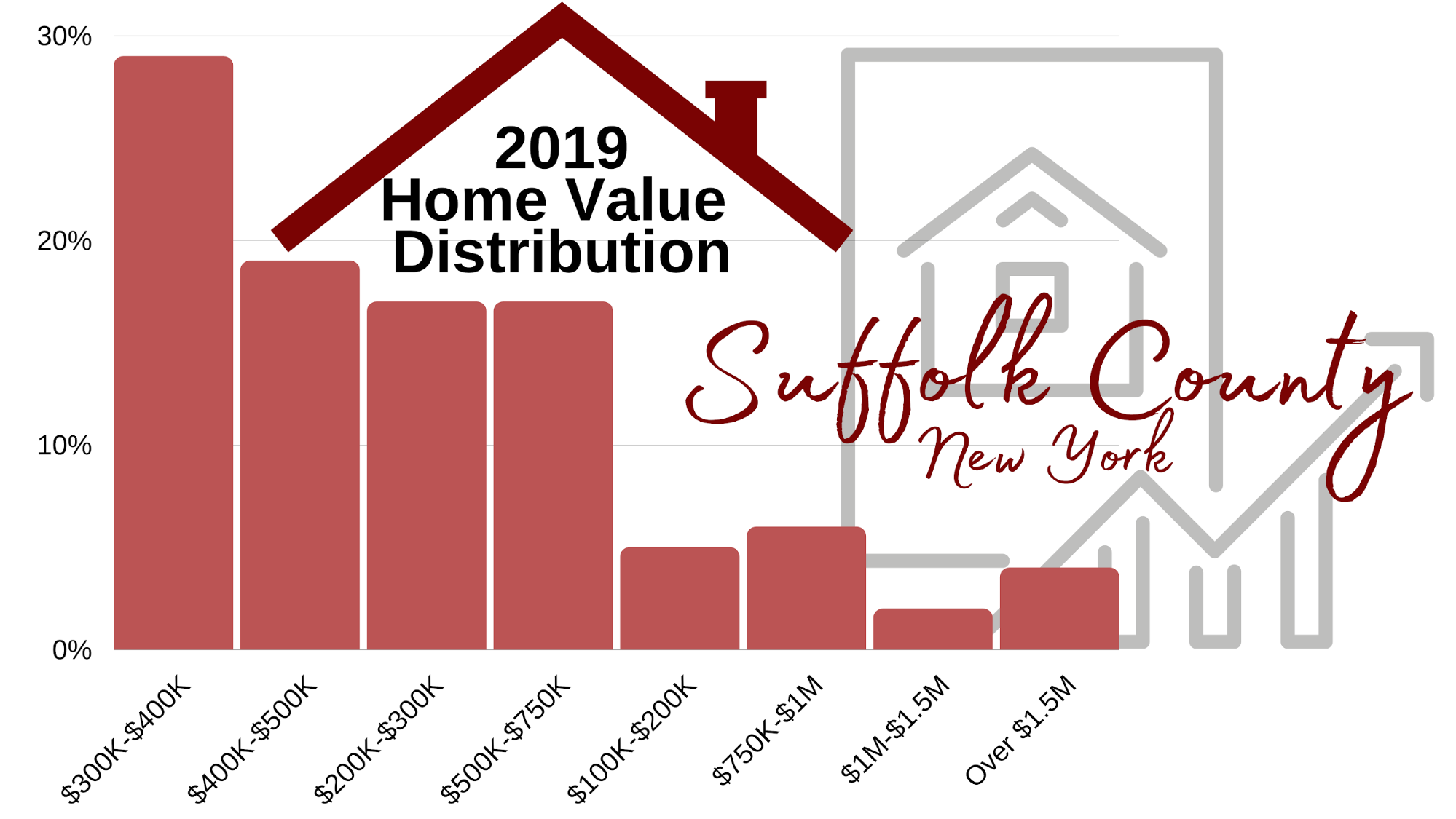

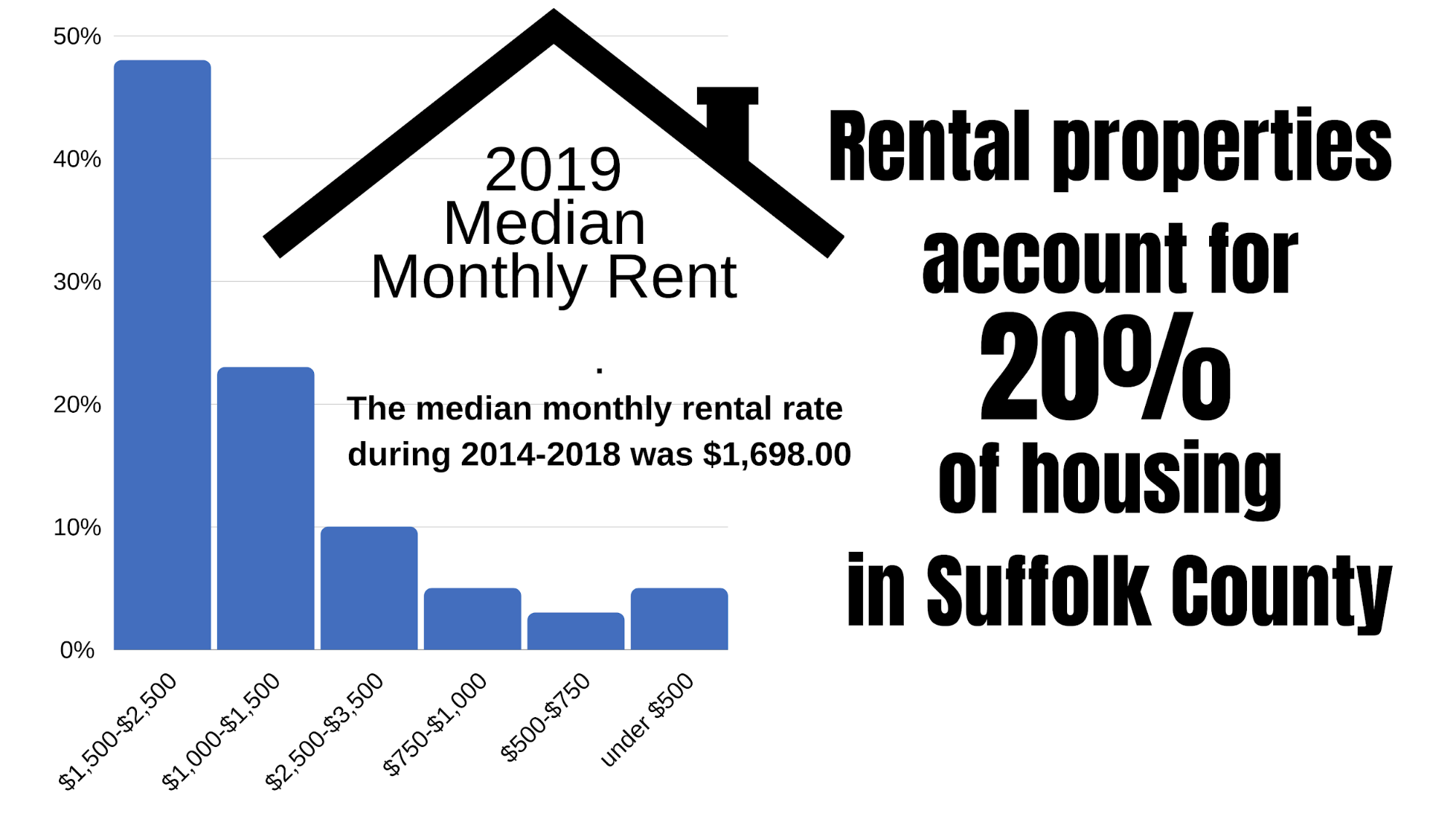

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Find An Advisor Fee Only Financial Planner Xy Planning Network Xypn

Find An Advisor Fee Only Financial Planner Xy Planning Network Xypn

Madison County Property Inquiry

Find Bills By Subject And Policy Area Congress Gov Library Of Congress

Find Bills By Subject And Policy Area Congress Gov Library Of Congress

Track Trails Accessibility Review Henderson County North Carolina

Track Trails Accessibility Review Henderson County North Carolina

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Dmv Vehicle Tax Information And Renewal Pitt County Nc

Suffolk County Property Search By Address

Suffolk County Property Search By Address

Assessor And Real Property Anderson County South Carolina

Assessor And Real Property Anderson County South Carolina

Early Voting Voting Dare County Nc

Outer Banks Real Estate Market Statistics Outer Banks Real Estate Market Outer Banks Real Estate Obx Real Estate Outer Banks Real Estate Listings Outer Banks Obx Listings Obx Matt Huband

Outer Banks Real Estate Market Statistics Outer Banks Real Estate Market Outer Banks Real Estate Obx Real Estate Outer Banks Real Estate Listings Outer Banks Obx Listings Obx Matt Huband

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home