Can You Claim Home Hazard Insurance On Your Taxes

First in order to receive a deduction on a loss home personal belongings or otherwise you must file a claim with your home insurance company in a timely manner in most cases within 30 days of the incident. This includes your home insurance premium as well as any property losses you incur regardless of whether the losses are covered by homeowners insurance.

Is Home Insurance Tax Deductible Rocket Mortgage

Is Home Insurance Tax Deductible Rocket Mortgage

View solution in original post.

Can you claim home hazard insurance on your taxes. You generally need to be self-employed meaning you pay self-employment tax or otherwise own a business to claim the home office deduction. For a personal home homeowners insurance including hazard insurance is a personal expense and is not deductible. If you have a rental property you can deduct insurance as an expense insurance category but it would not be property taxes.

Most costs related to homeowners insurance are not tax-deductible on your federal tax return. Therefore if you pay 1000 a year in insurance payments the IRS allows you to reduce that tax years taxable income by 150. If you are filing your income tax returns as per the updated tax regime of 2020 you will not be able to claim the deductions possible on this policy.

The following table lists the circumstances when you can get a tax deduction for your home insurance premiums and the IRS forms to file. You can only deduct homeowners insurance premiums paid on rental properties. The Effect of Insurance Payments on Cost Basis For a home you declare as your primary residence when you sell it you may have to report gains over 250000 or 500000 if you are married and file.

Although you might pay them both keep in mind that mortgage insurance and homeowners insurance arent the same thing. If you own a rental home or vacation property for example hazard insurance on that property is deductible along with certain other expenses of buying maintaining repairing and advertising. Homeowners insurance protects you against loss from damage to the property.

For example you may elect not to rebuild your home after a fire. Keep in mind that you may need to obtain quotes for the repair work from several providers. However in order to ensure that your full deductible is eligible to be written off you must first calculate the specific value of casualty.

If the insurance is on your personal residence no. However if you are sticking to the tax system that allows deductions you can get the GST you pay on. It means you unfortunately cannot itemize any payments for home insuranceincluding fire theft and comprehensive coveragenor title insurance.

When the home insurance claim process works like that there is no risk that you will have to worry about paying taxes on your claim. Some add-ons like hazard insurance are also included in expenses you can deduct. In some cases the work is not done.

If the space you use for your home office accounts for 15 percent of your home you can deduct 15 percent of the flood insurance premiums you pay as a business expense. Insurance deductions are taken on Line 9 of Part I on Schedule E Supplemental Income and Loss. Never is homeowners insurance tax deductible your main home.

Many lenders make sure the hazard insurance premiums are paid by including the cost of the premium along with property taxes in the monthly. For example if you suffer damage to property in your home and your claim for coverage is denied you can deduct it as a casualty loss on your tax return. You can qualify if you have self-employment income outside of your regular job but you can only deduct expenses related to your self-employment work.

The property damage or theft must also occur in a federally declared disaster area in order to qualify as tax-deductible. Though homeowners insurance is usually not tax-deductible you can get tax breaks for claims it wont pay or doesnt fully cover. Home insurance deductible tax write-offs are available.

Tax Deduction Tips For Homeowners In 2021 If You Re A Homeowner Should You Claim A Standard Home Decor Shops Homeowner Winter House

Tax Deduction Tips For Homeowners In 2021 If You Re A Homeowner Should You Claim A Standard Home Decor Shops Homeowner Winter House

A Brief On Homeowners Insurance Visual Ly Homeowners Insurance Homeowner Home Insurance

A Brief On Homeowners Insurance Visual Ly Homeowners Insurance Homeowner Home Insurance

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Home Ownership Tax Deductions Homeowners Insurance Coverage

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Home Ownership Tax Deductions Homeowners Insurance Coverage

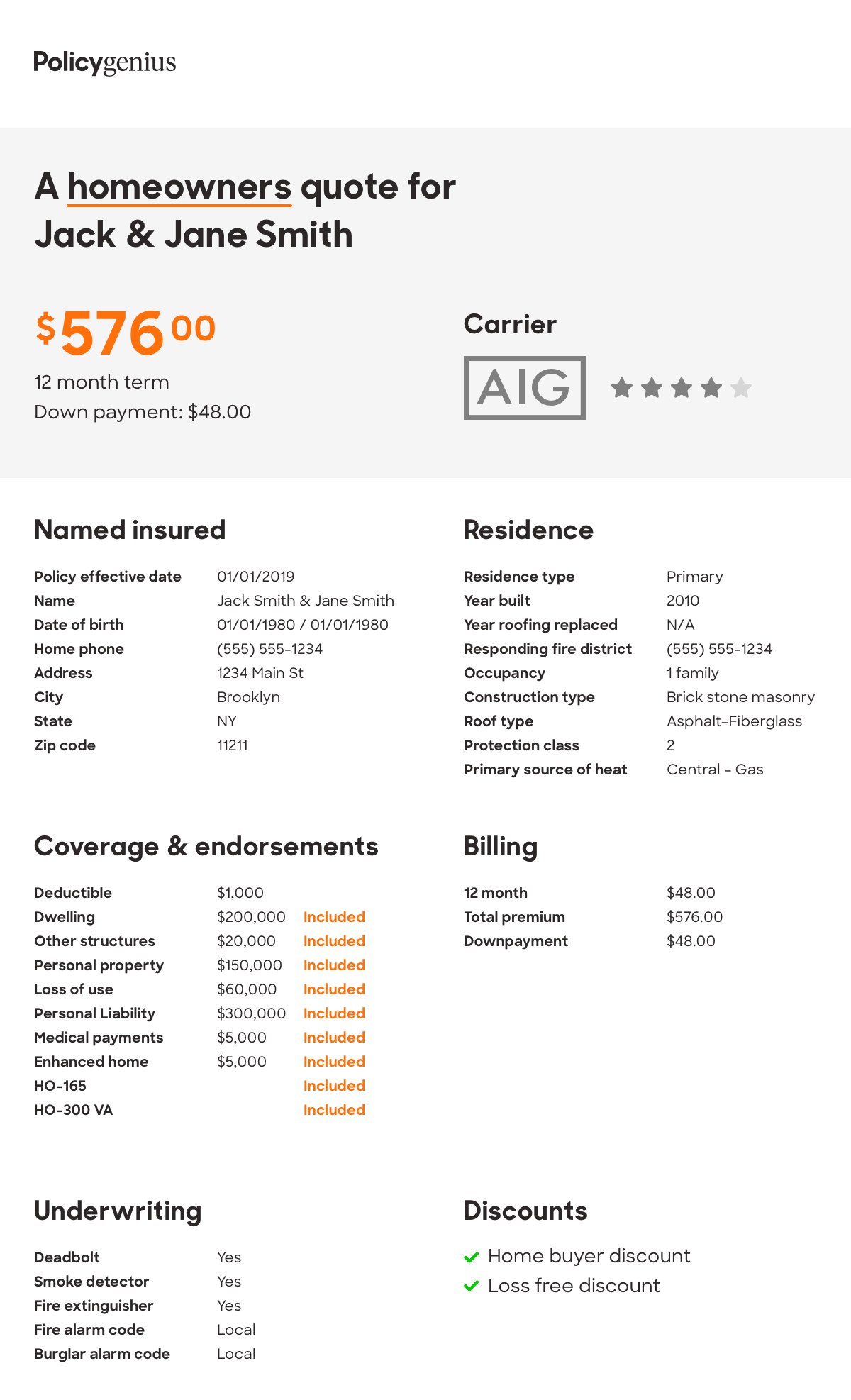

Understanding Your Home Insurance Declarations Page Policygenius

Understanding Your Home Insurance Declarations Page Policygenius

/house-model-and-key-in-home-insurance-broker-agent--hand-or-in-salesman-person--real-estate-agent-offer-house--property-insurance-and-security--affordable-housing-concepts-1076671916-586f4e8f2f994a5ca7518c675e7ae0e7.jpg) Is Homeowners Insurance Tax Deductible

Is Homeowners Insurance Tax Deductible

Pin On Real Estate Awesomeness

Pin On Real Estate Awesomeness

In202 Homeowner S Insurance Basics Homeowners Insurance Homeowner Homeowners Insurance Coverage

In202 Homeowner S Insurance Basics Homeowners Insurance Homeowner Homeowners Insurance Coverage

As A Home Owner Every Month Part Of Your Mortgage Payment Goes Into An Escrow Account This Part Are Homeowners Insurance Best Homeowners Insurance Homeowner

As A Home Owner Every Month Part Of Your Mortgage Payment Goes Into An Escrow Account This Part Are Homeowners Insurance Best Homeowners Insurance Homeowner

Can I Claim The Mortgage Interest Deduction Tax Deductions Home Ownership Homeowner Taxes

Can I Claim The Mortgage Interest Deduction Tax Deductions Home Ownership Homeowner Taxes

Publication 530 2014 Tax Information For Homeowners Business Budget Template Business Tax Deductions Tax Deductions

Publication 530 2014 Tax Information For Homeowners Business Budget Template Business Tax Deductions Tax Deductions

Is Hazard Insurance Tax Deductible What You Need To Know Clever Real Estate

Is Hazard Insurance Tax Deductible What You Need To Know Clever Real Estate

Rental Property Tax Deductions What You Should Know Smartasset Rental Property Homeowners Insurance Homeowner

Rental Property Tax Deductions What You Should Know Smartasset Rental Property Homeowners Insurance Homeowner

Can I Deduct Title Insurance On My Taxes Florida Title Insurance Title Insurance Business Insurance Insurance Meme

Can I Deduct Title Insurance On My Taxes Florida Title Insurance Title Insurance Business Insurance Insurance Meme

I Have Car Insurance Buy Health Insurance Cheap Health Insurance Rental Insurance

I Have Car Insurance Buy Health Insurance Cheap Health Insurance Rental Insurance

Hints On Filing Fire Insurance Claims Ehow Hazard Insurance Homeowners Insurance Homeowner

Hints On Filing Fire Insurance Claims Ehow Hazard Insurance Homeowners Insurance Homeowner

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Tax Deductions Deduction Mortgage Interest

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Tax Deductions Deduction Mortgage Interest

Thinking Of Renting Here Are A Few Tips Renting Rentersinsurance Apartment Condo Insurance Trustedchoice Renters Insurance Homeowners Insurance Renter

Thinking Of Renting Here Are A Few Tips Renting Rentersinsurance Apartment Condo Insurance Trustedchoice Renters Insurance Homeowners Insurance Renter

Is Homeowners Insurance Tax Deductible Homeowners Insurance Homeowner Tax Deductions

Is Homeowners Insurance Tax Deductible Homeowners Insurance Homeowner Tax Deductions

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home