Does Utah Charge Property Tax On Vehicles

In lieu of a property tax on motor vehicles Utah counties may impose a statewide uniform fee based on a vehicle s weight and age. Sections 59-12-103 and 59-12-104.

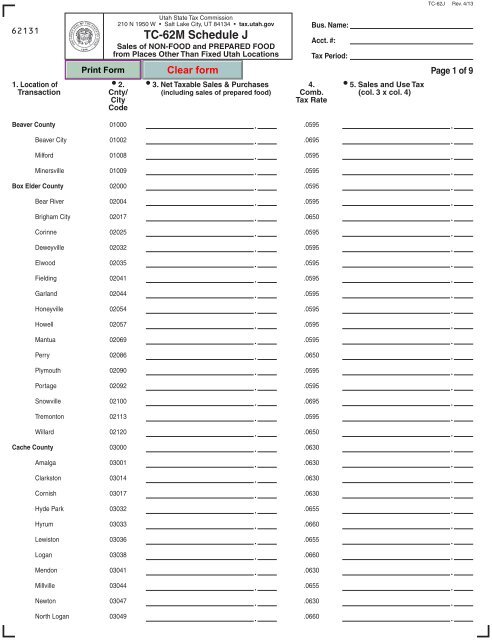

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Coming in with the 11th lowest property tax rate in the US Nevada residents.

Does utah charge property tax on vehicles. Personal property tax These taxes are usually paid yearly based on the current value of your car. Motor Vehicle Taxes Fees. The fee for cars and other vehicles 12000 pounds or less.

All other vehicles not listed under the age-based fee above are subject to the uniform fee in lieu of property tax which is 15 or 10 percent of the fair market value of vehicles as established by the Tax Commission. Note regarding online filing and paying. Generally most states base the registration fee for a vehicle on the vehicles weight model year or horsepower.

No sales or use tax is due on vehicles purchased in another state by a resident of that state and transferred into this state if all sales or use taxes required by the prior state for the purchase of the vehicle have been paid. To learn more see a full list of taxable and tax-exempt items in Utah. They conduct audits of personal property accounts in cooperation with county assessors statewide.

The taxes you pay on your state-registered vehicle in Utah is based on the age of the vehicle and therefore the perceived value of it. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge. While Utahs sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Trade-Ins Utah Residents. Low housing costs 141800 and a low effective property tax rate makes Arkansas one of the most affordable states to live for property owners. The Utah State Tax Commission defines tangible personal property as material items such as watercraft aircraft motor vehicles furniture and fixtures machinery and equipment tools dies patterns and stock in trade including supplies materials in process and other similar items as well as outdoor advertising structures and manufactured homes.

Tobacco Cigarette Taxes. Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

Sales and Use Taxes on Vehicles Purchased in Another State Pursuant to Utah Code Ann. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a 25000 vehicle. The fee is 100 per year upon registration of each motor vehicle except commercial vehicle registered as part of a fleet vehicles owned or leased by the state or its subdivisions and vehicles registered with a Purple Heart plate.

This page describes the taxability of leases and rentals in Utah including motor vehicles and tangible media property. About half of all states charge a vehicle property tax according to a 2019 WalletHub article. Subject to the 15 percent fee-in-lieu are medium and heavy duty trucks commercial trailers and vessels 31 feet and longer.

Other taxes and fees applicable to Utah car purchases. For motor homes and recreational vehicles the rate decreases to 75 of the first year amount as the vehicle ages. Part of your vehicles registration fee may include a personal property tax depending on the state in which you live.

The annual tax amounts range from 25 for vehicles valued up to 3999 to 1900 for vehicles valued over 9999999 Neb. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Section 41-1a-2061b of the Utah Code indicates the tax or fee is a lien on real property suffi cient to secure the pay- ment of the tax or fee.

Utah taxes vehicle purchases after rebates or incentives are applied to the price which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost 9000. The tax on vehicle valued at that amount is 220. This is defined as any movable man-made property such as your vehicle.

Personal Property Tax Included in Vehicle Registration Fee. Utah is also one of the 23 states with no personal property tax on vehicles. For security reasons our e-services are not available in most countries outside the United States.

Like most states Utah levies a tax on personal property. For passenger motor vehicles including recreational vehicles and motor homes the tax ranges from 15 to 1760 depending on weight. Code 60-3184-3 60-3 188.

The following scenarios illustrate how dealers handle trade- ins for vehicles subject to the 15 percent uniform fee. If you owe an excise or personal property tax youll generally be sent a tax. The tax ranges between 10 to 125 depending on the type of vehicle and its age.

Utah Llc How To Form An Llc In Utah Truic Guides

Utah Property Taxes Utah State Tax Commission

Utah Property Taxes Utah State Tax Commission

Utah State Tax Commission Official Website

Utah State Tax Commission Official Website

Https Tax Utah Gov Forms Pubs Pub 36 Pdf

Home Utahcounty Gov The Official Website Of Utah County Government

Https Tax Utah Gov Esu History History Pdf

How To Get A Sales Tax Exemption Certificate In Utah

How To Get A Sales Tax Exemption Certificate In Utah

Https Le Utah Gov Lrgc Briefings Briefingpaperpropertytaxhistorysept2010 Pdf

Tc 40 Instructions Utah State Tax Commission Utah Gov

Tc 40 Instructions Utah State Tax Commission Utah Gov

Https Tax Utah Gov Forms 2010 Tc 40inst Pdf

Environmental Lawyer In Salt Lake City Family Law Attorney Business Lawyer Litigation Lawyer

Environmental Lawyer In Salt Lake City Family Law Attorney Business Lawyer Litigation Lawyer

Redacted Plr 11 007 Request And Response Ltrs Utah State Tax

Redacted Plr 11 007 Request And Response Ltrs Utah State Tax

Http Tax Utah Gov Forms Pubs Pub 23 Pdf

Tc 305 Utah State Tax Commission

Tc 305 Utah State Tax Commission

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax On Cars Everything You Need To Know

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home