Utah Property Tax On Second Home

As of 2020 it is the same as the regular state income tax rate of 495. If you are considering purchasing a property in Utah home condo or land.

8 Tips To Spot A Potential Investment Property Investment Property Buying Investment Property Real Estate Investing Rental Property

8 Tips To Spot A Potential Investment Property Investment Property Buying Investment Property Real Estate Investing Rental Property

Capital Gains Tax Rate in the State of Utah.

Utah property tax on second home. Residential property in Utah receives a 45 property tax exemption. Your local tax rates apply to that taxable value. Tax amount varies by county.

In Park City Utah for example people who own a secondary home in the popular ski destination pay roughly twice what full-time residents pay 1 percent. The assessed value does not change upon the sale of your property. DISABLED VETERAN PROPERTY TAX ABATEMENT.

How much is the capital gains tax in Utah. This is because Utah is a non-disclosure state so sales are not reported to the County Assessor. If you rented out your second home for profit gain usually is taxed as capital gain.

Residents who say Utahs second-home tax rules are unfair are gearing up for a legal challenge. If the buyer is planning to make their Washington County home their PRIMARY RESIDENCE then the homeowner will pay only 55 of that tax amount so they will receive a 45 exemption as a primary resident. Counties in Utah collect an average of 06 of a propertys assesed fair market value as property tax per year.

There are more than 1000 different property tax areas in Utah. The Veterans disability rating must be at least 10 in order to qualify for this abatement. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Utah is ranked number thirty two out of the fifty states in order of the average amount of property taxes collected. Under the states taxing rules those who own two residences are levied almost 30 percent more for their secondary residences which include summer cabins vacation homes and condominiums that arent rented to others. The part of the gain you can attribute to depreciation is taxed at a maximum rate of 28.

You may be able to save money. 06 of home value. You will pay taxes based on this assessed value at a tax rate that varies from county to county depending on local programs bonds etc.

If you own vacant land or an investment or second home your property will be taxed at 100 of the assessed value. The deadline to appeal property taxes is in September in many areas. If you owned your second home for more than a year any capital gain will be taxed according to the long-term capital gains tax rates which are 0 15 or 20.

Thus if the market value of your home is 100000 the taxable value is just 55000. A Utah permanent place-of-residence property tax abatement that uses the VAs percentage-rating for a service-connected disability is available for disabled Veterans or for their un-remarried widows or minor orphans. When required to pay a capital gains tax Utah residents may be eligible for a 5 tax credit.

If you used the home for personal purposes and rented it. The median property tax in Utah is 135100 per year for a home worth the median value of 22470000. If you own vacant land or an investment or second home your property will be taxed at 100 of the assessed value.

If the buyer plans to use the home as a vacation home or a second home that homeowner will pay 100 of the assessed market value tax. The good news is that the Utah state capital gains tax is simple to calculate. A second home generally offers the same tax advantages and deductions as your first home as long as you use it as a personal residence.

With the decline in property values it may be worth appealing your property tax value to make sure you are paying the correct property tax amount. If you stay at the property for more than 14 days per year or more than 10 of the total days in which the property was rented then the second home is. How To Estimate Your Park City Area Property Taxes.

Column Fives Josh Ritchie gives us details on how frequency of use of second properties may impact how you report property taxes. Taxpayers who buy or bought a property after that point can deduct interest for mortgage loans of up to 750000 or. The Tax Cuts and Jobs Actthe tax reform package passed in December 2017lowered the maximum for the mortgage interest deduction.

The assessed value does not change upon the sale of your property because Utah is a non-disclosure state and sales are not reported to the county Assessor. So you can deduct the loss. Utah Property Tax Rates.

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Top 4 High Speed Tactics For Utah Homes For Sale Utah Homes For Sale Assisted Living Property Management

Top 4 High Speed Tactics For Utah Homes For Sale Utah Homes For Sale Assisted Living Property Management

9 Question And Answers To Understand About Utah Construction Liens Gary Buys Houses This Or That Questions Utah Selling Strategies

9 Question And Answers To Understand About Utah Construction Liens Gary Buys Houses This Or That Questions Utah Selling Strategies

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp In 2020 Mortgage Escrow Property Tax

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp In 2020 Mortgage Escrow Property Tax

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Utah Property Taxes Utah State Tax Commission

Utah Property Taxes Utah State Tax Commission

Guide To Buying A Vacation Property In Park City Utah

Guide To Buying A Vacation Property In Park City Utah

8 Questions To Ask Yourself Before Buying A Second Home Vacation Home Rentals Vacation Property Heron House

8 Questions To Ask Yourself Before Buying A Second Home Vacation Home Rentals Vacation Property Heron House

Inherit Law In Utah 7 Things You Should Know Gary Buys Houses Estate Planning Inheritance Tax Avoid Foreclosure

Inherit Law In Utah 7 Things You Should Know Gary Buys Houses Estate Planning Inheritance Tax Avoid Foreclosure

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Residential Property Declaration

5382 W North Lilac Ave West Jordan Ut 84081 Local Real Estate Real Estate Marketing Real Estate

5382 W North Lilac Ave West Jordan Ut 84081 Local Real Estate Real Estate Marketing Real Estate

The Do S And Don Ts Of A 1031 Exchange In Utah

The Do S And Don Ts Of A 1031 Exchange In Utah

Http Tax Utah Gov Forms Pubs Pub 27 Pdf

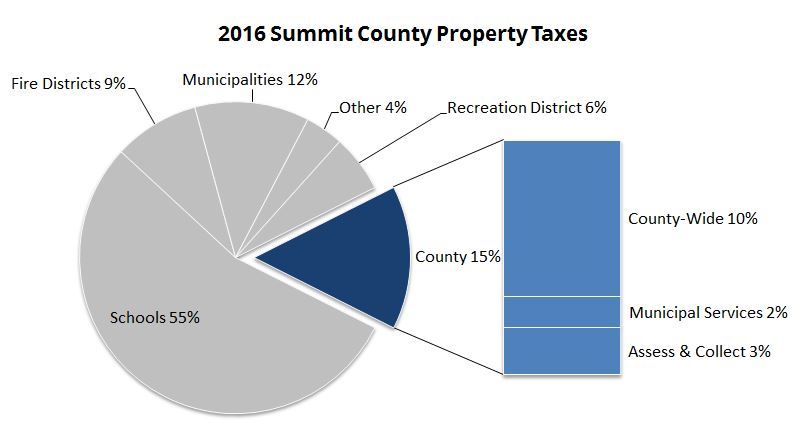

Your 2018 Summit County Utah Property Taxes Explained

Your 2018 Summit County Utah Property Taxes Explained

Traditional Lenders And Banks Limit Your Options As Far As The Amount Of Investment Properties You Can Property Investor Real Estate Investing Home Financing

Traditional Lenders And Banks Limit Your Options As Far As The Amount Of Investment Properties You Can Property Investor Real Estate Investing Home Financing

Your 2018 Summit County Utah Property Taxes Explained

Your 2018 Summit County Utah Property Taxes Explained

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home