Property Tax For Franklin County Ohio

This is also known as payment arrears For example. Annual Interest Rate By October 31 of each year the interest rate that will apply to overdue municipal income taxes during the next calendar year will be posted herein as required by Ohio Revised Code Section 71827F.

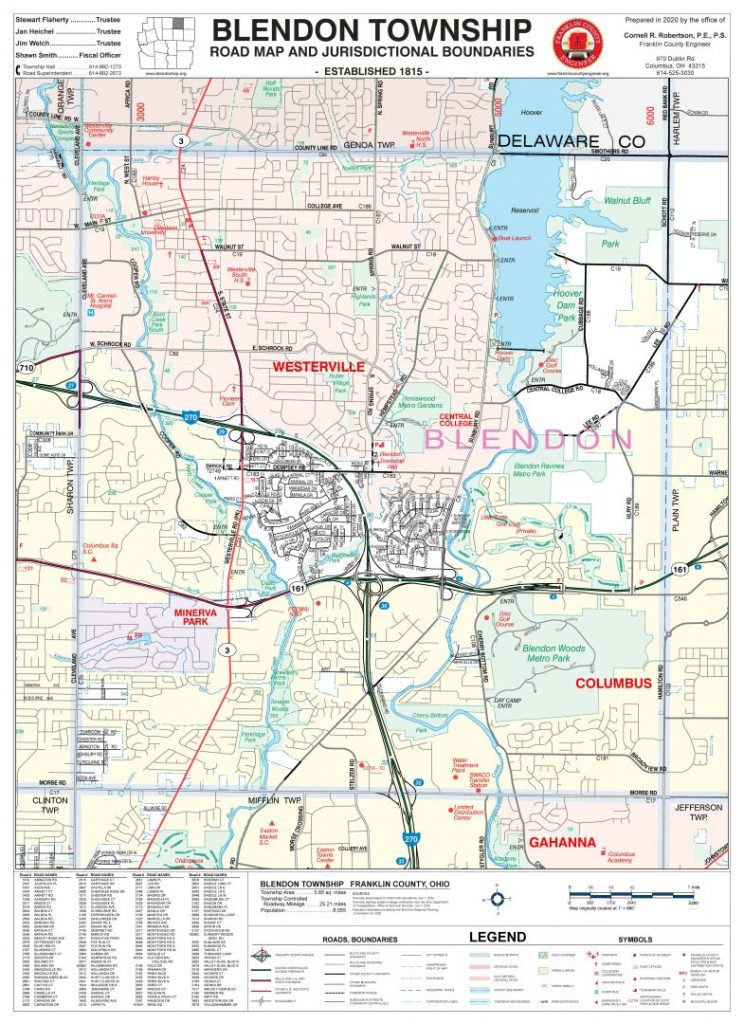

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

If either January 20th or.

Property tax for franklin county ohio. If you have any issues or questions contact Customer. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. 123 Main Parcel ID Ex.

This estimator is provided to assist taxpayers in making informed decisions about real estate taxes and to anticipate the impact of property value fluctuations. Your payment will be considered accepted and paid on the submitted date. Unpaid Current Taxes 000.

Real Estate property taxes are due semi-annually each January 20th and June 20th. The County assumes no responsibility for errors. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Franklin County Tax Appraisers office.

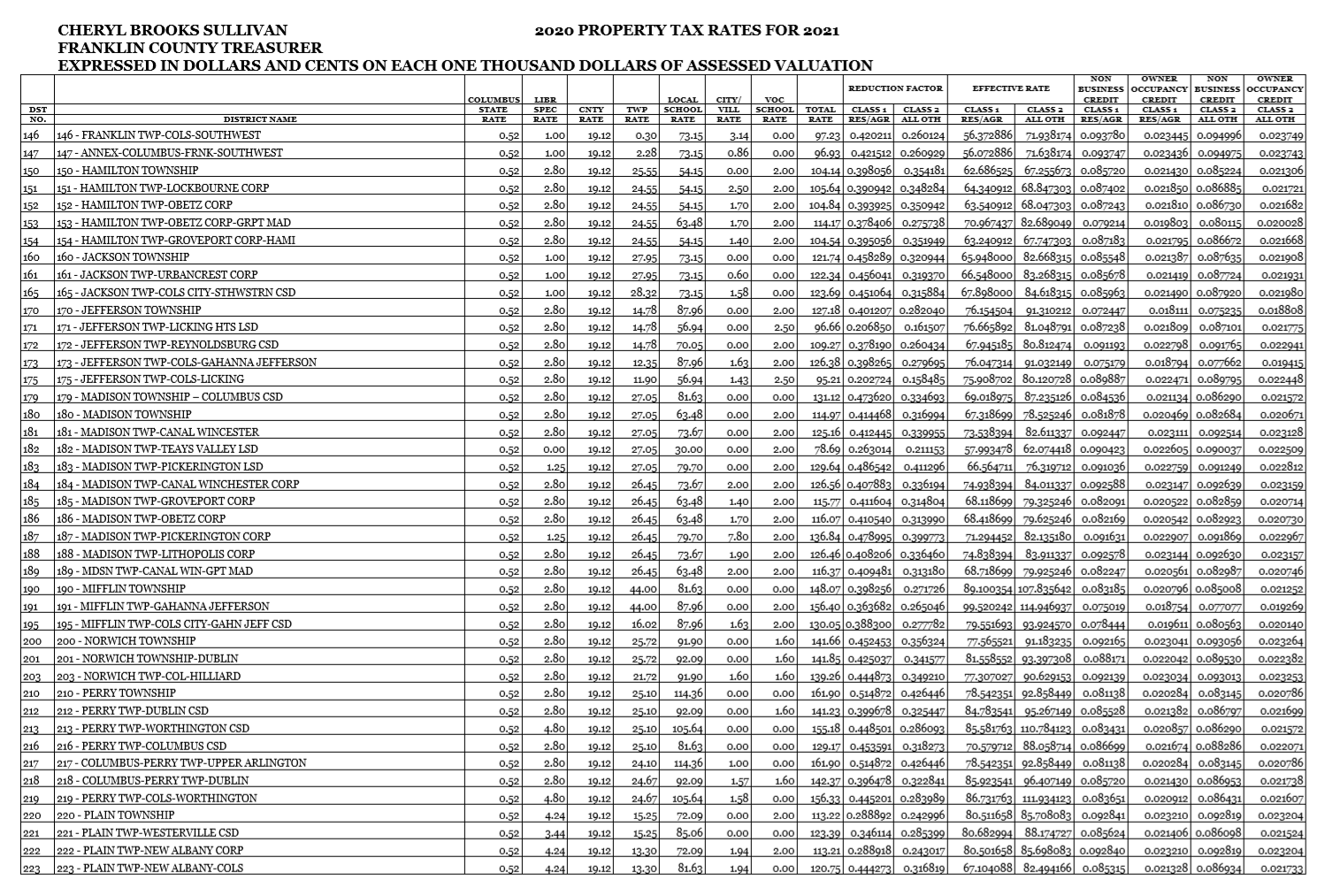

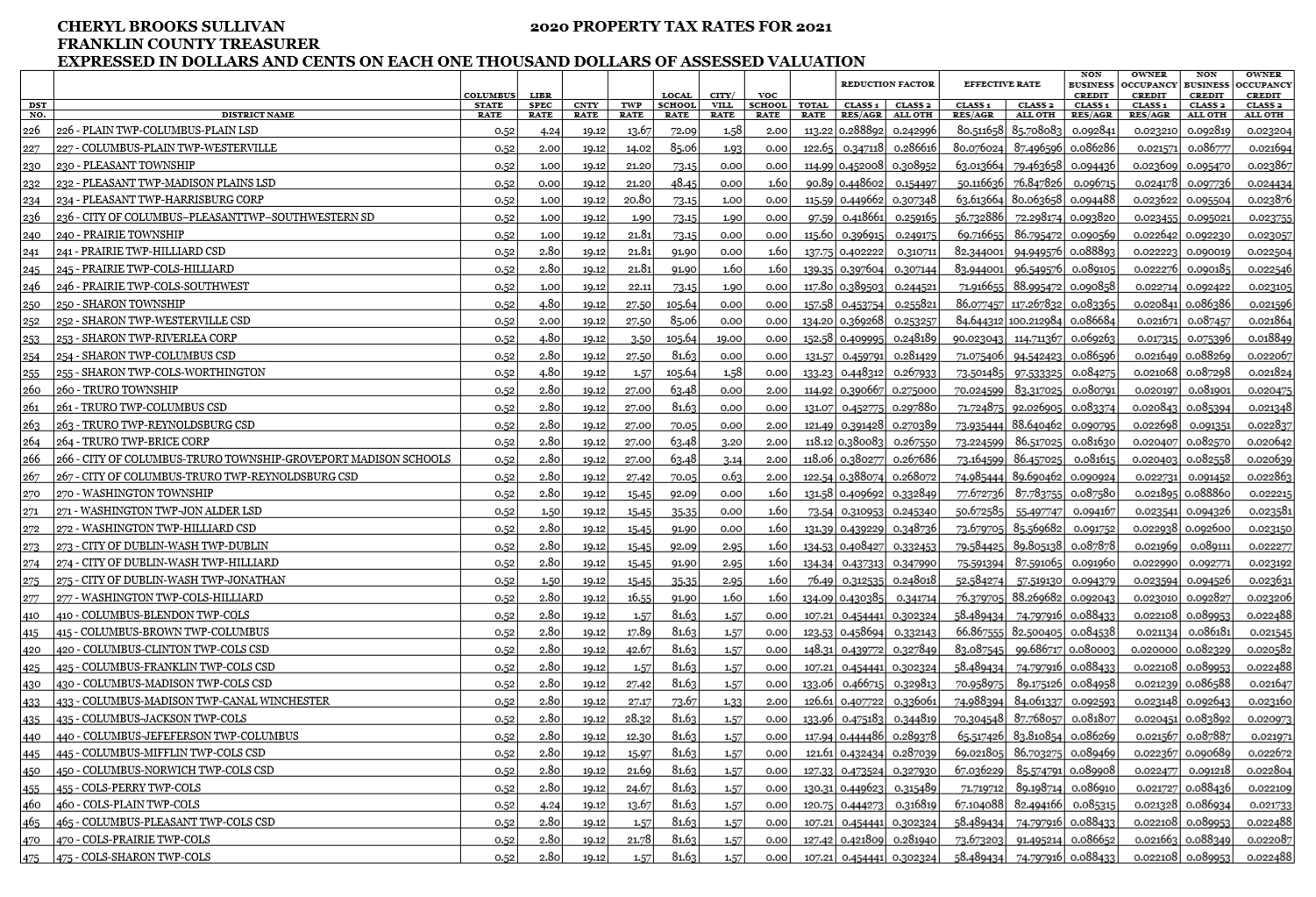

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Tax rates are established for the next year by the State of Ohio Department of Taxation. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes. PAY TAXES ONLINE To pay your taxes by credit card or eCheck click the button below. PAY TAXES ONLINE.

A decision by the Franklin County Board of Revision to change a value based on a filed complaint. Search for a Property Search by. The Homestead Exemption program assists senior and disabled citizens in Franklin County by providing a substantial tax savings on the real estate or manufactured home taxes.

Pay your real estate taxes online by clicking on the link below. Please note that it usually takes the County Treasurer 2-4 days to process your payment once it is made. Prior Penalty and Interest Charged - Special Assessment 000.

Franklin County Real Estate Tax Payment. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments. Delinquent Tax - Special Assessment 000.

Please reference our Franklin County OLP Portal User Guide. When are real estate taxes due in Franklin County Ohio. The median property tax on a 15530000 house is 211208 in.

Prior Penalty and Interest Charged. This is the State of Ohio Application for Real Property Tax Exemption and Remission More. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

John Smith Street Address Ex. In-depth Franklin County OH Property Tax Information. The following provides you with information on property tax payments.

If you have any questions or need assistance with your city taxes please call the Franklin Income Tax Division at 937-746-9921. However it may take 2-4 business days for processing. The median property tax on a 15530000 house is 259351 in Franklin County.

The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. The Franklin County Treasurers Office wants to make paying your taxes as easy as possible. Taxes collected in 2021 represent the real estate tax obligations from 2020.

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance for which you may be entitled. They are computed in strict accordance with procedures required by the Division of Tax Equalization Ohio Department of Taxation. Pay Franklin County Ohio property taxes online using this service.

The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County. Please note you cannot use home equity line of credit checks or money market account to make an online payment. Use this inquiry search to access Franklin Countys real estate tax records.

The median property tax also known as real estate tax in Franklin County is 259200 per year based on a median home value of 15530000 and a median. Tax rates are determined by the budgetary request of each governmental unit as authorized by the vote of the people. Franklin County collects on average 167 of a propertys assessed fair market value as property tax.

The Treasurers Office collects real estate taxes for the previous year during the current year.

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Map Of Franklin Co Ohio Library Of Congress

File Tn Williamson County Boundary Map Jpg Genealogy Williamson County Franklin Tennessee County

File Tn Williamson County Boundary Map Jpg Genealogy Williamson County Franklin Tennessee County

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Horse Property For Sale In Clermont County Ohio New Offering This Property Is Being Made Available For Purc Horse Property Horse Facility Equestrian Estate

Warehouses Will Total 1 5 Million Square Feet Canal Winchester Sidewalk Repair Parks Department

Warehouses Will Total 1 5 Million Square Feet Canal Winchester Sidewalk Repair Parks Department

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home