Property Tax Bill Utah County

Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Determine the market value of property.

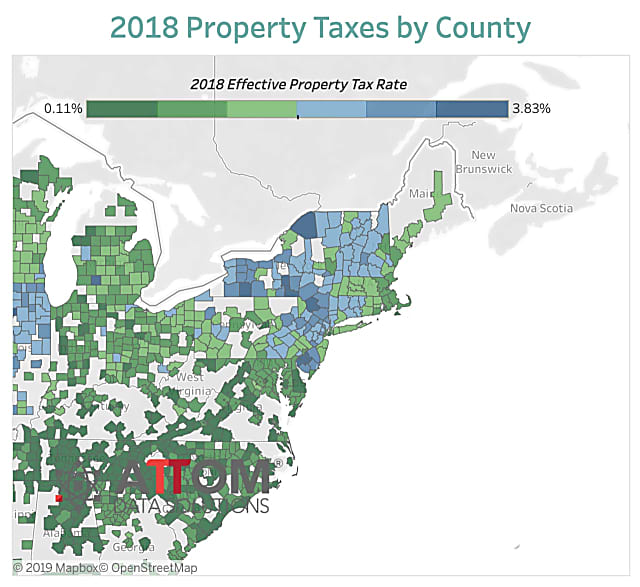

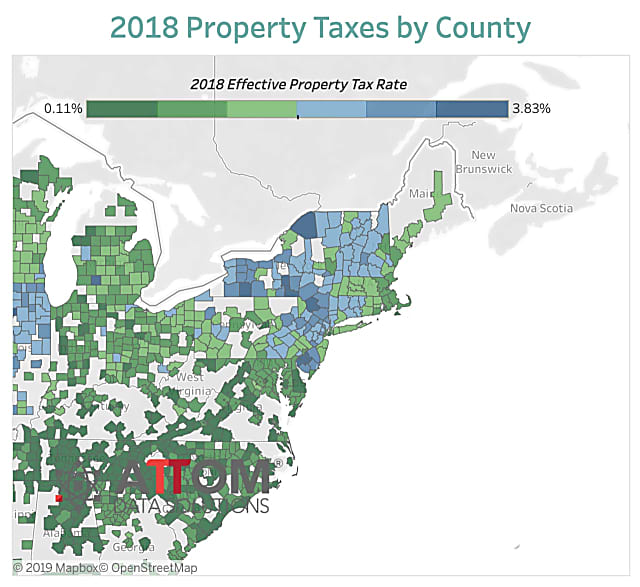

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Tax bills reflecting the spring and fall installments of Bartholomew County property taxes will be mailed out Thursday April 15.

Property tax bill utah county. Levy the property tax. 100 East Center Street Suite 1200 Provo Utah 84606 Phone Number. Interested in property taxes.

197 East Tabernacle St. 2 days agoLake County is back to a standard two-payment procedure for property tax bills. They conduct audits of personal property accounts in cooperation with county assessors statewide.

What You Need To Pay Online. Welcome to the Summit County Treasurers Office. We welcome your comments and suggestions so please email us.

For more information visit the Assessors web site and click on Assessment of Salt Lake County document. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Last year a four-payment option was enacted by the Lake County Board as.

Determine the tax rates. Process refunds of overpaid property taxes. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Online REAL Estate Property Tax Payment System. Enter Parcel Number with or without dashes Parcel Number. In-depth Utah County UT Property Tax Information In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The Assessors Office estimates the fair market value of each property. Dont know your Parcel Number. The Recorders Office and the Surveyors Office records the boundaries and ownership of each property in the county.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. 801-851-8255 100 E Center Street Suite 1200 Provo Utah 84606 M - F 800 - 500. Pay Property Tax Online.

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Publish a listing of delinquent taxes on an annual basis. Bill or collect Personal Property Taxes.

100 East Center Street Suite 1200 Provo Utah 84606 Phone. Are you looking for Tax Notice Information. You will need your property serial numbers.

Final Deadline for 2020 Tax Relief Applications. Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday. The spring installment must be paid no later than Monday May 10.

Property taxes in Utah are managed through the collaborative effort of several elected county offices. Kane County Property Tax Inquiry. George UT 84770 Phone.

Monday - Friday 800 am - 500 pm. Receipt and deposit funds from various County departments The Cache County Treasurer does not. If you do not have these please request a duplicate tax notice here.

Founded in 1850 Weber County occupies a stretch of the Wasatch Front part of the eastern shores of the Great Salt Lake and much. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you pay property taxes on 55 of your homes value. Reprint Your Tax Notice.

Upcoming Property Tax Dates. Or Owner Name as listed on tax bill. We are pleased to help the citizens taxpayers and stakeholders of Summit County with their property tax information and payment needs.

Comments or Concerns on ValueAppraisal - Assessors Office DocumentsOwnerParcel information - Recorders Office Address Change for Tax Notice. The ClerkAuditors Office calculates the property tax rate based on budget requirements and the total. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

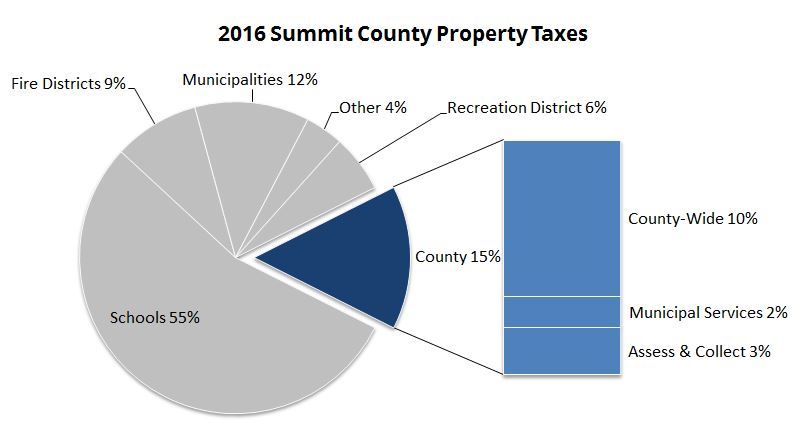

Your 2018 Summit County Utah Property Taxes Explained

Your 2018 Summit County Utah Property Taxes Explained

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Property Taxes When To Consider An Appeal Choose Park City Real Estate

Property Taxes When To Consider An Appeal Choose Park City Real Estate

Chart 4 South Dakota Local Tax Burden By County Fy 2015 Jpg South Dakota Dakota Burden

Chart 4 South Dakota Local Tax Burden By County Fy 2015 Jpg South Dakota Dakota Burden

Chart 4 Wyoming Local Tax Burden By County Fy 2016 Jpg Wyoming Burden Tax

Chart 4 Wyoming Local Tax Burden By County Fy 2016 Jpg Wyoming Burden Tax

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Http Keystoneresearch Org Sites Default Files Krc Whopayspt 0 Pdf

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Opinion Utah S Legislative Session Continues This Week Here S What To Watch In 2021 Legislative Equal Rights Amendment Utah County

Opinion Utah S Legislative Session Continues This Week Here S What To Watch In 2021 Legislative Equal Rights Amendment Utah County

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Prepay Coupons Utah County Treasurer

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home