Property Tax In Utah 2019

15 feet or more in length but less than 19 feet in length. File electronically using Taxpayer Access Point at taputahgov.

Property Taxes Sandy City Ut Official Website

These schedules are to be used to establish taxable value for personal property in the 2019 assessment year.

Property tax in utah 2019. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Property Tax Division of the Utah State Tax Commission 2019 UT App 87. Utah Code 41-1a-1206 and others.

How does Utah rank. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Total rates in Utah county which apply to assessed value range from.

The median property tax in Utah is 135100 per year for a home worth the median value of 22470000. The various taxes and fees assessed by the DMV include but are not limited to the following. Utah Income Taxes Utah State Tax Commission Official income tax website for the State of Utah with information about filing and paying your Utah income taxes and your income tax refund.

Counties in Utah collect an average of 06 of a propertys assesed fair market value as property tax per year. UTAH PROPERTY TAX 2019 ANNUAL STATISTICAL REPORT For Locally Assessed Real Property Locally Assessed Personal Property for tax year 2019 Centrally Assessed Property Motor Vehicle Prepared By. 058 average effective rate.

2019 tax rates by tax area utah state tax commission property tax division tax area 001 - 0000 1010 beaver 0001181 0001581 0001581 1015 multicounty assessing collecting levy 0000009 0000009 0000009 1020 county assessing collecting levy 0000332 0000332 0000332 2010 beaver county school district 0005819 0006163 0006163. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Sales taxes in Utah range from 610 to 905 depending on local rates.

In that case which In that case which involved a late filed appeal of a centrally assessed property tax assessment under Utah Code Sec. Utah is ranked number thirty two out of the fifty states in order of the average amount of property taxes collected. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

The first step towards understanding Utahs tax code is knowing the basics. Tax amount varies by county. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

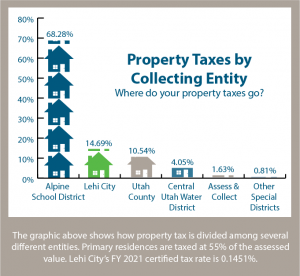

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Please click on each item for more information. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you pay property taxes on 55 of your homes value.

UTAH STATE TAX COMMISSION Property Tax Division 2019 LIST OF FINAL VALUES All TAX ENTITIES BY ENTITYBY PROPERTY TYPE 01 3010 BEAVER BEAVER CITY TOTAL REAL PROPERTY 162651415 TOTAL CENTRALLY ASSESSED VALUES 6621639 Primary Residential 16052647 Secondary Residential 3049900 Commercial and Industrial 9083226 FAA 569298. 27 feet or more in length but less than 31 feet in length. Monday - Friday 800 am - 500 pm.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. UTAH STATE TAX COMMISSION PROPERTY TAX DIVISION 2019 Recommended Personal Property Valuation Schedules The Recommended Personal Property Valuation Schedules presented herein are contained in Administrative Rule 884-24P-33. Below we have highlighted a number of tax rates ranks and measures detailing Utahs income tax business tax sales tax and property tax systems.

That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median. PROPERTY TAX DIVISION UTAH STATE TAX COMMISSION 210 NORTH 1950 WEST SALT LAKE CITY UT 84134 801 297-3600 wwwpropertytaxutahgov August 1 2020. Due Date for 2020 taxes to avoid additional penalties interest.

Each states tax code is a multifaceted system with many moving parts and Utah is no exception. 19 feet or more in length but less than 23 feet in length. The state of Utah has a single personal income tax with a flat rate of 495.

15 Penalty Added Interest Begins to Accrue September 1 2021. File electronically using Taxpayer Access Point at taputahgov. 23 feet or more in length but less than 27 feet in length.

100 East Center Street Suite 1200 Provo Utah 84606 Phone. The median annual property tax paid by homeowners in Utah County is 1517. 3110 cents per gallon of regular gasoline and diesel.

Deadline for 2021 Tax.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Holladay Utah Home Sales Sale House Real Estate New Homes

Holladay Utah Home Sales Sale House Real Estate New Homes

What Would It Take For Utah To Climb To 1 In The Kids Count Child Well Being Ranking Counting For Kids Birth Weight Children

What Would It Take For Utah To Climb To 1 In The Kids Count Child Well Being Ranking Counting For Kids Birth Weight Children

Utah Property Taxes Utah State Tax Commission

Utah Property Taxes Utah State Tax Commission

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Renting Vs Buying A Home Mckadie Jo Utah Realtor Era Brokers Consolidated Real Estate Tips Rent Vs Buy Real Estate Advice

Renting Vs Buying A Home Mckadie Jo Utah Realtor Era Brokers Consolidated Real Estate Tips Rent Vs Buy Real Estate Advice

Utah Property Taxes Utah State Tax Commission

Utah Property Taxes Utah State Tax Commission

Tax Return Preparation Tax Lawyer Tax Attorney Family Law Attorney

Tax Return Preparation Tax Lawyer Tax Attorney Family Law Attorney

Property Taxes Sandy City Ut Official Website

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Sales Tax Changes In Your State For Property Management Software Rentec Blogengage Sales Tax Property Management Tax Software

Sales Tax Changes In Your State For Property Management Software Rentec Blogengage Sales Tax Property Management Tax Software

Property Taxes Sandy City Ut Official Website

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

The Best States To Retire For Taxes Smartasset Com Retirement Income Tax Brackets Inheritance Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home