Are Property Taxes High In Utah

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Generally the amount is very close to 1 of the assessed value for the current year as a real estate agent I always provide my buyers with the current assessed value of.

Utah Property Taxes Utah State Tax Commission

Utah Property Taxes Utah State Tax Commission

In Ohio the tax property rate is the 12th highest in the country at 156.

Are property taxes high in utah. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. Property taxes help to pay for a variety of public services. The exact property tax levied depends on the county in Utah the property is located in.

One of every nine proposed tax hikes in Utah. The first step towards understanding Utahs tax code is knowing the basics. How does Utah rank.

That means a typical Utah homeowner can expect to pay about 580 in property taxes each year for every 100000 in home value. Census Bureau data to determine real estate property. Rather the base property tax revenue is the same from the prior year.

Each states tax code is a multifaceted system with many moving parts and Utah is no exception. Among the states 15 largest cities those with the highest overall property taxes generally are Ogden Salt Lake City and West Valley City in that order. The lowest taxes generally are in.

They combined to give Eastman and his neighbors the worst news among Utahns as annual property tax bills arrived during the past two weeks. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you pay property taxes on 55 of your homes value. To determine the residents with the biggest tax burdens WalletHub compared the 50 states across the three tax types of state tax burdens property taxes individual income taxes and sales and excise taxes as a share of total personal income in the state.

Information about personal property taxes in Utah. The average effective property tax rate in the Beehive State is just 058. A median house in Ohio valued at 129900 brings in 2032 in property taxes.

Property tax notices which must be mailed by Nov. Below we have highlighted a number of tax rates ranks and measures detailing Utahs income tax business tax sales tax and property tax systems. 1 will show those cities and towns are doubling their property taxes or more.

In order to rank property taxes by state from highest to lowest researchers compared all 50 states and the District of Columbia using US. This year the states with the best scores on the property tax component are New Mexico Indiana Utah Idaho Arizona and North Dakota. Taxes in that community are 2135 on a 200000 home.

Utahs property taxes are very low. The value and property type of your home or business property is determined by the Salt Lake County Assessor. Utah 06 41 Wyoming 058 42 New.

Total rates in Utah county which apply to assessed value range. On the other end of the spectrum Connecticut Vermont New Jersey New York the District of Columbia Massachusetts and Illinois had the lowest scores on the property tax component. But in California the tax.

Assuming everything else remains equal an increase in property value would mean a decrease in the tax rate and therefore the total dollar amount in taxes. A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Summit County collects the highest property tax in Utah levying an average of 192100 039 of median home value yearly in property taxes while Rich County has the lowest property tax in the state collecting an average tax of 42200 035 of median home value per year.

That is the sixth-highest figure among Utah counties but is still more than 1000 less than the national median. Note that home values in. 52 rows The total property tax as a percentage of state-local revenue is 1693 while the property.

In Utah additional property tax revenue is not a simple matter of raising property values to increase revenue. The median annual property tax paid by homeowners in Utah County is 1517. St George Utah Property Tax Rates Back to the St George property tax calculation.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

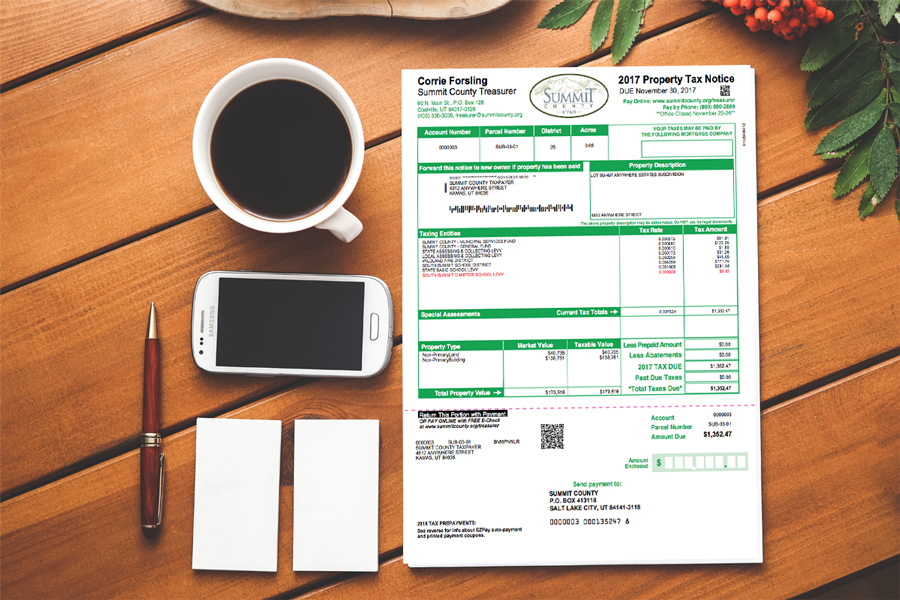

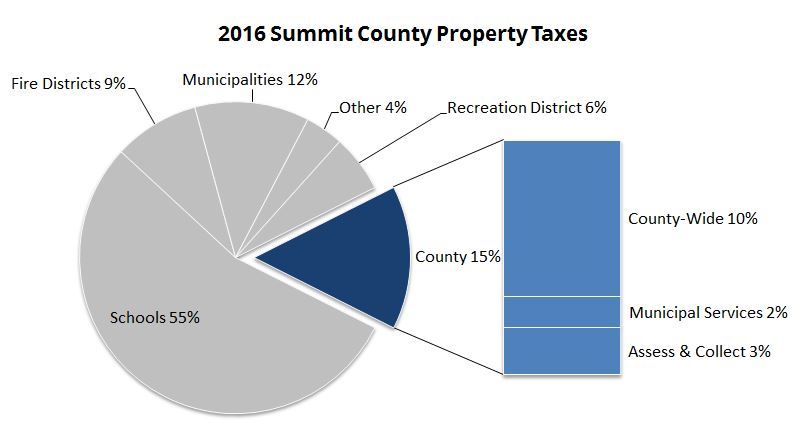

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

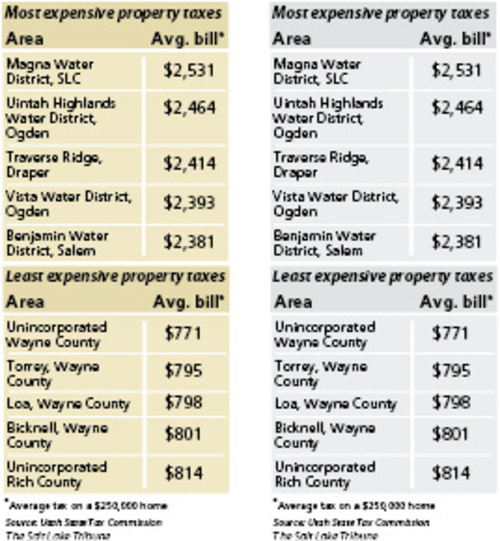

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Where Utah Taxes Are Highest Lowest The Salt Lake Tribune

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

/cdn.vox-cdn.com/uploads/chorus_image/image/65936587/1519399.0.jpg) Utah County Votes To Raise Property Taxes For First Time In 23 Years Deseret News

Utah County Votes To Raise Property Taxes For First Time In 23 Years Deseret News

Your 2018 Summit County Utah Property Taxes Explained

Your 2018 Summit County Utah Property Taxes Explained

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

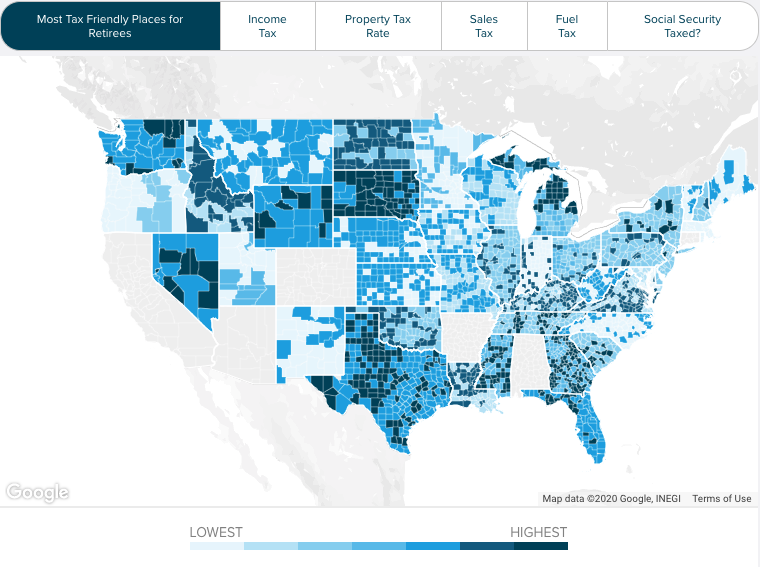

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Family Law Attorney

Estates And Trust Services 801 676 5506 Free Consultation Tax Lawyer Inheritance Tax Family Law Attorney

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Top 5 Reasons To Use Property Management In Utah Property Management Utah Management

Top 4 High Speed Tactics For Utah Homes For Sale Utah Homes For Sale Assisted Living Property Management

Top 4 High Speed Tactics For Utah Homes For Sale Utah Homes For Sale Assisted Living Property Management

Charitable Contributions For Taxes Tax Lawyer Tax Attorney Family Law Attorney

Charitable Contributions For Taxes Tax Lawyer Tax Attorney Family Law Attorney

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

To Address Intergenerational Poverty In Utah The Intergenerational Welfare Reform Commission And Advisory Committee Have A Share Poverty Year Plan How To Plan

To Address Intergenerational Poverty In Utah The Intergenerational Welfare Reform Commission And Advisory Committee Have A Share Poverty Year Plan How To Plan

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home