How To Look Up Property Taxes Nj

See New Jersey tax rates tax exemptions for any property the tax. Property Tax New Jerseys property tax is assessed on an annual basis by the local assessor then submitted to their county board of taxation.

In fact rates in some areas are more than double the national average.

How to look up property taxes nj. DOS Home New Jersey State Archives Search the Collections Catalog County Government Records. PROPERTY TAX DUE DATES. Overview of New Jersey Taxes.

Property tax information property ownership records deeds tax liens and more. New Jersey Department of The Treasury Property Records httpwwwstatenjustreasurytaxationlptlocaltaxshtml Search New Jersey Department of the Treasury property assessment records database by county district and block and lot number. Property records are updated on a weekly basis.

This data contains the collection of those lists filed in January of each new calendar year. If this is your first time filing a tax return with New Jersey you cannot use this portal to make a payment. View tax assessment records for free.

NETR Online Public Records Search Records Property Tax Property Search Assessor Public Records Online Directory The Public Records Online Directory is a Portal to official state web sites and those Tax Assessors and Recorders offices that have developed web sites for the retrieval of available public records over the Internet. Vineland joins lawsuit to make hospitals other facilities pay property taxes - Flipboard. Individuals can go here to make a payment if their unpaid balance is not yet listed on this site.

The assessed value is determined by the Tax Assessor. This page also allows Employers to look up and pay past-due Income Tax. Heres the calculation for a sample property with a 300000 assessment in a town with a 350 tax rate.

Your Ultimate NJ Property Records Source. Homeowners in New Jersey pay the highest property taxes of any state in the country. Just type in a single property address and a property report will be pulled up containing.

Google Translate is an online service for which the user pays nothing to obtain a. Assessed Value x Tax Rate Tax Bill. The tax rate is set and certified by the Hudson County Board of Taxation.

Use our free New Jersey property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Navigating our database of property tax records is done with ease. New Jersey Property Taxes By County You can choose any county from our list of New Jersey counties for detailed information on that countys property tax and the contact information for the county tax assessors office.

This page is for Income Tax payments filings and inquiries - as well as for repayments of excess property tax relief benefits Senior Freeze or Homestead BenefitIt cannot be used to make Inheritance or Estate Tax payments. Levering data from official sources we provide additional data beyond other sites such as the Monmouth Tax Board web application. See what the tax bill is for any New Jersey property by simply typing its address into a search bar.

In-depth Property Tax Information. NJ Division of Taxation Property Administration PO Box 251 Trenton NJ 08695-0251. New Jersey Property Tax Search by Address.

On each property report will display all property tax data and information we have on the property in question. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. Go here if you want to pay other taxes online.

Our property records tool can return a variety of information about your property that affect your property tax. Alternatively you can find your county on the New Jersey property tax map found at the top of this page. Union County Declaration of Intention 1885.

In some counties deeds and mortgages are filed by. Once the tax rate is set the municipal tax collector calculates the taxes on each parcel of land using the formula below. The average effective property tax rate in New Jersey is 242 compared to the national average of 107.

Any changes like ownership transfer that occur after that date will not be reflected in this file. Browse Filter and Export the data to Microsoft Excel. Available information includes property classification number and type of.

Regular filings in the Clerks Offices include deeds mortgages early marriage returns 1795-1878 tavern licenses etc. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate. Bills that are less than 60 days old may not be listed.

This page allows Individuals to look up and pay past due Income Tax bills.

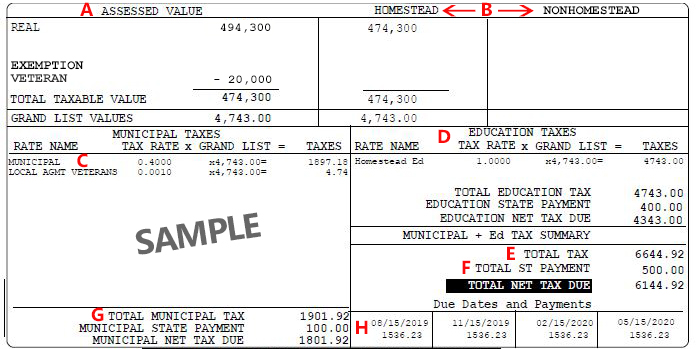

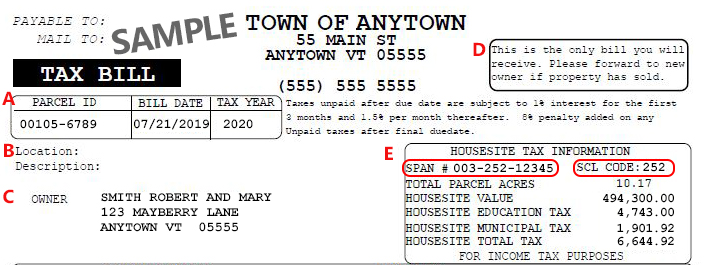

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Cam Fees A Closer Look At Commercial Leases Commercial Leasing Nj Lease Commercial Commercial Property

Cam Fees A Closer Look At Commercial Leases Commercial Leasing Nj Lease Commercial Commercial Property

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Can You Guess Which Bergen County Towns Have The Highest Property Taxes Mansions Stone Mansion Mansions Homes

Can You Guess Which Bergen County Towns Have The Highest Property Taxes Mansions Stone Mansion Mansions Homes

Tax Finance Dept Sparta Township New Jersey

Tax Finance Dept Sparta Township New Jersey

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

Property Taxes Property Tax Illinois Financial Information

Property Taxes Property Tax Illinois Financial Information

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

2020 S Tax Burden By State Business And Economics Smart Money State Tax

2020 S Tax Burden By State Business And Economics Smart Money State Tax

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Nj Counties With The Highest Lowest Property Taxes Property Tax Tax County

Pin On Real Estate Investing Tips

Pin On Real Estate Investing Tips

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State Real Estate Buyers

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

The History Of Women S Homeownership Home Ownership Womens Equality Women

The History Of Women S Homeownership Home Ownership Womens Equality Women

N J Property Taxes Hit A Record High In 2017 See The Numbers For Your Town The Average New Jersey Residential Property Property Tax Tax Identity Theft

N J Property Taxes Hit A Record High In 2017 See The Numbers For Your Town The Average New Jersey Residential Property Property Tax Tax Identity Theft

Ever Wonder How Much N J Celebs Pay In Property Taxes Look Here Flat Stomach Diet Healthy Meat Recipes Bulletproof Diet

Ever Wonder How Much N J Celebs Pay In Property Taxes Look Here Flat Stomach Diet Healthy Meat Recipes Bulletproof Diet

Nj Tax Records For 390 Annette Ct Wyckoff New Jersey Bergen County Property Tax Real Estate

Nj Tax Records For 390 Annette Ct Wyckoff New Jersey Bergen County Property Tax Real Estate

Echo Glen Section Of Totowa Nj Property Beautiful Homes Property House Styles

Echo Glen Section Of Totowa Nj Property Beautiful Homes Property House Styles

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home