Where Can I Find My Property Tax Number In Mumbai

If it falls in Andheri you can visit offices in Andheri Bandra and Vile Parle. Look on your last tax bill the deed to your property a.

Property Card Information System.

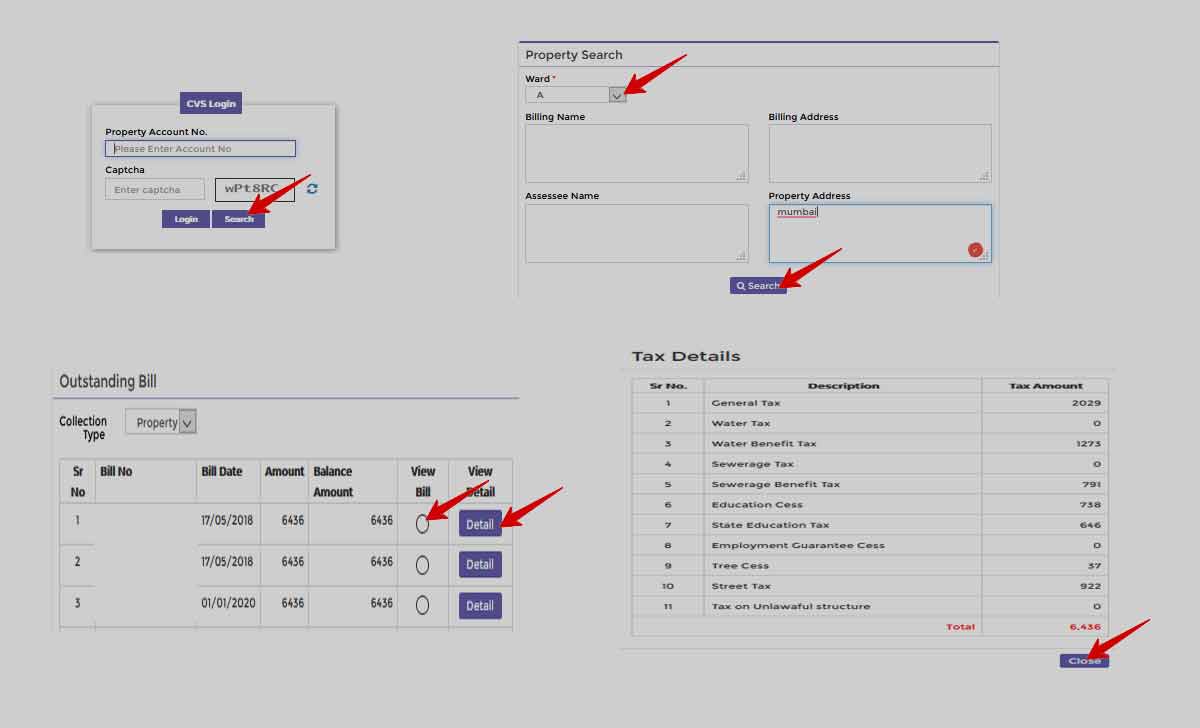

Where can i find my property tax number in mumbai. If your property falls in the Borivali taluka you can find out the propertys city survey number or CTS number from CTSOs at Borivali Goregaon and Malad. MGSTD HELPDESK TOLL FREE NUMBER 1800 225 900 AND E-MAIL ID IS helpdesksupportmahavatgovin. Search using your property address and your tax reference number ie.

For a property in the Kurla taluka you have to visit offices at Chembur Ghatkopar Kurla or Mulund. Log in to the BMC online website. Change in Billing Name Address.

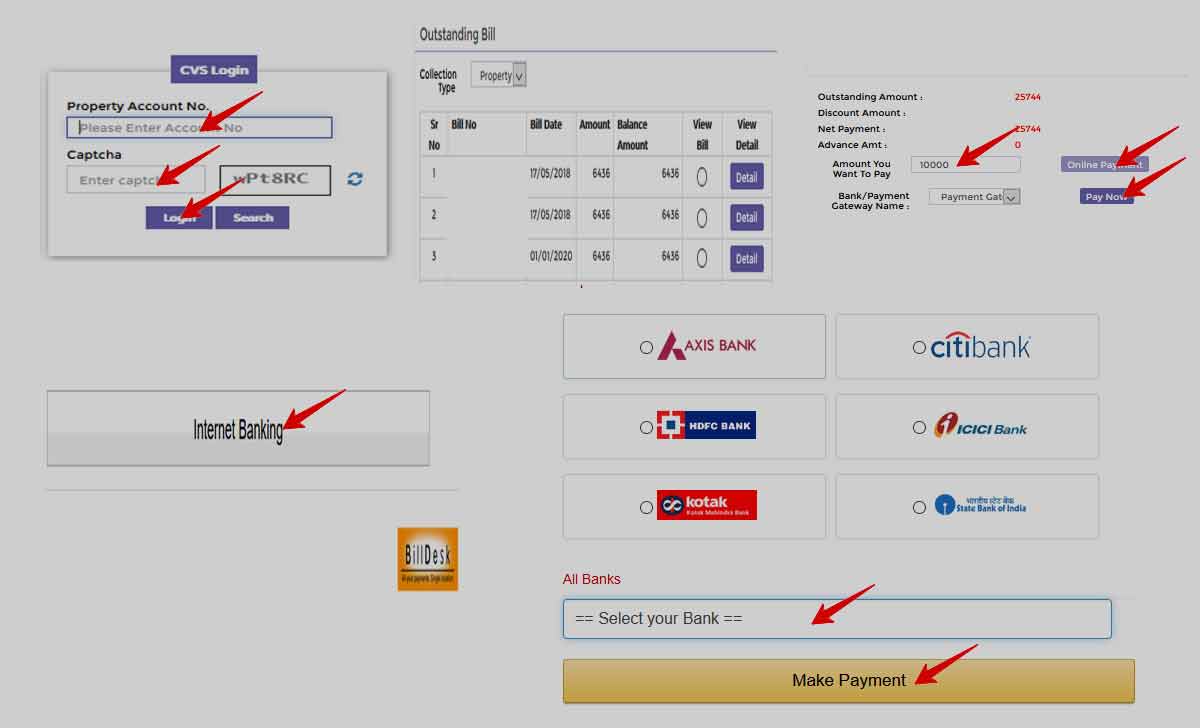

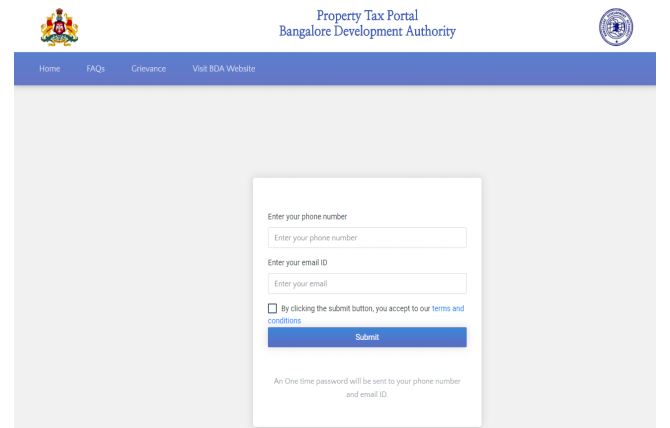

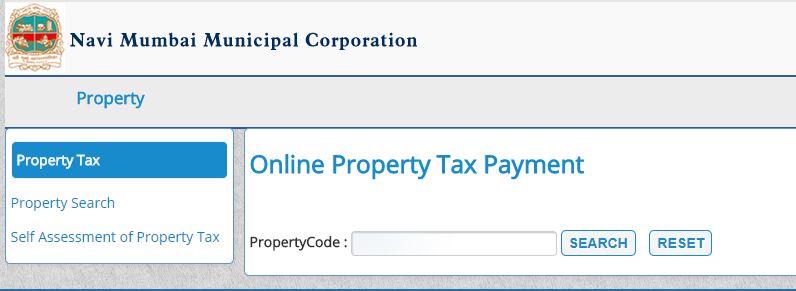

How to pay property tax online in Mumbai 1Log on to wwwmcgmgovin 2 Click on Property Tax option in the left column 3 You will be redirected to a new page where you have to enter your Property Account number for log in. Go to the site of the municipal corporation. Enter the email ID and contact details for receiving property tax alerts through email and.

On that page enter assessment codes and area details as needed. PV080236018888 from the property tax bill of the previous payment and sign in. Go to the page that allows you to pay property tax online.

Use the property tax reference number to pay your outstanding tax via the various payment options available. The hours of operation are 700 am. Its rather simple.

In case your property is in Ghatkopar you will have to approach the Kurla taluka office. Here are the basic steps outlined for you. Find the online services on the left side of the page click on that and go to property tax payment.

You will have to login in at the BMC portal at httpsportalmcgmgovinirjportalanonymous. All you need to do is know your property account number which you can find out online as well. An assistor will ask you for identifying information and provide the number to you over the telephone as long as you are a person who is authorized to receive it.

Upload the requisite documents and submit the attested copy. To make property tax information easily accessible Lake County has launched taxlakecountyilgov which combines data from the Treasurer County Clerk and Chief County Assessment Office into one searchable database. Finding Property Tax ID Numbers If the ID number you need to find is for a property you own you may already have the number in your files.

In fact the BMC has sealed over 200 properties over property tax defaults this year. The CTS number is mentioned in the 712 extract and the property card. NRIC FIN number or your property tax reference number.

You can find the number on. Select Search for property. After entering this number you need to select the assessment year for which you want to pay the home tax online.

You can find this on your property tax bill. Enter the captcha and click on login. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return.

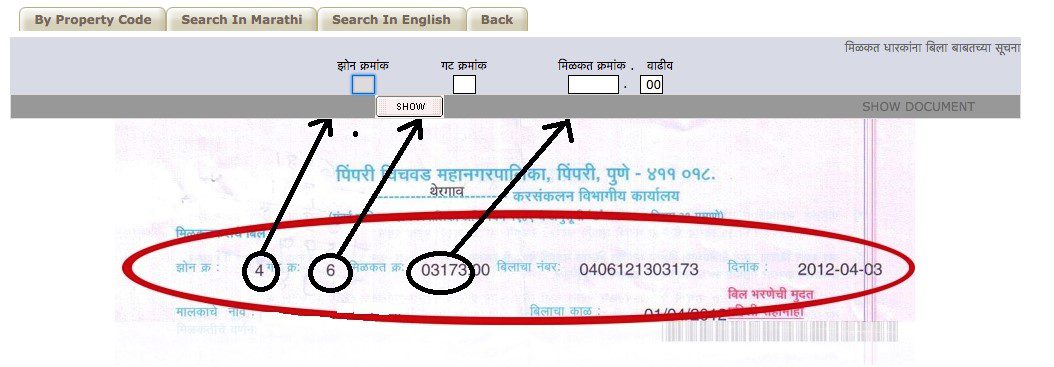

Httpsprcvsmcgmgovin Click on Pay Property Tax under the Online Services section. You may also get this number from your county assessors office. You can view information about property by entering division and CS.

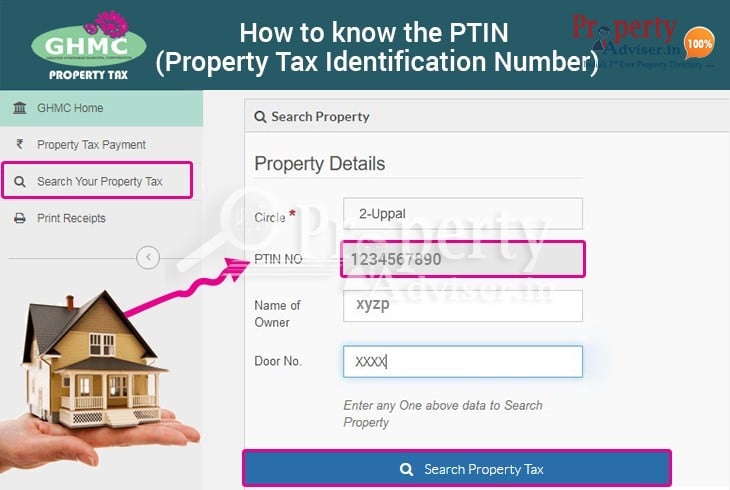

Youll now be asked to enter your Property Tax Number or Revenue Survey Number or Khatha Number. A non-action by a few defaulters will then not amount to the entire housing society getting punished. It is worth mention here that in case a housing society fails to submit its property tax bill for a long period the BMC can launch a move to seal the premises.

You may also be asked to enter details such as owner number old assessment number and door number. In case of apartments the number is mentioned on the first page where the schedule of the property agreement starts. Enter the SAC No eg.

Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933. However if you are unsure you can always visit a CTS office CTSO. Visit MCGM Citizen Portal and enter your property account number.

Enter the property number. Local time Monday through Friday. Type in the verification code shown in the image.

If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home